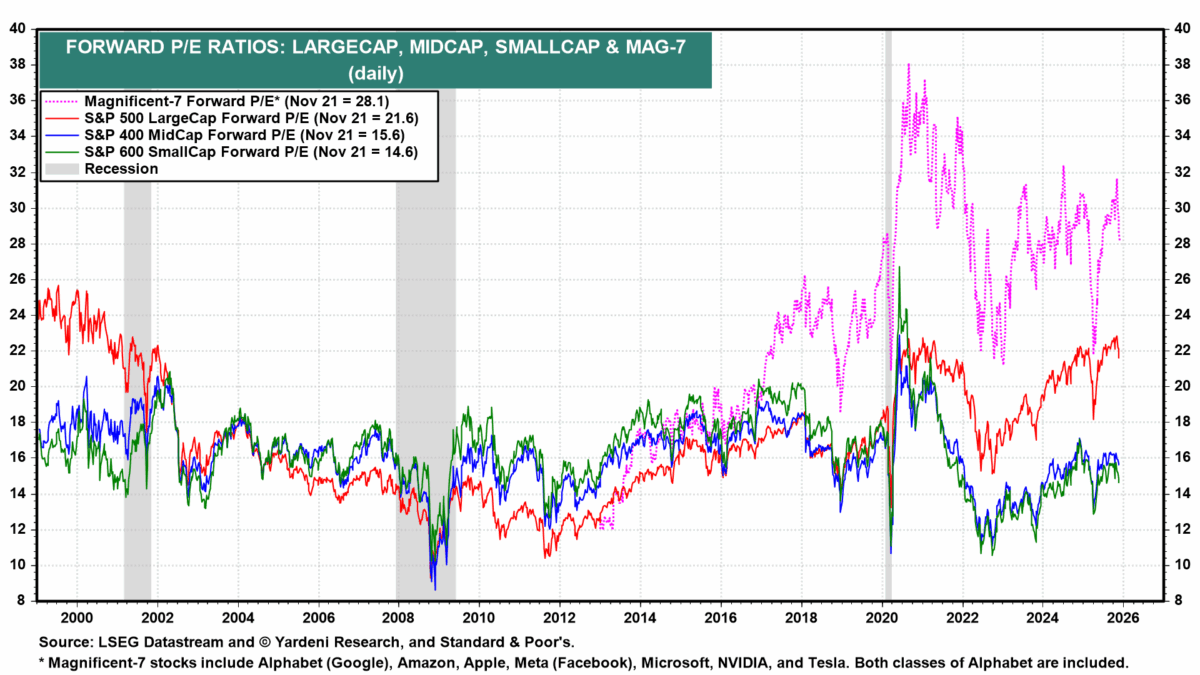

From Ed Yardeni’s website:

Source: Ed Yardeni, Accessed 11/22.

The Magnificent 7 forward P/E ratio, using prices as of 11/20 (as far as I can tell) was 28.1. If the Mag 7 index rose 0.8% on Friday, then the ratio has risen to about 28.3. It’d be nice to compare to the aggregate trailing P/E ratios, but Yardeni doesn’t provide this graph. It does seem that on an individual level, forward P/E ratios are below trailing for the individual stocks, but this doesn’t prove that the forward P/E ratios aren’t too optimistic (after all “forward” means using guesses about future earnings over the next year).

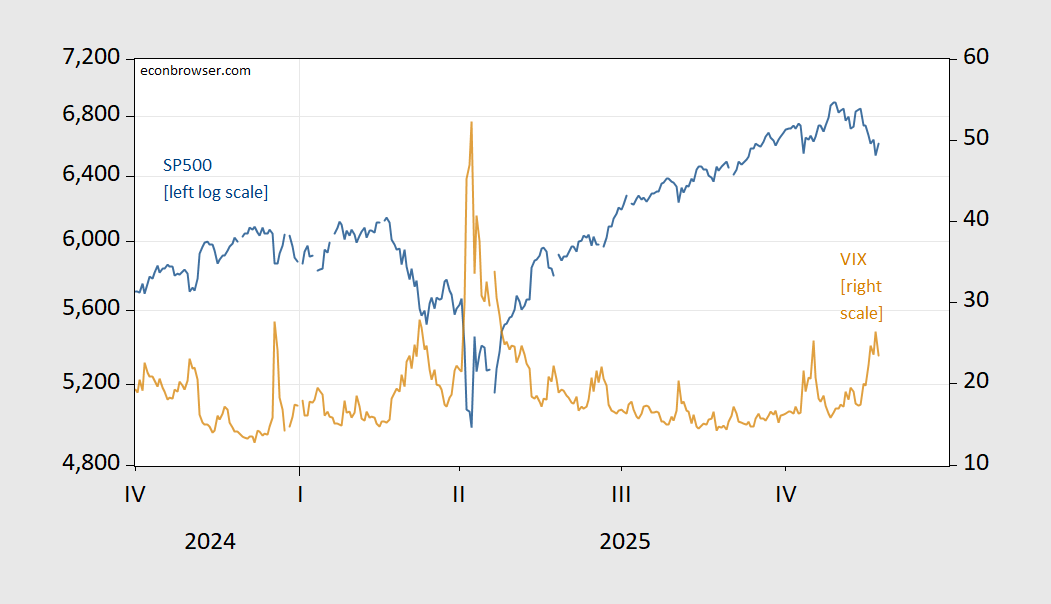

Here’s the SP500 and VIX through Friday’s action:

Figure 1: SP500 (blue, left log scale), VIX (tan, right scale). Source: Dow Jones, CBOE via FRED.

Indeed, forward earnings are guess. It is the kind of guess that in-house financial accountants are sometimes good at, and they give guidance to stock analysts.

The forward earnings of new technology firms are more of a mystery than those of more conventional firms and new technology firms have driven equity gains this year.

To see an example of what can happen when future tech-sector earnings estimates are over-optimistic, take a look at Cisco Systems around 2000:

https://finance.yahoo.com/quote/CSCO/

Notably, Cisco is now almost back to its Y2K-era peak. What’s that old saying? If at first you don’t succeed, fool me twice?

We are coming into the portfolio-tidying season. Rebalancing portfolios when a few shares have greatly outperformed the rest of the market can cause bumps. A risk-off trade (see Bitcoin) can cause bumps. Liquidity problems, ditto. If we look overseas, there are whispers of trouble in Japan and South Korea, while China continues to struggle with property-market and over-capacity problems. Their bumps could become our bumps. Fun, fun year-end trading.