Here are a few thoughts about some of the economic news that’s been coming in over the last few weeks.

|

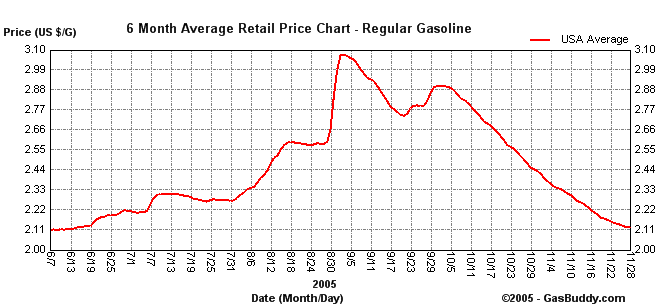

Gas prices.

Hard to complain here. We’re back at a point where not just the hurricanes but in fact the whole summer could seem like just a bad dream. And with gasoline futures on NYMEX now below $1.40, we could see retail prices nationally below $2.00 a gallon soon.

Hard to complain here. We’re back at a point where not just the hurricanes but in fact the whole summer could seem like just a bad dream. And with gasoline futures on NYMEX now below $1.40, we could see retail prices nationally below $2.00 a gallon soon.

Consumer confidence.

When Katrina first arrived at the end of August, I asked whether the gas price hikes that it induced might be enough to bring about a recession, and reasoned:

If it were just the consequences of the storm itself, my answer would have been, “probably not.” The reason is that I think most people would see this as a special event, tragic but thankfully short-lived. But this event did not arrive out of the blue. Instead, it came in an environment in which there was already considerable anxiety about gas prices.

The fact that the additional gas price declines of the last month have completely reversed all of the anxiety-inducing hikes of the summer should do much to soothe that, and indeed the University of Michigan’s index of consumer sentiment, which as shown in the graph on the right had plunged from 96.5 in June to 74.1 in October, rebounded somewhat to 81.6 this month. The separate Consumer Confidence Index calculated by the Conference Board rocketed up from 85.2 in October to a November figure of 98.9 announced yesterday.

|

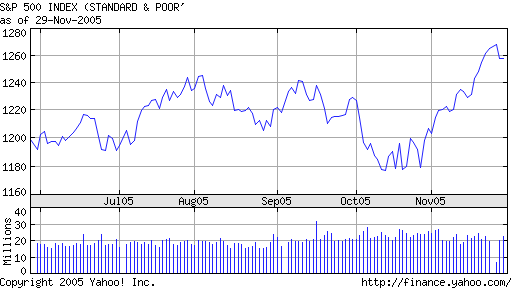

Stock prices. The stock market is another very useful leading indicator. Although it had been giving a slightly pessimistic reading a month ago, we’ve seen a significant move up over the last four weeks. Those Wall Street bulls wouldn’t be charging this way if they saw a recession just around the corner.

The stock market is another very useful leading indicator. Although it had been giving a slightly pessimistic reading a month ago, we’ve seen a significant move up over the last four weeks. Those Wall Street bulls wouldn’t be charging this way if they saw a recession just around the corner.

Autos. No way to smile about this one. Although I have no doubt that high gas prices were a key factor that precipitated Detroit’s current problems, I have no delusions that lower gas prices will make the problems go away. GM last week announced plans to eliminate 30,000 jobs. Although there are those who argue that there is little that can be done to help the U.S. auto industry, I remain more concerned than most observers about the consequences that Detroit’s woes may bring for the rest of the economy.

No way to smile about this one. Although I have no doubt that high gas prices were a key factor that precipitated Detroit’s current problems, I have no delusions that lower gas prices will make the problems go away. GM last week announced plans to eliminate 30,000 jobs. Although there are those who argue that there is little that can be done to help the U.S. auto industry, I remain more concerned than most observers about the consequences that Detroit’s woes may bring for the rest of the economy.

Monetary tightening. It would be pretty unusual historically for the Fed to raise interest rates as dramatically as they have over the last year and a half without causing an economic slowdown. The current spread between the yields on long- and short-term bonds is at the narrow levels that historically often precede slower economic growth, and a couple more FOMC meetings could easily put the yield spread all the way into negative territory. Kash at Angry Bear shares my concerns about that prospect, while Dave Altig says only that it “could at least be interesting.”

It would be pretty unusual historically for the Fed to raise interest rates as dramatically as they have over the last year and a half without causing an economic slowdown. The current spread between the yields on long- and short-term bonds is at the narrow levels that historically often precede slower economic growth, and a couple more FOMC meetings could easily put the yield spread all the way into negative territory. Kash at Angry Bear shares my concerns about that prospect, while Dave Altig says only that it “could at least be interesting.”

Housing. (???) This may prove to be the sector that tips things one way or another. This week we received news that (a) sales of existing homes fell 2.7% with inventories increasing 3.5% (which I take to be very bearish developments), and (b) sales of new homes were 10% higher in October compared to the previous year, setting a new record (which I take to be a very bullish development). So, what exactly do the two pieces of information put together signify? Beats me. Altig notes the doubts expressed at Housing Bubble about the accuracy of the October new home sale data. But I like Dave’s summary:

I’m not sure which one it is, but one piece of this puzzle just doesn’t seem to fit.

