Industrial and manufacturing production out today, retail sales out yesterday. All three are up, with IP +0.7% m/m and mfg +0.9% (vs. 0.2% and 0.3% Bloomberg consensus, respectively) but retail sales remain noticeably down from prior peak.

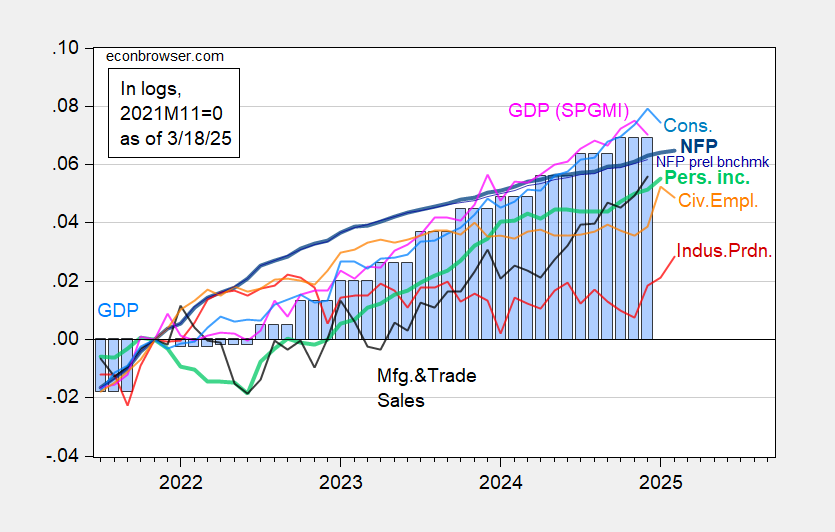

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

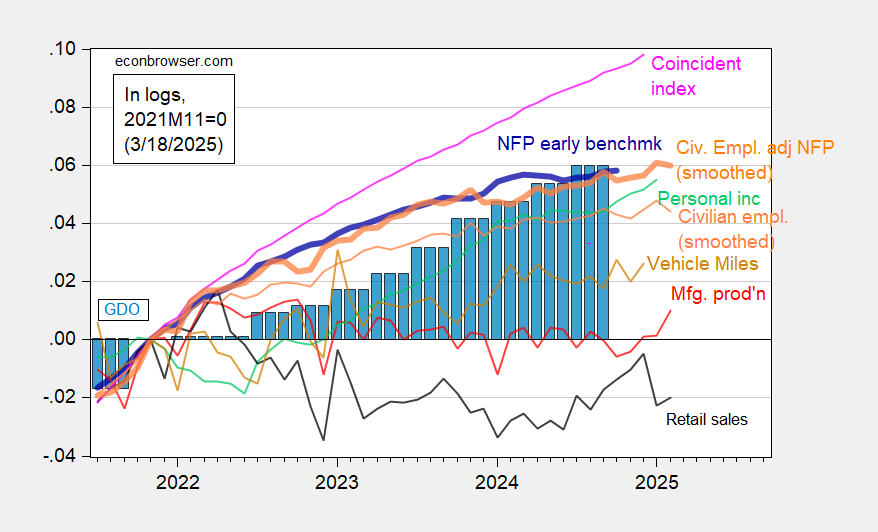

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 2nd release, and author’s calculations.

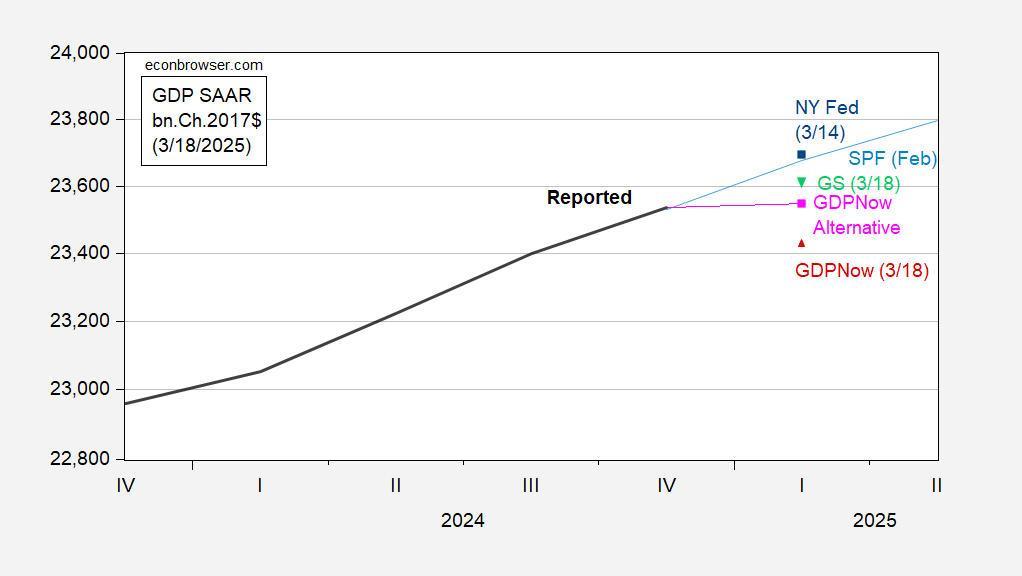

Nowcasts (GDPNow as reported and accounting for gold imports; NY Fed) and tracking (Goldman Sachs) as of today.

