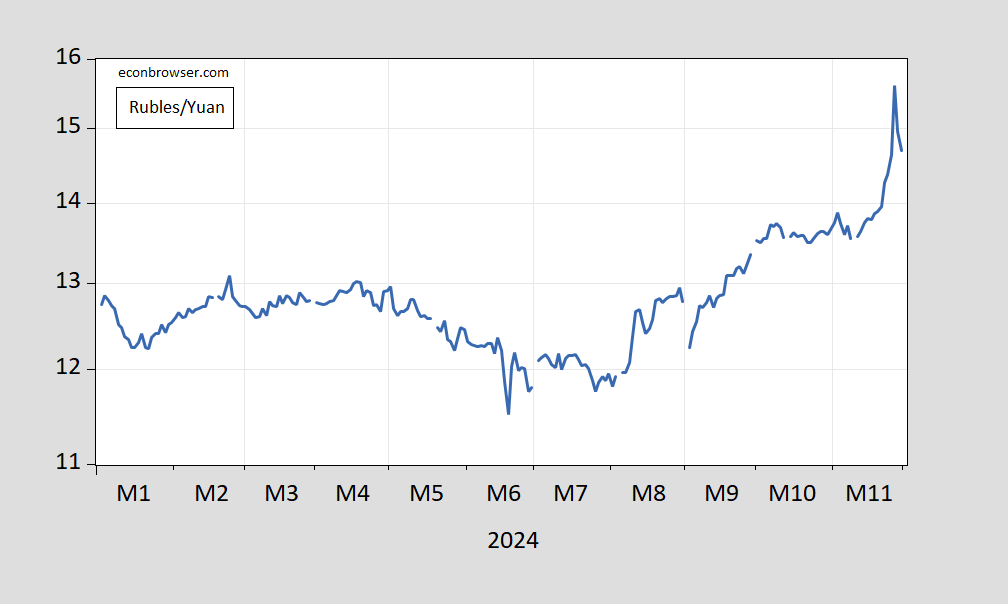

Consider the ruble/yuan exchange rate.

Figure 1: Rubles per yuan, calculated using dollar rates (blue, log scale). Up is a depreciation of the ruble. Source: Pacific Exchange Services accessed 12/1/2024, and author’s calculations.

The recovery in the ruble’s value after 11/27 was due to Central Bank of Russia intervention in the forex market.

While a devaluation makes the price of oil denominated in dollars higher in ruble terms (if the oil can be sold, now that Gazprom has been sanctioned), it has other effects on imported goods, including Chinese goods. As The Economist notes:

…a weaker rouble is a doubled-edged sword. A lower level against the dollar increases the rouble value of oil exports, helping plug the government’s widening deficit. Yet it also pushes up the price of imported goods—something that matters for both consumers and the government’s war effort. Analysts note that Russian imports of consumer goods usually rise as Christmas approaches. On November 28th Dmitriy Pianov, deputy chairman of VTB, Russia’s second-largest bank, told Interfax, a news agency, that the rouble’s decline over the previous few days was “a strong inflationary factor”. Moreover, China has become Russia’s most important trading partner in recent years, providing more than a third of all imports, as well as high-tech inputs that are crucial for the armed forces. The rouble has fallen by 7% against China’s yuan in the past month, which will raise the cost of military equipment.

Since October 1st, the ruble has depreciated 9% against the yuan. Taking literally estimates of exchange rate pass through at 3 month’s horizon from Ponoramu et al. (2016) (see table in this post), this means (in the absence of further depreciation) about a 5% increase in wholesale prices of imported goods from China.

Similarly, the ruble (auto-correct suggest “rubble” – implied commentary?) is down 9% on the month and 15.5% on the year vs India’s rupee.

Even when dealing with regular old trade, there are contractual issues which prevent FX rates from immediately changing the value of trade in domestic terms, or in trading-partner terms, depending on the contract. Russia’s trade with China, India and just about any other important partner is not “regular old trade”. India doesn’t want any more rubles. China is pretty draconian when it comes to trade terms. Recent weakness, and volatility, in the ruble is going to lead Russia’s trade partners to rethink whatever terms had been negotiated previously.

Hey Chinny either the currency has depreciated or it has devalued. It is either fixed or floating! It cannot be both even in Trump times

Not Trampis: What about if the currency is on a managed float/adjustable peg?

Depreciavaluating.

well we had that a long time ago and it aint a floating exchange rate

It’s gonna be hard to pound vodka pretty soon. Pootin should be poutin about that.

Off topic – France is following the example of the UK under the Tories, toppling a short-tenure government:

https://www.politico.eu/article/france-prime-minister-michel-barnier-is-facing-the-chop-what-happens-next-crisis-emmanuel-macron/

It’s a budget issue that is likely to end Barnier’s roughly 2 1/2 month parliamentary regime. His elevation was the result of preventing Le Pen’s ultra-right-wing party from building a ruling coalition – not a sturdy foundation.

All part of the turmoil among large Western governments. Putin and Trump will try to take advantage. Le Pen will get another crack at parliamentary power.

Meanwhile, about 7.2% of the Russian GDP is for defense, according to the AP’s report on Russia’s published figures. (It amounts to about 32.5% of their government budget.) That’s not going to help. But Russians are tough; they can sacrifice a lot for their leader… on the other hand, at this point in WWII, the Eastern Front was less than three months away from the beginning of Operation Bagration, also known as the Destruction of Army Group Center. No such happy future appears to await Russia in Ukraine unless Trump gives it to them.

Off topic – FT contributor Ruchir Sharma points out that U.S. equity indices are overvalued relative to indices elsewhere and relative to history:

https://www.ft.com/content/49cca8d7-7b6e-47e3-a50c-9557d7c85fc0

The conventional “deepest, most liquid…” explanation is offered as a conventional explanation, along with the good performance of the U.S. economy and stuff like this:

“The overwhelming consensus is that the gap between the US and the world is justified by the earnings power of top US companies, their global reach and their leading role in tech innovation.”

Don’t know where Sharma found this consensus, but he disagrees, arguing that the high valuation of the U.S. (and, presumably, Australian and Indian) equity market(s) is due to “sentiment”, that it amounts to a bubble.

Here are some of the data, the P/Es, behind Sharma’s view:

ASE 8.2

BOVESPA 8.9

BAX 12 9

KOSPI 14.9

NIKKIE 15.1

CAC 19.1

DAX 19.7

FTSE 100 19.9

TSX 24 0

SSE 26.5

NIFTY 27.2

ASX 31.9

U.S. 33.0

Here’s the P/E picture over time for the U.S.:

https://www.gurufocus.com/economic_indicators/57/sp-500-pe-ratio

The S&P 500 P/E has been higher, but not often, and never for long. For what it’s worth.

Some good news for Wisconsin. A county judge overturned Act 10, a law banning all unions except cop unions. The execrable Scott Walker passed this law 13 years ago but it was ruled unconstitutional by the judge for dividing public employees into two classes, general and public safety.

The case will no doubt go to the state Supreme Court which is currently 4-3 democrats after 15 years of Republican rule. However that majority hangs in the balance because of a retiring democrat to be replaced by an election early in 2025. This could be the most consequential election in Wisconsin for some time.

Incidentally, the retiring judge Ann Bradley was placed in a literal chokehold by judge David Prosser during a legal disagreement. The case was never adjudicated because of lack of quorum on the court due to recusals. Physical violence, because that’s just the way Republicans roll when they can’t get their way.