From Macroeconomic Advisers “The impact of sunset of tax cuts on GDP, employment, inflation & interest rates”, released today:

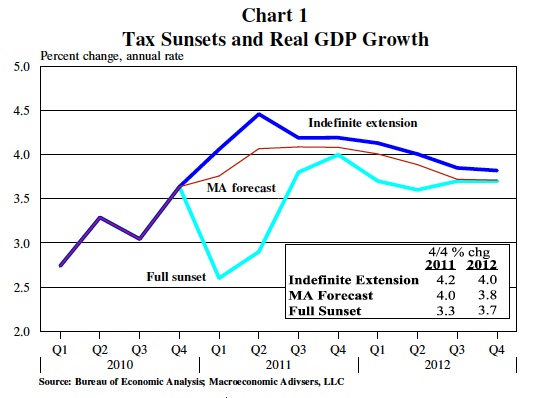

Macroeconomic Advisers finds that, compared to an indefinite extension, impending expiration of numerous prior tax cuts would trim 2011 growth by 0.9 percentage points, while only allowing an increase in taxes for high-income individuals and families would trim growth 0.2 percentage points.

Greater details are in the post. Chart 1 below depicts the impact over time from letting the EGTRRA and JGTRRA provisions expire as they were designed to [1], and implementing the Obama Administration’s plan to extend those provisions only for those households w/incomes in excess of $250K ($200K for singles).

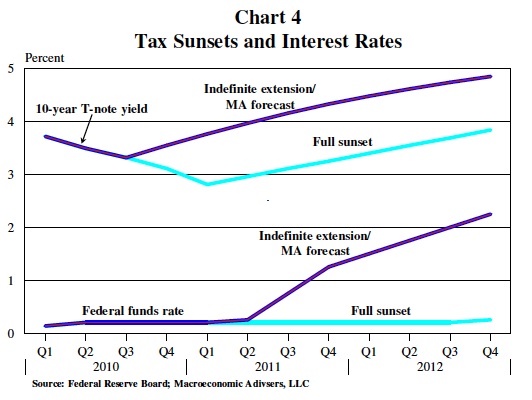

Chart 4 depicts the assumptions regarding Fed policy, and implications for long term Treasury rates.

For those self-described fiscal conservatives worried about crowding out, and yet in favor of fully extending EGTRRA and JGTRRA, Chart 4 should be of particular interest (if they are interested in data).

From the Concluding Remarks:

Tax increases may be necessary to address the nation’s long-term fiscal imbalance, and these results suggest that the fiscal drag from all the approaching tax sunsets could be absorbed by a robust economy in which the Fed has ample room to pursue an accommodative policy.6 However, given the still tentative recovery, with growth risks skewed to the downside, and the FOMC’s limited ability to maneuver now, we believe that the consideration of such large tax increases should be delayed until the economy is growing more strongly, with more certainty, closer to full employment, and with the federal funds rate well off the zero bound. An intermediate, and safer, near-term strategy is to let expire in 2011 just those provision affecting high-income individuals while extending the other provisions until they can be considered in the context of a healthier economy. This is what is assumed in the MA forecast.

Our focus here has been on the implications for near-term growth. To some extent this is the old story about short-term pain for long-term gain. While the process of reducing deficits can be expected to have a near-term cost in terms of slower growth, longer-term benefits of lower interest rates, more capital formation, and stronger growth of potential GDP can also be expected. Perhaps as important as reducing the deficit to sustainable levels (for example defined as levels consistent with a stable debt-to-GDP ratio) is the composition of revenue increases and spending reductions required to achieve meaningful deficit reduction. Thus, while we view the growth implications of allowing these prior tax cuts to expire as manageable (at least for a healthy growing economy when the Fed has ample room to support growth if needed), this does not imply that we endorse a full sunset. Rather, a comprehensive approach that simultaneously addresses both the spending and revenue sides of the budget is preferred.

I’ll leave the analysis of the feasibility of coordinating enhancing tax revenues and cutting spending in these times to others. But it seems to me that if one is worried about the fiscal drag from letting EGTRRA/JGTRRA expire in the midst of slow recovery, then extending it only for those with household incomes below $250K/$200K (couples/singles) seems a reasonable compromise, that is simple enough to implement.

Simple and feasible are two different things. One feature of the legislation as it exists is that it expires all by itself. Once you decide to go beyond that, it becomes a question of legislating. Both parties have, at times, been willing to stand fast on their own position, recompensed by allowing the other guy’s position to fail. There are some quirks to this situation that allow legislation without the complete filibuster schtick, but there is still need to legislate.

