Cognitive Dissonance in the 2006 Economic Report of the President

One of the most discussed phrase in the State of the Union Address was “oil addiction”. Even now, highlighted on the White House website is this link on energy issues.

In order to see just what the Administration has in mind in terms of substantive policies, it is probably useful to go beyond press statements. In this regard we are fortunate, as the Administration has just released two major documents pertaining to energy issues — the Economic Report of the President (hereafter ERP and the Annual Energy Outlook (hereafter AEO). The latter contains a number of projections that confirm that the United States, under a number of plausible assumptions, will continue to import most of the petroleum it consumes. Specifically, the AEO reference scenario indicates that by 2015, net crude oil imports will be 10.47 million barrels per day (mbd), compared to 2004 imports of 10.06 (p. 115), although DeutscheBank predicts a much higher level of 11.74 mbd. As I have noted in a number of occasions, the increase in the value of oil imports has accounted for almost half of the increase in the trade deficit since the end of 2001.

Source: Author’s calculations based on Jan 2006 NIPA release

How does the CEA see the energy issue, and what does it recommend in the way of achieving the aim of reducing our oil addiction? In the Energy chapter of the ERP (p. 232), the authors state:

Absent policy, individual energy market participants may not have an incentive to tackle certain problems associated with their energy production and consumption. Carefully targeted policies that reduce U.S. vulnerability to energy disruptions, encourage energy efficiency, and protect the environment can therefore be beneficial supplements to markets. These policies can be made more effective and less costly when designed based on economic incentives.

Economists should focus on relying upon market incentives, particularly those that yield a benefit-cost ratio in excess of unity. The remarkable thing is that while there are tremendous numbers of references to “tax credits” (just do a search in the PDF and see), there is not a single to “taxes”. And yet, in any appeal to efficiency and economic incentives, taxes as well as subsidies should be considered, especially insofar as one believes there are negative externalities associated with consuming — and importing — fossil fuels. Interestingly, there is discussion of how imposing new CAFE standards would affect energy use — both in the ERP and the AEO, without much criticism. I find that aspect interesting, given the fact that such command and control approaches are the least “incentive”-like, and least favored by economists, that there is so much stress on these standards, and other interventions. (Box 11-1 does discuss the new CAFE standards for light trucks as being set according to criteria to minimize costs relative to benefits — but why not just use the incentives so lauded at the beginning of the chapter? CBO estimates that a 46 cent/gallon tax would induce a 10% reduction in consumption with 3% less cost than what would occur with new CAFE standards, with or without permit trading)

This reliance on subsidies and command-and-control remains true despite the fact that if the President really wished to reduce our “addiction” to imported oil, the most effective way of accomplishing this aim would be an energy tax. That is because on the supply side, production is unlikely to rise strongly given the depletion of onshore reserves, even with the most generous subsidies. In addition, production takes years to put into operation. Moreover, a tax acts immediately, while standards would take longer to have an impact on consumption (since it would have to work through an alteration of the capital stock embodied in trucks and cars). Furthermore, a tax has a further advantage that it reduces the price foreigners — including Saudi Arabia and Iran — would receive for their oil exports. In this sense, it has a similar effect as an oil tariff, although it is WTO-consistent, while a tariff would not be.

A back-of-the-envelope calculation can be useful in defining the potential impact of a gasoline tax. In 2004, the United States imported about $180 billion worth of petroleum and petroleum-related products, equal to about one-third of the trade deficit. Ignoring interaction effects, a $1 per gallon tax on gasoline would reduce annual petroleum imports by $10 to $25 billion, or about 1.6 percent to 4 percent of the trade deficit. The calculation relies upon estimates of the gasoline demand elasticity of 0.3 percent to 1.0 percent. Specifically, each barrel of oil yields approximately 19.5 gallons, and U.S. consumption was 19.4 billion gallons.

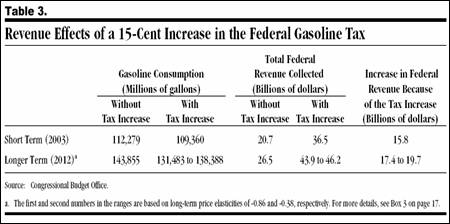

An additional benefit of such a tax would be the increased government spending revenues that would result. Based upon the CBO estimates, I estimate such a tax would increase tax receipts by $105 billion in the short run, and $110-125 billion in the long run. (The actual estimates are reported in CBO, Reducing Gasoline Consumption: Three Policy Options (November 2002).)

