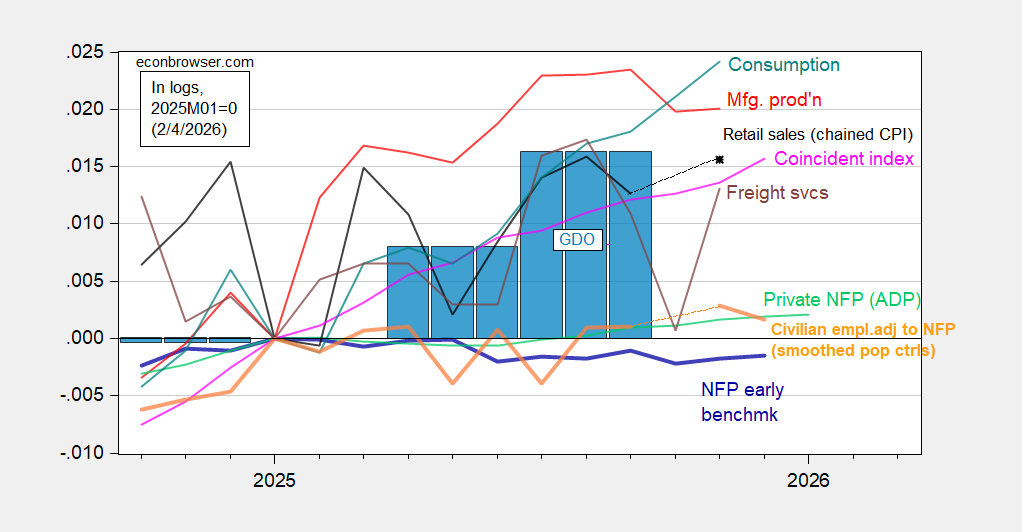

+22K vs. Bloomberg consensus of +46K, down from December (rev’d) +37K. Alternative business cycle indicators incorporating these figures show the labor market growth at near zero:

Figure 1: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, smoothed population controls (bold orange), manufacturing production (red), consumption (light blue), real retail sales (black), freight services index (brown), and coincident index (pink), GDO (blue bars), all log normalized to 2025M01=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve, BTS via FRED, BEA 2025Q3 updated release, and author’s calculations.

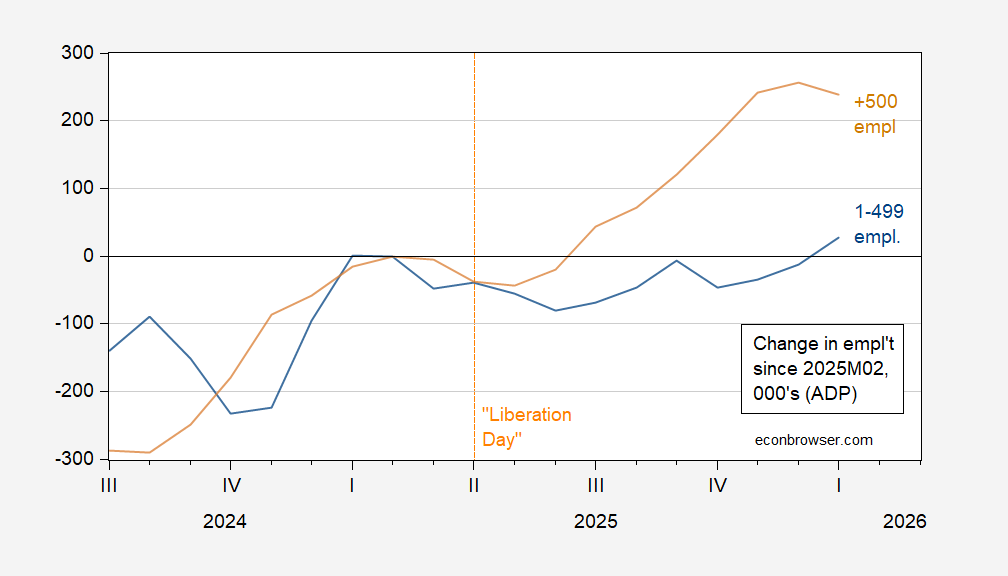

On the other hand, with revisions to benchmarks, the small firm employment/large firm employment dynamic has reversed, such that small firm employment is now growing faster than large firm employment.

Figure 2: Cumulative change since 2025M02 in employment in firms with employment > 500 (tan), employment 1-499 (blue), in 000’s, s.a. Source: ADP January 2026 release, and author’s calculations.

