Recall the 2001 and 2003 tax cuts were written to expire, for the most part, in FY2011. I wrote in February that one way to start fixing the Nation’s finances is to let the EGTRRA and JGTRRA expire as they were originally designed to. Via EconomistMom comes Bill Gale’s additional reasons why we should, despite the lackluster recovery [0] (more on that below).

The Myths and Gale’s Rejoinders

1. Extending the tax cuts would be a good way to stimulate the economy.

As a stimulus measure, a one- or two-year extension has one thing going for it — it would be a big intervention and would provide at least some boost to the economy. But a good stimulus policy can’t just be big; it should also offer a lot of bang for the buck. That is, each dollar of government spending or tax cuts should have the largest possible effect on the economy. According to the Congressional Budget Office and other authorities, extending all of the Bush tax cuts would have a small bang for the buck, the equivalent of a 10- to 40-cent increase in GDP for every dollar spent.

…

2. Allowing the high-income tax cuts to expire would hurt small businesses.

…

This claim is misleading. If, as proposed, the Bush tax cuts are allowed to expire for the highest earners, the vast majority of small businesses will be unaffected. Less than 2 percent of tax returns reporting small-business income are filed by taxpayers in the top two income brackets — individuals earning more than about $170,000 a year and families earning more than about $210,000 a year.

…

3. Making the tax cuts permanent will lead to long-term growth.

A main selling point for the cuts was that, by offering lower marginal tax rates on wages, dividends and capital gains, they would encourage investment and therefore boost economic growth. But when it comes to fostering growth, this isn’t the whole story. The tax cuts also raised government debt — and higher government debt leads to higher interest rates. If estimates of this relationship — by former Bush Council of Economic Advisers chair Glenn Hubbard and Federal Reserve economist Eric Engen, and byoutgoing Office of Management and Budget Director Peter Orszag and myself — are accurate, then the tax cuts have raised the cost of making new investments. As the economy recovers and private borrowing rises, the upward pressure on interest rates is likely to grow even stronger.

I have used standard growth and investment formulas to calculate that the overall effect of the Bush tax cuts on economic growth has therefore been negative — and it will continue to be negative if the cuts are extended.

4. The Bush tax cuts are the main cause of the budget deficit.

Although the cuts were large and drove revenue down sharply, they are not the main cause of the sizable deficit that exists today. In 2007, well after the tax cuts took effect, the budget deficit stood at 1.2 percent of GDP. By 2009, it had increased to 9.9 percent of the economy. The Bush tax cuts didn’t change between 2007 and 2009, so clearly something else is to blame.

The main culprit was the recession — and the responses it inspired. As the economy shrank, tax revenue plummeted. The cost of the bank bailouts and stimulus packages further added to the deficit. In fact, an analysis by the Center on Budget and Policy Priorities indicates that the Bush tax cuts account for only about 25 percent of the deficit this year.

5. Continuing the tax cuts won’t doom the long-term fiscal picture; entitlements are the real problem.

One theory holds that the country’s long-term budget shortfall is “just” an entitlements problem, the result of rising costs associated with growing Social Security rolls and increased health-care spending (via Medicare and Medicaid). Republicans like this idea because it plays down tax increases as a potential solution. Democrats like it because it makes the recent health-care package seem like even more of a triumph.

But it just isn’t true. The deficits we face over the next decade reflect a fundamental imbalance between spending and revenue, one that goes beyond entitlements. Based on projections by the CBO, Alan Auerbach of the University of California at Berkeley and myself, among others, even if the economy returns to full employment by 2014 and stays there for the rest of the decade, the continuation of current fiscal policies, including the Bush tax cuts, would lead to a national debt in the range of 90 percent of GDP by 2020. That’s already the highest rate since just after World War II — and Medicare, Medicaid and Social Security aren’t expected to hit their steepest spending increases until after 2020.

…

Read the entire article here.

The Budgetary Impact of Extending EGTRRA and JGTRRA vs. Extending Unemployment Insurance, or Maintaining Food Stamp Payments

A couple of observations. First, letting these tax provisions expire would have a lot more impact on the budget deficit than denying the unemployed an extension of their unemployment insurance, or cutting food stamp payments (after all, the Republicans have not demanded an offset to be found for the EGTRRA/JGTRRA extensions, as they have for the proposals the Administration proposed in the jobs bill). [1]

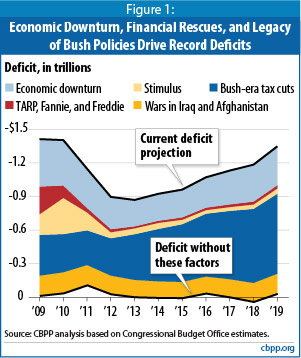

Second, EGTRRA/JGTRRA will be more “budget-busting” as we go forward. Just to remind readers, here’s a decomposition of the budget deficits going forward, depicted in this Figure from the Center for Budget and Policy Priorities’s Ruffing and Horning.