Source: CBO, Reducing Gasoline Consumption (Nov. 2002).

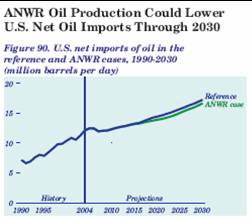

One digression: the ERP also makes mention of the impact of ANWR:

According to estimates by the U.S. Geological Survey (USGS), the

1.5-million-acre coastal plain of ANWR and adjacent Native lands and state offshore waters hold between 5.7 and 16 billion barrels of technically recoverable reserves, with a mean estimate of 10.4 billion barrels-enough to supply 1 million barrels per day for over 28 years. (p. 238)

There is one interesting figure from the AEO that should resolve the importance of opening up ANWR:

Source: Energy Information Administration, Annual Energy Outlook, (February 2006).

The foregoing suggests that if the objective is to end oil addiction — at least in my lifetime — the current set of Administration plans will not achieve that goal.

Technorati Tags: oil addiction,

gasoline tax

Economic Report of the President

BUT BUT BUT…, sputters the crowd, gas taxes are regressive!

(they aren’t, not really, but that’s what they’ll say).

Besides, any actual plan might have the effect of lowering oil company profits, and Bush could never allow that. Far better to allow the market to be chaotic and let prices soar, so companies can raise prices and have yet another year of record profits, after all.

The reason the Bush adminstration will not use a logical approach to energy issues is that it would violate the first three Commandments:

1). Tax cuts

2). Tax cuts

3). And more tax cuts

It is really the only tool available in their toolbox and has universal application. They touted tax cuts in the 2000 campaign as the cure for the budget surplus the same as they promoted tax cuts a year later as the cure for the recession and budget deficits. It only makes sense that their approach to energy problems would rely on tax cuts and credits.

If it is not, truly cognitive dissonance, then I think the government actors must be creating a veneer of “management” with these programs, as they really rely on the market (and the oil price curve) to sort it all out.

A gas tax might kill GM, do they (we) really have the guts for that?

It’s so much easier to let GM market those SUVs (with yellow gas caps) … and let the buyer beware.

The Europeans have already made your case for you. They have higher gas taxes which support far more energy efficient public transportation systems than found in the US.

If oil hits triple digits per barrel soon, (quit likely, read Matt Simmons’ book Twilight in the Desert) the first world countries will quickly be divided into two camps: one that can sustain many functions of its economy without millions of private automobiles moving people to consume goods and services, and another camp where this is practically impossible.

Guess which camp the US is in.

I was curious after posting the above (1:06 PM), to see if I was really being fair. Had I correctly remembered SUVs with yellow gas caps in those television ads? So I went to the Chevrolet home page, clicked on the yellow gas cap, and found that the 2007 Chevy Avalanche is their poster child.

In real-world fuel economy the 2006 Avalanche scores 15 mpg. Given the 30% by volume energy reduction with ethanol, call it 10 mpg with E85. Is that our future? Or just a vision of the future that is consistent with everyone’s corporate vision (and subsidy allotment)?

Regardless of pessimism about the Bush administration implementing anything like your plan, it is a good start for discussion.

One drawback is the disportional impact of an energy tax on the poor (notwithstanding M1EK’s comment). The poor are unlikely to afford new energy efficient cars, are more likely to buy the used gas guzzlers dumped by the more affluent, commute farther to their jobs because they can’t afford housing in the city, live in poorly insulated homes and apartments, and pay a higher portion of their total income for energy needs. Perhaps a mechanism like the earned income tax credit could mitigate these effects.

M1EK and Joseph: Excellent points regarding distributional effects. The evidence is mixed, with conclusions depending upon income versus spending measures used as a base. From CBO, Three options… (Nov. 2002), Chapter 6:

The document continues:

Has anyone calculated the impact of a gas tax on Ford/GM? 😉

It would seem that the impact of a gas tax on Ford and GM would hinge on their ability to bring more fuel efficient vehicles to market. In this regard, is it at all relevant that these are global companies whose european arms are already manufacturing such vehicles? I recently spent some time in a German Ford Focus diesel wagon, which was full of thoughtful design touches, seated four adults comfortably (I’m 6’2″) and got excellent mileage. What would it take to bring such a vehicle to the U.S. market?

