Chinese foreign exchange reserves and current account surpluses are (still) rising. Why and how important is this phenomenon?

It seems to me these days that every topic, be it trends in the labor market, the current account deficit, or interest rates, comes back around to the role of China in the global economy. I do not want to minimize the role of China — its entrance into export markets and commodity markets, as well as its acquisition of U.S. Government debt have had profound effects on the global economy. I think it is worthwhile to step back for a second to provide some quantitative context back into this discussion of China’s role (much as others have assessed the impact of Chinese exports on US goods prices).

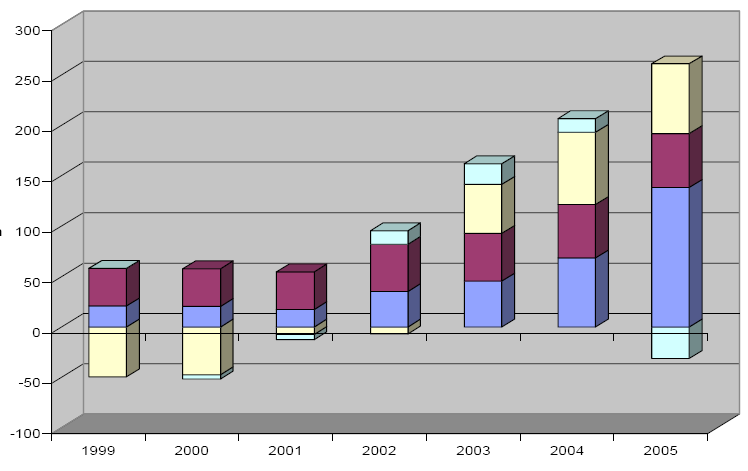

In particular, (inferred) accumulation of U.S. Government securities rose during 2002-04 largely as a function of what was presumably hot-money (specifically portfolio capital as opposed to FDI), as shown in these estimates kindly provided by Brad Setser.

Source: Brad Setser, RGE Monitor

[Legend: last year reported here is 2005; cream is non-FDI flows, burgundy is FDI flows, blue is current account, and light green is valuation changes]. These are big numbers, even in comparison to the U.S. current account deficits in the hundreds of billions of dollars. In 2005, the main impetus for reserve accumulation shifted from “hot money” to current account surplus. Once again, these are big numbers, even compared to the US current account deficit of around 6.5% of US GDP.

These trends are important when people assess stories that attribute all of the Chinese foreign exchange accumulation to either (1) mercantilism a la the Dooley/Folkerts-Landau/Garber world view, or (2) the Bernanke global “savings glut” view. The mercantilist view, as pointed out by Prasad and Wei, is hard to square with the steadfast resistance of China to competitive devaluation in 1997-98. It is also hard to square with the portfolio capital inflows driving reserve accumulation in 2002-4. Similarly, it is not clear to me that savings by the People’s Bank of China via reserve accumulation is what Bernanke had in mind when he pointed to a savings glut (otherwise, financial and institutional development would have little place in his prescription for solving the global imbalances).

Now, this brings us to the issue of whether the current situation in 2005-06is a good example of the global savings glut in action. After all, the Chinese current account balance is now $128.5 billion in the year ending 2005H1. Maybe, but I think the following picture should put in perspective the Chinese contribution to the US current account imbalance.

Source: UNESCAP, Key Economic Developments and Prospects in the Asia-Pacific Region 2006 (Dec. 2005).

China is important, but so are other parts of the world. The fact that the United States so dwarfs the other imbalances is telling. And it reminds me of this question I ask myself. In most of the macroeconomics that we teach our students up until the present (and I still teach my students), developments in the United States largely drive developments abroad. Why have we suddenly dropped our US-centric world view, when it is U.S. behavior that seems so anomalous? The global savings glut view favors viewing the excess savings in the rest of the world having to flow to the US. But imbalances have to sum up to zero (up to a statistical discrepancy). Doesn’t it make more sense to say that the US is sucking savings from the rest of the world. And part of this is driven by fiscal profligacy, where heretofore low interest costs have encouraged the Administration and the Congress to spend and spend and cut and cut taxes?

