Blame crude oil and the calendar.

|

Gasoline prices have been moving up quickly around the country over the last few months, putting us back up to the highs of last summer. If you’re feeling a sense of deja vu, yes, it’s true, something similar seems to happen every spring. There has always been a strong seasonal in gasoline prices, with prices highest in the summertime when demand for gasoline is highest. The blue line in the graph below shows what this seasonal looked like before 2000. The height of the graph for each week is the ratio of that week’s average U.S. retail gasoline price (data source: EIA) to the value it had been at the start of the third week in September of that year, with this ratio then averaged over 1994-1999 to summarize the average seasonal trajectory. In a typical year over this period, gas prices ended up the year about 5% higher than they started. However, this price increase was not monotonic, but instead started out as a 5% decline in gas prices through January. That 5% decline, which resulted from the end of the summer driving season, when combined with the 5% cumulative increase over the year, meant that in a typical year, retail gasoline prices would rise 10% between January and May.

With the introduction of reformulated gasoline requirements in 2000, the process of converting from winter to summer fuel blends has become more costly, and the seasonal is much more pronounced. As shown in the red line (the average seasonal over 2000-2005) above, gasoline prices in recent years have dropped about 15% between September and January, and therefore exhibited an even sharper subsequent rise between January and April. The current NYMEX futures price is betting on the same thing happening next year, as evidenced by the 15% price difference between the May 07 and Jan 08 NYH RBOB contracts.

It’s interesting to calculate what you’d predict would have happened so far this year if the seasonal from 2000-2005 had simply been repeated exactly for 2006-2007. That is shown in the dashed red line in the figure above (which just reproduces the red curve from the previous figure, scaled to the September 2006 price of $2.62/gallon). Also shown for comparison is the actual price (in blue). It appears that a good deal of what has happened this year is just following exactly along the recent seasonal.

|

Of course, another important factor is the price of crude oil. Although crude oil prices do not themselves display a clear seasonal, this year they happened to decline in the fall and resurge in the spring, reinforcing the usual seasonal pattern for gasoline prices. One rough guide is that a one dollar change in the price of a barrel of crude oil means 2 cents per gallon of gasoline at the pump. One can then get a crude measure (if you’ll forgive the pun) of the contribution of this effect by multiplying the change in the WTI price (data from EIA) since September 11, 2006 by 0.02, and adding this to the 2000-2005 seasonal. This calculation is reported in the red line in the graph below.

The combined contribution of the usual springtime run-up in gasoline prices plus the effects of higher crude oil prices would lead us to expect something like a 60 cents per gallon increase in the retail price of gasoline in the U.S. between January and April of 2007, close to what actually happened.

I used to regularly get phone calls about this time of year from reporters asking me why gasoline prices had gone up. My answer was always, “because crude oil prices are higher and it’s springtime.” I haven’t received any calls so far this year, though. Maybe reporters have finally figured out there’s nothing particularly surprising about the recent rise in gasoline prices. Either that, or they’ve figured out that if they call somebody else, they get a more exciting soundbite.

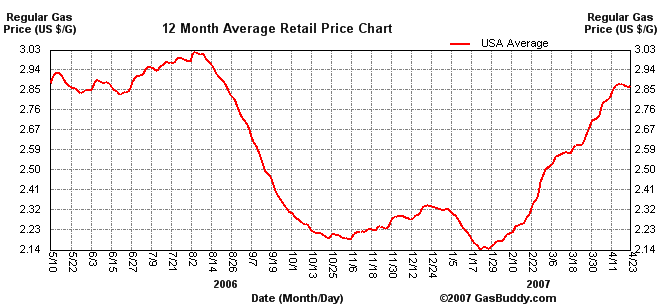

Via GasBuddy, here’s what gasoline prices in your area look like at the moment:

Technorati Tags: gas prices,

gasoline prices,

oil,

oil prices

So I wonder why some guy doesn’t load up his 10,000 gallon tanker truck, drive from Salt Lake City to Tahoe and make an easy $6000 for a day’s work? Can this be an efficient market?

odd. Does anybody know why Penn has higher prices compared to neighboring states?

I meant, NY. But never mind. Just realize why.

Joseph and earth, according to the API, you’d pay 8 cents more per gallon in tax in Nevada than in Utah and 10 cents more per gallon in New York than Pennsylvania. Don’t know whether regulations such as these ones in Nevada might also eat into your anticipated profits for your tanker truck drive. And don’t forget it takes some gas to drive that truck!