“while only allowing an increase in taxes for high-income individuals and families would trim growth 0.2 percentage points”

I asked a similar question on your previous post as well but I think I may have been too late to the party.

As I understand it there are two problems, GDP below potential leading to unemployment, and deficits / debt. A decision has to be made on how much to reduce / increase deficits versus how much to stimulate / contract. My question is whether or not the deficit effect of letting the tax cuts on the rich is of a similar magnitude on the GDP growth drag effect?

Maybe if we need to stimulate on net, then all of the tax cuts should be extended. If we can afford to extend only some portion of the tax cuts, then it could be done pro-rata across income groups and types of taxes.

Do we know the model Macroeconomic Advisers use? Do we have access to the equations? Can we check if what they are saying is accurately calculated? Is their model subject to the Lucas Critique? Do their agents change behavior when policies change? Do their agents have rational expecations?

I am very weary about these proprietary models, to which nobody has access, and thus nobody can check the equations and replicate results.

Same critique, by the way, goes to the Blinder-Zandi paper that was so much in the news last couple of days.

Manfred: I have linked to the documentation for the MA model on several occasions, but the latest is in this post, with this link.

You bring up good questions — they are the standard questions that people who have had first year Ph.D. macro ask. If you had followed the debate, you would already know the answer to your questions, so I suspect they are rhetorical. But I’ll also add you might ask these questions about most models being discussed, since in almost all extant DSGEs, we have moved far away from having only “deep” parameters of the RBC models. Sticky prices, quadratic adjustment costs, rule-of-thumb consumers, portfolio frictions (otherwise you wouldn’t have risk premia, and UIP would hold) are everywhere.

DSGEs are computed with model consistent expectations, which are not usually the case for the big macroeconometric models (the original Taylor (1993) model is an exception, but that is not what is typically being used; Taylor himself cites the Smets et al. New Keynesian DSGE which, if you are worried about Lucas Critique, would be vulnerable as well).

I hope this clarifies matters for you.

I also refer you to Neil Ericsson’s work on the relevance of the Lucas Critique for real world analysis.

Manfred: By the way, if you are so concerned about proprietary models, you can buy a site license to run the MA model. It’s not like the models are as secure as the launch codes for our ICBMs. When I was a CEA staffer, the in-house model for checking things was the MA model.

Dear Menzie: thanks for taking the time to respond. Even though I do try to follow this blog somewhat consistently, I do miss a post every now and then; thus, thanks for the links regarding the Macroeconomic Advisers model.

Menzie: I guess I never really thought of the MA model as being representative of DSGE models in general. I always understood it to be kind of halfway between an old fashioned structural model and a DSGE. And in the current environment I don’t mean “old fashioned structural” as a term of derision. I remember hearing Mark Thoma say that with the current economic situation he was no longer embarrassed to teach undergrads the old IS-LM pedagogy.

2slugbaits: I apologize — I did not mean to imply that the MA model was at all like a DSGE. In my comment, I meant to say that Manfred‘s comment regarding the Lucas Critique could apply — perhaps with less force — to DSGE’s as well as old-style macroecnometric models.

By the way, I don’t mean to deride “old fashioned structural” models; I think they have their strengths and weaknesses. The point is to know what those strengths/weaknesses are compared to DSGEs, RBCs, VARs, etc. And I have been teaching undergrads IS-LM ever since 1990. So, I think we agree along many dimensions.

So we have run up massive debt from the Bush tax cuts for “The unemployment rate would be 0.6 percentage point higher…”

How much did it cost each year to create those 0.6% in jobs.

What if the same deficit had been spent rebuilding those bridges built in the 30s, 50s, and 60s which seem to have been neglected for the past three decades so they fall down and get rebuilt in 14 months as was the case for the I-35W Mississippi bridge in Minneapolis? Or been invested in the decaying water systems that seem to spring leaks and create giant sink holes that swallow cars? Or invested in electric power super highways to bring wind power from the huge upper west farms to cities while generating jobs for farmers who add wind to the crops they invest in and harvest, boosting the farm incomes and creating the kind of economy that helps keeping farming a family business?

Instead the tax cuts funded consumption, not capital, while debt was increased and the public infrastructure was decapitalized. Reagan changed the Republicans from capitalists to decapitalists.

Based on the Tax Foundation estimator at mytaxburden.org, my wife and I will be “asked to contribute” an additional $3k when the tax cuts expire. Couldn’t go to a better cause when all we would have done was save it or spend it (our own private stimulus program). The fact that the rates go up in 2011 is an artifact of budget rules (form over subtance). This is a tax increase pure and simple (substance over form).

