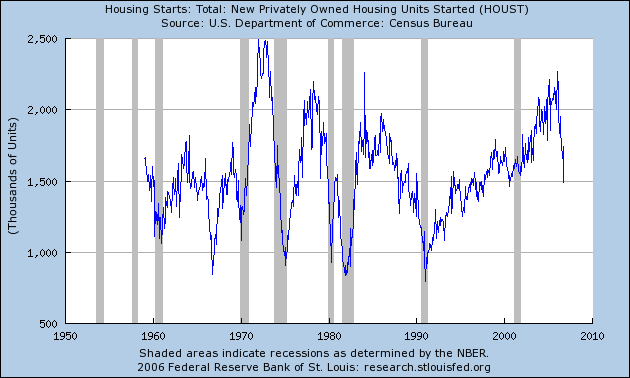

Much worse numbers for housing than I was expecting were announced today by the Census Bureau.

Housing starts, which had been up an encouraging 4.9% during the month of September, surrendered those gains and a great deal more with a 14.6% drop in October. That puts them down 27% from October 2005.

|

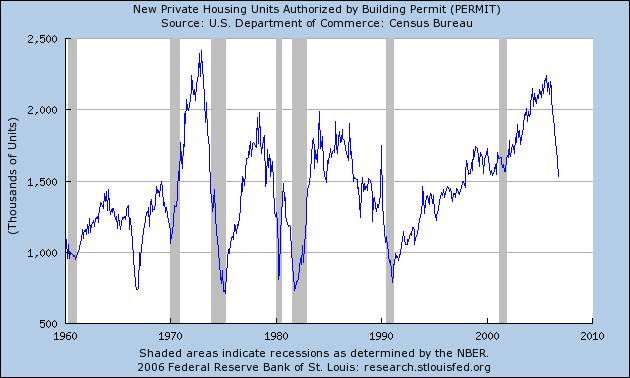

Building permits for privately-owned housing units continued their free fall, down 6.3% for the month and 28% year to year.

|

Not exactly the stabilization I’d called for.

The one encouraging bit of news for the week has been a slight decrease in builder pessimism, though I wouldn’t read too much into that.

I’ll be watching the home sales data coming out at the end of this month with renewed concern.

Technorati Tags: macroeconomics,

housing

It is good to express concern in any case.

WSJ econopundits, on the other hand, seem to think it is no big deal–a good omen even.

With every measure of inventory high compared to just about any point in the past decade, some measures high for any period, stabilization doesn’t seem all that likely to me. Margins are also looking pretty unattractive. Think what you can read in the press about price cuts and other blandishments to attract buyers. With lower margins, there is less reason to build, and less reason to take risk.

The winter months, because they involve smaller numbers, are volatile. They may show a few good months simply because of noise, but you have to worry about the high season for starts next spring.

I have read some analysis that suggests bad weather in the south may have been a factor. If so, we could get a bounce in the November starts figures.

And you wondered why we gave you hell when you considered housing might hit a soft landing 😉

charts, cannon loaded, waiting for some Pythonesque “Mere flesh wound” from James, was forced to wait until next month…

So, what’s with the vacancy figures?

Honestly, they puzzle me, but until they turn I do not see residential housing stabilizing unless you know an explanation that doesn’t involve overbuilding.

less housing starts = higher prices for existing homes…Go low housing starts! (from my selfish perspective as a homeowner.

This is not unexpected. I think all economists’ analysis has been so shallow it is bound to give more gotchas to that other even more shallow group that disses the economists, not that the economsts don’t need a bit of out behind the woodshed straightening out on this one.

First of all, any even half-way cogent analysis of the housing market has to include a general feel for the value of housing in the U.S.

Housing has declined precipitously in real value because of rising property taxes. A home simply isn’t worth as much as it was when its property taxes were half what they are today, and that was generall three to four years ago. Property taxes are on the march. I’ve yet to see a single econmist point out this crucial factor in evaluating the real worth of the U.S. housing stock. Why? Because we commonly suffer from the delusion of the Dictatorship of the Marketplace.

Lest we forget what Lincoln added to our knowledge about those who determine what the marketplace will bear, You can fool most of the people some of the time. That’s what we saw in the dot-com bust. That’s what we’re seeing in the housing bust.

A lot of people got fooled about the real value of housing. Look. No one should doubt, it is entirely possible that property taxes can rise so high, you’ll have to pay me to take it, move in and pay the property taxes every year. At some point, it’s not even going to be worth that much.

The other shortcoming I see in the analysis of the housing market is, Who owns real estate?

Where are the crucial reports and analysis of who are all the prospective sellers that might be coming into the marketplace in the coming months?

This is yet another glaring example of the sort of academic arrogance that is commonly associated with economic forecasting.