I wouldn’t volunteer to be the PR guy in charge of selling a significant gas tax increase to the US consumer.

I’m not sure why spending would be a better metric than income when analyzing the impact of a tax. After all, if you ignored the fact that the lowest decile spends 100% of income each year and the highest decile spends say, 75% of income, then any sales tax seems flat.

As for the lowest decile having the lowest gas expenditure, as a group, I’m sure that is because a large portion of them don’t even have cars, but for those that do, I would bet they are paying a lot more than 2.5% of income for fuel.

Upon exhaustive investigation and research, I have discovered an amazing fact. The United States already has a gasoline tax. One would not know it, from reading the analysis above.

I believe your arguments would be even more effective if you pointed out that you were merely suggesting that we change the level of an existing tax, rather than creating an entirely new one.

The administration is between a rock and a hard place. While I certainly agree that an increase in the gas tax makes sense (pun included), politics, alas, will intervene. The alternative for this administration is to play for time, hoping that the market will do the hard work. This is not necessarily a great idea at this stage in our history.

On the other hand, the administration certainly could signal some kind of leadership here, as well as acknowledging that we do have a problem, simply by vigorously advancing the cause of alternative, renewable energy sources at all levels of society. But then politics againwe will disturb our friends in the Middle East. And Bush is extremely sensitive to this political reality, as evidenced by his reassurances to them after the State of the Union speech.

The longer we wait before tackling this issue, the greater the adjustment will be.

In confronting this issue, Bush and the rest of our politicos, will have to confront some very real issues, ones about which they have been in denial for a number of years.

It is difficult to maintain my capitalist credentials in the face of the energy problems we face in the U.S. Oil companies are extremely efficient at extracting and delivering fossil fuels that threaten our security and destroy our environment. The free market will continue to adjust prices with respect to demand and supply, but the market has a difficult time setting the price at a level that takes into account the amount of fossil fuel remaining, the long-term ecological damage, and the political landmines that can lead to the destabilization of the entire economy.

Therefore, I feel compelled to favor a tax on fossil fuels and to abandon my ‘free market’ philosophy in this area. I believe that the tax needs to be used to improve energy efficiency. For example, rather than submit to the fact that poor people have less insulation in their homes and will have to pay more for energy, tax money can be used to support a campaign to insulate homes.

In the September, 2005 Scientific American (p. 81) it was written, ‘ Wind power is also abundant: wind farms occupying just a few percent of the available land in the Dakotas could cost-effectively meet all of Americas electricity needs.’ This sounds questionable, but there is enough truth in it to be worth engaging in a ‘Manhattan Project’ to produce and install wind turbines.

Another good project for the tax proceeds would be to fund the ‘Million Solar Roofs’ (http://www.millionsolarroofs.org/) project.

Perhaps, after a period of suffering with a tax, we will become energy-independent enough to save a few hundred billion dollars a year currently being used to defend our access to fossil fuels and do one of my favorite things: cut taxes!

Hal: Yes, there is a Federal 0.183 dollar/gallon tax. It has been at this rate since 1993, so of course given inflation, has been eroding over time in real terms. Taking into account state taxes, when the price of gasoline is $1.10, the pre-tax cost is $0.70 per gallon. See the Energy Information Administration here:

Joseph: We might want to use spending if there is unreported income, and that degree of unreporting decreases with income decile (because there are nonmarket transfers, transfers in kind, etc.)

Ric: Taxes are unpopular, but it is a false choice that is set up when one sets up taxes vs. no taxes. If the objective is to reduce energy dependence, then it can be accomplished with taxes on the activity, hidden taxes on the activity (e.g., CAFE), or with subsidies to alternative means of generating energy from domestic sources. But subsidies are not costless, and either have to be financed by taxes from the general treasury, or by bond financing (borrowing) which is approximately taxing future generations. That concept may be difficult to explain to the general public, but shouldn’t that education process be part of the aim of this discourse?

http://www.dilbert.com/comics/dilbert/archive/dilbert-20060219.html

Hey Ken, I recently bought a 5 year old german-engineered Ford Focus Diesel (90hp) and I get around 41 MPG. My father has a Opel (Vauxhaul) Meriva Diesel and get’s around 40 MPG. I live in the Netherlands and 1 gallon of Diesel costs me $5.19 (in Germany it’s $6, $2.55 of this being taxes).

