By Menzie Chinn and Mark Copelovitch

A Harris administration is far less likely to disrupt the ongoing and unprecedented American economic recovery of the last three years with stark policy reversals. This is an expanded version of an op-ed published in the Milwaukee Journal Sentinel.

For the 2024 presidential election, American voters face two starkly different paths for the economy.

The first one is a path toward further economic isolationism, deregulation, and tax cuts for high income households financed by massive government deficits. The other is a road that supports the middle class through tax policies, retains engagement in the international economy, and invests in the future with spending on infrastructure and new factories. This second choice builds upon the path that has led to rapid and widely shared growth over the last 3½ years.

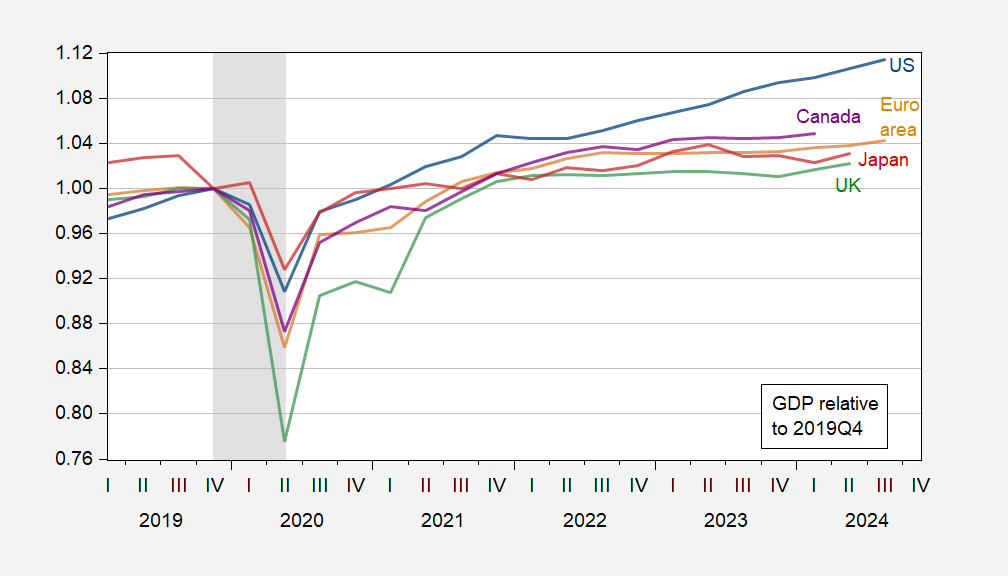

Despite the economic turmoil and inflation caused by the global pandemic and the war in Ukraine, the U.S. economy has experienced an unprecedented rapid and successful recovery in the last three years. In the year ending last quarter, GDP grew at 3%, while unemployment was at a near record low of 3.4% (January 2023). Among the large industrial nations, the U.S. recovery has far outstripped that of our G7 counterparts since the pandemic’s onset.

