I’ve maintained that rising oil prices put a significant burden on the U.S. economy in recent months. How much will falling oil prices help to alleviate those concerns?

Certainly rising gasoline prices were one factor in this year’s plunging consumer confidence. With prices now falling, the Reuters/University of Michigan index of consumer sentiment is up slightly for the last two months. But it still has a long way to go before you’d describe consumers as upbeat.

|

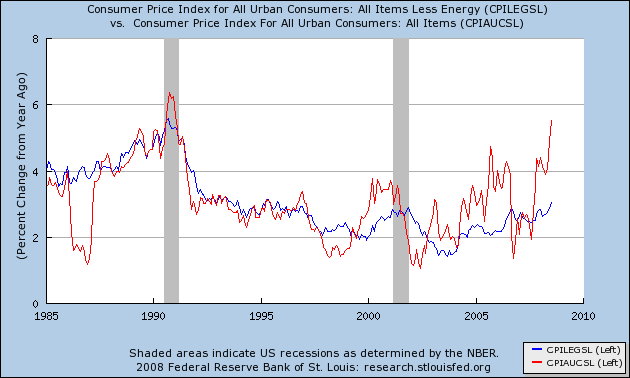

Falling oil prices also mean immediate relief on inflation. The energy price decreases over the last two months should subtract a full percentage point from the 5.6% year-over-year CPI inflation reported by the BLS last week. But again it will take a lot more to bring headline inflation back to comfortable levels.

|

Sometimes the stock market has taken lower inflation to be good news insofar as it gives the Fed breathing room to lower interest rates. But I

have been skeptical of the Fed’s ability to stimulate the economy with further rate cuts, and agree with Tim Duy that the main effect of falling oil prices is likely to be that the Fed holds a bit longer at the current 2% fed funds target before trying to make a move in either direction.

Nor do I expect falling oil prices to bring relief to U.S. automakers. The fleet of U.S. vehicles is inexorably going to be converting to more fuel-efficient models as old cars get replaced, and that’s a big challenge given Detroit’s traditional market niche.

|

But really the key question for purposes of assessing the economic consequences of falling oil prices is, Why did oil prices fall? To the extent that it is due to the increased global oil production that we’ve been anticipating ([1],

[2]),

that is unambiguously good news for an oil importer like the United States. But I’m persuaded that another key cause of oil’s recent plunge has been economic weakness in Europe and Japan, which has meant both a stronger dollar and weaker global oil demand.

And weakness in global economic growth is a real threat to the U.S. economy. Exports are the one sector that seemed to keep the U.S. economy going in the second quarter. If you kick out the leg of a one-legged stool, prospects for stability are not too great.

Breakdown of U.S. real GDP annual growth rates.

|

Technorati Tags: oil,

oil prices,

dollar

euro,

exchange rates,

inflation,

economics,

macroeconomics

You also might look at US real oil imports, it is the US marginal demand curve.

They had been volatile around a flat trend for the last few years but this spring they clearly broke out of this flat trend to the downside.

The other point in favor of weakness is that other commodity prices have also broken significantly to the downside.

And, can prices fall far enough to get drivers to change back from their inefficient behaviors they mistakenly adopted with high gas prices? Drivers seem to be more efficient when they focus on getting from point A to B quickly (and hopefully reasonably safely). We lost that when we started getting high gas prices in about 2005. People accelerated slower and congestion (at least to me) seemed to get worse. Fuel efficiency went down rather than up. Now that drivers have stupid things stuck in their heads, will they simply forget them just because gas prices get lower, or will they keep their new bad habits. And can they change back without higher economic growth. If incomes remain low, people will continue to drive at the most inefficient times to try to keep above water and keep their bad habit thinking that they’re saving.

Sadly, expensive oil is a net positive for society in the medium and long-term.

Read a detailed case here.

For starters, the US used to have 42,000 fatalities and 2 million injuries a year due to traffic accidents, costing $500B/yr in direct and indirect costs (police, hospital, morgue, court, insurance, lost productivity). Expensive oil was slashing this grim toll.

The FED and congress have been successful in driving the whole world into economic distress. As I have noted with posts from various FED governors this was intentional to fight inflation. The FED is much like a doctor who removes a splinter in a finger by cutting off a hand.

You get winners and losers.

Obvious winners are anyone impacted by energy-cost driven inflation. That’s probably only a few hundred people at most.

Obvious losers are pension funds, stockholders of energy/oil companies, special interests seeking funding for alternative fuels [the crisis is gone syndrome]. That’s probably only a few hundred people at most.

The biggest loser, of course, would be the government from lost tax revenues.

Jim, the main effect of lower oil pricing will be a drop in global liquidity with dollar weakness.

With the new supplies and rollovers at Treasury and the GSE’s long term yields should be heading higher. If inflation moderates(a big if) the FED may cut to give the banks a fatter spread.

The consumer is screwed under all scenarios.

The consequences of falling oil prices, and the benefits of high oil prices

Lynne Kiesling At Econbrowser, Jim Hamilton has a very thorough post on the economic consequences of falling oil prices. Consumer confidence, inflation, GDP, Fed policy, … and his conclusion is not very optimistic in the short run. In fact, here’s…

“Obvious winners are anyone impacted by energy-cost driven inflation. That’s probably only a few hundred people at most.”

You left out million, a few hundred million people at most. Most of the cost of food is oil.

We are a service economy, that requires energy. It’s the main component of both every service and every product we produce. You either use fuel to run a machine or you use labor, which requires food, which is produced using fuel.

Consumer sentiment. Almost as low as the end of the Carter years. Interesting. I suspect they are harder to please now than back then. Personally, my sentiment will not perk back up until I see the front runners for the 2012 election cycle regardless of what the economy does. I suspect that sentiment could get a lot lower as we save the planet.

The Philadelphia Index of manufacturers’ 6-months expectations shows a remarkable increase: in my opinion it is good because it seems a positive CONSEQUENCE of falling OIL prices (at least in the businesses’ minds). It will help to alleviate the inflation scare, as long as Russia doesn’t react and China doesn’t ease the domestic economic policy.

Don’t judge too fast. Oil prices are increasing again and soon they will be $150.

Ekonomix

http://turkeconomy.blogspot.com/

http://www.time.com/time/business/article/0,8599,1834888,00.html

In fact oil priced in terms of gold has been increasing over the last month, probably mostly due to the Russian invasion of Georgia. Gold and silver fallen faster than oil, which suggests that talk of “energy-driven inflation” gets the causation backwards — it is changing inflation expectations that have been driving the ups and downs in oil prices.