Don’t forget that comparing Europe to the US is not completely fair. I can drive across the entire Netherlands and back with just one gas filling…

As for the regressivity of the gas tax:

http://mdahmus.monkeysystems.com/blog/archives/000188.html

(it’s not regressive by most standards)

As for how ‘great’ diesels are:

http://mdahmus.monkeysystems.com/blog/archives/000247.html

(you can get not quite as good fuel economy as you do in a much bigger hybrid while polluting a hell of a lot more. Yippee!)

As for “you can drive across a European country in one day” – the implication being the typical one that the US is full of “wide open spaces”, that’s fundamentally not true. Most drivers in the US drive to and from work every day, and don’t go into those vast empty spaces very often. (How many times have each of you driven through Wyoming or Montana?)

Cleaning up the language in the last paragraph: the implication that many try to make that US drivers have to cover vast distances on a daily basis because the country is so darn big is the one that’s untrue – most of that driving is confined to metropolitan areas for commuting and shopping. (and those metropolitan areas didn’t sprawl because the US is so big; they sprawled because we subsidized sprawl for decades).

Stefan–my question was whether the ability of U.S. automakers to respond quickly to increased demand for fuel efficient vehicles was at all impacted by the fact that those same automakers already manufacture and market such vehicles overseas. It was not to compare the two markets. And I don’t presume to know the answer to the question. But if high gas prices start impacting the U.S., either because of policy (higher taxes) or flat or declining production, the U.S. market will start to look a lot more like the European market.

Ken – if Ford/GM carried the lessons of the 70’s in their DNA, then they remember “emergency” efforts to bring European models to the American market. Maybe (who knows) there are German Opels or Fords that are ready to go. But really, in a true national emergency setting, it would be pretty easy for the government to legalize those cars, as they now exist.

Change in topic, and another question for the economists:

On the theory that gas prices will play in the 2006 elections, and that the party in power will benefit from lower gas prices … can they “drive” them in any way, at this point?

Forgot to mention that German makers could have made the same preparation. I’ve actually seen Mercedes “A-Class” cars on the roads of southern California more than once. It would be an interesting change to see small luxury cars accepted.

Stefan, the only diesel powered sedans available in the US is the VW Jetta/Golf but not in California and NY because they set their own higher emmission standards. I wish we could get other 4cyl turbo diesels like Europe. It is certainly a better approach than the unproven hybrid hype.

odograph, those Mercedes “A-Class” cars you saw surely had Mexican plates as I have seen them here in Texas. The VW Derby sold in Mexico is about the same size too. Of course we can’t get them because of EPA/DOT knowing what’s best for us.

I should have been more clear .. mfg plates, I live not far from a “secret” design center (it’s in Irvine, CA).

M1Ek is right on in regards to miles driven. Long trips really aren’t generally a significant percentage of a vehicles total mileage. The “average” annual mileage often is stated as 12-15,000 miles per year. In regards to high mileage trade-ins our discussions almost always relate to the length of the commute, or business use of the vehicle(usually sales reps). Urban sprawl absolutely has a dramatic effect. On the bright side, average mileage dramatically decreases with age(yes there are exceptions, but this is without question the norm) so an aging population will likely decrease gas useage without external stimuli required.

In the words of G. H. W. Bush – “Read my lips.”

Think G.W. Bush remembers that line?

The answer is really in the carrot, not with the stick. Market prices for oil and gasoline will reflect supply and demand for transportation. Most observers expect that to trend upward and I agree. There are alternatives in the pipeline although I will grant nothing is in the intermediate term,

I expect that Bush is twisting some arms at Ford and GM – he has publicly critized them already and he’s probably making them an offer they can’t refuse.

While “switch grass” doesn’t belong in the same sentance with “nuclear” in any technical prescription, it makes sense as a political positioning statement.

The Republican Congress and the Republican Presidency have been elected and reelected on platforms of reduced taxes, not tax increases.

You still offer no compelling reason to convince Americans to hand over even more money to the government, all for their “own good.” We’ve just had our fill of failed “tax and spend” policies.

Taxes vs the status quo is indeed a false choice.

It would be very straightforward to balance a gasoline tax increase with an income tax cut at the lower end, designed to balance the revenues and make the gas tax less regressive. Maybe apply 75% of the revenue to an income tax cut, and 25% to subsidies for new car purchases (to help out GM & Ford, and lower income groups that need to replace their cars). Another alternative tax cut would be revenue sharing to the states, earmarked to reduce sales taxes, which would have roughly the same impact on lower income groups as the gas tax. Maybe earmark 5% to cover health care costs for domestic car manufacturers (a cost which foreign car makers don’t pay, with their national health systems) – that would generate $5B per year, more than enough to help out GM & Ford.

