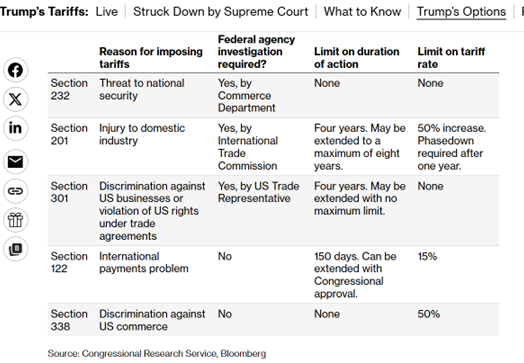

CRS via Bloomberg, various trade authorities.

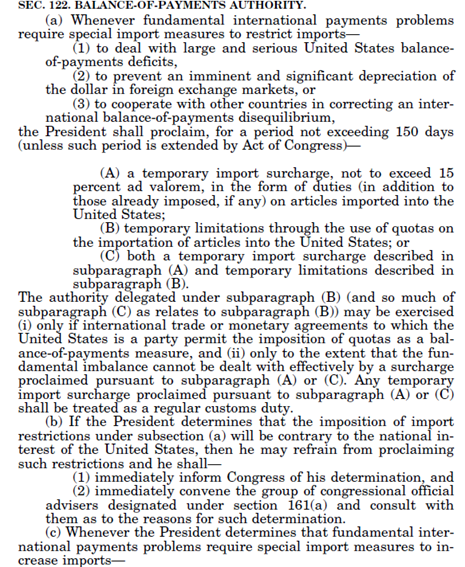

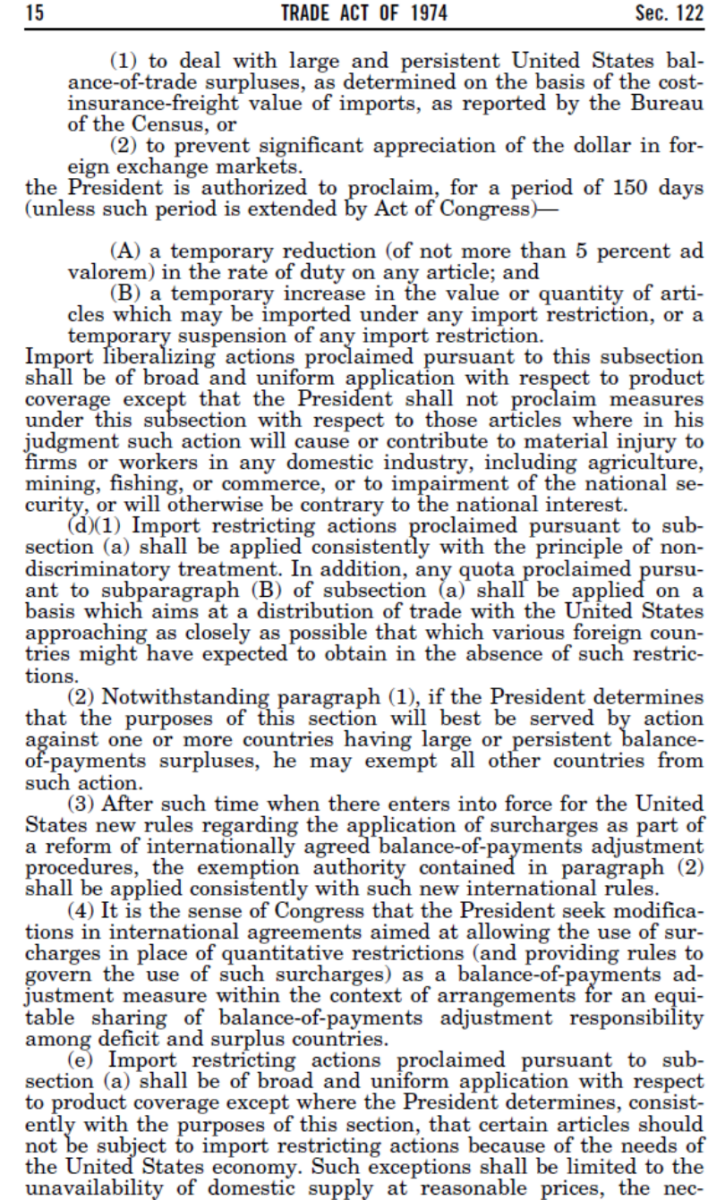

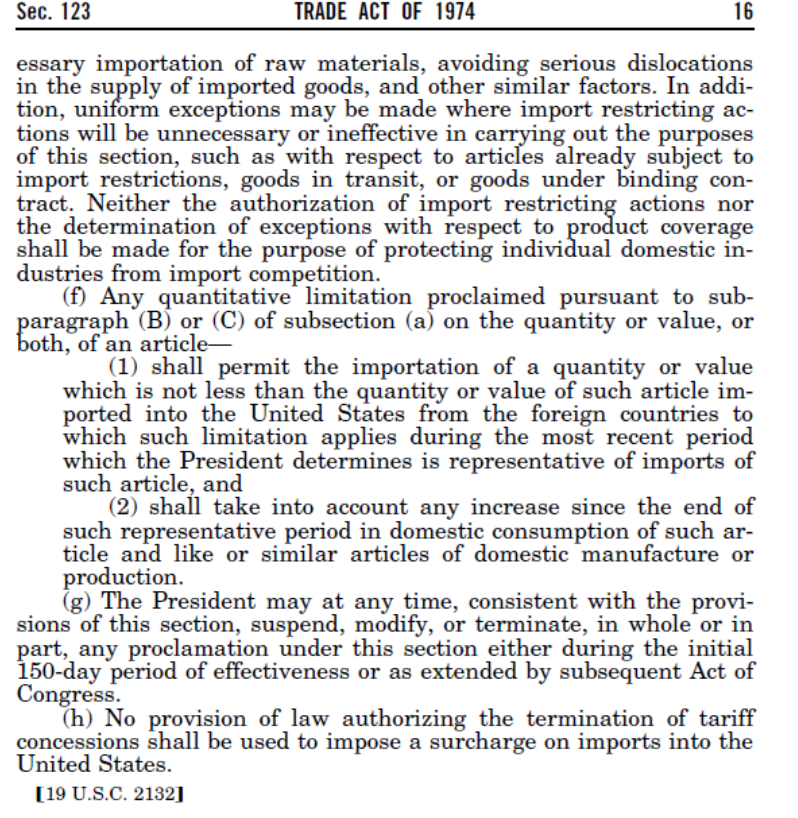

Mr. Trump has invoked Section 122. Here’s the actual text:

Other commentary on the alternatives to IEEPA based tariffs, [1] . I will point out that there is no evidence of a balance of payments problem for the United States currently, nor is there evidence of an immediate and significant depreciation of the dollar.

Returning to the balance of payments, as noted in Chapter 11 of Chinn-Irwin (or any reputable international economics textbook, Feesntra-Taylor, Krugman-Melitz-Obstfeld),