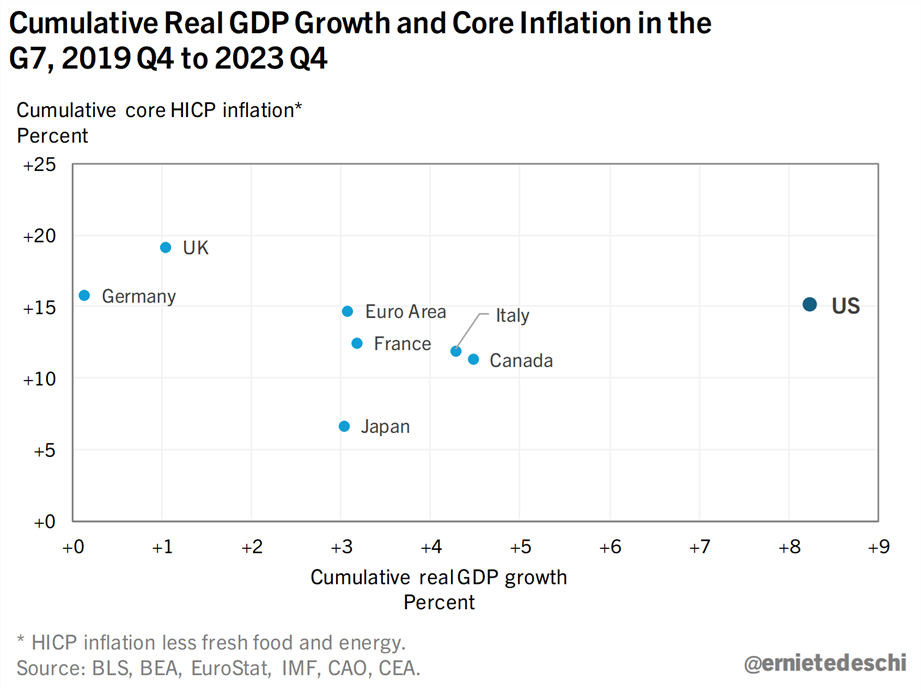

What is most impressive about the U.S. growth is that it has come without any additional inflation over and above that of our G7 peers. This is further evidence that the primary drivers of inflation, in the U.S. and elsewhere, have been global shocks (the pandemic, the war in Ukraine), rather than the result of the Biden administration’s fiscal policy. It turns out that the conventional wisdom in the U.S. in 2022-23, which entailed countless pessimistic headlines about the economy and blamed Joe Biden’s fiscal policy for being the primary cause of inflation, was not quite right.

Economic recovery in U.S. outstrips other G7 countries

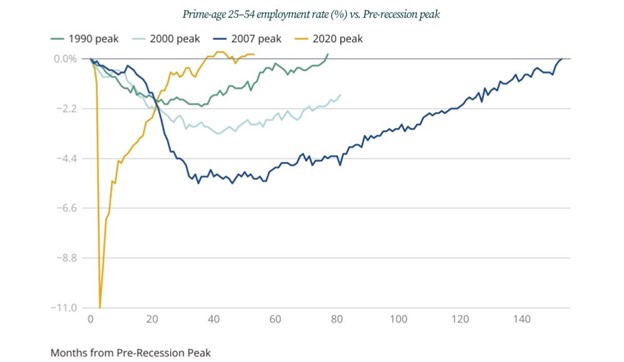

The US recovery has not only been impressive relative to other countries. It has also been historically unprecedented in American history. After the start of the Global Financial Crisis in 2008, it took more than a decade to return to pre-crisis levels of unemployment. America truly experienced a “Lost Decade,” which some estimates have calculated cost the average household tens of thousands of dollars in lifetime income loss. In contrast, the U.S. recovery from COVID-19 has been extraordinarily fast and complete. Employment is higher now than in 2020, and the recovery took only three years.

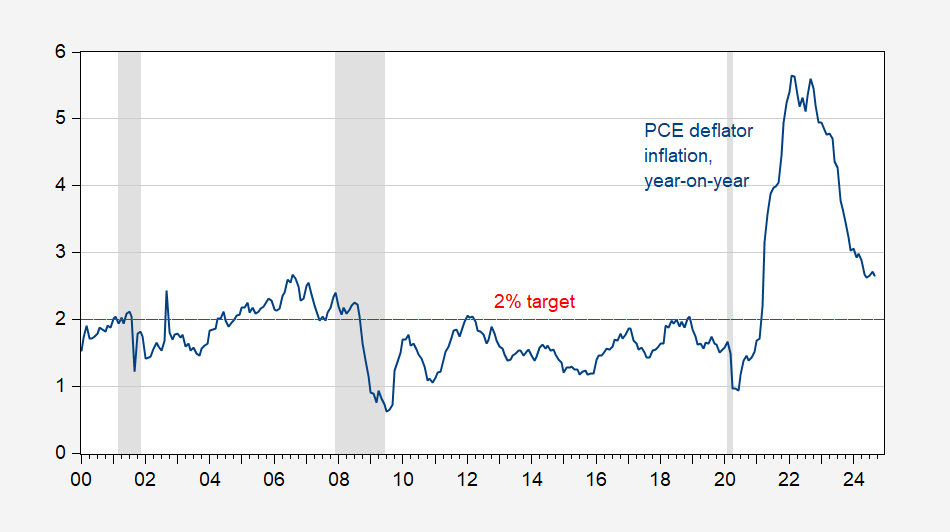

In addition, the inflation shock is basically now over. In the latest August count, inflation was 2.6%. If that sounds too high, by comparison, in the last month before the pandemic struck (January 2020), inflation was 2.5%. The Federal reserve targets 2% inflation. We are now closer to that target than we were for much of the last two decades, when we systematically undershot the mark by a wide margin.