Just takes a little creative planning.

Joseph Somsel: I’m not certain what your alternative is, unless it is “more of the same”.

Which means that, instead of “tax and spend”, we have “borrow and spend”. But borrowing has to be paid back, at least in part, or the accumulated debt has to be inflated away (don’t they call that “the cruelest tax”?). So taxes of some form are coming regardless of what action — or inaction — is taken.

Kinda funny to say “failed ‘tax and spend’ policies” as you all borrow money from the next generation to send my my hybrid tax credit.

We spend. We just pretend we don’t have to tax anymore.

Well, M1EK and Menzie, you have half convinced me that a gas tax isn’t as regressive as I thought or at least it is a small enough portion of most people’s spending that it isn’t a deal breaker. But I doubt that a gas tax has a prayer of passage with this administration. We will be lucky just to get the adults to allow some of the sunset tax cuts to expire.

The political gridlock in the US makes a tax that hits directly the average working person practically impossible to enact.

Particularly as it is the ‘red states’ which are less densely populated, more spread out. I cannot see the Senators (D or R) of North Dakota or Montana or even Texas or Okl going for a gas tax increase and keeping their jobs.

There would have to be a national sense of emergency about events– most people probably don’t understand why a dependence on Mid East oil is important, and why Bush was being highly misleading when he talked about reducing US dependence on ME oil (rather than oil imports, generally). A widespread ignorance about a fungible commodity in a global market.

One of the striking things about the Bush Administration is that whilst they have used post 9-11 to stoke up fear (of weapons of mass destruction, of further terrorist atttacks) they have not asked for specific sacrifices of the American people.

Taxes were not raised to fund the war in Iraq. Americans were encouraged to shop, as their patriotic duty, after 9-11. They have not asked Americans to drive less or, shock horror, to buy more fuel efficient cars and houses. Bush in particular has avoided personal appeals to young Americans to enlist.

All of this might have been good macroeconomics, but it perpetuates a ‘something for nothing’ mentality.

There is no language of sacrifice in modern American politics. Maybe a president McCain could make such work, but Carter was derided for it, and Bush I sabotaged by his own party for it. The winner is always the ‘morning in America’ candidate, who promises gain without pain.

It’s a general western phenomenon, reflected again and again in the reaction to deficits (loud yawn), the growing popularity of gambling (something for nothing), the housing market (a sure win), obesity (loss of self control and the desire to blame outside forces for our love of fast food), the popularity of instant Celebrity (reality TV shows) etc.

Whether the US could again throw up a JFK or an FDR who would appeal to the national sense of solidarity and sacrifice, I do not know. As nations, we in the West may just no longer have the attention span.

“I wish we could get other 4cyl turbo diesels like Europe. It is certainly a better approach than the unproven hybrid hype.”

No. Once again, the midsized Toyota Prius is beating the compact-sized Jetta Diesel by a fair margin in both city and highway driving in real-world testing. Even the much less impressive Honda Civic Hybrid beat the Jetta Diesel.

http://mdahmus.monkeysystems.com/blog/archives/000247.html

Do you folks all go to the same FUD school or what?

There’s been considerable debate regarding the political feasibility of an increase in the gasoline tax. I agree that it is politically difficult to increase explicit taxes in this environment, although the real tax on gasoline has been higher in the past — namely before the first oil crisis in 1973-74.

In addition, there is now at least opinion across the political spectrum for the need to reduce oil imports. See Challenge and Opportunity: Charting a New Energy Future (Washington, DC: Energy Future Coalition, 2003); and J. Andrew Hoerner and James Barrett, “Smarter, Cleaner, Stronger: Secure Jobs, a Clean Environment, and Less Foreign Oil,” A Special Report for the Blue-Green Alliance (October 2004), andGeorge P. Schultz and R. James Woolsey, “Oil and Security,” A Committee on the Present Danger Policy Paper (2005). When the Committee on the Present Danger starts thinking that we should be concerned about energy issues, I think we may be near a consensus for real action.

I think there are some great points on this post, however, I would like to say that it is not as simple as increasing taxes on the activity and seeing consumption drop.

