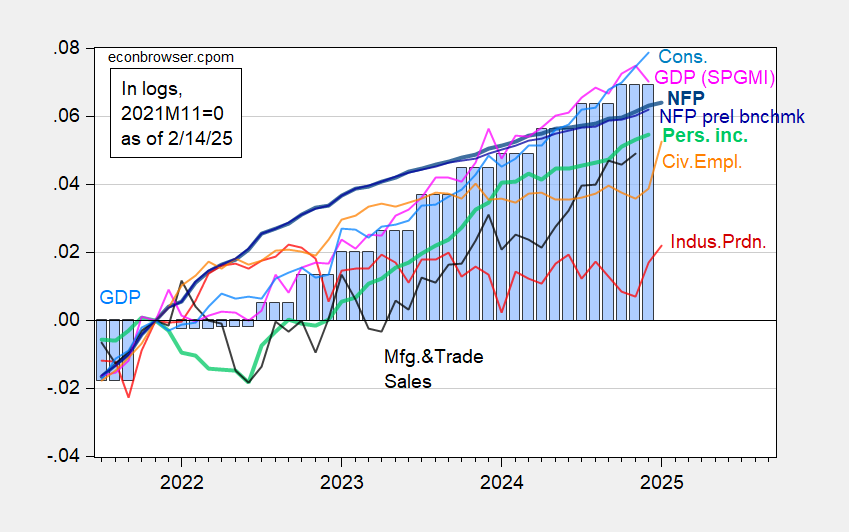

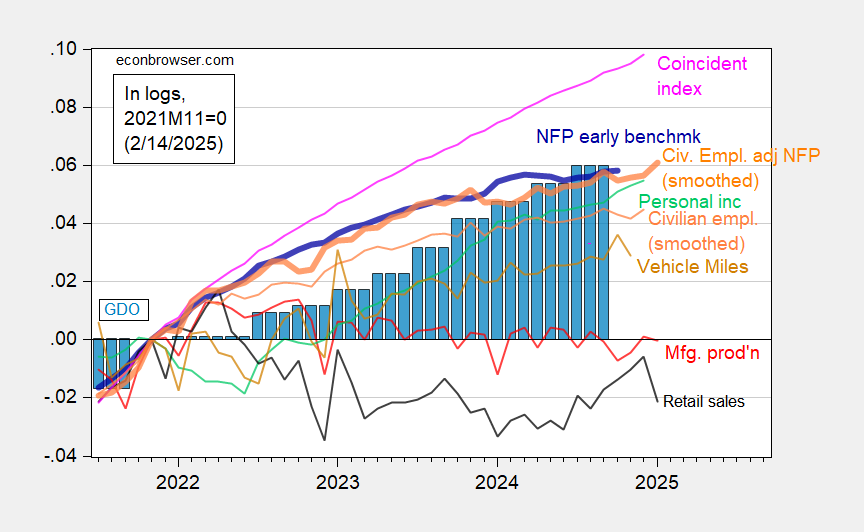

In the first set, industrial production continues to rise (as did employment). In the second set, while civilian employment and civilian employment adjusted to NFP concept rose, manufacturing output flat, and real retails sales fell noticeably.

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/3/2025 release), and author’s calculations.

Note the official civilian employment series evidences a sharp jump in January; that’s almost entirely due to incorporation of new population controls. BLS has produced several research series which smoothly incorporate population controls. I plot below the overall civilian employment and adjusted-to-NFP concept series. Both evidence upward movement.

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 advance release, and author’s calculations.

GS notes that unusually cold weather might have weighed on retails sales, which came in -0.9% m/m vs. Bloomberg consensus -0.2% (unusually cold weather also drove up industrial production via utilities output).

Still dubious on recession call, given upward movement in employment (see discussion here of research series and the CES/CPS gap)

I’ll just drop this here and let you figure out the math.

Genius Treasury Secretary Bessent: “We’re also looking at currency manipulation,” Bessent said in an interview on Fox Business Network. “The U.S. has a strong dollar policy, but because we have a strong dollar policy, it doesn’t mean that other countries get to have a weak currency policy.”

Okay, this is hilarious. But also not so hilarious because it illustrates the danger of Elon and his techbro adolescents mucking around in computer systems they know nothing about.

Recall Musk’s ridiculous claim that there were lots of 150 year olds receiving Social Security, surely a sign of fraud and corruption. Well, it turns out there is a story for that.

You see, all computer languages use a baseline or zero date as the starting point from which all future dates are calculated. And it happens that the COBOL language used by Social Security uses the date May 20, 1875. This is the date that the Metre Convention was signed in Paris adopting the international metric system of time and measurements. And for a person for whom the actual birth date is not known, a placeholder zero in that date field would indicate they are 150 years old today. So that would explain why there may be some people receiving Social Security benefits who appear to be 150 years old. It’s just a missing birth date.

It’s not waste and it’s not corruption. It’s pure ignorance and stupidity on the part of these kids who know nothing about the system they are playing around in and certainly nothing about COBOL Now, a smart person would be curious why there would be all these 150 year-olds born on exactly the same date and no other date that are receiving benefits. And a smart person might ask some other experienced Social Security person who could answer that question for them in five seconds.

But Elon and these kids are not smart but nevertheless are so convinced of their superior intelligence that they wouldn’t ask that question and instead immediately leapt to the conclusion of fraud and corruption.

These idiots are dangerous — move fast and break things. And now they are mucking around in IRS data and your tax forms.

We might want to figure this into any jobs forecasts for the next couple of months:

https://thehill.com/homenews/administration/5144113-federal-probationary-employees-fired/

This could mean up to 200,000 federal workers fired. In addition, a hiring freeze would cut into job growth in coming months.

This strikes me as a Chesterton’s fence kind of deal – getting rid of employees without knowing why they were hired ain’t good management.

About 6% of the federal budget is spent on civilian employees. Leave out veterans, DoD and homeland security (just guessing), and it’s more like 2.4%.

And you are not necessarily just firing inexperienced probationary workers. Under federal rules you can have 30 years experience and have just started a new position in a related department and be technically considered probationary. They may be terminating some of the most experienced and valuable workers.

Just another example of Musk and his little minions being ignorant about what they are mucking with. Move fast and break people.

Not to talk about the whole process of finding the best available candidate for a position will have to be repeated. Not sure how many qualified candidates would even apply.

So far, not much panicking.

https://fredblog.stlouisfed.org/2025/02/measuring-fear-what-the-vix-reveals-about-market-uncertainty … aside from a minor blip last October.

But as the saying goes:

Det er vanskeligt at spaa, især naar det gælder Fremtiden… It is difficult to make predictions, especially about the future.