This brings me full circle, back to this focus on China. If China were to revalue by 20%, given that a large portion of its exports incorporate imported inputs, would that change the basic pattern of global imbalances? Or would East Asia pick up the slack? And even if East Asian currencies appreciated with the renminbi, would that reduce the US imbalance, or would our deficits merely shift to India? I think that by and large, the imbalances may be somewhat reduced, but not eliminated.

This analysis may seem inconsistent with my previous call for greater renminbi flexibility. But I want to be clear that greater renminbi flexibility would help ease the way toward eventual adjustment — but it in itself will not cure the US current account imbalance. Consumption, both private and especially public, must be adjusted downward in order for a substantial reduction in global imbalances to occur. Unfortunately, I don’t see any substantial move to reduce the public part of excess spending in the Administration’s current budget proposal.

Technorati Tags: href=”http://www.technorati.com/tags/trade+deficits”>trade deficits,

Chinese trade,

budget deficits

If nations with trade surpluses were to sell their dollars, instead of investing them in the US, then the dollar would fall, imported goods costs would rise, consumers and businesses would buy fewer foreign goods, and it seems to me that our trade imbalance would then automatically correct itself, regardless of the size of the government deficit. Since it is primarily the Asian nations, especially China and Japan, that choose to invest their surplus dollars in the US rather than selling those dollars, artificially suppporting their own currencies, then why isnt it fair to blame the Asians?

Also, the Fed raised short-term interest rates over the past year, but I gather that long term rates stayed low because of those Asian investments in our bonds, which is why we now have a dangerous flattening of the interest rate curve. So again, isnt it fair to blame those Asian nations for thwarting Fed intentions?

In light of the above, why place the major responsibility on the government deficit?

You are prcisiely right in laying the blame at US consumer doorsteps. Call it Walmart blowback- the unintended consequence of consumer products egalitarianism. Discipline is extinct. I wonder when the hangover kicks in?

Steve – “then the dollar would fall, imported goods costs would rise, consumers and businesses would buy fewer foreign goods, and it seems to me that our trade imbalance would then automatically correct itself”

With my very limited economic knowledge I can see a problem with this. With the rise of globalisation and corporations like Walmart very basic goods are now imported and the the capacity for manufacture of these items in the USA has been lost. The fall of the US dollar would have major implications for the standard of living of US citizens as they have no other source of these items other than from overseas. Also an increasing amount of oil is imported and this would also have living standard implications.

It probably was true 20 years ago that US manufacturers could just take up the slack of higher import costs however as a lot of manufacturing and service industies have been offshored and outsourced then there might not be the capacity to take up this slack in the short term.

The figures are horribly pixellated. Can you make them links to larger versions?

I hope everyone has already seen this.

http://www.theonion.com/content/node/44455/print/

Steve Bodner: I think there is an element of truth in what you say. But I also think you are conflating two effects. One is the flow of savings, and the other is the stock of assets being held in different currencies. The dollar would drop in value if central banks slowed accumulation of dollar assets. If the dollar drops, in a partial equilibrium elasticities-absorption approach, then it is true that the US trade balance will improve. But this approach takes incomes as exogenous, and we know that that is probably not the right assumption in the medium term. The current account imbalance has to be validated by the savings-investment gap and the budget balance. You have to argue that these will be strongly affected by a realignment of asset holdings in order for your interpreation to hold.

I also wonder about the “it’s all East Asia” characterization of who’s putting assets where. See Brad Setser’s post on reserve accumulation and the entry of the OPEC countries into the process.

You make a good observation regarding the “conundrum” of lack of responsiveness of long term rates to the rising Fed Funds rate. And that these unnaturally low rates are partly the cause of excess consumption (via the housing boom). One study by Warnock and Warnock does find that up to 105 basis points of depressed long term rates is due to the above average capital inflows — but these are not necessarily East Asian inflows. And indeed official flows (which are mostly attributed to East Asian central banks) are not found to have as nearly as large an impact.

s: I agree that in adjusting the current account deficit, some retrenchment in consumption behavior is likely to occur. But this shouldn’t be construed to mean that the only overconsumption is taking place in the private sector (spurred either by housing equity withdrawal, or by tax cuts). The public sector has also witnessed a rapid rise in spending (think “bridges to nowhere”).