In my particular situation and many others I know, if fuel prices went up by 10 or 20% tomorrow, I would simply be paying that much more. And comparing the landscape of the United States to that of many European countries and their public transportation systems is good in some aspects but unrealistic in others.

Until the alternative sources of energy (diesel, ethanol, hydrogen fuel-cell, etc.) are proven technologies for widespread, efficient and economic use, it is not certain that there will be a widespread drop in the consumption of fossil fuels by making gas more expensive.

Personally, I believe that to increase taxes on the consumption of gasoline and fuel will ultimately come out of us. I find it interesting that the above article suggests a possible 10% drop in consumption with a .46 cent additional gas tax.

Then again, when figuring out how much an increase in the gas tax would cost society vs. increasing CAFE standards, the CBO DOES NOT factor the additional tax paid as a “cost to society”:

“It does not include the tax payments because they would be transfers–from people who paid the tax to people who benefited from the increase in revenue (for example, through increased public expenditures or reductions in other tax payments)–and, as such, would not be costs to society as a whole.”

In other words, the increase that the common person pays in fuel expenses “does not count” because the government MAY be able (able, not willing) to cut your some of your other taxes sometime in the future, or because that money will come back to you in increased government expenditures in the future.

And what of the people who cannot alter their driving habits enough to compensate for the increase in fuel costs? What about the independent builder or electrician that must go where the job site is, regardless of the cost. Or what about people in areas that don’t have widespread public transportation and more to the point do not have the efficiency to do so.(Mostly speaking of rural areas) Perhaps they should see less of a tax increase because they cannot jump on the subway or commuter rail to go to work?

In addition, what about the increase in the cost of goods produced in the U.S.?? You can’t say that this won’t have some inflationary pressure on price levels, because an increase in the level of the gas tax as suggested above would be what, somewhere in the vicinity of 15-25% of current gas prices (I don’t have the exact average prices in front of me.)

Some businesses will be able to alter their logistics and perhaps ship more by railroad, or other alternatives. But others will simply have to increase the price of their goods to the consumer. In other words, don’t expect the only cost to you, the consumer, to be the .46/gallon more you pay.

As I said though, many many good points on this blog and I agree that we all need to take a look at our behaviors and alter them to become more efficient. However, the “tax it and people will stop buying it” philosophy does fall somewhat short of reality. We can “sacrifice” more by paying more, but what is the actual PLAN for using the money to help people afford hybrid vehicles and switch energy production and consumption to other fuel sources. After all, as much as ethanol and other sources are being touted, we need to have a plan to make these sources more efficient, and more profitable or they will not be a sustainable, long term solution.

Just a couple thoughts.

So your solution to $3 a gallon gasoline is $3.50 a gallon gasoline?

With the difference going to Washington?

And for what? So that China can burn more, grow their economy and steal our jobs.

This is how the American voter will interpret your proposal.

Would Hillary Clinton stand up and propose this? Would Joe Lieberman? Would John McCain? Would Evan Bayh?

OK, maybe Barbara Boxer….

The remaining $0.50 a gallon can offset the payroll tax, if you’re concerned most about the impact on lower-income workers.

Or, if you’re concerned about the impact on people living in metropolitan areas with insufficient public transportation, it could be dumped in the FTA’s budget (which is pretty damn paltry, by the way).

Or, if you’re concerned about the rural interests, (I don’t have an idea here; but I bet somebody does).

But frankly, the idea that CAFE is better is just stupid. CAFE might lead to you buying a more fuel-efficient vehicle, if we ever get rid of all the loopholes, but its incentives end at the day you buy that car. A gasoline tax gives the Prius driver an incentive to drive less, too.

Yeah M1EK I agree with you on your CAFE standpoint. I wasn’t arguing in favor of the CAFE standards, although I can see how it was taken that way. I was more arguing against this suggested tax increase on gasoline.

I just wanted to point out some of the more complex issues with evolving our nation’s energy production and consumption. Well, that and some of the flaws in the CBO’s reasoning in this particular article.

And I certainly understand and appreciate how the additional tax revenue CAN be used, but the question is WILL it be used in that way.

And still, the CBO also operates under the assumption that we all drive more than we need to and could instantly cut this down by a great deal. If I thought for one second that this tax revenue could be used efficiently to solve the problem it is being proposed to do(cut down on fossil fuel consumption) than I wouldn’t be as cautious. But we ARE talking about a government, most particulary OURS.

