In today’s VoxEU, Kati Suominen asks “Did global imbalances cause the crisis?, and surveys the arguments. I recently wrote a survey on the same topic for the forthcoming Encyclopedia of Financial Globalization. Here’s my take:

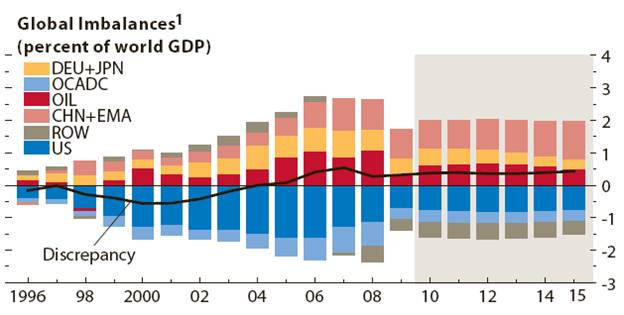

First, to place things in perspective, here is Chart 1.6 from the April WEO:

Excerpt from Chart 1.6, IMF, World Economic Outlook, April 2010.

From the Introduction to the paper:

In the years from 1998-2008, economists focused their attention on the causes and consequences of the expanding current account deficits and surpluses. The pattern of current account balances was interesting from an economic standpoint, in that it did not appear to conform to what would be predicted by standard economic theories. They were troubling from a policy standpoint in that they were unprecedentedly large by post-war standards.

Throughout the first decade after 2000, the United States ran enormous current account deficits. China, the rest of East Asia, and the oil exporting countries ran correspondingly large current account surpluses. In 2008-09, these current account balances drastically reversed, albeit incompletely, as a global financial crisis engulfed the world economy. The proximity of the two events naturally leads to the question whether the two phenomena are related, or causal in nature.

In this chapter, the various explanations for the rise of global imbalances, defined as large current account balances, are reviewed. These explanations include (1) trends in saving and investment balances, (2) the intertemporal approach, (3) mercantilist behavior, (4) the global saving glut, and (5) distortions in financial markets. Note that the explanations are not mutually exclusive.

The first approach relies upon the definition of the current account as the difference between national saving and investment. The second approach is the standard economist’s explanation for lending and borrowing — namely the tendency to smooth consumption in the face of time variation in output. The third approach relies upon the export oriented development path undertaken by East Asian countries as an explanation for the pattern of deficits and surpluses. The fourth approach assumes there is a distortion in less developed country financial markets, in so far as they are not able to channel capital from savers to borrowers domestically. The financial intermediation activity is thus outsourced to developed countries. The fifth approach takes the key distortion as lying in the financial markets of the United States, and to a lesser extent, other developed countries.

The entire paper is here [pdf].

For my preferred interpretation, see [1] [2].

Update 1:35PM Pacific Ryan Avent/Free Exchange also comments.

I’m reminded of Greenspan’s “conundrum,” that raising the short-term rates was not following through in terms of higher long-term rates. Pundits were arguing, not without a some truth, that China’s currency interventions were an important pillar of our prosperity, because they helped support housing.

The capital flow imbalances (the other side of the coin of the trade imbalances) was an important driver of the housing boom, in the U.S. and a number of other countries (as Martin Wolf spells out in his story of ants and grasshoppers). Governments have now taken over for private borrowers, keeping the imbalances alive (although reduced). They are still growing at unsustainable rates, however. If fiscal measures in borrowing countries merely help sustain the imbalances, they will prove to have been worse than useless.

Evidence on financial globalization and crises

FIG 2

The enablers may be missing including but not exclusively, Money supply, credit supply, credit multiplier and an increasing influence of derivatives on the long term yield curves (euro as well usd).

Please see P10 date 2004, oocc (http://www.occ.treas.gov/ftp/release/2010-33a.pdf)

2004 is an interesting date,the distribution curve of CA is flattening.At the same date, the beginning of an expanded relaxation of financial rules is recorded (see former ecownbroser posts) coupled with an inflexion point for the federal budget balance and an exponential curve on Income Receipts on U.S. Direct Investment Abroad

http://research.stlouisfed.org/fred2/series/BOPXMDA

P9

How Could the savings glut effect be evidenced ?

The credit make the deposits?:

Series: LLRNPT, Assets at Banks whose ALLL exceeds their Nonperforming Loans

http://research.stlouisfed.org/fred2/series/LLRNPT?cid=93

Please delete this point

Just a test of the comment system

Thank you