Two recent publications should help put to rest the conjecture that there are vast pools of U.S. wealth lying overseas, ready to save the day.

In one paper written by NY Fed economists Matthew Higgins, Thomas Klitgaard, and Cedric Tille, the authors conclude:

Sustained large U.S. current account deficits have led economists and policymakers to question whether future current account adjustment will occur smoothly or via a sudden and disruptive deprecation of the dollar and contraction in U.S. consumption. The stability of U.S. net external liabilities despite ongoing current account deficits cast some doubt on these concerns. So, too, do the minimal net income payments the United States makes on its large net liabilities. We show that the stability of the external position reflects sizable capital gains due to strong foreign equity markets and a weaker dollar, both of which could be reversed in the future. We also show that minimal U.S. net income payments reflect a much higher measure rate of return on U.S. FDI assets than on U.S. FDI liabilities. On present trends, however, ongoing borrowing is overwhelming this favorable rate of return, pushing the U.S. net income balance more deeply into deficit. We also review the argument that the United States holds large amounts of intangible assets not captured in the data, leaving the true U.S. net investment position close to balance. We argue that intangible capital, while a relevant dimension of economic analysis, is unlikely to be substantial enough to alter the U.S. net liability position.

In other words, just because things have gone well thus far does not mean they will continue to do so. How do they explain the simultaneous existence of a large negative net international position for the U.S., and near zero net income?

A closer look at the data reveals that the U.S. rate of return advantage lies entirely in FDI (Chart 5). Indeed, the rate of return on U.S. FDI assets abroad came to 8.0 percent during the first half of 2006 (top panel, solid line), vs. a rate of return on foreign FDI assets in the U.S. of just 5.1 percent (dotted line). A persistent U.S. earnings advantage is also evident in earlier years. In contrast, rates of return on other U.S. international assets and liabilities (bottom panel) were about the same during the first half of 2006, a pattern that has held historically.

:

…One point, though, should be clear. How U.S. foreign assets are valued has no implications for the income flows associated with them. If we conclude that U.S. FDI assets are “really” worth $6 trillion rather than the reported $3.5 trillion, we must also conclude that the rate of return on U.S. FDI has “really” been 4.7 percent rather than 8.0 percent. The same point holds for future FDI investments and income flows. If we believe that DubaiDisney, although requiring an initial investment of only $1 billion, actually generates a business line worth $2 billion, than it may make sense to value it at $2 billion. But future income receipts will be the same; the measured rate of return on Dubai Disney will simply be half as high as if it had been valued it at $1 billion.

Since the dark matter hypothesis sheds no light on current or future investment income flows, it has no substantive implications for the evolution of U.S. and global imbalances. Only asset reappraisals actually due to changes in expected future income receipts would carry such implications. Nor can the United States count on further leveraging its FDI position to keep large, ongoing current account deficits from translating into a deteriorating net income balance.

(This paper is not yet on the web, but an older, related version is here). [Addition on 12/12: Paper posted here]

A second paper (Statistical Issues Related to Global Economic Imbalances: Perspectives on “Dark Matter”) more directly discusses the Hausman-Sturzennegger (HS) conjecture. Ralph Kozlow at the Bureau of Economic Analysis (BEA) dissects the arguments HS make, and concludes that they have drastically mis-interpreted the way in which BEA calculates U.S. holdings of foreign assets, and foreign holdings of U.S. assets.

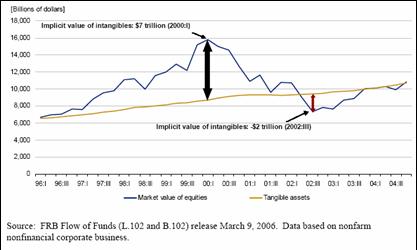

It has been our experience that inferring the market value of intangible assets from related data sets can lead to large swings and distortions. For example, during the U.S. stock market run-up in the late 1990s, some analysts said that the large difference between the stock market value of U.S. corporations and the replacement value of their tangible assets was the implied value of the intellectual property and other intangible assets held by those corporations. However, when the implicit value of these intangibles fell from +$7 trillion to -$2 trillion in less than 3 years, this technique was shown to be flawed:

Technorati Tags: balance of payments,

dark matter,

net income,

interest rates

Very helpful, Professor. I’m in the ‘foreboding’ camp — I’ve tracked the corollary, direct foreign investment in the U.S. over time, wondering when the floor would fall out — and this paper, for me, sheds some light on that issue. Thanks much!

This whole “dark matter” schtick has become a running gag, especially for knowledgeable international economists like Dr. Chinn. As economists always like to remind us, there ain’t no such thing as a free lunch. They can take their dark matter and…(edited, Econbrowser is a family-oriented website 🙂

Menzie

The concept that a swing in the relationship between asset value and income is not a demonstration of a “flawed” concept. Generally, business valuations must consider income, perceived security, and perceived growth rates. The swing in value of the bubble stocks of the late 90’s is probably attributable to the realization that the growth rate that had previously been assumed was wildly overstated, and when one realizes that there is an overstatement of value, then the perceived security vanishes.

If we assume that value is the product of the present value of the sum of future cash flows, the valuation assuming a 10%, or 20% annual growth is dramatically higher than a no-growth assumption. This is (or should be) the basis of a difference between a 6X or 35X price/earnings ratio.

We often encounter cases where the value of the future cash flows is less than the liquidation value, and/or replacement value of the assets. Real estate, especially agricultural land, is a frequent illustration of this issue. There is a sense of security that land values will always increase because they aren’t making any more of it, and you compound this with the attractiveness of owning your own private ranch or farm, and the result is agricultural properties that often yield in the 1% to 2% range.

Measuring value by the single factor of current cash flows is flawed. However, the assumption that a negative value of intangibles is an illustration of the flaw is inappropriate.

Bill

“edited..Econobrowser is a family oriented website” Yeah I’m sure there are flocks of 9 yo’s who come here to read up on the latest in acedemic finance and how it affects public policy. Every 4th grader has Nick.com, cartoonnetwork.com and econobrowser all bookmarked.

Good work Menzie,

The Federal Budget Deficit widened to $49B from 47.3B a year ago and Interest payments on the national debt increased by 18.6% to $22.3B in October.

There is no sidelined dark matter coming to the rescue.

However, our corporate overseas profits, cycled through foreign holding companies and individuals will continue to be repatriated to buy US bonds and hold rates down while supporting the dollar.

Anything else will result in a global economic disaster of epic proportions.

I thought our FDI had started to pay off in terms of exports to foreign countries on a relative basis, especially in emerging markets..

Once GDP per capita gets high enough foreign domestic consumption drives US exports??

Great site..