While the assumption is true for many, for others where traveling is required as part of their job, the burden either falls on the individual employee or business owner(s), in which case it would get transferred over to the price of their products, or to the end-line consumer.

“And still, the CBO also operates under the assumption that we all drive more than we need to and could instantly cut this down by a great deal.”

Instantly? No. In the long-run? Yes. Expensive gas makes people think twice about buying houses in sprawling exurbs. Etc.

“It is certainly a better approach than the unproven hybrid hype.”

Hybrid technologies are well proven. There are currently over 400,000 hybrids in the US, and about a million worldwide. The Toyota Prius was introduced in fall 1997 in Japan; the Honda Insight was introduced in fall 1999. (Honda’s hybrid system is simpler but less efficient than Toyota’s. Despite the Toyota system’s greater complexity, there’s no evidence that it’s less reliable than a Honda hybrid or a conventional car.) The next Prius – probably the 2008 model year – will be the technology’s third generation.

I think it’s bad form to be a puppy over raising taxes.

If you’re going to preach about raising gasoline taxes, go all the way and nail the private and commercial vehicle operators for $2.50-3.00 a gallon in new federal taxes. Go ahead and whack the economy that much harder. Did you read the latest inflation data? Might have a bit of competiton for your tax plans. Didn’t think of that? Bummer…

Remember to go out and tell everyone to buy the non-available, most highly efficient vehicles manufactured (non-available due to inadequate production growth). And tell the Class 8 truckers to just suck it up.

Then open your little bicycle shops. And laugh at the poor souls who are still driving cars in the midsize to mega cities.

Of course, I recommend investing in boats as we’re certainly going to lose one of our polar caps before we run out of fossil fuels. We’ll need the boats more than fuel efficient cars.

Yeah, maybe you should concentrate more on those boat taxes.

The new inflation info? It’s here: http://stats.bls.gov/news.release/cpi.nr0.htm

Pretty speed up the passage of your new fuel taxes. A few more inflation reports like this one and you can forget about any support for increased fuel taxes.

You guys don’t get it yet, do you? We’re not going to need the fuel taxes to curtail vehicle mile usage. The slippage in real wages, real compensation, and rise in the cost of goods including food and energy will take care of that problem.

Nice try, fellows. But you’re too late.

That’s better speed up…

The problem, Movie Guy, with saying “you guys” is that there’s always someone futher up in the thread who as not signed onto your target position and/or strawman. I said:

If it is not, truly cognitive dissonance, then I think the government actors must be creating a veneer of “management” with these programs, as they really rely on the market (and the oil price curve) to sort it all out.

Now, if I really had the energy I’d type a rant similar to yours, but flipped the other way … why did the Gov allow the low-middle class to be put over this barrel? Why did they pretend “solutions” that they knew would not actually control gasoline prices? Why did they end-run CAFE just to make sure that the poor average buyer gets caught holding an SUV as the game of musical chairs quickens?

I continue to think this is the worst combination of two possible worlds. We might have had an aggressively “managed” energy economy, or we might have had a purely free market. What we got was a free market, but with empty promises of oil/gas replacements (cheap ethanol and hydrogen for everybody!).

I’m sure that some individuals realized that I’m just having a little fun.

There are a multitude of climatic and environmental problems that should be addressed more aggressively. Very few of the existing approaches are adequate in terms of turning the corner in time.

If we’re really serious about devising viable and timely solutions, then I recommend that any new fuel taxes flow directly to firewalled climatic and environmental programs that are required to produce measured results based on mandated timelines.

This is the only taxation approach that I am willing to support.

Well, that and the new boat tax…

I missed the fun because I think it is true that we tend to worry once we are in a pickle, and are in less of a position to adjust.

I used to get a kick out of the words “pre-planning” when they were suggested in business. Someone would say “we need more pre-planning” and I’d ask “what other kind is there?” … blank stare.

Maybe people do post-planning too, naming things (like gas taxes or better CAFE) that they should have done earlier.

FWIW, I think we could slash our energy intensity right now with current tech, and without impoverishing ourselves. We just have to decide it is important enough to warrant our attention and creativity.

Joseph

If the proceeds of an increase in the gas tax are directly credited to Social Security taxes (either employee or employer contributions, or a split)

it is quite possible the result will be a larger GDP than pre tax.

Why?

Because consumers would consume less gas (buy more fuel efficient cars, drive less). Conversely, they would have higher incomes (and/ or more of them would be hired).