Figure 1 from Ruffing and Horney, CBPP, Dec. 16, 2009.

Ruffing and Horney describe the method of calculation of the “Bush-era tax cuts” portion thus:

Through 2011, the estimated impacts come from adding up past estimates of all changes in tax laws — chiefly the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), the 2008 stimulus package, and a series of annual AMT patches — enacted since 2001. Those estimates were based on the economic and technical assumptions used when CBO and the Joint Committee on Taxation (JCT) originally “scored” the legislation, but the numbers would not change materially using up-to-date assumptions. Most of the Bush tax cuts expire after December 2010 (partway through fiscal 2011). We added the cost of extending them, along with continuing AMT relief, from estimates prepared by CBO and JCT.[14] We did not assume extension of the temporary tax provisions enacted in ARRA. Together, the tax cuts account for $3.4 trillion of the deficits over the 2009-2019 period. Finally, we added the extra debt-service costs caused by the Bush-era tax cuts, amounting to $1.9 trillion over the period and an astonishing $350 billion in 2019 alone.

The graph makes obvious that while the EGTRRA and JGTRRA do not account for most of the deficit right now, they (in addition with AMT patches) are slated to account for a much larger proportion by FY2015, as shown in the blue area in the Figure 1.

See also Andy Samwick/CGG.

Recessionary Impact: Will the Economy Be Killed If We Return Tax Rates for the Rich back to Pre-Bush Levels?

Returning to the issue of the impact on the economy’s recovery, we have the hyperbolic (and inaccurate) headline from CNBC: “Letting Bush Tax Cuts Die Would Kill Recovery: Analysts”. The article states:

The nascent US economic recovery would be halted in 2011 if Congress fails to extend the Bush tax cuts for the wealthiest Americans, analysts at Deutsche Bank said.

Well, I’ve got the the Deutsche Bank note that the author purports to use to back up that headline in front of me. It’s a bit more nuanced than what that headline states. From C. Dobridge, P. Hooper, T. Slok, and E. Sufian, “The Growing Risk of Fiscal Drag,” Global Economic Perspectives, July 28, 2010.

Allowing the Bush tax cuts to expire will likely depress

GDP growth significantly in the near term. We have shown

in Charts 5 and 6 the estimated effects of this outcome on

the level and growth of real GDP under a range of

assumptions about the tax multiplier (from 0.5 to 1.0). The

range of possible outcomes is to depress growth in 2011

by anywhere from 0.75% to 1.5%, with a best guess of

around 1.1 (assumes multiplier of 0.75). Failure to pass an

AMT fix would mean another 0.5% fiscal drag in 2011. If

all the tax cuts are extended except that for the top income

bracket, the associated drag on growth in 2011 would be a

bit less than 0.5%. Passage of the Administration’s

proposals in full would mean drag of only about 0.25%. In a worst case scenario, allowing the Bush tax cuts to expire

and failing to fix the AMT could result in 1-1/2% of fiscal drag

in 2011 on top of the 1% fiscal drag we expect to occur as

the Obama fiscal stimulus package unwinds. If the recovery

remains soft/tentative through early next year, this additional

drag could be enough to push the economy to a stalling

point. In this light, it is perhaps instructive to consider the

Japanese experience of the 1990s.

So, if the Administration’s proposal of extending the tax cuts for two-person households with incomes less that $250,000/single person households less than $200,000 is implemented, then the impact is relatively minor, and would not “kill the recovery” initself.

I will further note that some people are misinterpreting Romer and Romer paper with respect to the impact of tax changes as supporting arguments against letting EGTRRA and JGTRRA lapse. From John Harwood in today’s NYT:

Indeed, Christina Romer, the chairwoman of the White House Council of Economic Advisers, wrote a recently published paper with her economist husband, David Romer, in which they said, “Tax increases are highly contractionary.”

Mr. Harwood should’ve read the paper more carefully (or at least the introduction). From Romer and Romer (AER, 2010):

An examination of the two types of exogenous tax changes separately

shows that tax increases motivated by a desire to reduce an inherited deficit appear to have much

smaller effects on output than tax changes taken for long-run reasons.

