Last semester, teaching the Financial System, I laid out three things that worried me: Crypto & stablecoins, private credit, and the AI boom. How’re things looking for the latter?

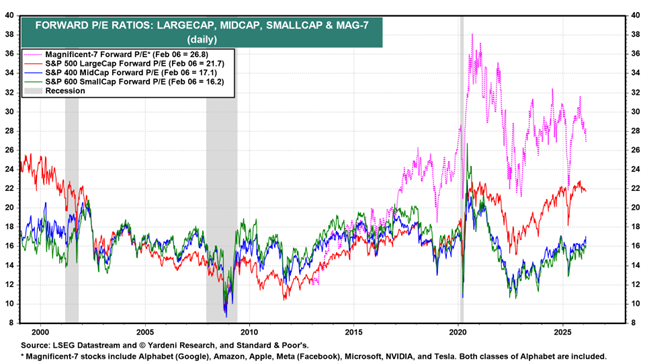

Despite recent movements in Magnificent 7 prices, forward price earning ratios remain elevated.

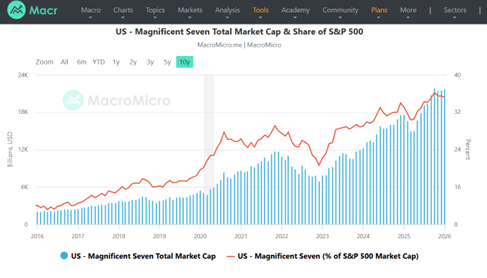

Through January, Magnificent 7 accounts for 35.7% of the SP500 capitalization. Or $21.7 trillion.

At the end of Q3, household net worth was $172.9 trillion, so the Magnificent 7 capitalization accounted for about 12.1% of household net worth at that time.

A big correction of the dot.com bust nature (about 20%) decline would have a substantial impact, given the greater holding of stock market assets now. I provide a back -of-the-envelope calculation of first round effects on consumption, here.

A large correction would finance-constrain AI-related firms aside from the Magnificent 7. The Magnificent 7 up to now have largely relied on internal funding (and even Amazon has indicated that going forward, that’s less true); that’s not true for many other firms that have relied on debt.

Recent reports put capital investment plans for 2026 at about $665 bn. 2025q3 nonresidential fixed investment as about $4300 bn (SAAR). Assuming the same rate for all of 2026, one gets a share of about 15.5%. Should there be a big drop in AI-related spending, that will also hit aggregate demand.