From USDA on Thursday:

- Overall, farm cash receipts are forecast to decrease by $14.2 billion (2.7 percent) from 2025 to $514.7 billion in 2026 in nominal dollars. Total crop receipts are forecast to increase by $2.8 billion (1.2 percent) from 2025 levels to $240.8 billion in 2026 following higher receipts for corn. When adjusted for inflation, total crop receipts are forecast to decline 0.7 percent. Total animal/animal product receipts are projected to decrease by $17.0 billion (5.8 percent) to $273.9 billion in 2026. Receipts for both eggs and milk are forecast to fall relative to 2025.

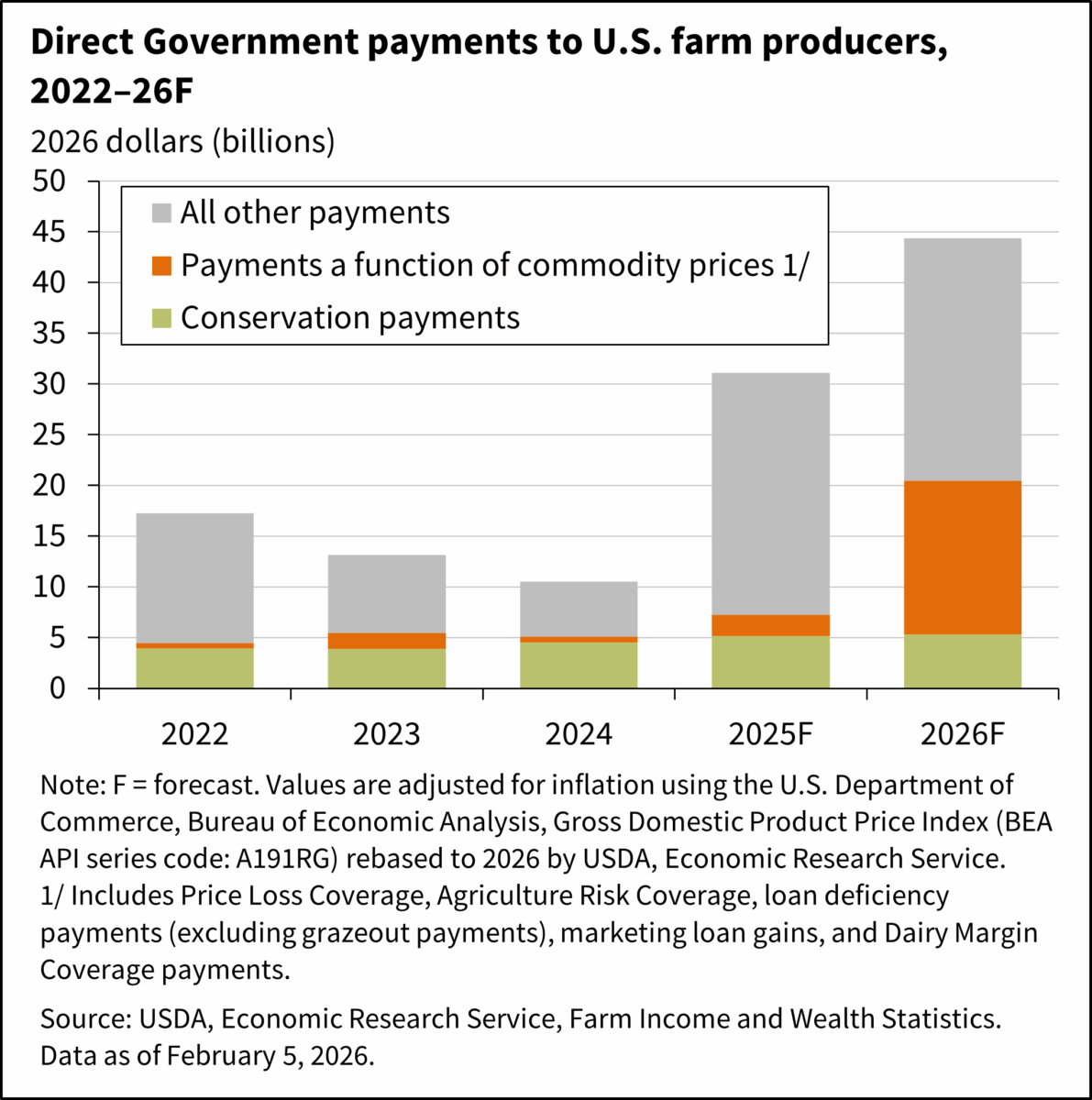

- Direct Government farm payments are forecast at $44.3 billion for 2026, a $13.8-billion increase from 2025. The forecast increase is largely because of an expected increase in commodity payments that are a function of prices while supplemental and ad hoc disaster assistance to farmers and ranchers is forecast to remain high in 2026. Direct Government farm payments include Federal farm program payments paid to farmers and ranchers but exclude U.S. Department of Agriculture (USDA) loans and insurance indemnity payments made by the Federal Crop Insurance Corporation (FCIC).

