From Econ442, yesterday’s lecture:

Main Impacts

• Reduced immigration (legal, undocumented)

– Reduced labor force

– Reduced consumption

– Reduced inflows into Social Security,

Medicare trust funds

• Mass deportation (increase in enforcement,

establishment of camps)

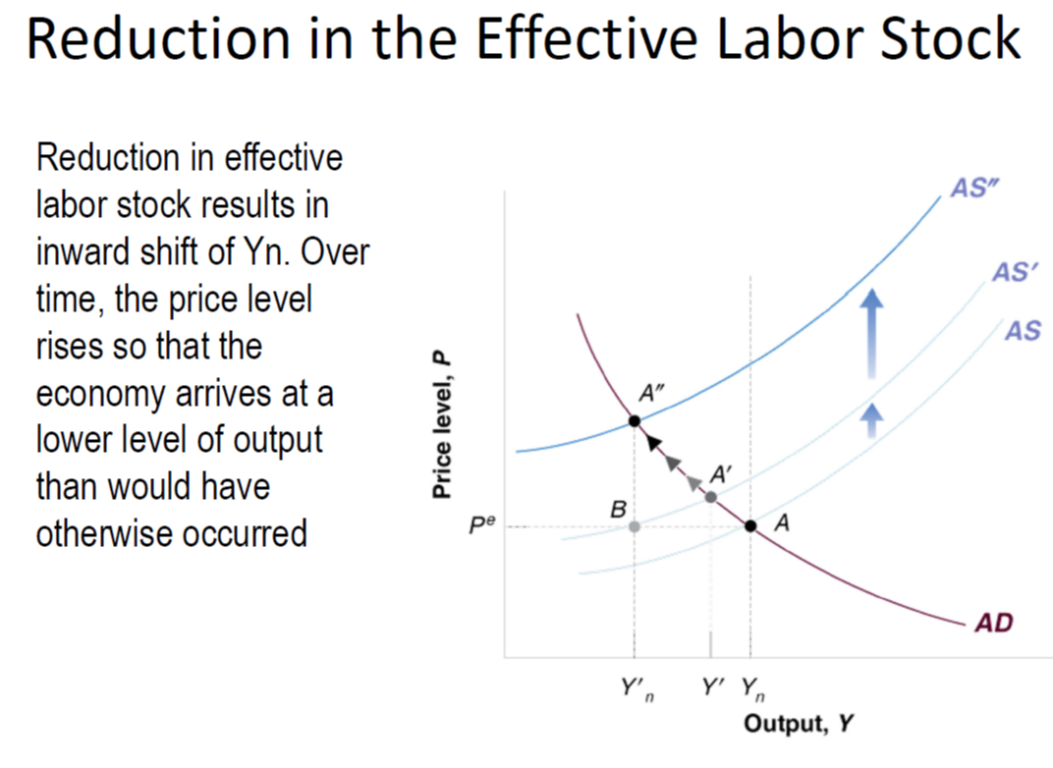

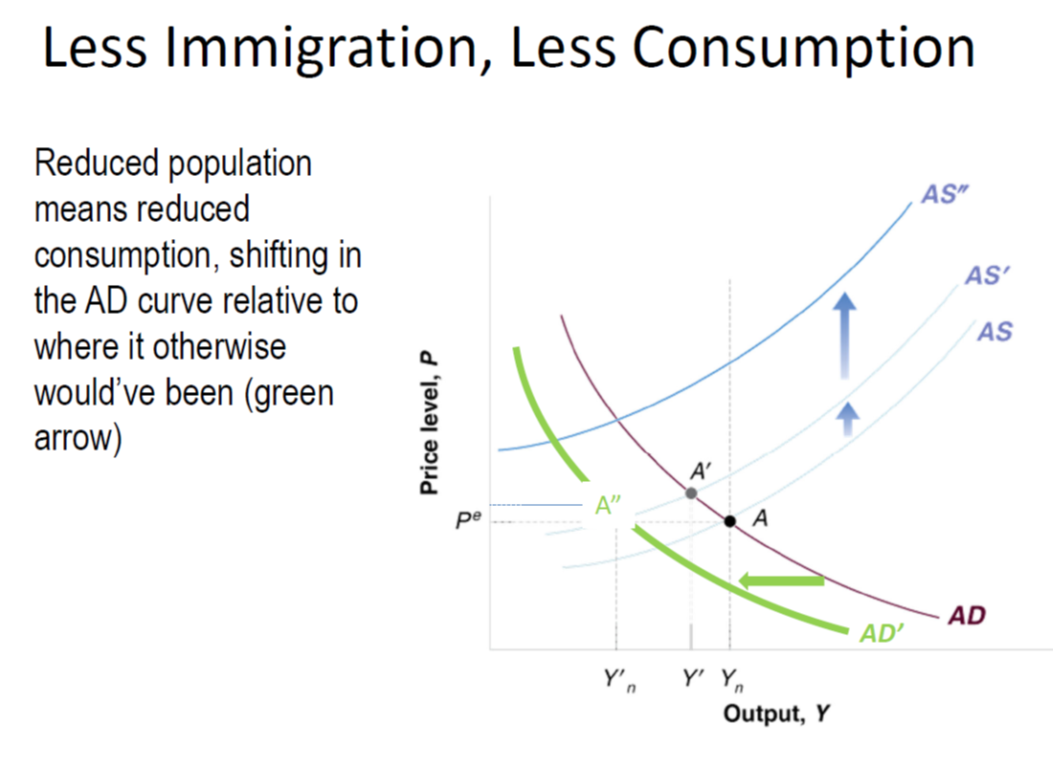

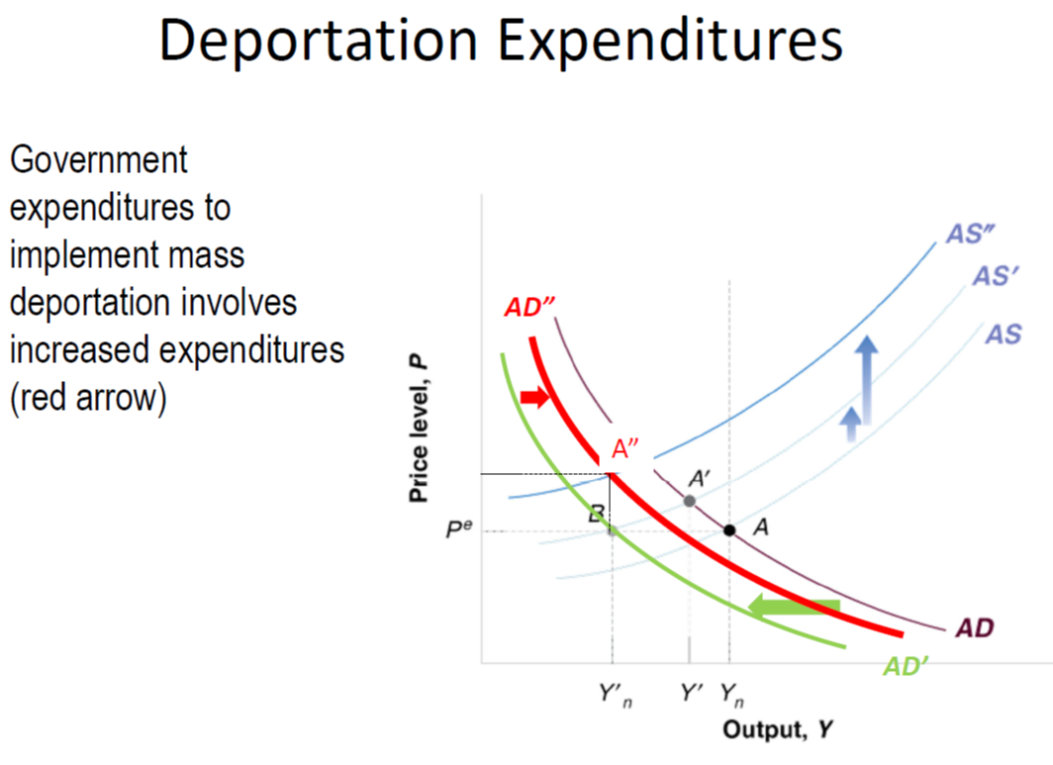

AD-AS Interpretation

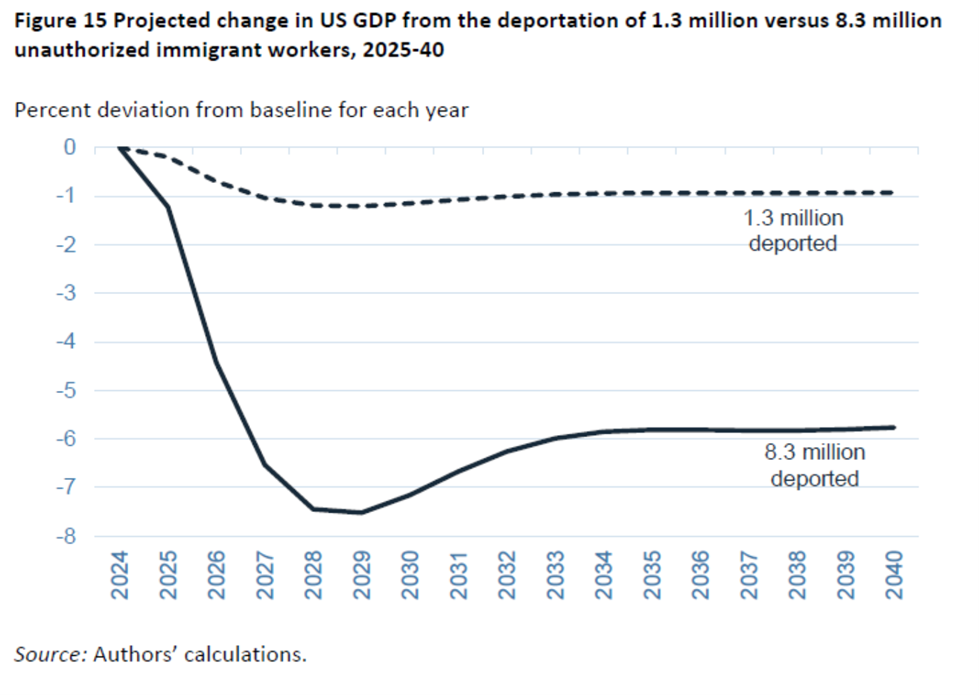

Source: McKibben, Hogan, Noland (2024).

Given the high marginal propensity to consume out of income at lower incomes, maybe the decrease in aggregate supply from reduced immigrant labor is roughly matched by the decrease in aggregate demand, ignoring transfers overseas. If, however, there is some exploitation going on – labor compensation not equal to the marginal product of labor – then the reduction in aggregate supply may be greater than the reduction in aggregate demand. We’ve recently seen that negative supply shocks slow the economy and cause inflation. Nice job.

