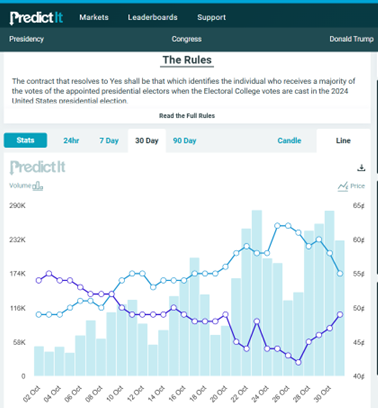

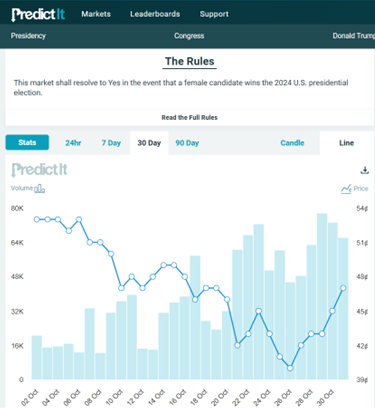

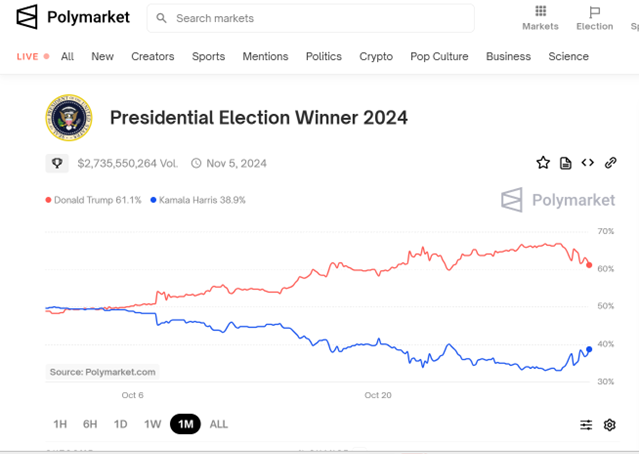

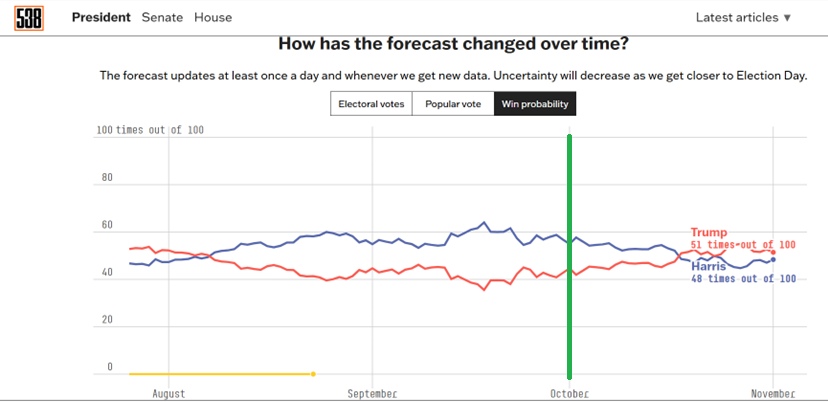

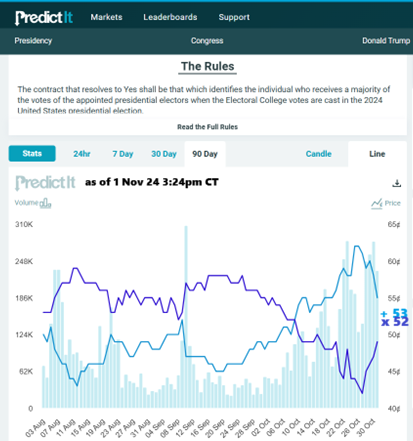

Reversion, seen over the past month. Why? Unclear given small movements in swing state polls.

I would expect these odds to match, pretty closely, but they don’t. Liquidity?

Polymarket way off (segmented from US participants?). RealClearPolitics average doesn’t include PredictIt (nor Kalshi).

538’s prediction over time. Green line marks beginning last month of data.