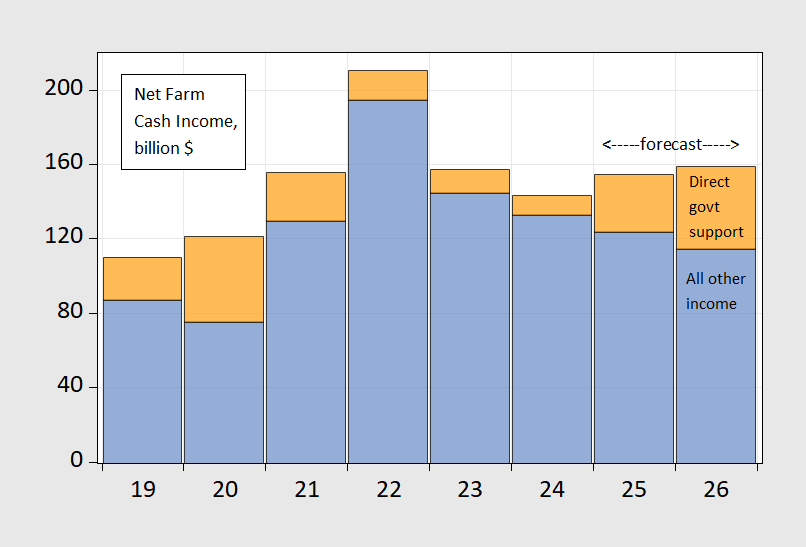

Here’re the numbers (forecasts in 2025-2026).

Figure 1: Farm net cash income from direct government support (tan), all other net cash income (blue), in billions $. Source: USDA, 2/5/2026 version.

From USDA:

Government payments discussed here do not include Federal Crop Insurance Corporation (FCIC) indemnity payments (listed as a separate component of farm income) and USDA loans (listed as a liability in the farm sector’s balance sheet). Direct Government farm program payments are forecast at $44.3 billion for 2026, a $13.8 billion increase (or 45.2 percent) from the $30.5 billion total for 2025. This overall increase reflects higher anticipated payments from Farm Bill programs that trigger payments when commodity prices fall while supplemental and ad hoc disaster assistance payments are expected to remain high.

Graphically (now in real terms):

Source: USDA, 5/2/2026.

In real terms, assuming 2.6% GDP deflator inflation in 2026 (SPF, Nov. 2025), net cash income would increase by 0.4%, while net cash income ex-direct government support would decrease by 9.0%.

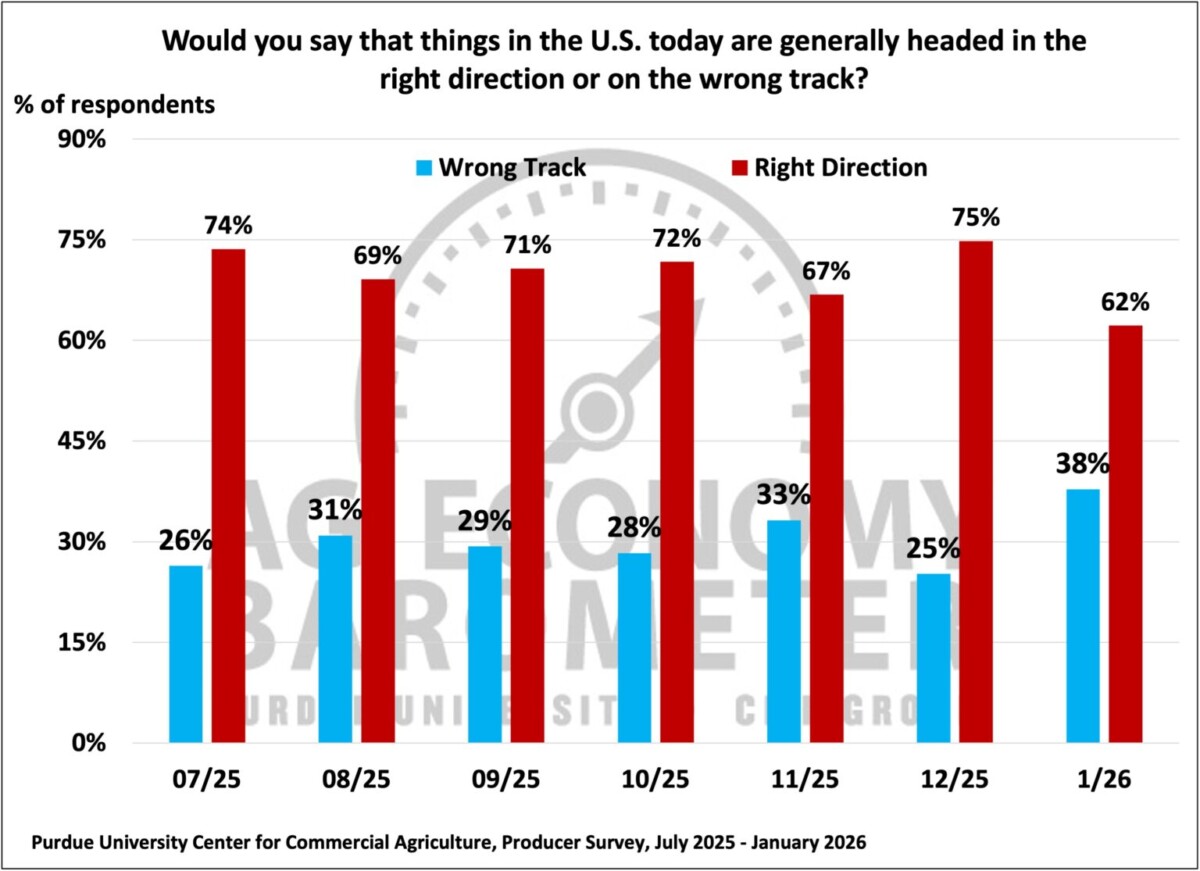

With this amount of government largesse, it’s no wonder that despite all the trade challenges facing agriculture, the “right direction” share remains pretty high for farmers (albeit lower than in previous months).

Source: Purdue/CME, February 2026.

It’s also worth noting that overall assessment of the situation, according to the AgBarometer, dropped significantly in February (see this post).

What about the great deal that President Trump made with China re: soybeans? As of end-January, exports during this Marketing Year is 4.3236 million metric tons; the corresponding value last Marketing Year was 18.1198 MMT.