$3.50? Pfft.

Note what happens at the tail end of your seasonal-plus-crude predicted chart. It’s not that unleaded is up again that chafes me — it’s that it’s up twenty cents too much.

For those last two dimes, if you have it, I’d like the explanation.

Why Are Gasoline Prices So High?

James Hamilton has a good explanation. If you live in a place with above average gas prices, his map may give you a clue. Nutshell: overall gas prices are a product of normal seasonal fluctuation and the price of crude

wcw. the 20 cents in August (if that’s what you’re talking about) I think isn’t a seasonal, but reflects unusual factors like the 2005 hurricane that was big enough to skew the average. My summary of the “seasonal” here is incorporating by construction any trend over the year, which, as you know, has generally been up over this period. But my main point is that, on the way to rising over the course of a year, the price tends first to fall in the autumn, making the rate of increase in the spring particularly impressive.

if dollar is getting spanked…

if money printing is rampant..

if merger mania/lbos are rampant…

if asset bubble is rampant…

why should oil not go to $100..just desserts for ASSinine FED policies..

The reformulation requirements have a minor effect on prices compared to the recent refinery fires this year.

Jan 2007-in CA. Chevron 260,000 bpd

Feb 2007 in TX. Valero 158,000 bpd

Feb. 2007 in Canada, Imperial Oil 118,000 bpd

April 2007 IN, BP 420,000 bpd

Given that gasoline is a very inelastic commodity I am suprised that we aren’t facing higher gasoline prices.

Just a note. Increases in gasoline do not automatically go to the bottom line of the gasoline companies. The government takes a significant portion of the increase and that is not just the gas tax. Additionally there are additional taxes not often considered such as the income tax and if the government decides you make too much they take that too in an excess profits tax.

Then consider the companies are at the mercy of the country where they extract the crude. They make long term investments that can be confiscated on a whim.

Today on a worldwide basis the governments of oil producing countries are taking more and more for themselves. This has been a cycle for years and the ultimate result is a serious oil shortage and energy crisis as companies find it impossible to produce. Currently we have a price concern but soon we will have a supply concern driven by the confiscation of capital by governments.

With the introduction of reformulated gasoline requirements in 2000, the process of converting from winter to summer fuel blends has become more costly, and the seasonal is much more pronounced.

To clarify– Phase I reformulated gasoline was required in 1995, and Phase II reformulated gasoline was required in 2000.

The reformulation requirements make the refiners job very difficult. Changeovers at the refinery are notoriously difficult. Many things can go wrong (SNAFUs). So the refinery is down, the refiner is selling gasoline out of inventory (which has a cost), and he has to make that inventory last over the shutdown and restart.

It is a more difficult process than the public acknowledges.

With that said, I don’t think that the switchover is responsible for high prices at this time. The switchover was done in March.

The refiners are swimming in money for the first time in 20 years. There is a ton of deferred maintenance that wasn’t done in the lean years. Refineries are down all over the place for upgrades. Unfortunately, summer is the time that upgrades are done. You need decent weather to do refinery work.

Buzzcut wrote:

The refiners are swimming in money for the first time in 20 years. There is a ton of deferred maintenance that wasn’t done in the lean years. Refineries are down all over the place for upgrades. Unfortunately, summer is the time that upgrades are done. You need decent weather to do refinery work.

Buzzcut,

This is not to challenge you or question what you have said. I only want to gain information. How do you know that refineries have postponed maintenance until now? Do you have a reference or is this from personal knowledge?

Very nice fitting of the data, Professor, with those two variables. Makes sense.

Dick, I worked in the industry from 1995 to 2004. I worked for a refinery equipment manufacturer/ refinery technology developer. Our worst year in the 100 year history of the company was 2002. I didn’t get a raise in ’03 or ’04, which was why I left the company. I switched industries, now I work for a company that makes emissions controls for heavy duty diesel engines, which is a growth industry because of increased government clean air regulations.

But I’m tempted. BP is calling. They’re increasing their refining capacity and are having trouble finding engineering talent. Like I said, the deferred maintenance is being taken care of. Also, BP is making investments to be able to refine the Canadian Tar Sands crude.

Dick F, I think Buzzcut meant”deferred upgrades” instead of “deferred maintenance”. There are upgrades/expansions going on now to add capacity to existing refineries.

