Asking for a friend. From Atlanta Fed today:

Now, as has been pointed out, some of this drop as of 28 February was driven by the mechanical inclusion of the trade balance, where imports deduct in an accounting sense. The outsize increase in imports — if reversed next release — should diminish the negative impact if imports have been moved forward in anticipation of tariff imposition.

Of course, like any tax, if the tariffs (say the ones due tomorrow on Canada and Mexico) is not implemented, then more imports will be shifted forward until the resolution of uncertainty.

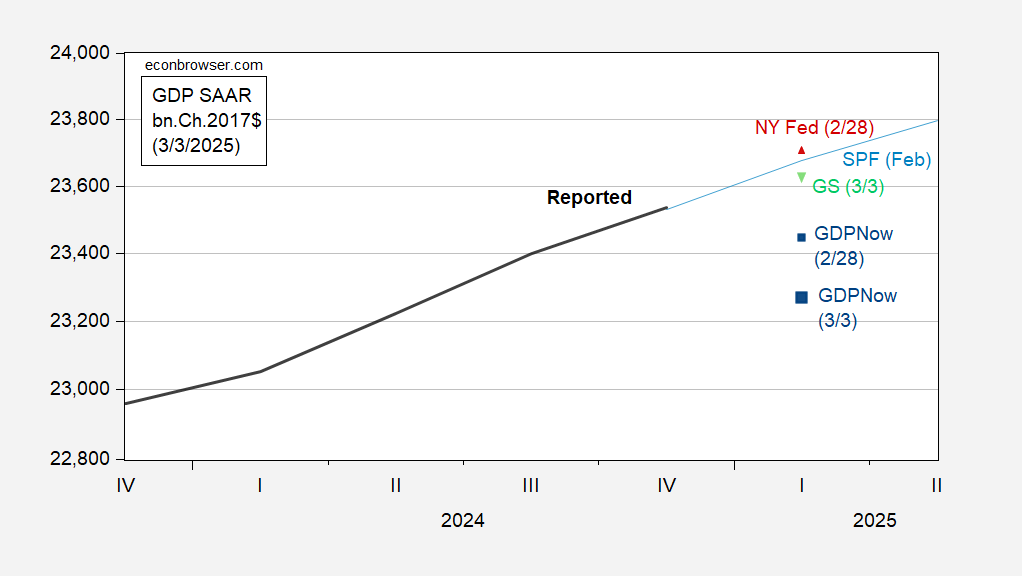

For context, here are recent nowcasts and forecasts, as well as the GS tracking (where the forward shift of imports can be taken into account judgmentally).

Since the downward shift in GDPNow from 2/28 to 3/3 is primarily due to the ISM maufacturing index and construction numbers, one can be a little more certain of this latter downward revision.

The GS tracking forecast is at 1.6% q/q annualized, which is still decent, but slower than Q4.

GDPNow has subtracted the effect of imports, but shows no corresponding effect from inventory change. Imports show up in inventories, until they are used or sold. If we assume that there will be an offsetting rise in inventories, then come Wednesday’s factory inventory data, we may see a partial offset. More, perhaps, Thursday when wholesale inventory data are released, along with fuller detail on January imports and exports.

Back in the days before just-in-time inventory management, we sometimes had inventory errors big enough to generate recession; it was in all the old textbooks. Maybe the surge in imports won’t fool NBER into declaring a recession, but inventory errors could lead to an actual slowing of activity.

My cursory search has turned up nothing on the effect of the Smoot-Hawley tariffs on inventory swings, and anyhow, the effect when already in depression is probably different than when not. Anybody have more on tariffs and inventories?

“Now, as has been pointed out, some of this drop as of 28 February was driven by the mechanical inclusion of the trade balance, where imports deduct in an accounting sense.”

This goes to my longstanding point that there are no imports in GDP. By definition, the D stands for domestic. Imports neither add nor subtract from GDP.

GDP = C + I + G + (X-M)

The minus M is in there only as an accounting correction to adjust for import spending that is included in C, I and G. In theory, everything that is imported as M appears in C, I and G spending and therefore cancels out M. But in this case there seems to have been a flood of import accounting early in the quarter that has not yet propagated into the spending accounting. It’s a data timing issue, not an import issue per se.

“The outsize increase in imports — if reversed next release — should diminish the negative impact if imports have been moved forward in anticipation of tariff imposition.”

I think this is misleading. It implies that the imports are like inventory, which can build up in one quarter and decrease in the next quarter. It isn’t the case that high imports in this quarter are necessarily offset by low imports next quarter. It is the case that high imports in the beginning of the quarter are offset by their spending on C, I and G later in the quarter. The imports cancel themselves out by the accounting identity. It has nothing to do with imports next month.

GDPNow should revert to a more normal reading as C, I and G accounting catches up with imports, cancelling M. This temporary anomaly illustrates the danger in thinking that imports mechanically subtract from GDP. In this case it gives an illusion of something terrible happening to GDP which is not really true.

Goldman had a report that covered this.

The tariff report on Friday is for advance goods, which is calculated on a census basis, which includes monetary gold. The BoP goods deficit calculation, which is what is used by NIPA, does not include monetary gold.

So the threat of tariffs led to a huge increase in gold imports, which increase the census goods deficit, but this shouldn’t show up in the BoP numbers that come out Thursday. If Atlanta Fed updates based on the BoP numbers, then I expect a big reversal then.