Figure 3: GDP (black), GDPNow (red triangle), GDPNow adjusted for gold imports, using Atlanta Fed adjustment for March 7 applied to March 17 (pink square), NY Fed (blue square), Goldman Sachs (inverted green triangle), Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

Q1 GDPNow, accounting for gold imports, remains essentially flat…

Among the lies being peddled by the felon-in-chief’s minions is that the Biden economy was “bloated” by government spending. Here’s a picture of GDP growth during the Biden administration, along with contributions to growth of government spending, overall and federal:

https://fred.stlouisfed.org/graph/?g=1EIQR

There was a heck of a lot more going on than just government spending.

Here is the share of GDP growth contributed by federal spending, by quarter, during Biden’s presidency:

https://fred.stlouisfed.org/graph/?g=1EIWp

In all but one quarter, the contribution was less than 20% and sometimes was negative – very similar to the felon’s first administration. In one quarter during Biden’s term, government was actually a massive drag on growth.

Here’s the GDP growth along with government’s contribution over a longer period:

https://fred.stlouisfed.org/graph/?g=1EITv

Notice that the single largest quarterly contribution from government spending came during the felon-in-chief’s first term.

Here’s a picture of the number of federal employees over time, alongside the number of non-farm employees:

https://fred.stlouisfed.org/graph/?g=1EJ3D

Here’s the federal workforce as a share of all non-farm employment:

https://fred.stlouisfed.org/graph/?g=1EJ58

MAGA/DOGE mad dogs are really gonna fix that bloated Biden economy, really gonna fix the deficit, by recklessly cutting federal employment. Sure they are.

Remember the million woman march early in the felon-in-chief’s first term? Black lives matter demonstrations? We need more of that now. Before the damage is all done.

Sadly, the DOGE boyz don’t understand that even if they make the federal government more efficient (a big if), that’s not the same thing as making the macroeconomy more efficient. And it’s the latter that ought to be the Trump Administration’s goal. Firing government workers might reduce government outlays a tiny bit, but unless those fired workers quickly find private sector jobs that have a value of marginal product that’s at least as high as their government jobs, then the economy as a whole becomes less efficient. It’s especially rich that Trump’s supposed war on inefficiency in government doesn’t seem to apply to the deadweight losses he’s accumulating with his tariffs.

trump has found a fool who is willing to gut entitlement programs. and when that happens, he will throw musk under the bus and blame him for the action. republicans will avoid taking responsibility. but they will have achieved their goal of gutting entitlements, without taking the direct political beating for it. musk is immoral and unethical enough to torch the third rail.

Off topic – Ezra Klien’s interview with Gillian Tett (FT America’s chief) is getting a good bit of attention:

https://www.nytimes.com/2025/03/14/opinion/ezra-klein-podcast-gillian-tett.html

Tett is not an economist and has never worked in finance. She’s a cultural anthropologist (so an ideal choice to explain America to the Brits). Her background comes through quite clearly in the interview. Tett recognizes the problem with the felon-in-chief’s monkeys-with-clubs approach to change, but soft peddles. She’s above it all.

One part of Tett’s message is that “everybody is wrong” because they think the cultural rules they know are natural and enduring – specifically with reference to post-WWII systems of trade, finance and mutual defense. In this, Tett is utterly wrong. Tett has allowed the doctrines of cultural anthropology to blind her to the evidence published daily in her own paper.

How does cultural change take place if everybody accepts that the rules they grew up with are natural and enduring? Did Adam Smith see merchantilism as inevitable? More importantly, did the first run of his second book sell out in a few days because Brits all saw merchantilism as the natural order of things? Did Truman accept European colonialism as a sort of “what is, is right” areangement? Did hippies see U.S. imperialism and conspicuous consumption as inevitable? Do MAGA idiots and progressives agree that neo-liberalism is just how it has to be? Please, look around you.

Tett’s lack of urgency in discussing monkeys with clubs is annoying, but she’s FT, and that’s the FT way. (It’s natural and enduring.) If the world burns, Tett will still have a job. Her cool repetition of received cultural-anthropology wisdom is another matter. That’s how we know her blinders are as big and dark as everyone else’s. She’s a received wisdom kind girl, but doesn’t know it.

In the spirit of full disclosure and follow-up.

After about a year both INPRO and IPMAN seem to have broken out from what looked like a downward trend.

Both jumped above the trend’s 2 standard error bands. Prior to the current report the model looked fairly robust.

So, back to the “drawing board”.

Don’t you worry. Once (if) tariffs begin to bite, manufacturing will slow down.

Take a look at capacity use and the average workweek. If the economy were to pick up, there is room for growth. The strains evident earlier in the expansion have eased. The U.S. could continue its above-trend run, if allowed to.

In January and February, utility production was 5% higher than it had *ever* been in the past. Allegedly due to the coldest winter temperatures in 8 years in most of the US.

Add in frontrunning tariffs by manufacturers, and there you are.

Cold weather, plus crypto-mining and AI, neither of which is obviously socially beneficial.