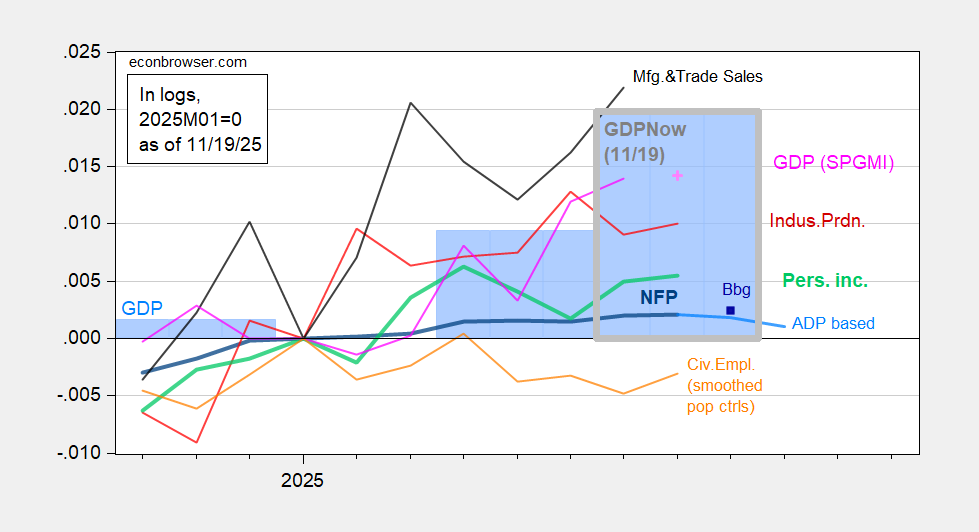

Tomorrow, we get results for September employment. Bloomberg consensus is for +55K, compared to +42K at the originally scheduled release date (and +22K in August). Here are key indicators followed by the NBER Business Cycle Dating Committee.

Figure 1: Implied NFP preliminary benchmark revision (bold blue), ADP based author’s estimate (light blue), Bloomberg consensus employment for implied preliminary benchmark, (blue square), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), estimate of monthly GDP based on coincident index (pink +), GDP (blue bars), GDP from GDPNow of 11/19 (blue bar, gray outline), all log normalized to 2025M04=0. Source: BLS via FRED, Federal Reserve, BEA 2025Q2 third release, Atlanta Fed, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

My nowcasts using ADP to interpolate private NFP indicate a drop in employment. Goldman Sachs estimates +85K for October.

In any case, the substantial divergence between employment and output growth continues, at least as indicated by GDPNow. Actual GDP will be reported November 26th.

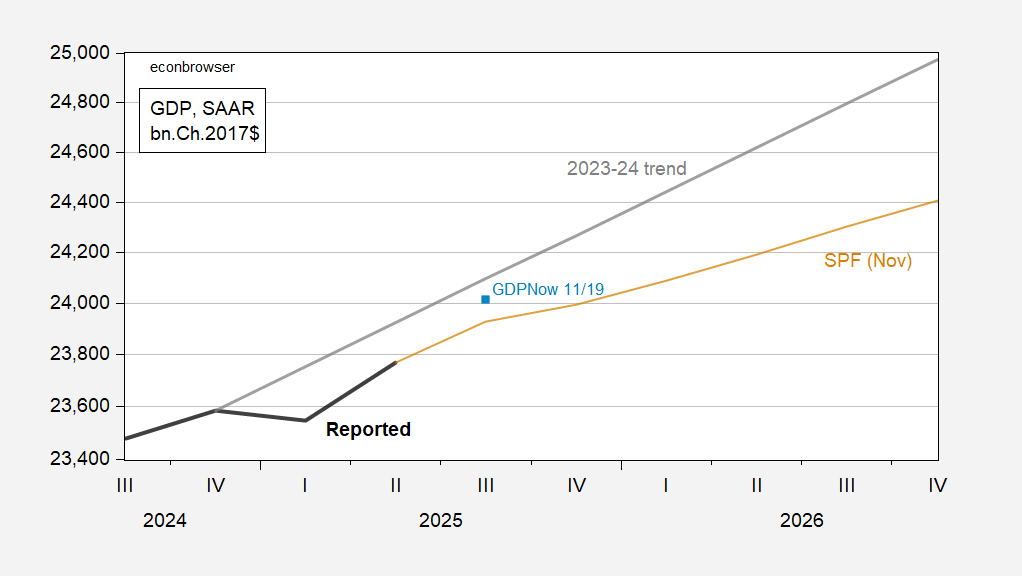

GDPNow is predicting 4.2% q/q annualized growth in Q3. While this number seems pretty high, it still does not take us back to the 2023-24 trend.

Figure 2: GDP (bold black), GDPNow (light blue square), Survey of Professional Forecasters (tan), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q2 3rd release, Atlanta Fed, Philadelphia Fed, and author’s calculations.

What about “core GDP” (aka final sales to private domestic purchasers)? There’ slower growth nowcasted, but the 2023-24 trend is not re-attained here either.

Figure 3: Final sales to private domestic purchasers (bold black), GDPNow estimate (light blue square), Survey of Professional Forecasters estimate (tan), all in bn.Ch.2017$ SAAR. SPF forecast based on simple sum of consumption, nonresidential and residential investment. Source: BEA 2025Q2 3rd release, Atlanta Fed, Philadelphia Fed, and author’s calculations.

Core GDP is forecasted to slow after Q3.

September job growth reported at 119,000. That and downward revisions to July and August counts leaves the Q3 monthly average at 36,000. In the period of the Great Moderation, a late-cycle quarterly average that low has always led to recession within a few months:

https://fred.stlouisfed.org/graph/?g=1O1Eb

The Sahm rule ticked up but isn’t recessionary.