I think the reason for this is that economists aren’t people who generally have ever run a business. They’re not practical. And, they don’t listen. They read what other economists write. Well, hear me.

Just from gut instinct, I, like others, and even a few economists, note the growth of worthless loans given to people who simply did not qualify for them in the past few years. But, because that little bit of shady business is a known, known, what no one has pointed out is going to come into the marketplace with a tsunami shock.

A large percentage of the housing stock in this country is still owned by the parents of the baby boomers. Their parents all in their 80s and up. All of that housing stock is coming on the market regardless and at an exponentially growing rate. Damn! Look around at your neighbors! How old are they? Is that so hard to see?

These oldsters are simply dying off, and generally they can either no longer afford to live in their homes, or, their homes no longer fit their ability to live in them because they’ve become so hobbled or enfeebled with old age.

So. That’s the spit on the housing industry.

I’ve been saying it for a long time, so long, I’ve grown tired saying it.

I also sold my home over a year ago, and I rent now. The interest I get on the CASH more than pays my rent, so I’m going forward. I see lots of people going backward because they made an unwise lifestyle choice, not an investment.

Here’s something more for your already infuriated bonnet:

I’m fifty-six. I expect to see $30 oil again in my lifetime. That’s all oil is worth. You just watch. The imbalance at $50-60 dollar oil would require huge inflation to offset, and that won’t happen because it just doesn’t serve anyone’s interest over the long run, not the banks, and not the oil producers who have money in the banks.

And, as for the great hysteria about the U.S. dollar? These Second Coming doomsayers are so common in American economic history, I’m amazed at the way every economist has jumped on the Chicken Little bandwagon again this time. The sky is falling! The sky is falling!

Give me a break. The world’s appetite for the dollar will never end. There is no other currency that is seen as the economic life-raft of the world. You simply can spend a dollar anywhere in the world.

Yes, some people in the U.S. in the coming months and years because of unwise lifestyle choices and huge debt loads are really going to be hurting, because the fed isn’t going to let inflation away even if Ben (Lincoln’s McClellan) Bernecke has to be fired and U.S. Grant has to be found, it’ll not happen. But the U.S. dollar grows even more stong with every new dollar that is overseas in some foreign government’s reserve. That’s their safety net. It’s why they sell their wares here as cheap as they have to sell them.

The strength of an economy is determined by how much currency it can float without causing inflation. The small amount of currency sitting in China, and it is small when we look at the amount it adds up to per capita in China, only makes the dollar stronger, and that by exactly the same amount it makes the Chinese stronger.

Best! But, don’t trash the place. Someone else is coming in here after you and I leave, and I don’t see why they should have to deal with your mess.

Don Robertson, The American Philosopher

Limestone, Maine

An Illustrated Philosophy Primer for Young Readers

Precious Life – Empirical Knowledge

The Grand Unifying Theory & The Theory of Time

http://www.geocities.com/donaldwrobertson/index.html

Wow, Don – your website is the kookiest thing I’ve ever seen. Have you been introduced to Time Cube theory? (www.timecube.com)

calmo: lol

new: way too simple an analysis. when housing starts drop off as quickly as they have, it’s typically indicitave of a recession. (see: fed chart). a recession is awful for housing prices. next year you have even more ARMs resetting, so that doesn’t bode well for supply. it may take a very long time for the current decrease in housing starts to trigger an increase in housing prices.

JDH,

Thank you for admitting your call was off!

I always found that call weird, considering it has been in no small part the analysis here at this very blog which has lead to me believe the downturn will be severe and long-lived and create or exacerbate a severe economy-wide recession.

Don Robertson:

Give me a break. The world’s appetite for the dollar will never end. There is no other currency that is seen as the economic life-raft of the world. You simply can spend a dollar anywhere in the world.

Wow, are you really a philosopher? Must not be a very good one, given that cheesy “things are this way now and therefore they will always be this way” fallacy.

Hmmm. I think we just found another soul who took a tad too much of the brown acid at Woodstock. “‘scuse me, while I kiss the sky.”

About that housing market: I continue to vote for mucho downside, no upside. Caveat emptor.

One thing that is being over looked by many is how much of a catalyst the Subprime borrower will be in the down turn. One major source of concern is the amount of risk layered by the Subprime lenders and borrowers that is gradually being discovered. This can be seen by the reported on securitized subprime loans…Looking at loan level data one can see serious credit deterioration.

Given the CDO demand and innovation in Credit Derivative technology linked to housing, the housing down turn could have serious global implications.

