What to make of the newest inversion?

Usually, I leave interpretation of the yield curve to my co-blogger Jim Hamilton, who is the real expert (see also this recent post), but as I prepared for the new semester’s course in Money and Banking, I generated a picture that I could not resist posting. Here is the 10 year (constant maturity) minus 3 month (secondary market) spread over the past three decades, with NBER recession dates in gray shading.

Figure 1: Ten year-three month spread, in percentage points, monthly average of daily data (blue line), and spread as of 8/16 (red square). NBER recession dates shaded gray. Source: St. Louis FRED II, NBER, and author’s calculations.

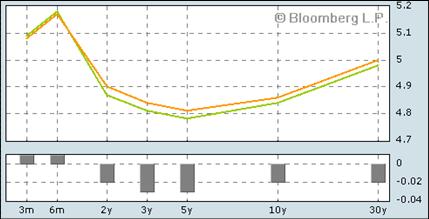

A snapshot of the entire maturity spectrum on 8/18 (green) and 8/17 (orange) is provided by Bloomberg.

Figure 2: Yield curve. Source: Bloomberg, accessed on 8/19.

Entering the data from Bloomberg for 8/18 into the Wright (2006) formula calculator at Political Calculations yields a probability-of-recession estimate of 44.3% (Note: his formula incorporates the use of the Fed Funds rate as well as the spread illustrated in Figure 1). Of course, this calculation is based on historical correlations, which might, or might not, be relevant to today’s situation (remember the “conundrum”).

Technorati Tags: recession,

yield curve.

A Fed paper on the yield curve I liked this year is Wright’s own at http://www.federalreserve.gov/pubs/feds/2006/200607/index.html

Worth a skim if you missed it.

Thanks. That was the first of the two links provided (one to Wright’s paper, the second to the calculator). I’ve now reformatted the line to make it obvious there are two links.

This inversion has a unique characteristic: The 10 year is being depressed by Asian central banks & recycled oil profits.

In other words, as the Fed attempts to reduce liquidity on the short-end, foreigners are supplying it–cheaply, in my view–on the long-end. I predict the recession will require at least another rate hike & be delayed somewhat as a result.

algernon…spot on….The Yen carry trade is still in effect. Since the world is so small now, the FED is fighting the influx of cheap capital from abroad and they can’t really stop it until the recession comes and winds down investment here temporarily. Oil is only going up from last year and won’t stop until half of the world can’t buy it, then we’ll stop and ask what happened? Interesting times lie ahead.

Hi Menzie:

I hope all is well and please say hello to Dr. Hamilton and give him my best.

In my view, there is a great deal of information in the current government spreads.

First, a lot of demand is taking place at the 5-year note as that yield continues to get driven down. My interpretation is that the Fed will be cutting the Federal Funds rate due to slower than expected economic growth and its aim to avert potential deflationary pressures from entering the US economy.

Second, there is a great deal of geopolitical uncertainty at present and a global flight to quality for the US$ and in turn Treasury notes and bonds is underway driving up prices and yields down. Global macro risk aversion is underway at present.

Third, there remains a great deal of speculation in oil prices and gold as well conditional upon the Middle east remaining uncertain for the foreseeable future. It is my expectation that a drop in aggregate demand in the US economy will trigger a drop in the same globally into 2007 and bond prices are simply anticipating this at present with the current inversion at the short end of the curve. Lower oil prices are also expected to reduce uncertainty in the Middle east.

Finally, and most interesting, remains the two macro statistical facts that higher oil prices and rapid increases in short-term lending rates have preceded essentially all post WW2 US recessions while many forecasts remained complacent or too optimistic. With housing activity expected to continue to slide and its potential negative impact on consumer spending, it remains very reasonable that the future worries of the Fed and financial markets will not be slowing potential inflation growth and/or expectations, but instead maintaining consumer and investor confidence to avert an unexpected shock to financial markets that is rooted in the developing macros at present….