My guess is that the negative impact of SS taxes is so large on the economy (because they are a tax on employing people) that reducing these taxes would significantly improve economic growth.

Lower costs of employing workers would be translated either into higher wages (where workers are in short supply), more employment (labour is cheaper) and/or lower prices for goods and services.

Only in the case where the industry was an oligopoly *and* workers were not in short supply would the industry be able to capture the tax reduction as more profit. Even then, companies are owned by shareholders, who would experience higher incomes and wealth (particularly public and private pension plans).

Effectively what the policy would do is increase a consumption tax, and reduce a tax on labour and production. It is increasing one tax, but reducing a tax which is potentially much more harmful to the US economy.

Movie Guy

There is already a looming tax on new boats.

The cost of owning a boat is driven by the residual value of the boat (just like car depreciation is the biggest cost of owning a car).

When the housing bubble busts, the boat bubble will bust, too. Virtually nobody who buys a boat does not, already, own a house with equity.

And so the residual value of used boats will fall, and thus the cost of owning a boat will go suddenly upwards.

They are all part of the asset inflation bubble. We’ve been here before- in the mid 70s and the late 90s, the market for light planes was uber buoyant. Most light planes are bought used. Why was it buoyant– because in the early 70s every oil exec of every Ewing Oil had his own plane, and in the late 90s every newly rich tech exec had his own light plane.

The boat market is similarly linked to the property market.

John

(remove at to reply by email)

John,

Rearranging taxes is something that is constructive to discuss since ALL taxes are harmful to economic growth but some are more so than others.

As to social security tax, this is one tax where I would consider paying MORE. That is, if the structure was changed from a regressive tax to a flat tax. That would bite me since I’m well over the maximum base. Let Bill Gates pay 8% of all his income too. I’d also want the rates to match the current payouts rather than the excess going into the general Treasury account to be spent by Congress.

That said, private transportation is a fundamental productivity booster in our economy. Gasoline more than makes up for its costs and efforts to use less by a general increase the costs per mile will also harm the economy in ways that the Professor seems to ignore. While encouraging academics to bike to work is not going to change things, restricting the geographical range from which employers can draw employees will definitely hurt. Likewise, every sector of the economy will bear a burden from this tax in the form of higher costs.

Higher gasoline taxes are, from this view, a tax on economic efficiency and productivity.

True price of oil

We need to keep in mind what the true price of oil is. With the cost of drilling, transporting, refining, not to mention military intervention to keep pipelines and transportation lanes open, the price of oil is extremely significant; probably close to $1,000 per barrel.

Why not use the money to create a national magnetic levitation (mag-lev) transportation system here in the US? With 80% of all shipments normally shipped by rail, jet, or tractor-trailers, we will save millions of barrels of oil a year, reduce or even eliminate our foreign oil dependancy, reduce emissions that contribute to global warming and air polution, and increase intellectual knowledge by stimulating growth in new technological arenas.

In the past, various ‘highways’ have contributed to a great deal of weath and growth in the US. In the 1800s, the railroad was instrumental in growth. The 1950s spurred the Interstate Highway System which spawned even more growth. The 1990s brought about the Information Superhighway which brought on the growth spirt of the roaring 90s. Now, in the dawn of the 21st century, it is time for yet another system: the mag-lev transportation system. We have the technology. We have the need. Now let’s get at it!!!

ONE MORE TIME

Now as Fall 2006 begins we have had an experiment in gasoline price uncertainty and the lack of policy to solve one of the US “addiction problems”.

So why not do a “check and adjust” of the February 20, 2006 article and seek new ideas, maybe a new reason to “get on the recovery wagon”?

Key points:

1. We paid summer 2006 gasoline prices of $3.00 plus per gallon AND funds from our oil addicition financed a Middle East war that looped back our money to create the $3.00 price.

2. Current $2.40 prices could be slid to $3.00 per gallon with a $0.60 per gallon tax.

3. We also now have a data point on any demand effects from $3/gallon gas and a data point on what Iran can buy for terrorists with, was it $200M, a tiny part of their oil income.

So how to get oil independent? Get smarter!

4. I read a recent (2005) US Geographical Report on ANWR, total US oil reserves, that said we can maybe recover 16B Bbls from ALL recoverable US sources.

5. This month, news reports show a recent find of deep water oil off my home state, Louisiana, that is believed to have 15B Bbls of oil reserves.

Who does that stuff!