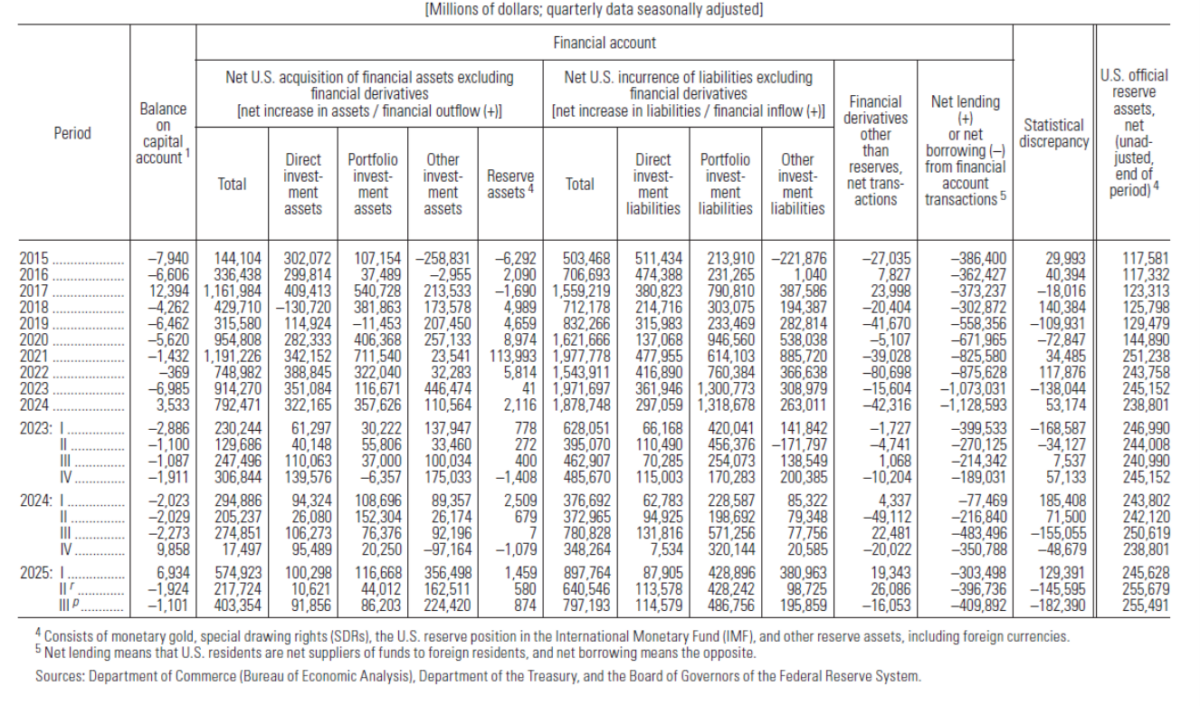

If we have a balance of payments deficit, ORT > 0, and reserves should be decreasing. As of Q3, US international reserves have not changed substantially. Why should they? The US is on a flexible exchange rate regime, and does not intervene regularly to peg the dollar’s value against a given foreign currency. Hence, there’s no risk of a drastic drop in forex reserves.

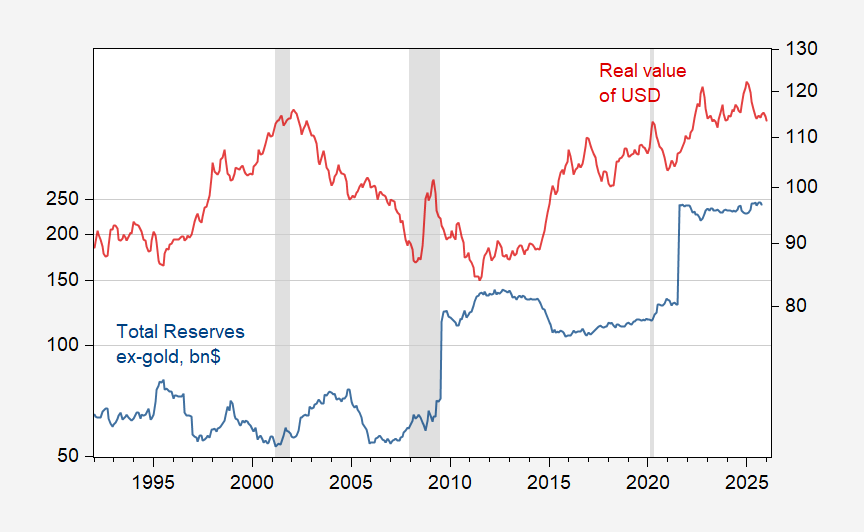

The modern variant of a balance-of-payments crisis would be a “sudden stop”. If that happened on a pure floating exchange rate regime (it hasn’t ever to my knowledge), this would show up in a currency crash. That hasn’t happened either.

Figure 1: Total reserves ex-gold, bn.$ (blue, left log scale), real value of US dollar against a broad basket of currencies, 2006M01=100 (red, right log scale). NBER defined peak-to-trough recession dates shaded gray. Source: IMF, Federal Reserve Board via FRED, NBER.

So, I ask again, where’s the balance-of-payments problem?