Personal income, consumption both down in May, with today’s release. Industrial production, civilian employment in NFP concept down from previous releases. Monthly GDP from SPGMI and manufacturing and trade industry sales down in April…it’s reasonable to ask whether this is all signaling something.

First up, indicators followed by the NBER Business Cycle Dating Committee (BCDC). The BCDC places primary emphasis on the employment and income series.

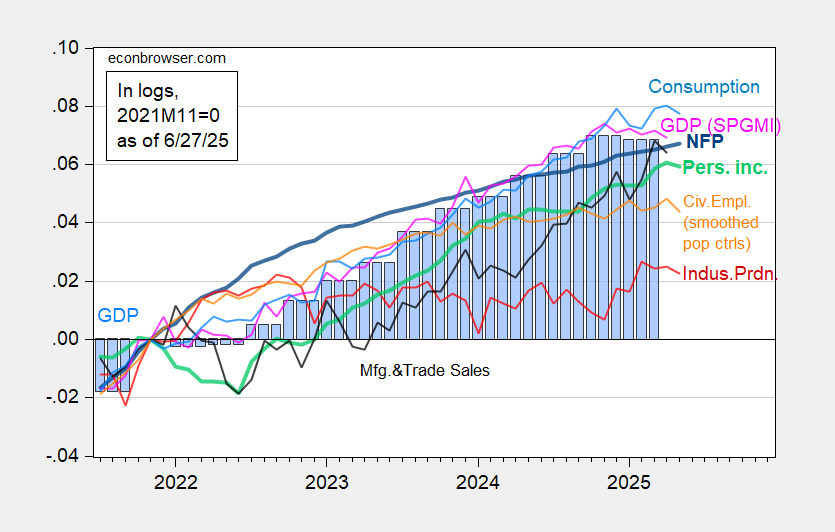

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), civilian employment using smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/2/2025 release), and author’s calculations.

Total nominal personal income at -0.4% m/m was below Bloomberg consensus increase +0.3, while nominal consumption spending was below (-0.1% m/m vs. +0.1%)

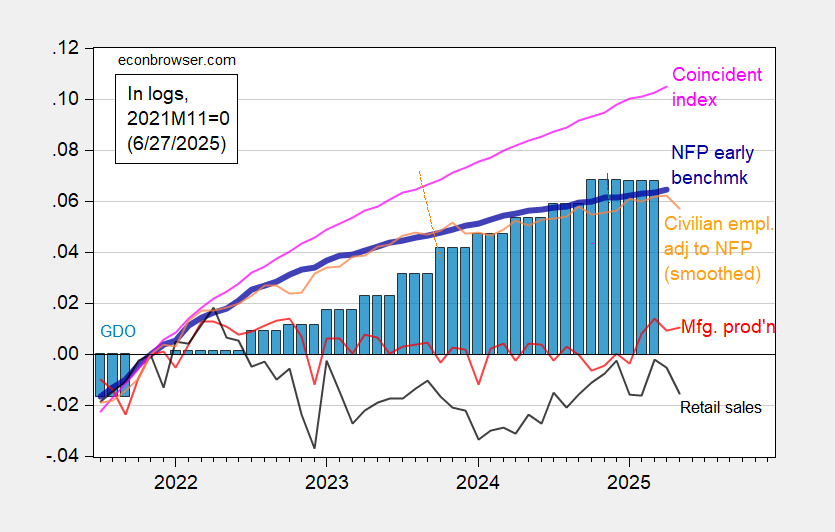

Figure 2: Preliminary Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, with smoothed population controls (orange), manufacturing production (red), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2025Q1 third release, and author’s calculations.

In general, I put much heavier weight on the CES vs. CPS measures of employment. However, if you’re a believer that the CPS series signals recessions earlier than the CES, well, time to start worrying (there’s actually only mixed evidence in support of this view, using real-time data, see this post).

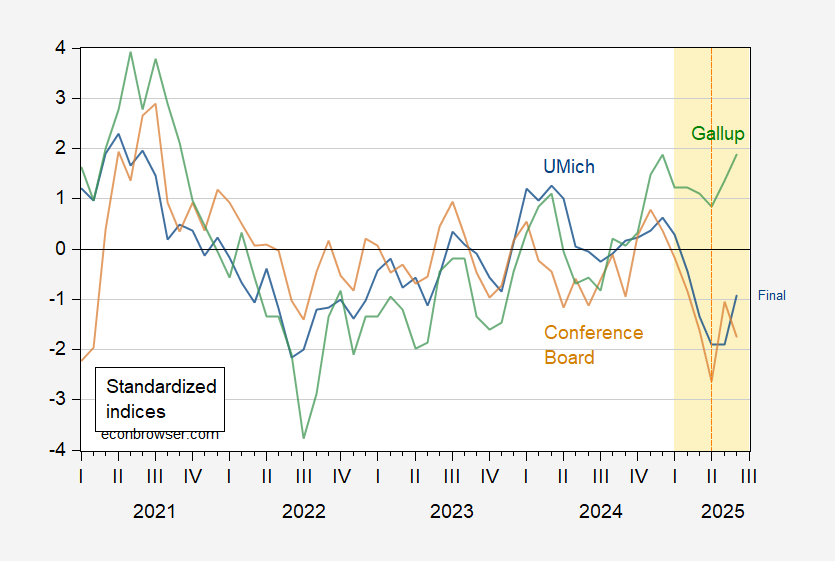

The falloff in (chained CPI deflated) retail sales is also suggestive of a tiring consumer, which would not be surprising given the relatively low levels of consumer sentiment.

Figure 3: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (brown), Gallup Confidence (green), all demeaned and divided by standard deviation 2021M01-2025m02. Dashed line at “Liberation Day”. Source: UMichigan, Gallup, Conference Board, and author’s calculations.

surprised, then later disturbed, to see the 7.3% drop in social security payments to individuals indicated by today’s income an outlays report.

see line 23 in table 1: https://www.bea.gov/sites/default/files/2025-06/pi0525.pdf

reading the press release, i find that was a decrease in payments associated with the recently passed Social Security Fairness Act.

that was promoted to ensure social security for teachers, firefighters, police officers, and other public employees…

here’s details on that trojan horse, which i have yet to see covered in the media:

https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html

Here’s the series on Social Security:

https://fred.stlouisfed.org/graph/?g=1JQPv

Big jump and dip, distorting the entire income series because of its size.

This is, of course, small potatoes compared to the dip anticipated un about a decade, if nothing is done. I suspect the slashing of Medicaid, and possible sequestration of Medicare, are test runs for allowing Social Security benefits to fall because Congress won’t do anything to raise revenues.

Government workers have been robbed for decades on this issue. If you worked outside of government in your career, SS did not give you credit for that time working. You received no SS benefits even though you paid into the system. This was republican effort to put the screws on union government workers. Really a shame, and cost many people tens of thousands of dollars or more in lifetime social security. Well done angry conservatives.

an on topic addition, while i’m here:

(( (((16,375.4 + 16,330.0) / 2) / 16,291.8) ^ 4 ) – 1 ) * (16,291.8 / 23,512.7) = 0.0104185951

wherein the all annualized figures, in 2017$, are April and May PCE, first quarter PCE, first quarter PCE, and first quarter GDP

that tells us PCE would add 1.04 percentage points to the growth rate of the 2nd quarter, with that based on the unlikely assumption that there’d be no change in June PCE from the April-May average…