The felon-in-chief is working to reduce trade, while talking a good game about deporting immigrants. Trade and migration are substitutes in theory, but historically there tends to be a positive correlation between trade and immigration – as if they are compliments. Whether trade and immigration are substitutes or compliments, attacking either hurts the economy. Attacking both compounds the harm. We’ll see whether he’s dumb enough to actually attack both.

Other than the awesomeness of having a rapist running the government, the only offsets to the harm from tariffs and deportations are tax cuts and deregulation. Richies may like both, but the evidence for growth effects is not strong.

It’s usually the case that preside ts get too much credit, or blame, for the performance of the economy. This time may be an exception.

“The (U.S. Logistics Managers Index) rose for a second consecutive month to 62.8 in February 2025…The expansion was primarily driven by a sharp increase in Inventory Levels (+6.3 to 64.8), the fastest growth since June 2022, partially fueled by ongoing shifts in trade policies. Meanwhile, the spike in inventories has led increases for Inventory Costs (+7.1 to 77.3) and Warehousing Prices (+4.0 to 77), their fastest rate of expansion in several years…as firms attempted to avoid costs associated with potential tariffs.”

https://tradingeconomics.com/united-states/lmi-logistics-managers-index-current

Off topic – the IRS is planning for a 50% reduction in its workforce:

https://apnews.com/article/irs-doge-layoffs-tax-season-0659e4b439400bf66023273f6a532fa0

The Treasury Department has confirmed it is considering a “wide range” of “streamlining” options for the IRS.

Fun time for tax cheats.

The IRS has already indicated it is giving up on audits of wealthy tax evaders because of staffing problems:

https://www.icij.org/inside-icij/2025/03/after-mass-firings-the-irs-is-poised-to-close-audits-of-wealthy-taxpayers-agents-say/