Today’s low and near-target inflation defies many of the predictions made during the height of the pandemic. In 2022, prominent experts, such as Larry Summers, made grim forecasts predicting stubbornly high inflation that would need to be beaten down via years high unemployment. We have avoided this outcome, and the Fed has seemingly achieved the much desired “soft landing.” Moreover, while price levels have increased about 20% since the start of the pandemic in 2020, real (inflation-adjusted) income per capita has increased by nearly 9% and is now back on pre-pandemic trend.

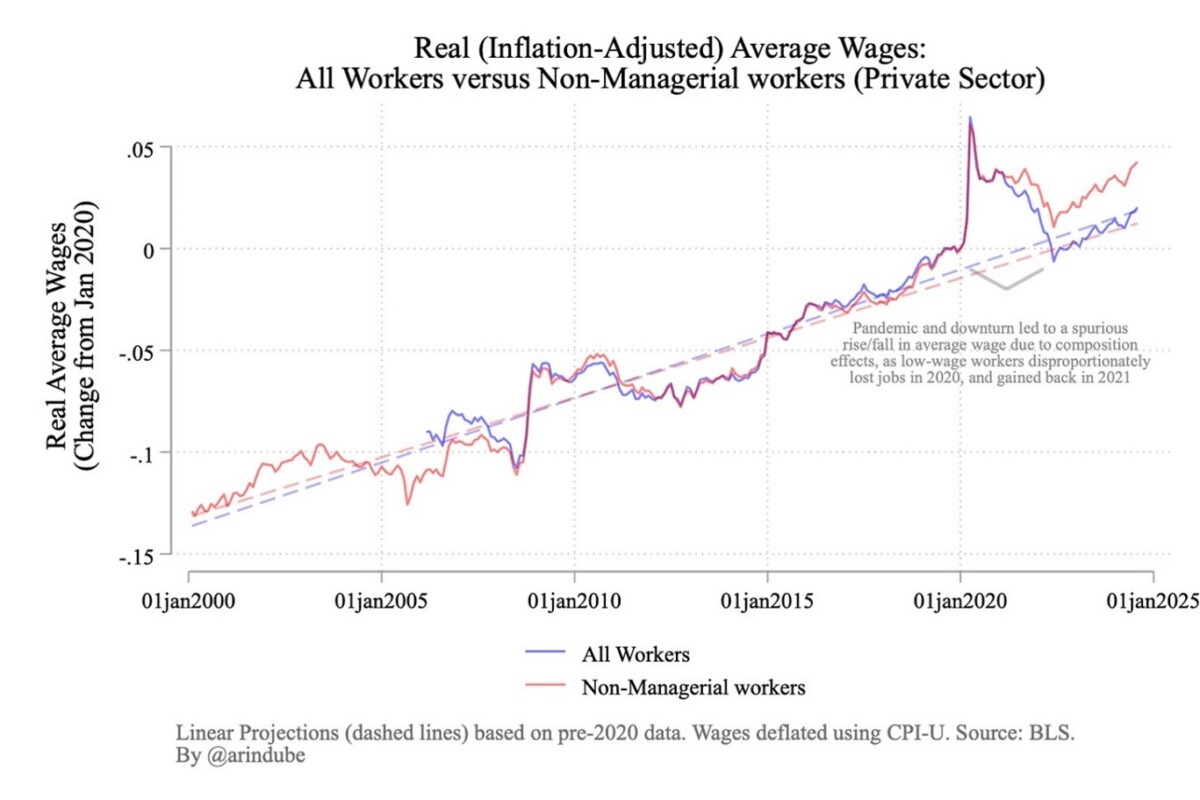

To be sure, inflation has distributional costs and this progress has not been equally shared. However, those at the lowest rungs have actually gained, rather than lost, compared to those better off. This can be seen by looking at the weekly earnings of those in the bottom quarter of the income distribution, adjusted for inflation, compared to the median. Likewise, we can see this when look at real wages, which have grown significantly faster for “regular” (non-managerial) workers than for all workers, which includes executives and other more highly-paid professionals.

Put simply, despite the global shocks and the inflation since 2020, the economy is in excellent shape, the average American voter is doing substantially better now than four years ago, and inequality is declining in America as wage and income growth at the bottom of the income distribution are increasing faster than at the top. This reality runs counter to the doom-and-gloom narrative many of us accepted over the last few years.

