From Bunn and Pomerleau/Tax Foundation, “Will E.J. Antoni Raise Your Taxes?”:

Every year the IRS adjusts more than a dozen tax thresholds to account for inflation, a process called indexing. In 2020 the 10% tax bracket applied to income up to $9,875 for single individuals and $19,750 for married couples. Thanks to inflation indexing, those thresholds are now $11,925 and $23,850, respectively.

…

The IRS doesn’t come up with those inflation adjustments on its own. It relies directly on the consumer price index, which the BLS publishes monthly.

…

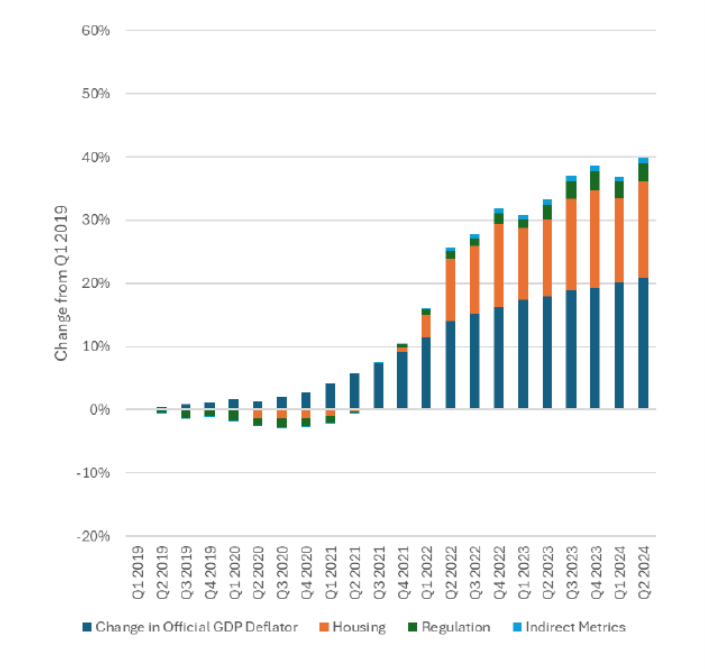

Will that be true under Mr. Antoni? There are reasons for concern. He co-authored a 2024 paper with Peter St. Onge for the Brownstone Institute that critiques the way government measures the cost of living. Messrs. Antoni and St. Onge created an alternative measure of inflation and used it to claim that the U.S. economy has been in recession—shrinking in every quarter since the start of 2022.

…

If, as they assess, inflation has been significantly higher than the CPI shows—Mr. St. Onge specifically claimed it was undercounted by half—then millions of Americans have been paying more income taxes than they should have been.

On the flip side, consider what would happen if Mr. Trump prefers a political narrative of low inflation and the BLS finds a way to support it. Artificially low inflation numbers would lead to artificially higher taxes as tax parameters are insufficiently adjusted for inflation each year.

I honestly hadn’t thought about this implication. According to Antoni-St. Onge, how much did the BEA deflator understate the “true” GDP deflator? The answer: A cumulative 17 percentage points over the 5 years 2019Q1-2024Q1

Source: Antoni and St. Onge (2024).

This implies that, over five years, Antoni and St. Onge would have had measured the GDP deflator inflation at 7.4% instead of 4%…