Aaron Krowne: Sorry, not much I can do given my limited technical abiities. But you can see a pdf version here

Menzie. Thanks for the references, both to my data on the sources of Chinese reserve accumulation (my blog has a relatively clean version of the same graph) and on petrodollars.

I generally agree with you — the causality runs both ways, adjustment requires a fall in US consumption/ demand growth, and a reduction in the US fiscal deficit would be a big help. But in that context, I would put somewhat greater weight than you do on Chinese exchange rate policies (and oil exporters exchanage rate and budget policies).

1) Tis true that China’s current account surplus accounts for maybe 1/6th of the US current account deficit (2005 data; 140 v. 820). But Chinese dollar reserve accumulation in 2005 could have been as high as $200b — so it plays a bit larger role according to that metric. Given that lots of the FDI going into China comes from Taiwan, Korea, Japan and HK/ Singapore (HK poses all sorts of complicated issues about round tripping and intermediation, which i’ll set aside), I think it makes sense to think of China as intermediating some fraction of East Asia’s broader surplus, not just its own.

2) I also think that there are a set of fairly clear channels through which a move in China’s currency (at least one large enough to end expectations of a further revaluation and reduce hot money flows, slow FDI inflows and eventually reduce China’s current account surplus) would impact savings and investment in the US – namely through reduced chinese reserve accumulation and higher US rates. The Banque de France found a somewhat larger impact than Warnock and Warnock for peak Japanese + chinese reserve accumulation in 03/04 on Treasuries. Moreover, studies that focus just on treasuries have a problem: the US data that folks rely on for the official/ private inflows split worked ok in 03/04, but works terribly now. only 35% or so of Chinese 05 reserve accumulation shows up in the US data — and that’s far higher than the share of the oil exporters buildup of official assets that shows up in hte US data.

3) that said, I do think the role of oil exporters right now exceeds the role of east asia, but for various data related reasons, that role is bit harder to observe in the US data and thus gets overly discounted. Particular by economists who like formal models that require good data — the 05 official inflow data in the US BOP, in my judgement, significantly understates official inflows. But that is the kind of qualitative adjustment that is hard to model.

4) the US sucking in capital story has one obvious problem: persistent low US rates. The mechanism that most obviously would suck in capital is higher rates. now we have higher rates than europe — but, as the IMF data in your graph shows,europe isn’t financing the US. I consequently am a bit more inclined to think that Bernanke is on to something, tho I suspect that right now, the core source of any savings glut has to be in the oil exporters. Dr. Roubini and I debate this constantly — he is more in your camp.

5) The Bernanke story — and also the story in Caballero, Farhi and Gourinchas about the lack of financial assets in savings rich emerging economies — is, however, a bit hard to square with data showing a large net flow of capital into emerging economies. private investors are not the vector carrying the savings surplus of the emerging world to the US. and private investors are finding plenty of attractive finanical assets in the emerging world — be it Chinese savings deposits (growing quite fast), brazilian government debt or the equity markets of just about any emerging economy! To get a big flow of capital from the world (ex Europe) back to the uS at current uS rates, methinks you need official intervention — whether oil states saving through the budget the oil surplus, or China and others resisting appreciation in the currency market.

I tweaked the figure a little. Does it look any better now?

On Brad Setser’s 3) and 5) and the role of oil and oil states, the EIA indicates energy imports of about 5 billion boe at current levels, based on http://www.eia.doe.gov/oiaf/aeo/table1.html. At $50/boe, that’s $250 billion to pay for oil and gas imports. Saudi is content to let it pile up, Russia’s reserves increase by $10 bn/month, the list goes on.

With these states being content to control their spending so as not to stoke domestic inflation, US treasuries seem a straightforward, liquid option. Recall how much hassle Russia had in trying to pay off its Paris Club debts early.

And Big Oil is no different, pouring their excess funds into repurchasing US$ based equities or paying down debt, forcing the purchasers of their high quality debt to switch to other low risk debt options.

Now, in my highly simplified manner, if you cut oil prices in half, you cut the outflow in half, and you reduce this element of demand for treasuries; this then leads to the market interest rate edging up?

two comments:

1. Energy plays a large role. If you eliminate oil & gas imports/exports from the data the relative picture would be much different. Problem is that changing the price of energy or the exchange rate of the dollar won’t affect the quantity of energy movement-energy demand is relatively inelastic.