Looking forward over the next two months and into 2025, barring unexpected events like the outbreak of a major military conflict, few economists see a recession. With interest rates falling, borrowing will become easier, particularly for those hopeful homebuyers.

All these positive developments are at risk, depending upon the choices we make in November.

Trump and Harris campaigns present divergent economic plans

The economic proposals of the two presidential candidates, to the extent that we know them, differ substantially. The economic policies that Republican nominee Donald Trump has offered typically have much less detail than the corresponding plans from Vice President Kamala Harris, the Democratic candidate.

For Trump, we have full extension of the tax rate reductions in the Tax Cuts and Jobs Act of 2017, a further corporate tax reduction, and the elimination of taxes on tips. More specifics have been provided for mass deportations of undocumented (and apparently documented) immigrants, as well as an across-the-board 10% (or 20%) tariff rate, with 60% tariffs on Chinese products and 200% on John Deere equipment produced in Mexico.

In contrast, Harris has proposed a set of tax breaks that include parts of the TCJA, expansion of the Child Tax Credit, a tax credit for first-time homebuyers in conjunction with incentives to increase affordable housing.

We understand that it’s often easier said than done in today’s highly polarized political climate, but we still believe in the value of using evidence-based analysis to guide views on what’s best for our country in terms of economic policy. To evaluate these measures proposed by the candidates, one has to take into account both the costs, and the benefits.

Trump’s economic plans will cost substantially more than Harris’

We can count the candidates’ proposed tax measures’ costs for the taxpayers fairly easily. For Trump’s plans, economists have calculated a cost of about $3 trillion over 10 years. For Harris, the number is about $1.4 trillion. A more recent tabulation of the cost of Trump’s promises is $11 trillion over 10 years, as he has expanded the number of tax breaks he has promised

There are also non-budgetary costs. In the case of Trump’s tariff plans, the near-unanimous opinion of economists is that his proposed across-the-board tariffs would lead to a disaster. Here the evidence is not so fuzzy. The tariffs of 2018-19 led to increased costs — not only for American firms that used steel, aluminum and other imported goods — but also for American consumers. Moreover, as costs increased, the tariffs didn’t even help manufacturing, costing the sector 175,000 jobs, on net. With every imported good subject to at least a 10% tariff, the economy would likely shed growth, perhaps going into recession (particularly if our trading partners retaliate).

Furthermore, America’s farm exports dropped precipitously due to retaliation by our trading partners. Only by virtue of a government bailout with government funds, to the tune of over $12 billion, were farmers’ fortunes saved. A key thing to keep in mind with respect to this promise to start a new trade war is that for many of the proposed trade measures, Trump does not need Congress’s approval.

Similarly negative assessments have also been reported for Trump’s stated plans to pursue mass deportation policies targeting both legal and undocumented immigrations. One recent estimate from the American Immigration Council notes that such policies could cost over $300 billion and reduce U.S. GDP by 4.2% to 6.8%, a shock to the economy similar to that of the Great Recession.

Even if only limited to post-2020 arrivals, these mass deportations would undoubtedly depress economic activity significantly. Of course, this doesn’t even begin to touch on the human cost of such a draconian approach to immigration that would likely tear at the fabric of communities across the country.

Harris plan would continue growth, Trump’s would spur higher prices

In contrast, the policies proposed by Harris would almost certainly guarantee a more stable and prosperous economy. In avoiding a more escalated trade war, the U.S. and global economy would likely continue to grow. Moreover, her tax proposals are aimed at reducing economic inequality (as in the expansion of the Earned Income Tax Credit), and toward investing in human capital by way of the expanded Child Tax Credit. The previous Child Tax Credit expansion, which was enacted during the pandemic, cut child poverty nearly in half. Hence, we have solid empirical evidence that both of these tax measures will help reduce poverty and income inequality.

At the same time, Harris has proposed keeping a majority of tax cuts from the 2017 Tax Cuts and Job Acts, specifically those aimed at lower and middle income groups. These are the big ticket budget items, which could largely be offset by tax increases on higher income households and corporations.

More targeted, but nonetheless important, measures would barely make a noticeable impact on the budget. For instance, the housing credit for first time homebuyers, coupled with measures to expand the housing supply, could make a significant impact on housing affordability. Proposals to prevent price gouging by suppliers of groceries, by way of anti-trust actions, would have essentially no fiscal impact, but still help to keep living costs down.