Buzzcut,

Thanks for the info. You should know. It is also interesting that BP is approaching the Canadian Tar Sands. If we can tap the tar sands the abundance of oil will continue. If we can tap the tar sands and the shale oil we will be set for a long time. That is why I don’t worry too much about energy for the future. But I do worry about government meddling with energy sources. They have created horrible conditions in the energy business especially in the 1970s. If government got out of the way I would not be surprised to see the price of gasoline fall 50%.

Legendary oil investor Boone Pickens says oil will return to $78/barrel:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aV0_eeXN9Rho

Note that he doesn’t even mention that weather forcasters are expecting an active hurricane season.

However, note that the Colorado State 2007 hurricane forecast of 17 named storms, 9 hurricanes and 5 major hurricanes is exactly the same as the 2006 hurricane forecast from the same month: 17/9/5. And as we know, 2006 was a bust, with 9 named storms, 5 hurricanes and 2 majors.

Or go back to 2005, the year of Katrina, where the April forecast was for 13/7/3 and the actuals were an astounding 23/13/7.

Bottom line is, I wouldn’t put a lot of stock in hurricane forecasts. Now, a stopped clock is right twice a day so they probably won’t be as wrong this year as 05 and 06, but I wouldn’t count on this season being especially active.

http://typhoon.atmos.colostate.edu/Forecasts/index.php

for all the forecasts.

Hal, you may be right about Colorado State but they aren’t the only ones forecasting an active hurricane season. See the bottom of this news story from today:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aMZxPSGMXCf4

However, I don’t know what the track record is for these two weather forecasting firms.

Defrred maintenance. May be an urban legend, but see:

http://www.salon.com/tech/htww/2006/04/24/oil_prices/index.html for the same assertion.

Dick, there are a lot of things that a refiner can do to get more gasoline and diesel out of a barrel of oil. You can throw technology at the problem to a certain extent. You take more of the waste (asphalt), and turn it into higher value products (gasoline).

But there is a capital cost for doing so, as well as an operating cost. Back in the late ’90s, gas was selling for less than a dollar. The refiners were swimming in red ink. There was no way that they could make these upgrades (and thus, no way that my company could make any sales).

The higher gas prices now are driving refiner profits. The extra cash is being reinvested in the business, expanding capacity in existing refineries, turning lower value product into higher value product.

The boom will create the conditions for the next bust. It always has. That is why I’m such a “peak oil” skeptic.

I just noticed that you are referencing NJ gas prices. Keep in mind that East Coast gas prices are influenced by European gasoline markets. There is a shortage of diesel fuel in Europe and a glut of gasoline (because of European gas tax structure that encourages people to drive diesels). Refiners ship gasoline on barges to NJ and take back diesel.

I have no idea how this works in practice, seeing as European gas and diesel are different than US gas and diesel. Maybe the refiners can do this in the winter and not the summer, or something like that. This practice could be responsible for the price swings.

In the future, more and more gas and diesel will be coming from out of the country. Reliance is building a huge refinery right next to their existing huge refinery in Northwest India, with the intent of selling the product in California.

Buzzcut, the website that provides this data is called NewJerseyGasPrices.com, but it has prices for all different U.S. communities. It’s their USA average price that’s used in the first price, and the EIA US average price in subsequent graphs.

Just one point to Buzzcut and others: “peak Oil” doesn’t say anything about oil prices – it only states that at some point of time we will extract oil faster than we discover new reserves (or put differently: we will reach a point of maximum production followed by a production decline).

At that point the price may go up or it may go down depending on how this peak oil flow corresponds to demand. If we are able to reduce demand faster than extraction diminishes, (e.g. by tele-commuing, or by discovering an new energy source) then peak oil might coincide with a reduction in price.

Oil Prices go up because they can. The spin the first time they went up was because countries such as India and China were now consuming more oil. The spin a year later on gas increases are refineries are in repair and not enough of them. Lets get real now. The reason oil prices are increasing is because most goods/services increased many times where oil increased one or two times. ITS ABOUT $$$. PERIOD!!!

And why do they go down then, Deb?

You guys seem like you know what you’re talking about when it comes to refineries. Here in Panama there is a sudden rush to build refineries. Oxy and Qatar signed a deal to build a new $8 billion dollar refinery here on Tuesday. Today in the paper there’s another article about a different project that will be built with US and European funding. PEMEX is also going to build a refinery here, and Venezuela (Hugo Chavez) said he would as well, but he’s nuts. Any thoughts on why Panama is, all of a sudden, the place to build refineries?

Ron Paul is sponsoring a bill (H.R.2415) that should remove some regulatory factors and do a few other things. It might help.