2. The world current account balance is zero. One country’s surplus is another country’s deficit, in the aggregate. If the U.S. reduced its deficit or even went into surplus it would have the opposite effect on the rest of the world. Then the rest of the world would complain about the U.S.’s pushing them into recession. It’s a no-win situation.

First, let me thank all for some excellent comments. I believe Brad Setser has laid out some excellent reasons for thinking that China is more important in driving the global imbalances than is implied by its current account. Hence it comes down to apportionment of the causes of the US current account deficit.

I agree that if the People’s Bank of China ceases reserve accumulation, the renminbi would appreciate, their current account surplus with respect to the world would probably shrink. In addition, US Treasury, agency and other yields would likely rise. Rising US rates would accelerate the deflation of the housing market, thereby decreasing private consumption. Rising interest rates would increase the borrowing requirements of the US Government. Given that half of US Treasuries are held by foreigners, I suppose that would exert a contractionary impact on US aggregate demand. But I wonder if the Chinese imbalance necessarily shrinks with the US even as its imbalance with the world shrinks. Probably yes, but mostly because of the interest rate increase that hits interest sensitive components of aggregate demand.

My other, more important, query is whether this China factor would have a first order effect on the US current account imbalance. My main point has been that in order to get the first order effect, government spending growth reduced, tax receipts increased to slow growth of imports.

One other issue: Low real rates in the US represent a combination of factors. Since ex post uncovered interest parity doesn’t hold, real rates in the US can diverge from those abroad for a number of reasons. Even assuming real interest rate parity, a shift in the US aggregate savings schedule (due to public sector dissaving) can, if combined with a sufficiently large inward shift in the US investment schedule, result in depressed real interest rates at the same time as a current account deficit widening. So low ex post interest rates to me are not conclusive evidence that it’s a global savings glut at work.

Walter R.: What would happen if oil prices halved? Hard to say since there are offsetting effects. US aggregate demand would rise as the value of oil imports fell; monetary policy would likely be less tight. These would lead on net to greater non-oil imports. On the other hand, the demand for dollar assets might fall, weakening the dollar, and improving the trade balance.

Jim Miller: Changing energy prices has aggregate demand effects so even in the short run, it would have an impact on the trade balance.

The fact that the global current account balance is zero does not mean that if the US reduced its current account deficit, the net effect on world GDP would be zero. The CA is an endogenous variable, and as the US CA fell, other countries would probably try to offset that impact on their economies by expansionary fiscal or perhaps monetary policies. So the answer depends in part on the policy reaction functions in the rest of the world, as well as the origin and nature of the US policy shock. But I agree that it is likely that US fiscal restraint would slow down world growth — but if so, it’s something that would better be experienced in a gradual manner than in a abrupt, disruptive, fashion.

Reserves accumulation have direct link with the fed rates. As the fed lower the fed fund rates in 2002, everyone started borrowing cheaply. Fed fund rates do not apply just in the US, but in the world.

China but also India have seen reserves increased dramatically since 2001, nothing to do with trade deficit. private agent have borrowed dollars for investment in these countries. in order to ensure stable money supply in these countries, central banks of these countries have placed this borrowed amount in the US. It makes perfect sense for them not to spend this amount, because they borrowed it (in dollars) and they will have to reimburse one day (in dollars).

If like Steve said, china was spending its reserves, it would be mistacke for them because it is money china own to someone. this reserves are not china money. it is money lent by private agents to china in dollars. It should consequently be placed in dollars denominated assets (exactly what china central bank is doing).

>it is money lent by private agents to china in dollars.

sorry, i wanted to say that it is money that went into china.

The ownership of this money is private: it could be chinese private agents or European, US private agents investing in china (possibly real estate) to speculate on remnibi reevaluation.

If this capital flows out of china, the chinese central bank will need these reserves to reimburse them in dollars.

this is the way i see it!

I was asking some friends in China about their banking regulations, and they suggested that if all restrictions were lifted, many Chinese would want to invest outside China and the USD/Yuan rate might be very unpredictable, including the possibility that the dollar may become stronger.