China raises rates again. What will higher rates do?

From Bloomberg:

China Cools Investment, Fails to Tame Trade Surplus (Update1)

By Nipa Piboontanasawat

March 19 (Bloomberg) — China, which raised interest rates for a third time in 11 months this weekend, is discovering that solving one of its two main economic problems makes the other one worse.

The interest rate increases and other measures are cooling investment in factories, real estate and other fixed assets, allowing Premier Wen Jiabao to claim partial victory in a fight against wasteful spending. At the same time, the trade surplus — which has pumped cash into the economy, fueling inflation and asset bubbles — is ballooning.

The People’s Bank of China raised interest rates to the highest in almost eight years on March 17. By curbing investment, Wen has reduced demand for imported steel and cement for factories, exacerbating the trade imbalance and straining ties with the U.S.

“It’s difficult to reduce both investment and the trade surplus,” said Huang Yiping, chief Asia economist at Citigroup Inc. in Hong Kong. “You can do one but you’ll see a rebound in the other.”

Wen is concerned that building too many factories will leave the world’s fastest-growing major economy vulnerable in a slowdown. The central bank has increased the amount of money lenders must set aside as reserves five times in eight months, sold bills to soak up cash, and restricted property investment.

See also coverage here: FT, WSJ, and Macroblog.

Interestingly, the increase in the nominal interest rate is only offsetting, to a certain degree, accelerating inflation. This point is made in Figure 1.

Figure 1: Nominal (blue) and real one year lending rates (green). Real rates calculated by subtracting off lagged one year CPI inflation rates (quarterly averages of monthly year-on-year inflation rates). Source: IMF, International Financial Statistics, and author’s calculations.

I find it interesting to think about this issue in the context of the Mundell-Fleming model with low capital mobility. “Low capital mobility” is modeled as a small value for the parameter linking capital flows to interest differentials vis a vis developed market economies. I’ll depict this characterization as a “BP=0 schedule” steeper than the LM curve.

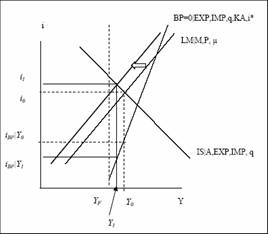

Figure 2: Tightening of monetary policy.

Just to review, this is an demand side model, with prices assumed fixed (or sticky) for the period of analysis. The IS curve summarizes the relationship between interest rates and income for which income equals aggregate demand, for a given level of autonomous spending and real exchange rate. The LM curves summarizes the combinations of interest rates and incomes for which a given money supply equals money demand. The BP=0 curve includes all combinations of interest rates and income for which the current account and private capital account sum to zero, for a given real exchange rate. YFE is full employment output. As drawn, under quasi-pegged exchange rates, the country experiences a substantial balance of payments surplus; the LM is held in place by sterilization of reserve accumulation through the sales of monetary stabilization bonds.

The increase in the domestic interest rate (and the imposition of restrictive administrative measures) could be interpreted as a shift inward of the LM schedule. This leads to a reduced GDP at Y1 (or in dynamic terms, a slower growth rate), as desired by the authorities. But at the same time, the combination of reduced output and higher interest rates (now at i1) leads to an exacerbation of the external disequilibrium (a bigger balance of payments surplus, through an increase in the trade balance, and higher capital inflows), thereby illustrating Huang Yiping’s assertion.

As many observers have noted, a more rapid appreciation of Chinese yuan — as shown in Figure 3 — could accomplish both aims of slower growth and less external imbalance more efficaciously.

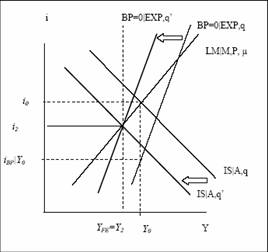

Figure 3: Accelerated real exchange rate appreciation.

A stronger yuan shifts up the BP=0 schedule and shifts in the IS schedule due to expenditure switching toward foreign goods (although the strength of this effect is subject to great uncertainty — see Marquez and Schindler, Thorbecke and Chinn). Output is reduced down to full employment levels, while equilibrium interest rates fall to i2.

This then poses an interesting question: Why is it the Chinese authorities choose this route? The exchange rate route leads to a larger investment expenditure share, and smaller export sector, while the monetary tightening route leads to a smaller investment share and larger export base. It therefore appears that they value the export sector more than domestic investment. To the extent that Chinese authorities are wary about the quality Chinese capital investment, this might make sense. However, to justify the current (costly) approach, Chinese investment must be very low productivity indeed (which may be true — see Dollar and Wei). Or alternatively a yuan’s worth of foreign demand might be perceived as inducing more employment than a yuan’s worth of domestic investment.

On the other hand, maybe Chinese authorities are coming around to the need for more drastic appreciation. From Daily News and Analysis:

HONG KONG: Economic policy circles in China and Hong Kong are abuzz with speculation that Chinese authorities are preparing for a one-off 10% appreciation of the renminbi later this year as a “shock treatment” procedure to rein in the country’s soaring trade surplus and beat back currency speculators.

…

“The intriguing possibility that the authorities might be preparing for a second renminbi revaluation in the 10% range is gaining traction in policy circles,” notes UBS chief Asia economist Jonathan Anderson.

How realistic, though?

“In the current environment, it’s a small but rising possibility,” notes Anderson. However, he acknowledges, this is an “unlikely scenario” – not only because there isn’t sufficient political support for such a large discrete move but also because it’s not clear that carrying out another revaluation would solve China’s trade problem or end the currency speculation. …

So perhaps we may still have to wait a while more for “rebalancing”.

Technorati Tags: China, renminbi, exchange rate, yuan, and Mundell-Fleming model.

Zhou just stated that in an interview that China will not accumulate reserves anymore. What could be the consequences of the recently announced BoC policy?

Does it mean yuan appreciation? USD term structure steppening? More consumption in China? More imports?

FX markets disruption? Closing Chinese financial markets borders? Higher interest rates in China?

Fantastic post, Dr. Chinn. I’m sorry I didn’t come across it sooner. That old IS-LM warhorse still has life in it.