“Trumpflation” Risks Likely Overstated by Lance Roberts via Zerohedge:

The question is whether policies being considered by the next Presidential administration will lead to “Trumpflation” or not.

…

Current Thinking

Many mainstream economists and analysts believe President Trump’s economic policies could trigger “Trumpflation.” The term refers to potential inflation driven by his administration’s fiscal and trade policies. Analysts suggest that extending the TCJA tax cuts, further tax cuts, infrastructure spending, or increased military budgets will boost economic growth and lift inflation. The belief is that this fiscal stimulus, especially during an already low unemployment environment, would increase demand, leading to price increases.Furthermore, “Trumpflation” could be triggered by introducing trade protectionism and tariffs. Economists argue that restricting imports and raising tariffs on foreign goods will lead to higher domestic prices, as the costs of imported goods would rise. Combined, these policies pointed to risks of higher consumer prices and potentially higher interest rates.

The advantage that we have today is that we can review President Trump’s first term to see if the same policies instituted then led to higher interest rates and inflation.

The problem with reasoning this way is that Mr. Roberts is looking at what actually happened, not what happened relative to the counterfactual, or what economists parsed out as what happened as a result of the measures undertaken by Mr. Trump during his first administration using econometric methods.

What is true is that predictions of higher inflation are conditional on passage of the proposed measures (as modeled by the modelers), and the models themselves. So deviations from predictions can happen because the assumptions of what happens (invasion, war, measures fail in congress) vs. the models.

What about reasoning from what happened in 2018. The proposals are different. A 10% overall tax on imports and 60% tariff on Chinese imports is different from selective tariffs on steel and aluminum (Section 232), and tariffs on Chinese goods under Section 301.

Mr. Roberts also goes into a long discursion into why tax cuts (and/or maintaining TCJA cuts) isn’t going to be inflationary, noting that increased debt-to-GDP hasn’t been correlated with higher yields. Well, that’s reasoning by correlation. What needs to be assessed is whether rising debt issuance will be matched by rising demand for Treasurys either domestically or by foreign holders. In the past, the US has been bailed out by the foreign sector avidly buying up Treasurys. Can we rely upon that in the future? Maybe, maybe not. If interest rates go up, then (given Mr. Trump’s desire to have bigger say in interest rates), the Fed might be forced to keep monetary policy more accommodative to (expansionary) fiscal policy, and that means (over time) higher inflation than would have otherwise occurred.

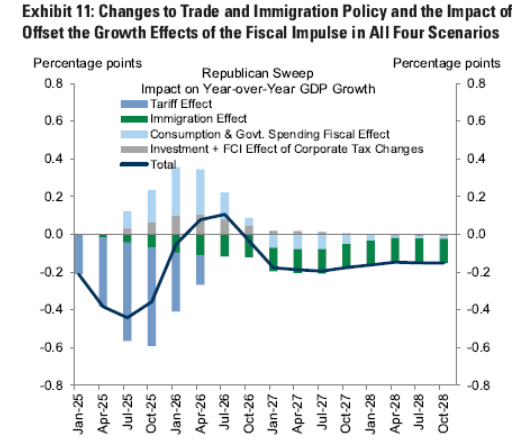

So, for my part, I’m more partial to this set of scenarios (from Goldman Sachs, discussed here):

Note that these are differences relative to baseline.

Wait – Trump deficits are not inflationary but Biden’s deficits were? Are we back to Dick Cheney – “deficits do not matter” when run by Republicans?

That seems to be the case.

Welcome back! If Menzie allows this comment. Have you recovered since the election?

“Mr. Roberts also goes into a long discursion into why tax cuts (and/or maintaining TCJA cuts) isn’t going to be inflationary, noting that increased debt-to-GDP hasn’t been correlated with higher yields.”

No. Simply no. Slipping interest rates in as a proxy for inflation? No.

If one wants to argue – by correlation – that this or that isn’t inflationary, then interest rates aren’t the issue. There are several risks inherent in running large deficits, two of which are higher inflation and higher interest rates. They are related, but not the same. I can’t tell whether this is misdirection or just sloppy thinking.

No.

It is not sloppy thinking. It is misdirection. The typical maga follower is very susceptible to this kind of argument.

The basic problem seems to be one of the classic logic fallacies of ignoring “all other influences” on a parameter – I call it “single parameter logic”. The reason we build economic models rather than just correlating two parameters is that there is always multiple inputs. In experimental research you hold all other parameters equal but that is not possible in economics. From the definition we know GDP will go up with increased government spending. But if private sector spending goes down at the same time, we may observe a reality where government increased its spending, yet GDP didn’t go up. Such an observation doesn’t invalidate the simple fact that increased spending increase GDP. Yet there will be morons on Faux news who will make that claim.