The issue of international capital mobility comes up time and time again. There is the worry of capital and associated production capacity moving abroad to China for lower wage rates, and if not to China, to the rest of the world to escape environmental regulations or to avoid corporate taxation. So how mobile is capital?

There are a number of ways to answer this question. Frankel discusses the advantages and disadvantages of each approach. I’ll focus on two — the flow approach of Feldstein and Horioka, and the price approach of looking at long term interest rates.

Feldstein and Horioka examined the correlation between savings and investment rates. In a world of full capital mobility, they conjectured, there should be no correlation between the two ratios. When examining a broad cross section, they found that the correlation was very high. In fact, in the most recent sample they examined (1970-74), it was 0.87 for 16 OECD countries (unweighted). As Feldstein noted last year, the results are quite sensitive to the weighting scheme. If using GDP weights, the coefficient for 1971-80 was 0.93, dropping to…0.57 in the decade ending in 2002. What this means is that for each dollar’s increase in savings, investment increases by 57 cents. Furthermore, Feldstein conjectures, and Blanchard and Giavazzi concur, that a lot of this effect is driven by integration in Europe. They write:

“In short, for the countries of the European Union, and even more so for the countries of the Euro area, there no longer appears to be a Feldstein-Horioka puzzle. In highly integrated regions, investment and saving appear increasingly uncorrelated.”

So for industrial countries, the observed decline in the Feldstein-Horioka coefficient is largely being driven by integration within the Euro area. This suggests that capital mobility, at least defined by this measure, is not increasing substantially outside of the Euro area.

What about the vast flows from China to the US? Well, note that capital on net is flowing from China to the US. And this flow — as from the rest-of-the-world, is driven substantially by actions by governmental and semi-governmental entities (as Feldstein notes), and not by private agents seeking the highest returns (or escaping the most onerous taxes).

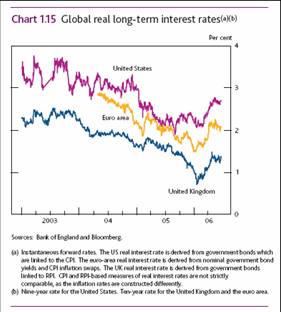

The use of the Feldstein-Horioka regression coefficient of capital mobility is, of course, subject to debate. Hence, let me discuss another definition of capital mobility — that long term real interest rates are equalized. This is related to the (admittedly old-fashioned) approach of thinking about perfect capital account mobility as being characterized by equality of marginal productivity of capital across borders. A picture from the Bank of England’s July Financial Stability Report is not kind to the proposition that real interest rates (here drawn from inflation indexed securities) are equalized.

Chart 1.15: from Bank of England, Financial Stability Report, July 2006.

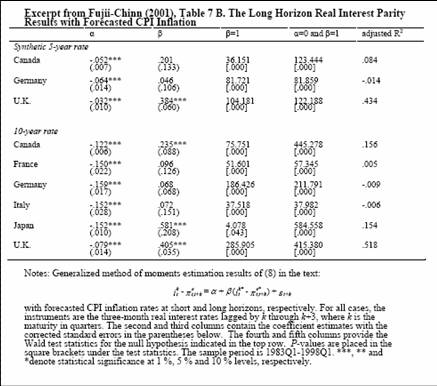

Econometric work, conducted with Eiji Fujii, does not support the view that long term real interest rates are equalized across countries (although the evidence is better at long horizons than at short).

Excerpt from Table 7.B from E. Fujii and M. Chinn,”Fin de Siecle Real Interest Parity,” Journal of International Financial Markets, Institutions and Money 11(3-4) (September 2001).

The beta coefficients are typically less than unity, sometimes statistically significantly so. (There are several tables in the paper; this one uses ARIMA forecasted PPI inflation, since this maximizes the use of recent observations, and PPI’s cover more tradable prices than CPI’s.)

Bottom line. I understand why many models assume perfect capital mobility. Imperfect capital mobility is hard to model. But one should be cognizant of how the model conclusions will change as one reduces the scope of adjustment along this dimension. In the context of, say, corporate taxation, a somewhat greater share of the tax burden will be borne by owners of domestic capital than what is implied under a perfect capital mobility assumption. (I have to say, since I spend about a third of my time in seminars seeing newly minted or about to be minted PhD’s in macro introducing frictions into otherwise perfectly integrated capital markets, I gotta wonder …).

This is why the the recent CBO report on the burden of corporate taxes notes the following:

As capital mobility is reduced [so that it is only perfectly mobile between developed economies], domestic labor’s share of the corporate burden becomes smaller and domestic capital’s share of the burden becomes larger. For example, when the domestic economy is increased from 30 percent of the world economy to 70 percent of the

world economy, domestic labor’s share falls from 73.7 percent to 32.5 percent (Table 8). Domestic capital’s share of the burden increases from 32.5 percent to 72.7 percent.

Technorati Tags: capital mobility,

real interest rate,

Martin Feldstin,

Charles Horioka.

What is capital mobility?

In the first paragraph, we assume that it is capital investment, i.e., FDI flows into developing countries to leverage cheap labor, taxes, and the environment.

By the time we get to the fifth paragraph, it is Chinas purchasing of t-bills, the consequence of FDI to China and the result of private entities seeking advantage.