Well, if there was ever an inherited budget deficit, this is it (See graph below, Figure 1 from this post):

Figure 2: Cyclically adjusted budget balance as a ratio to nominal GDP. Tan shaded area, FY1994-2001; gray shaded area, FY2002-2009.Source: BEA (for GDP, 2010Q1 3rd release), CBO (for cyclically adjusted balance), and author’s calculations.

More on the the paradoxical nature of the Republican insistence on extending the tax cuts for households w/income greater than $250K, from Jeff Frankel.

I’m seeing an opening for a deal if the Democrats want to make one: a temporary extension of the Bush tax cuts in exchange for additional funds for state and local governments and unemployment benefits. If Republicans walk away from the deal, then they get tarred with wanting tax increases.

Fig 1 looks whacky to me. Light blue effect of the downturn is pretty much constant for a decade.

NO DEAL !!

If the do-nothing Congress follows its usual pattern, no action will be taken and ALL THE TAX CUTS WILL EXPIRE.

People who are suffering the most from the downturn have little or no income. Only those of us who are surviving OK (as most of my friends are) will pay the extra taxes. The big secret is that most of my friends and myself can afford to pay more taxes.

Maybe Russ Feingold will prevent any action by filibustering all bills.

Dave Backus: Refer to the original document, and you’ll see “economic downturn” is actually shorthand for “economic downturn and technical factors”. The biggest of the technical factors is changes in projected tax revenue trends. See their explanation here.

1. Cutting taxes may have less bang for the buck in macro models, but in our world, cutting taxes has far more bang then Nancy Pelosi’s spending.

2. Most “returns reporting small-business income” are not hiring. Most of small business hiring is turnover. The vast majority of small businesses that intend to increase employment and production either are or intend to be in the top tax brackets. That is why raising taxes will hurt small business growth.

3. Cutting taxes on savings and investment will increase savings and investment. Increased spending increases interest rates. Both matter. Cutting taxes and spending reduces reduces the cost of making new investments by more than just cutting taxes. Raising taxes to reduce the deficit has less harmful effect on output than raising taxes to fund long-run spending.

Not extending the cuts for the top rate will harm the economy, but will probably not “kill the recovery” (People needing cable show bookings need to state otherwise.) Not “killing the recovery” is not reason to not extend the tax cuts. Raising taxes on private capital by not extending all of the tax cuts will do more to crowd out private capital than reducing the deficit.

This place is as predictable as the Daily Kos.

1. Cutting taxes may have less bang for the buck in macro models, but in our world, cutting taxes has far more bang then Nancy Pelosi’s spending.

Indeed. How much plastic surgery can one person have? Boosting the income of plastic surgeons is not very stimulative.

Separately, I can agree to let the Bush tax cuts expire, IF WE FIRST CUT SPENDING ALL THE WAY DOWN TO BUDGET BALANCE. Do that first, and then you will have my support to let the tax cuts expire.

But not otherwise.

The most stimulative move that the government could make is to abolish all capital gains taxes.

India, China, and Russia all have capital gains tax rates of 0-10%, vs. up to 50% for US residents in CA and NY. Who was on which side in the Cold War again?

Abolish all capital gains taxes. The upside of attractive capital back to the US will more than compensate for any short-term reduction in tax revenue.

If we raise taxes, we must also cut spending.

How about we slash government support of public universities? They need to adjust to hard times and market forces.

Fact : Socialism is much more rigged in favor of the super-rich than capitalism is.

Capitalism at least has many new people competing against those who are already rich. Socialism raises the barrier to getting rich such that the super-rich can lock out new competition.

Ride on!

Tax reformer Ray and his friends but do not tax

Ali Burton

Menzie: “Passage of the Administration’s proposals in full would mean drag of only about 0.25%.”

Just so I understand what is going on here, the “full” proposal means letting the “tax cuts on the rich” but keeping the other tax cuts in place?

It says the drag effect on the economy is relatively minor. Is it also true that the net effect on the deficit / debt would also be similarly minor?

In other words, what proportion of the dark blue shaded region in the CBPP chart is, over time, due to the tax cuts on the rich portion of EGTRRA and JGTRRA?