I think this layered risk could be the catalyst that will accelerate the credit crunch and bring about the collapse in housing. This could be a classic Minskyan credit crunch. As lenders and particularly subprime lenders panic and lend only to those who dont need the lending, liquidity in housing will dry up significantly. The lender panic is clearly on its way, for instance the well know subprime mortgage lender Option One Mortgage, is facing larger than expected losses from defaults on subprime mortgages and its parent company H&R Block has hired Goldman Sachs to help dump the one time extremely profitable king of subprime lending.

Aaron Krowne-

As I suspect your criticism is sincere, wholly disbelieving anyone could make a prediction as I made about the dollar in light of the wind (hot air) blowing so hard in the other direction.

The worldwide trust in the dollar should be looked at historically, not hysterically as has been the commmon trend throughout much of American economic history. Trust in the dollar as the specie of general preference for its strength can be likened to humankind’s belief that gold is a precious metal worthy of a similar belief, a belief even more persistent than the belief in the dollar.

I’ve admitted there are some downsides in the credit markets for those who have taken on more debt than they can justify, but that doesn’t include the U.S. government. Those who are at financial risk are generally those individuals who have not considered that the world’s economy has ups and down, and that their personal financial condition is likely to change from day to day, month to month, from year to year and from decade to decade. Taking on personal debt over a span of decades based upon equity that is at a current peak, as is housing, was simply a dumb move on the part of those who are today beginning to see their signature on the loan contract as equivalent to indentured servitude for which there is significant risk that no matter how long they hang on, they still could wake up the next morning, and find they worked, and worked, toiled and labored to keep up with the payments, only to find the bank, or in some cases even the town or city has seized their entire work product for non-payment of the current payment.

But again, the dollar is strong.

It will remain strong as long as there is confidence in it worldwide. Confidence can be shaken intermittantly by hype in the financial columns, but there are those who have made massive fortunes buying dollars when some fool decides he’s going to dump his based upon what these common Katie Couric wannabees report.

Confidence worldwide will remain as long as there is no other feasible and reasonable alternative.

Now, I see no other alternative. The Euro is based in a land where sixty years ago the whole continent was engaged in a futile and destructive war, and others a couple of decades before that right back through into the Middle Ages when the Black Plague gave them a forty year respite from war. China is no bastion of security in recent historical terms, and neither is Japan, or any other country with circulation enough in their national currency to take up the dollar’s place.

Physically, it’s almost as if these economists who are spelling the end of the dollar are proclaiming the world is going to stop breathing air. It can’t happen. And no one will win even if it could be made to happen.

If you read between the lines of those economists who are spelling doom, they somehow seem to be saying the dollar will fall against other currencies, just as if there is some safe haven with the broad width and capacity to supplant the dollar, which they proclaim like Chicken Little, will go to Zero! But I don’t see it. There was for a while this idea that gold was the only safe place, but that is not only hysterically unrealistic, and foolhardy, it has proven to be the downfall of many who took futures positions in that dubious metal specious future.

I’m not one who is afraid of sounding like a kook, and there’s been plenty of history of that. But, I remember in the very early Seventies having my anthropology professor tell the class, “The Japanese economy is much bigger than that of the U.S. today.” This bit of ridiculous misinformation he gleaned from the common press, no doubt the wise words of some ne’er-do-well economist then, press about how Japan was overtaking the U.S. economy.

Well, it wasn’t happening, it didn’t happen, all this despite it being widely believed that it already happened. And, it won’t happen with China or the E.U. either.

I won’t ask it of you because you seem reasonable enough, if temporarily caught up in the common mass hysteria about the dollar, but, the Second Coming doomsayers usually put a due date to their prescription for the apacolypse riding into town.

Keep in mind, to settle your fears, the day might be predicted to happen, it spells the end of economy for the entire world, not just the U.S.

Best!

Don Robertson, The American Philosopher

Limestone, Maine

An Illustrated Philosophy Primer for Young Readers

Precious Life – Empirical Knowledge

The Grand Unifying Theory & The Theory of Time

http://www.geocities.com/donaldwrobertson/index.html

Hey Aaron. Don’t knock the brown acid unitl you’ve tried it.

Don, please try to limit your contributions to one or two paragraphs. In the future, we may have to edit these for length.

JDH-

How’s this?

Good by!

Don, at risk of being villified by others here, I think you may turn out to be correct. We will see in time.

Don:

While my initial criticism was just towards your logical fallacy, I will say the following about the fate of the dollar.

The EU economy is already larger than the US economy.

Drug dealers moving to Euros is bad news for the dollar. Thesis: the black market always does what is smarter, sooner, in international finance. The politicos will inevitably follow, albeit, perhaps late (much later than they should).

There really was no alternative to the dollar until the Euro. And there will be more alternatives even to this, soon enough (witness the discussion on the Asian or Arab [oil] currency units).

That the US retained its global reserve monopoly after Vietnam and the 70s/80s inflation was less due to anything inherent to the US and more due to the lack of alternatives and pressure from the Soviet bloc.