While both are in a sense flows of capital, they are profoundly different in nature. One is an investment that has reaped substantial profits; the other is a purchase of an instrument of debt that at some point must be repaid.

Concerning the Randolph CBO paper, I have some questions concerning the model:

1. Capital owners can own capital in either country, but cannot themselves relocate abroad. Does mean they, as persons, cannot move abroad? Or does it mean that their businesses cannot relocate abroad? I assume the former.

2. Can Country X offer tax incentives to Country Ys corporations so that they will relocate to Country X? I assume yes.

3. If profits are high and if there is a hike in capital cost, might not capital be willing to absorb that hike instead of passing it on to labor (for any number of reasons)? In short, are we missing an assumption, i.e., that profitability must be keep within accepted margins? These margins should be explicit within the study. Conversely, lower capital costs need not lead to increase wages, especially if there not full employment.

4. Does the model assume full employment in both countries?

If you want to understand how mobile capital can be in response to tax policy take a look at Bermuda, Cayman and Ireland.

Cayman has more banks than it has citizens – the deposits are from other countries. Bermuda is a major financial center as respects insurance and reinsurance – none of their business is from Bermuda. Ireland has attracted a flood of new corporations who run their revenues through that country to pay less income tax in the EU.

All of these countries are enjoying business activity, profits and employment at the expense of other countries who have high corporate income tax rates. The capital has moved to a lower cost environment.

As it stands now, foreign corporations can sell their goods in the US with a cost advantage achieved by not paying US income tax.

If we taxed corporations based on their US revenues there would be no tax advantage to operating from outside of the US.

This would increase US employment and expand the US tax base.

Zephyr,

Agree totally. You’ve hit one of my favorite themes.

In terms of China, foreign businesses are taxed at half the rate of indigenous firms; in some cases, no taxation for ten years, if they promise to stay.

Stormy: Indeed, my point is that there are many different definitions of capital mobility, and hence there are multiple approaches to measuring it. Actually, the first definition I cited (Feldstein-Horioka) is not related necessarily to only FDI. What is true (if you refer to the Frankel article I linked to) is that the Feldstein-Horioka criterion requires a lot more assumptions than real interest parity, and real interest parity correspondingly requires more assumptions than, say, interest rate parity [pdf]. My main point is that by these two definitions, capital mobility is less than perfect. And even using interest rate parity, it’s not clear.

Regarding the CBO study, I’ll let paper speak for itself, rather than me characterizing it (much safer that way).

On your last comment, I highly recommend to you Ed Leamer’s discussion [pdf] of Friedman’s book.

Zephyr: I have no doubt headquarters can move so as to avoid taxes. But the actual capital does not then work in the Cayman Islands; rather it is intermediated to someplace where equities or debt instruments or a factory are purchased.

Your second point, regarding foreign firms selling in the US without having to pay income taxes, is what spurred the establishment of the Foreign Sales Corporation (FSC), which was ruled illegal by the WTO. There is currently underway legislation to implement a WTO-compatible tax regime that levels the playing field.

Menzie,

Thanks for the link to Leamer.

You know, of course, I disagree with many of Leamer’s conclusions concerning globalization. It is how globlationization is being conducted, not that it is, with all due deference to Leamer’s hill/Japan analogy. Wealth is not being shared.

But truth and history will “out,” as they say, regardless of what I or Leamer say about its future course.

I just have to address Leamer’s final comment with some observations of my own:

“We send our children to good private schools and then on to UCLA. The rest is up to them.”

Well, well, wellprivate schools, huh? And which part of the hill do you live on, Leamer? Yes, Menzie, I am aware how Leamer would respond to my thrust, although you have to admit it does have a cutting edge to it.

Now, I know hmmmm quite a bit about private schools, far more than Leamer or Friedman or most people who would enter this blog.

Let me share with you a small trend happening at one of the more prestigious private schools in CT. This particular area of CT lies well within its wealth belt.

Total annual giving is trending upward, year after year.

Ironically, the number of givers is growing ever fewer.

Strange, but not strange. The director of admissions is seriously concerned about the future of the school; fewer and fewer can afford it. Applications are fewer and fewer each year.

Again, I am aware of how Leamer would respond, but I wish he and his children well. Chuckle.

“him and his children well”! Laughter.

STANDING ON THE SHOULDERS OF MEN IN DITCHES;

VERY DEEP DITCHES

Menzie Chinn at Econobrowser: “I understand why many models assume perfect capital mobility. Imperfect capital mobility is hard to model.”…

“The issue of international capital mobility comes up time and time again. There is the worry of capital and associated production capacity moving abroad to China for lower wage rates, and if not to China, to the rest of the world ***to escape environmental regulations or to avoid corporate taxation.***”

Absence of regulations presents its own problems, for example, protection of the intellectual property of a company making FDI

Minzie,

The issue is not credits and incentives to help US exporters – it is the tax advantage enjoyed by foreign companies who sell into the the US economy, undercutting US domestic companies in their own market.

The capital does indeed get invested back, but the owners being foreign no longer pay much US income tax. This gives them a cost advantage over US tax paying companies.

The paper is really excellent, quite clear and touching. Would you please consider sending me more papers.