Rich Berger: Well, gee, in 2003 I was asked to volunteer what has turned out to be $2600 in FY2009$ so far (about $800bn/305million [1]) for a war I was told would cost $50 billion total, rationalized upon information our President knew was false. At least here we have known — from independent agencies — what the implications are since 2001 and 2003 when the legislation was written. I’ll say if the tax cuts lapse per original legislation, at least democracy worked, as opposed to to our Iraq adventure — substance and form complaints notwithstanding.

Professor Chinn

“..for a war I was told would cost $50 billion total, rationalized upon information our President knew was false.” I don’t think you can support those last five words.

But anyway, I would be very happy to have a la carte government. I can think of many programs that I would decline to support. I would be happy to reduce the 35% of my income that I pay in taxes.

Menzie: you opened the can of worms, thus apologies for saying this. “[F]or a war […] rationalized upon information OUR PRESIDENT KNEW WAS FALSE.”

Wow. Bold statement. You must have excellent contacts in Washington, very, very close to national security advisers, very high government officials, the White House and the like. But if Bush knew the info was false, then others, like Bill Clinton, knew it was false as well. Bill Clinton said in 1998: “”[L]et’s imagine the future. What if he [Saddam Hussein] fails to comply and we fail to act, or we take some ambiguous third route, which gives him yet more opportunities to develop this program of weapons of mass destruction and continue to press for the release of the sanctions and continue to ignore the solemn commitments that he made? Well, he will conclude that the international community has lost its will. He will then conclude that he can go right on and do more to rebuild an arsenal of devastating destruction. And some day, some way, I guarantee you he’ll use the arsenal. And I think every one of you who has really worked on this for any length of time, believes that, too.”

The difference is that Bush did something about it, rather than just sit and watch.

But again, it is all Bush’s fault.

Rich Berger and Manfred: When one’s Administration keeps on pushing the intelligence agencies to obtain the requisite conclusion, and is time after time rebuffed, but finally gets the desired answer, then, ok, perhaps that’s not “knew”, but I think requires some all-too-common ability to convince oneself into self-delusion. Sort of like, well, everybody tells me this AAA rated bond was rated AAA, so must be just fine. So, I revise “knew” to “convinced himself it must be true because he beat the agencies into submitting answer that validated his priors”. I hope this resolves this dispute. (I do wonder why he evinced so little surprise that no WMDs were found, as several accounts have described — but as you say, I cannot know what was in his mind.)

Finally, I apologize for distracting attention from the point at hand — the debate over whether $3000 is being “volunteered” by the Rich Berger household. We don’t all agree on the purposes to which our taxes have been put, but in 2001 and 2003, the democratic process put us where we are today.

“…I will be “asked to contribute” an additional $3k when the tax cuts expire. Couldn’t go to a better cause when all we would have done was save it …”

I hope you saved it, buying $3000 in US Treasuries each year to fund the debt incurred to give you that $3000 tax cut. When taxes are hiked, not to reduce the deficit, but to repay the past decade of debt, you can sell those US Treasuries to pay those higher taxes.

When I look at history, it looks to me that many people get the tax cut that comes with a cut in income from the lost jobs or jobless recovery that follows tax cuts.

Rich, thanks for that website.

My increase for the full tax cuts expiring is $4300. OUCH! I hope that the Obamaistas are at least successful in preserving the tax cuts for the Proles.

“Finally, I apologize for distracting attention from the point at hand”

I doubt your apology simply because I trapse through your site (which I used to visit multiple times per day) once every few weeks, and yet I somehow see you simply pointing fingers into the past every single time. You have become obsessed with proving to everyone that everything you have said is “right,” and have become devoutly political in almost everything you say.

I find that sad, and every time I come back I find it sad all over again. I’m sure you don’t care, and that you will be dismissive and grumpy as you always are any time someone asks a question that, even if only slightly, indicates potential disagreement or disapproval of something you have said or employed. Please don’t bother. I’m simply pointing out that you have moved from providing good discourse and education to being little more than a shill whose writing can no longer be trusted to be objective.

MPO: Thank you for your comment. Let me note that you have stated this sentiment, repeatedly, and yet come back again and again. To recap:

On 7/30/2010:

On 4/26:

On 4/14:

On 2/09:

On 2/09:

On 8/27/09:

I regret your departure, but do not anticipate your departure from the comment section will measurably degrade the level of discourse.