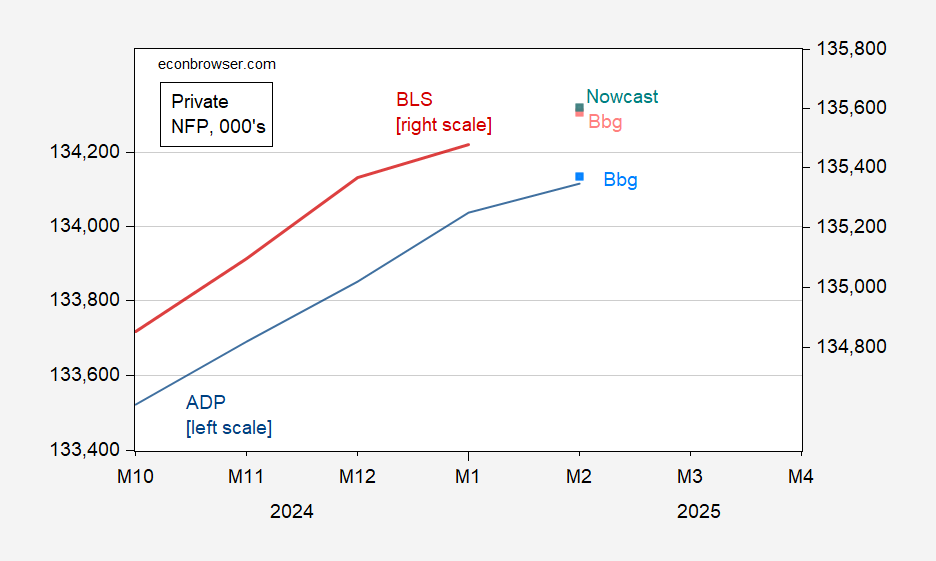

+77K vs. +141K (Bloomberg consensus). Using the 2021M07-2025M01 relationship between ADP and BLS measures (in log first differences), I nowcast +125 vs Bloomberg +108K (although the 95% prediction interval encompasses a drop to 135310K from January’s 135479K).

Figure 1: Private nonfarm payroll employment from ADP (blue line, left scale), Bloomberg consensus (light blue square), private nonfarm payroll employment from BLS (red line, right scale), Bloomberg consensus (light red square), author’s nowcast (teal square). Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

The author’s nowcast is based on 2021M07-2025M02 data, regressing first differenced log private BLS NFP on first differenced ADP private NFP, and lagged first differenced BLS private NFP (adj-R2 = 0.65, SER = 0.001, Breusch-Godfrey serial correlation test with 2 lags fails to reject no serial correlation null at 10%).

Off topic – the other big economy:

China has released the economic plan arrived at at this week’s parliamentary gathering. Here’s a review:

https://www.cnbc.com/2025/03/05/china-reportedly-targets-around-5percent-growth-in-2025-amid-trade-war-worries.html

The biggest development is a deficit target of 4% of GDP, up from a prior 3%. Since 2010, the highest ratio was 3.6% in 2020 – whether this is adequate, I don’t know, but for China, it’s big. More spending subsidies for households, no new income support that I can see.

The target for issuance of special long-term debt is now 1.3 trillion yuan, up 30% from last year. Another 500 billion yuan in debt will go to supporting banks. The GDP growth target is “around 5%” for what that’s worth. The unemployment target is 5.5%, up from an actual 5.1% end of year rate. That’s a pretty clear admission that China’s leaders expect a rough year.

Services (especially trade and transport), small firms, the West and Southeast all reported job losses. Goods production, large and medium sized firms, the Northeast and Midwest added jobs.

Government employment isn’t covered. It’s conceivable that the BLS may report net job losses once government jobs are accounted for, given weak ADP data, but ADP isn’t all that good at predicting BLS results, month-to-month.

So here is how it will play out. Trump is tanking the economy with tariffs and government layoffs. But this will result in lower interest rates. So he will brag winning on interest rates soon. After the economy tanks and rates drop, he will start to spend federal money and cut taxes. As economy rebounds, he will claim victory of tax cuts. Lots of people will be hurt in this process. But he will claim victory. And his people will love him for it. Even if they are unemployed.

Economist Peter Navarro today:

“Canada has been taken over by Mexican cartels.”