Update, 3:31pm CT:

More reversion (picture over last 3 months):

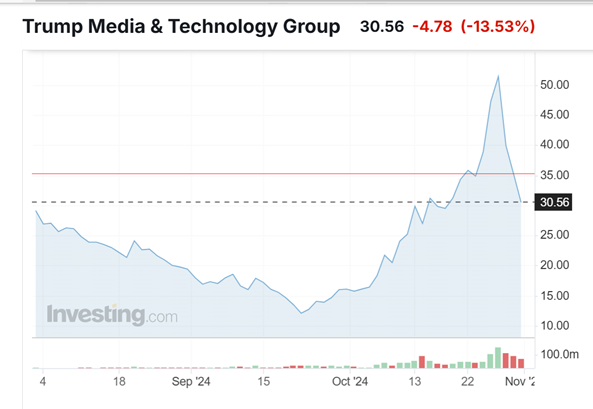

Proxy? DJT collapses (again), picture over last 3 months as well:

Repeating myself here. One possibility is that firms are hedging against the bad economic consequences of a Trump win. Buy “Trump” to compensate for the economic risk should Trump win.

Not entirely related, the press has taken note of increased implied volatility in financial markets. The VIX is high, relative to actual stock price volatility:

https://fred.stlouisfed.org/graph/?g=1xI3w

The MOVE Treasury volatility index is also on the rise, though not particularly high:

https://en.macromicro.me/charts/35584/us-treasury-move-index

USD volatility is the standout among the three, having just hit a high for the year:

https://www.cnbc.com/quotes/.DBCVIX

Maybe just the normal reaction to elections, rather than a freak out?

how do you factor in this week’s crash of the trump truth social stock? is trump selling? lost a couple billion this week alone.

DJT is a high-beta stock. That, alone, makes price wobbles part of the scenery. That latest drop mirrors an earlier rise – pretty symmetrical. That, too, is a common feature of high-beta stocks.

We should be seeing SEC filings for insider sales, but I don’t see anything in the press. Given the nature of the thing, I’m happy to believe there’s some underhanded stuff going on, but I don’t have a feeling for what it would be.

As you move further to the election you move further away from crazy dream scenarios towards reality. All those crazy things you were sure each side would do either materialized or not and you are left with the pools.

Time decay of the imbedded option?

PredictIt’s spot price is now 53/53. Pretty hard to make sense of any of this.

Macroduck: “One possibility is that firms are hedging against the bad economic consequences of a Trump win. Buy “Trump” to compensate for the economic risk should Trump win.”

No need to invent some loony three-dimensional chess here. Republicans aren’t that smart. The Republican Party has been flooding the zone in recent weeks with bogus right wing junk polls showing Trump as an easy winner. And MAGA hatters are easy marks for the grift. The reason they are driving up the prediction markets is the same reason they are driving up the DJT stock. They are true believers in the grift. It isn’t hedging.

Republicans favorite poll aggregator, the right wing Real Clear Politics, gives every poll equal weight regardless of quality, whether it is a junk Republican poll or a high quality Gallup poll. And the results show Trump winning every swing state. And MAGA hatters are eating it up. The same folks who think DJT stock is worth $10 billion are the same folks who think Trump has a 60% chance of winning — no hedging required.

But as we get closer to the election note that both the prediction markets and DJT stock are moving in sync back toward normal. The reality based traders are moving in for the kill.

Look, you’ve offered a bunch of “facts” about what’s going on in prediction markets which aren’t facts, just speculation. Every rebuttal to me is just smack talk. In fact, even your speculation about what’s going on in prediction markets is just smack talk. You sound like faux news. Grown ups don’t behave like that.

Readers can decide for themselves what they consider most likely. Whether firms are making multi-million dollar bets in the prediction markets to hedge against hypothetical business risks of a Trump presidency or whether a bunch of loyal MAGA hatters are bidding up prediction prices because they are true believers in the grift. The same MAGA hatters that are bidding up the price of DJT stock. The same MAGA hatters that are buying $100,000 Chinese knockoff Trump watches.

We have lots of evidence for the latter but not one single documented instance of the former. Which do you think is more likely?

Somebody is on the other side of every trade.