From Bloomberg:

“If we don’t adjust policy down, then I think that we do run risks,” Miran said during an interview with Bloomberg TV on Monday. Miran added he doesn’t foresee an economic downturn in the near term, though rising unemployment should push Fed officials to continue cutting rates.

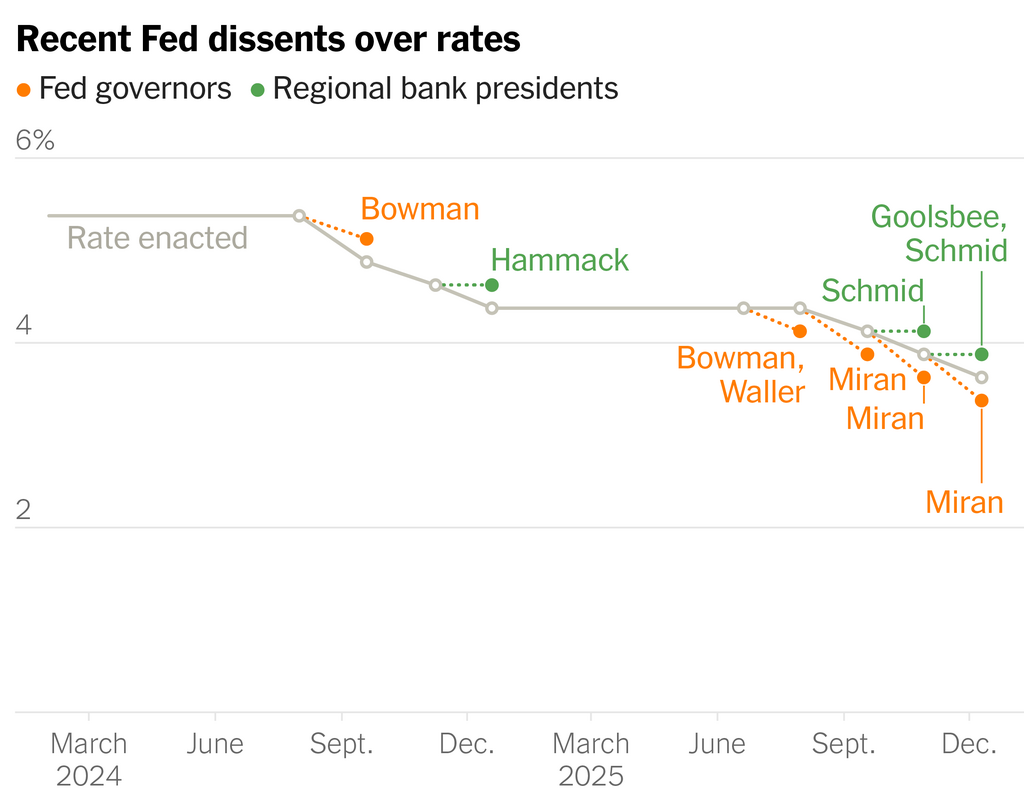

This graph from Andrew Ross Sorkin puts Miran’s view in perspective:

Source: Dealbook newsletter, 12/20/2025.

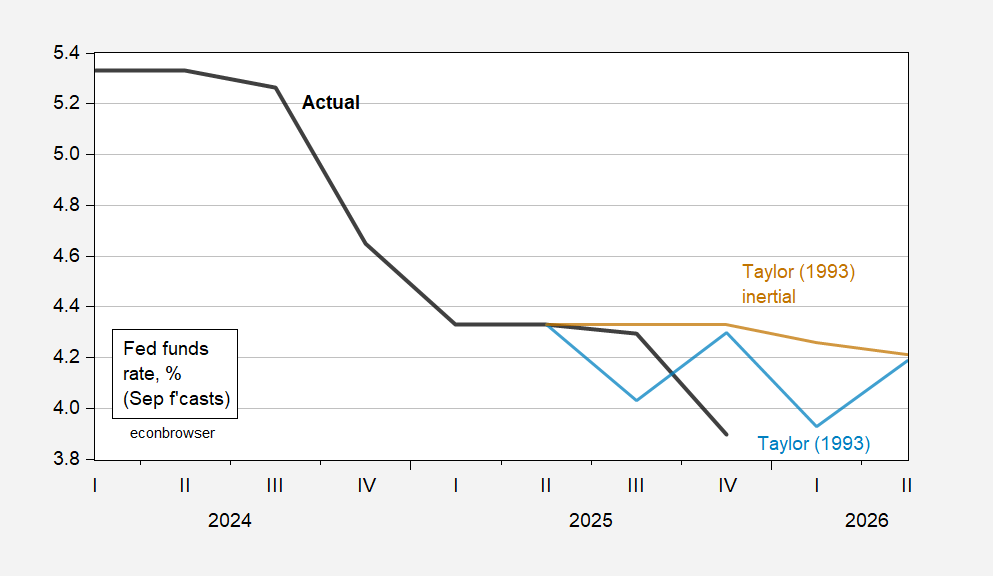

According to a simple Taylor rule (the original), the Fed funds rate is now below the implied.

Figure 1: Fed funds rate (bold black), Taylor (1993) implied rate (light blue), and Taylor (1993) implied inertial rule (tan), all in %. Source: Federal Reserve via FRED, and Cleveland Fed utility.

The prescribed Fed funds rate depends on r*; if Miran believes r* is 0.4 ppts lower than the median FOMC estimate as of September, 1%.

Real GDP up 4.3%.

Real GDI up 2.4%.

PCE deflator up 2.8%, core 2.9%

GDP deflator up 3.4%.

Fed policy is accommodative, and we need more rate cuts?

The above list of data is backward-looking, of course. Miran says we need to cut rates because a slowdown is coming, though not soon, to which any legitimate monetary policy maker would way “That’s not how we usually do things.”

The problem is the part that Miran isn’t allowed to say. GDPNow hasn’t updated fof Q4 yet, but will show a slowdown in the current quarter. If Miran wants to make an argument for more rate cuts, he could simply admit we’re in a slowdown right now. He won’t, because he’s a partisan hack, who in his other gig had a hand in causing the slowdown.

On a related matter, real disposable personal income was flat in Q3, while corporate profits after tax were up 4.4% (10.5% y/y). There’s yer affordability problem, right there.

GDPNow has released its initial Q4 estimate, but only in the PDF. The web page is not updated. The estimate is for 3.0% growth. PCE accounts for 1.83%, inventories 0.98%, government for 0.24%.

If the Hutchins Center estimate of a 1.5% drag from fiscal policy is taken out, that would make fora 1.5% gain, which would be pretty good. Hutchins expects fiscal policy will add 2.8% to growth in Q1.

“Fed Risks Recession Without More Interest Rate Cuts”

That is unpossible. I have it on good authority from the President of the United States that the economy is the hottest ever, the hottest in the world, the envy of the world. How could we have a recession?

Miran needs to talk to his boss at the White House so they can get on the same page.

Off topic – It’s official. Renewable energy is a threat to national security:

https://www.doi.gov/pressreleases/trump-administration-protects-us-national-security-pausing-offshore-wind-leases

I would explain, but I can’t; the nature of the threat is a secret. I can, however, speculate. I think the threat is along the lines of “Nice windmill. It would be a shame if something happened to it.”