Analyses by independent research groups, such as Goldman Sachs, Moody’s, Peterson Institute for International Economics, indicate that implementation of the bulk of the Trump economic agenda, even when excluding full-fledged mass deportations of immigrants, would lead to slower economic growth within the year.

However, the Goldman Sachs and Moody’s analyses estimate a positive impact for the Harris agenda. Moreover, because growth would be slower, and deficits larger, the federal debt would rise faster under Trump than under Harris. Furthermore, inflation, spurred by tariffs, would also rise faster under Trump.

On the basis of economics, the choice is clear, at least for those not in the top 10% in income and wealth. The cost of living, unemployment, and government debt would all be higher under a Trump administration. Even those who might gain from tariffs might very well lose out in the end, should Trump’s tariffs spur retaliation and trigger a broader trade war with China and other major trading partners.

On the other hand, a Harris administration would pursue economic policies that would largely benefit wide swaths of the American population. And while the future is uncertain, a Harris administration is far less likely to disrupt the ongoing and unprecedented American economic recovery of the last three years with stark policy reversals that create new uncertainty about our national economic policies and our economic ties to our closest allies and major trading partners.

Menzie Chinn is a professor of public affairs and economics in UW-Madison’s La Follette School of Public Affairs and Department of Economics. Mark Copelovitch is a professor in UW-Madison’s La Follette School of Public Affairs and Department of Political Science.

Repeating a comment that didn’t make it to the screen, ’cause it’s not just the economy that would suffer under Trump –

Back in 2016, the VOA ran this headline:

“Trump Embraces Unpredictability as Foreign Policy Strategy”

http://www.voanews.com/amp/trump-foreign-policy-unpredictability/3610582.html

Unpredictability was only half the story. In 2016, Trump had limited knowledge of foreign policy, and limited interest. His fascination with autocrats was already evident, but otherwise his interest was mostly “deals” and cash. Foreign governments routinely make contact with presidential campaigns and transition teams in preparation for new administrations, but couldn’t find anyone to talk to on Trump’s behalf; they simply weren’t there.

I point this out because of a recent headline from the FT:

“Trump’s foreign policy plan: embrace unpredictability”

https://www.ft.com/content/f18588c8-a122-4dc2-b095-0f75aeb748bf

Sure, maybe the FT has plagiarized a little bit, but the point remains – this ain’t good. If the U.S. is unpredictable, then we’re also unreliable. That’s a poor basis for cooperation. It creates openings for rivals. It undermines both soft power and the threat of hard power.

This is a great fact-based layout of where we have been and the two possible way we can go forward. Unfortunately the Faux news alternative reality is immune to facts. I do hope that all the recent defections of GOP politicians from Trump is a sign that society will manage to do the right thing and sips of the orange clown. I have seen some indications that the pools are underestimating democrats strengths just like they did in 2022. I guess now it’s just vote and pray.

I voted early, last weekend. the pandemic increased the opportunity for early voting. this should be embraced around the country. I fail to see what problem we have with increasing the opportunity for citizens to vote. that is a sacred right of any democracy. anybody against early and increased voting is anti-democratic.

Establishment survey: ÷12,000

Household survey: -368,000

ADP: +233,000

Not at work due to had weather: 512,000

That clears things up nicely.

Yep. Boeing is worth 41,000 jobs. Another big deal in Q4 is retail hiring, which was down a piddling 6,400 in October. Given the size of seasonal adjustment for retail hiring, it’s easy to generate big swings in Q4 and Q1.

With the latest jobs report showing “positive job growth for 46 consecutive months, putting the current streak in a tie for 3rd place of the longest job streaks in US history (since 1939).” And the September PCE price index increased 2.1% year-over-year (YoY), down from 2.3% YoY in August, And real GDP increased at 2.8% Annualized Rate in Q3 – and the deficit is being paid down – can the media narrative switch from “Republicans are good for the economy” B.S. to under Democrat administrations – we get healthy economic growth with low unemployment and responsible governance and proper funding for Social Security and Healthcare and under Republicans we get increases in wealth inequality with tax cuts for the top 0.1%, disastrous cuts to govt services, harmful cuts in regulations, and speculative investment bubbles leading to recessions? https://www.calculatedriskblog.com/2024/11/comments-on-october-employment-report.html