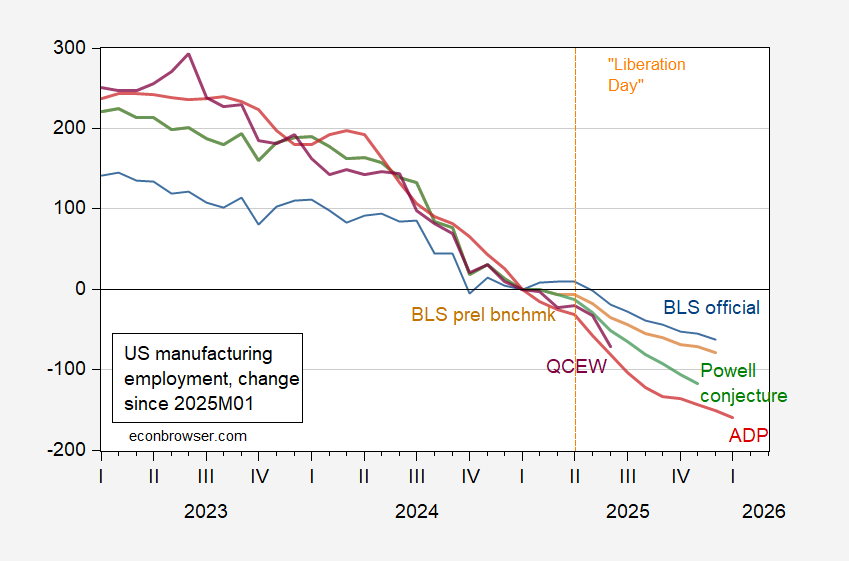

Moving to manufacturing, the sector which the current administration has touted as being on the recovery, has shown employment loss relative to January 2025 (in contrast to the earlier vintage which indicated an employment gain — see this post).

Figure 3: Change since 2025M01 in manufacturing employment from BLS (blue), from implied preliminary benchmark (brown), in Powell conjecture prorated applied to implied preliminary benchmark (green), QCEW covered manufacturing seasonally adjusted using X-13 (in logs) by author (purple), and ADP (red), all in 000’s, s.a. Source: BLS via FRED, BLS, ADP, and author’s calculations.

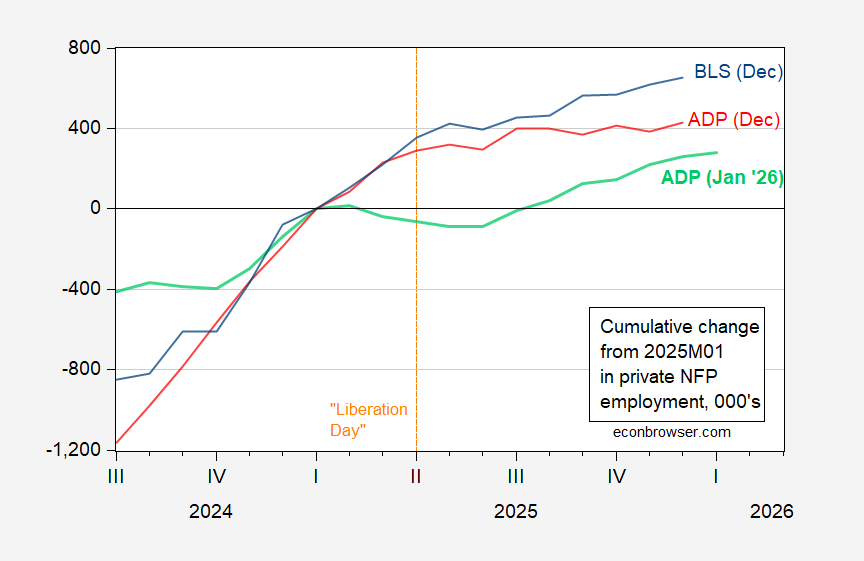

Addendum:

The benchmark revision makes the 2025 employment gain smaller:

Figure 4: Cumulative gain in ADP private nonfarm payroll employment, January 2026 release (light green), December 2025 release (red), and BLS/CES December release (blue), all in 000’s, s.a. Source: ADP via FRED, ALFRED, BLS, and author’s calculations.

The official BLS series incorporating the preliminary benchmark revision (not shown) looks pretty close to the ADP pre-benchmark revision series (red lie).