Putting it all together, what are this month’s data telling us? Overall, the numbers are better than expected, so whatever your take on the economy was at the start of the month, you should be a little more optimistic about things now. Like, if you started out  maybe now you’re

maybe now you’re  .

.

Half the time I feel like I’m in over my head reading here; but at least I can understand the smiley faces are barely overtaking the sad ones. 🙂

JDH,

any thoughts (maybe another smiley?) about the upward revision to Q3 GDP?

I’m also not sure what to make of the housing market, but thought it was interesting that the upward revision (to 4.3% from 3.8) “…primarily reflected upward revisions to residential fixed investment…” (and other stuff).

PS

2005Q3 GDP growth revised to 4.3%

From the Wall Street Journal: The Commerce Department reported Wednesday that gross domestic product, the broadest measure of U.S. economic activity, grew at a seasonally adjusted annual rate of 4.3% in July through September. That was stronger than th…

“I remain more concerned than most observers about the consequences that Detroit’s woes may bring for the rest of the economy.”

Care to expand?

Peter Summers, William Polley has a discussion of the GDP revision– no question this is another bit of excellent news. That would make the smileys outnumber the sad sacks two to one! But housing is probably still a big enough gorilla to settle any arguments.

Tdo, historically a downturn in autos has tended to bring much of the rest of the economy down with it, and I’m not convinced things are all that different now. GM and Ford are still huge, and their sales were making a noticeable contribution to GDP earlier this year.

it will be interesting to see how retail sales come in this nov-december

it will also be interesting to see how much business cap ex occurs in 2006

Professor Hamilton

It would seem to me that any recession would reduce auto consumtion so there is little wonder that there is a corelation. But, which is only a symptom of the other?

Bill

The explanation I have seen of the new home sales data involves the rising interest rates and the argument that a lot of people are rushing out to seal deals before the mortgage rates really rise, kind of a last gasp before the bubble ends.

BTW, about two weeks ago the Washington Post had a front page story showing that housing prices (all of them) had peaked in the Washington area in July and had been drifting down since. The one exception was Prince George’s County in Maryland to the northeast of D.C., where prices have been much lower all along. I also heard someone claiming that prices have fallen in New York by 20% already, although I do not have a solid source on that and that may be just in one or a few neighborhoods.

Anyway, there is reason to believe that the surge of buying of new houses is likely to peter out pretty soon.

Plan on seeing pretty dismal numbers from GM and Ford again in November. If you’re in the market for a nice house in Flint, Mi. you won’t need to worry about paying too bubbly a price.

Perhaps we’ll soon have some useful data with which to test your hypothesis, Bill.

Any comment on why gold ($500 per ounce) and platinum ($1,000 per ounce) are at 20 year highs and copper is at an all-time high?

Plan on seeing pretty dismal numbers from GM and Ford again in November. If you’re in the market for a nice house in Flint, Mi. you won’t need to worry about paying too bubbly a price.

Add Kokomo Indiana to the list – I just drove through Kokomo and heard the local station announce that the local Daimler Chrysler plant had announced a large pending lay off… add to that the woes of the largest employer – Delphi (also laying off & may even close)… Kokomo is the World Headquarters for the Delphi Electronics & Safety business unit (very large)…

There isn’t much else in Kokomo other than Daimler & Delphi and service jobs catering to the salaries of workers at Daimler & Delphi.

Housing Bubble Update 11-30-05

Econbrowser provides an overview on how the economy is performing backed up with several graphs. But Econbrowser says housing remains a mystery:

Missing the trade balance or is that slightly too old to count as “the latest”?

I don’t know if it was just the Biblical look of it or what, but like the rest of the happy consumers, I don’t want to dwell on it either.

Why I’m Bullish on Retail Sales

Someone asked me how I can believe Holiday sales increases can be in the 3 to 4% range when I don’t buy the NRF data. The answer is twofold — I am interested in correcting their horrific statistical error, and returning expectations back to baseline (…

It seems to me that new home sales can lag the economy more than existing. New homes involve construction, with a substantial lead time. Developers must sell (while existing home sellers often have leeway on when they sell), and they will do whatever it takes to push the product, so I would think new home prices (and existing home unit sales, as existing home sellers will usually extend market time before dropping their price) would be a much better indicator than new home sale unit volumes.

As myself and a few others predicted (against the astroturfing of a couple of others), GM and Ford’s reliance on gas-guzzlers continues to hurt them as consumers have apparently come to view $2.00/gallon as the new _floor_ for gas prices rather than the _ceiling_.

GM’s solution to this? New full-size line of SUVs. Wow.

I understand that downward revisions are expected this week for the last six months of labor costs figures; productivity up! Certainly another possible smiley or tow that could lead to lower interest rates, higher stock prices, consumer confidence and a strong gradual boost to GM and housing. Wage increases having been weaker than initially reported explains much. Wage increase from here forward should help GM make the turn.