Neither holds anymore; and no one is buying the faux equivalence between the Soviet bloc and the “terrorism bloc”.

To put today’s housing starts in context requires a perception of what the underlying demand for houses is. Household formation will like average around 1.5 m (although partially income growth dependent) over the next decade. All the rest of demand is second home, investment, stock knockdown, and adjusted for mobile homes. In my view not enough work is done on the drivers of those factors.

Such an odd term David, and I could look for a technical definition with a few clicks but I need to hear your expansion:

as opposed to ‘New houses’, or to ‘non-rental housing’ or ‘new houses less condo rental conversions’ or ‘consenting adults under 1 roof’ or ?

“What is Household Formation?”

http://www.usc.edu/schools/sppd/futures/presentation/fannieHousehold.pdf

Would a housing “crunch” also include a reduction in imagined versus real wealth? I understand the now-infamous-Don’s comment on the effect of taxes on local property values and consumer discretionary although I, too, disagree with him on the Almighty Dollar.

So I’m stuck wondering if I should, “git while the gittin’s good,” or, “ride that bucking bull.”

New Housing Starrts? Way Down

Building Permits Granted? Way Down

James Hamilton presents the data at Econobrowser.

Here are some observations that I’ve made as a real estate investor over the last 20 years:

Housing Real estate prices goes up and down relatively independent of “Housing Needs” (= the combined needs of rental units, condos and single family owner occupied housing).

If times are good and/or interest rates are low, then more renters try to buy. If “cost of housing” exceeds about 40% of available income then fewer buyers materialize.

It’s the “supply and demand” ratio of buyers/seller rather than the ratio of families to housing that set the prices.

In that sense the New Housing Starts and New Household Formation is relatively unimportant for real estate prices (other than in the margin).

Unless we have massive unemployment people have to live somewhere, but when cost goes up, folks turn to renting rather than living under a bridge or moving out of the area. They are, however, willing to commute longer distances.

Interest rate and incomes are the two drivers of price. If R= interest rate, S= salary/income and P = price then I’ve observed a relation ship like this: P = k(S/R) (where k = some scaling constant)

This holds true for shorter duration, so long as there isn’t a significant change in the Household to available housing stock ratio (could be altered by building housing or migration into or out of the area)

Professor, has there been any rigorous mathematical analysis of this to your knowledge?

Bellanson

Bellanson, you might find this article by Richard Rosen of the Chicago Fed of interest.

“If times are good and/or interest rates are low, then more renters try to buy. If “cost of housing” exceeds about 40% of available income then fewer buyers materialize.”

That analysis works as long as you’re careful to remember that the total number of properties OWNED has to stay the same – i.e. every property rented by a renter still has an owner. So if fewer renters buy, that usually means more properties-per-owner; not fewer properties-owned.

M1EK said:

“That analysis works as long as you’re careful to remember that the total number of properties OWNED has to stay the same…?

Quite correct, and also not important for the price, since every item (not just houses) bought must have a seller. I maintain that it’s the ratio of sellers to buyers that sets the prices (rather than households to housing stock)

What’s strange with the real estate market, is that in most market, the land-lord subsidizes the renters. This is because because typically the owner expects appreciation of the property to more than compensate him. E.g. here in California a single family house might cost 800,000 dollars but rent for 2000 per month. Just the interest on those 800K will come to 48,000/year at 6% interest -> 4000/month. That amounts to a negative 2000/month, and that’s before property taxes and insurance and …..

However, if that house appreciated by 10% that would amount to 80K. Lately appreciation has exceeded 10% routinely – that’s why land lords are willing to buy, and rent out, houses. [It’s also important to remember that rents go up each year, but the purchase price, remains fixed] so after a number of years you WILL see positive cash flow.

The point I’m trying to make is that prices are set by interest rate (and income), since said land lord is willing to subsidize his renter to the tune of $40K per year. This means that if interest rates were half (3%) he could have paid a lot more than 800K, and still have an attractive investment.

It’s worth noting that because of this relationship low interest rates leads to rising prices, which leads to an increased availability of rental housing leading to stagnant rents.

Sure enough, right now we do see falling, or stagnant real estate prices, but rising rental rates, at least here in Silicon Valley.

If, on the other hand, peoples ability to pay is reduced, such as during a recession, then both real estate prices and rents decrease.

As a landlord myself, it’s not necessarily that I expect the property to appreciate (it has, but I haven’t counted on it); but that rather, as time goes on, the balance of (rent minus interest and other costs) moves in a beneficial direction for me.

Even on a strict cash-flow basis (i.e. counting principal payments), it seems to me that rents more dependably rise gradually (with inflation) than do sales prices (seems like there are fewer factors competing to raise or lower rents than with home prices).