Hetero,

Let me clue you in. This blog attracts its share of declarative trolls, but most of the serious readers here really don’t need to hear declarations of personal views as if they are facts (or sexual preference, for that matter). This here establishment is run by a scholar. The guy he is citing is a scholar. They make their points mostly by introducing fact and offering analysis. (Make that “narrow fact”, since a good many people think that declaring socialism better or worse than capitalism in some way amounts to a fact.) Give it a try.

I’ve sent lists of page numbers from the Romers’ paper to people who misquote it. Here is another line, one that illuminates the problem. After saying that tax increases to address an inherited budget deficit don’t have big negative effects on GDP, they say: “This is consistent with the idea that deficit- driven tax increases may have important expansionary effects through expectations and long-term interest rates, or through confidence.”

In other words, while people are arguing for government contraction because that will boost confidence – which they deem necessary despite the bond market’s low levels – the Romers suggest that raising taxes to reduce the deficit sends exactly that signal. So the deficit hawks should be all in favor of letting the tax cuts expire. That is if they actually were anti-deficit rather than anti-something else, often stuff they can’t name.

kharris whined :

This here establishment is run by a scholar. The guy he is citing is a scholar.

Which means what, exactly?

Spending should be cut first, and THEN a discussion about tax increases can be had.

A zeal for tax increases but no courage to cut spending does not cut it.

Let’s start with cutting spending on public universities (which has already happened in California, without detriment).

How can anyone argue that the tax cuts expiring will result in a worse economy than we have had since the tax cuts were slowly phased in?

2009 and 2010 were the years in which the full effect of the 2001 and 2003 tax cuts to boost economic growth and create jobs were fully in effect.

Are we really better off after the tax cuts than we were before the tax cuts?

I suppose in 2000 the Republicans had to really steel themselves to justify tax cuts: we are running a budget surplus and that will deprive investors of safe Treasury bonds for investors to buy.

Boy, not only did the Bush tax cuts and other policies create a huge supply of Treasury bonds but also the crisis to drive investors to buy them.

The tax cuts and focus on consumption crowded out public and private investment, and add the energy policy of pillage and plunder, and the US has been decapitalizing. So much for Americans being capitalists.

If all of these tax cuts were so great, why are in in this mess? All the tax cuts and at the end of the decade there are less people employed than at the beginning. And the stock market, why it is all the way back to what, where it was 1998?

While I disagree totally with the analysis there is a side of me that hopes that the current administration shares the same sentiments and has reached the same conclusions. After all, it isn’t often that one gets the opportunity of a lifetime to make safe bets that could pay off thousands of percent in a relaitvely short period of time.

Back to the analysis. The way I see it the problem is quite simple and has little to do with taxes. In fact, the US corporate tax rate is higher than that of most of the world so I do not see how one can argue that it should go up. As for personal taxes, when local and state taxes, charges, and fees are added into the picture, most American taxpayers have the same burden as much of the OECD.

As I wrote above, the problem is simple. The government spends far too much and makes it too difficult for capital formation. All that spending and all those promises mean that the government is also bankrupt and that there is no way to service debts with dollars of equal purchasing power.

Of course, political reality being what it is, it may be very likely that the failed Keynesian mythology will get another kick at the can and drive the real economy even closer to the abyss than it is already. That would set up the US to go the way of Britain after WWI except much faster. If the Keynesians have their way a relatively safe bet would be to sell the USD and to buy gold, silver, oil, and agricultural commodities in non-US markets.

Vangel: If you are interested in actual facts regarding the effective corporate tax rate, this CBO report (discussed in this post) might be of interest to you.

Vangel, if you had your way, you would dissolve America and create a plutocratic tryanny finally turning monetary control of the system to foreigners.

The point is, capital is out of control and hoarding globally. You say the government spends to much, but in fact, the government spends far to little, instead giving away most of its gains to health companies and the corporate elite.

It is why when the people are faced with poverty and death they are comforted by national socialism. Under a “libertarian” decapitalism, the US would collapse and lose its position globally, instead becoming a 3rd world type with massive unemployment and poverty. The Corporations with their hoarded bounty, would then pretty much have 100% market share, a target they are going for today with the current system. A wholesale liquidation of debt would do it even quicker, but the dislocation and suffering would be more immense, it is why they allowed the “banking” bailout to go through and fund corporate sponsered rebellion. It gives them a little more time to prepare their security forces(which I suspect isn’t ready yet) when they begin to dissolve countries.

National Socialism is accepted by people because they know the government has their back. Even if it means losing some democratic and constitutional freedoms. They don’t have to suffer anymore. The US will reindustrialize, have health care and damn the rest of the world.