My title for Setser-Sobel in OMFIF, more soberly entitled “It’s time for China to let the renminbi appreciate sharply”:

The renminbi is hugely undervalued. This is an impediment to tackling China’s enormous current account surplus and the leadership’s stated desire of boosting domestic demand. Instead of managing the currency tightly against the dollar, it is high time for the authorities to promote strong appreciation against the dollar and on a trade-weighted basis.

Gauging undervaluation

Prominent currency valuation models are based on current account positions. This summer, the International Monetary Fund’s External Sector Report noted China’s 2024 cyclically adjusted current account surplus was 2.0% of gross domestic product, exceeding its norm by 1.2 percentage points of GDP. On that basis, the Fund estimated renminbi undervaluation at 8.5%.

In the Fund’s October World Economic Outlook report, however, China’s 2025 current account surplus was revised up to 3.3% of GDP. Applying the Fund’s elasticity estimate, that would suggest an undervaluation of around 18%, assuming the estimate is broadly in line with the cyclically adjusted surplus.

The IMF’s current account estimates are based on Chinese balance-of-payments data, which started to diverge significantly from China’s customs trade data after China changed its BoP methodology in 2022. If one uses customs data (based on the previous methodology), then the current account surplus increases significantly.

Further, assuming China’s income balance is flat, notwithstanding the large and rising net international investment surplus (thus discounting the increased income deficit China has reported since the pandemic), the current account surplus could be in the order of 5% of GDP. Applying the Fund’s elasticity estimate yields an undervaluation of roughly 30%.

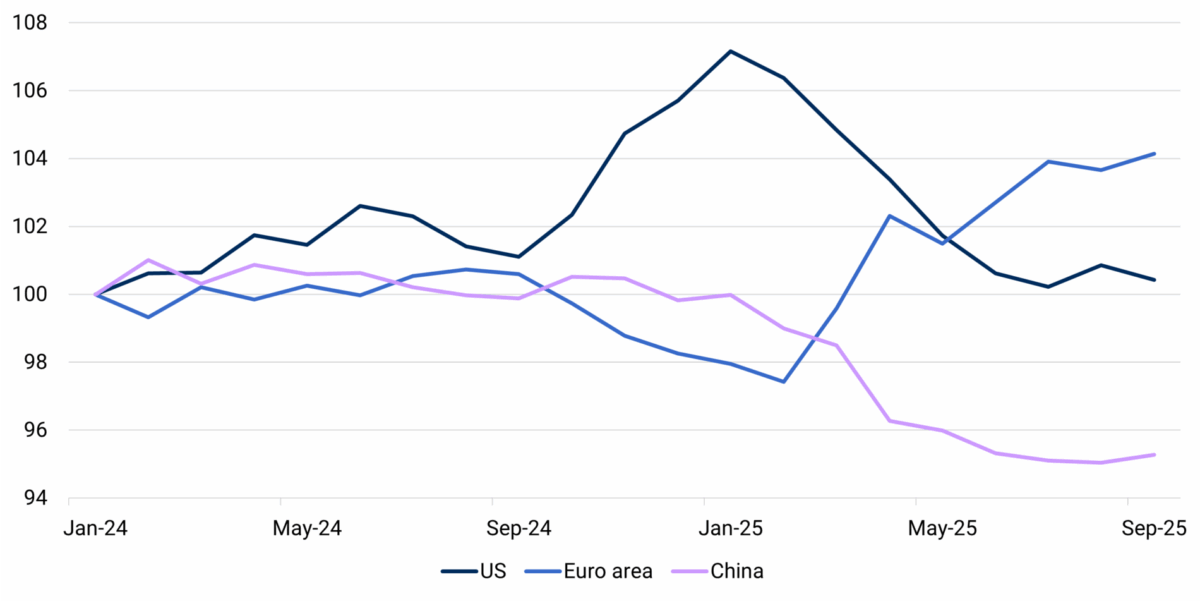

Here’s Figure 2 from their article:

Interestingly, this is lower than the 23.4% implied (for July) by Big Mac Parity.

An evaluation using the Penn effect (as in Cheung, Chinn, Nong, 2017) would likely yield similar results.

While this estimated undervaluation is smaller than the 30% or so in May 2006, China is a much larger economy now, accounting for a much larger share of world GDP.

In other words, yuan undervaluation is helping to sustain Chinese GDP growth, but at the expense of aggregate demand in the rest of the world (in particular Europe).

“

Aside from the inherent conservatism of China’s policy makers, there is reason to think policy makers will shy away from currency appreciation right now. Overcapacity in manufacturing wpuld be harder to deal with if the yuan strengthens. Share prices might drop in domestic terms to offset appreciation in international terms. Disinflation is a problem, and yuan appreciation is likely to be disinflationary.

If I were a technocrat who had been struggling to stabilize household wealth and the financial system overall, I’d be disinclined to tinker with the FX regime. It’s China’s yuan, but it’s our problem.

A pretty good article in Asia Times regarding the economic balancing act going on in China.

https://asiatimes.com/2025/11/chinas-bet-on-self-reliance-wont-fix-an-unbalanced-economy/

Bruce, just fyi. X (formerly known as twitter) just released a tool to help better identify the history of a poster. Interestingly, a large number of influential maga posters on X are actually foreign trolls from places such as eastern europe, africa and china. They are not from the united states. Maga influencers are being controlled by foreign nations. So much for republican actions emphasizing america first. But we have been telling folks like bruce this issue for years.

Bruce actually lives in Mongolia where he can afford a cup of coffee.

there is ample evidence to indicate that bruce and the rest of maga have been taking direction from foreign influencers for years now. bruce will deny it, but musk released the tools that indicate this is actually the case. which explains why they claim America first, but tend to promote policies in direct contradiction to their stated goal. idiots.

The PRC has 5 year plans. Lenin had a 5 year plan. Trump? 5 days plans followed by TACO!