We’re still not seeing the deterioration in economic conditions that some had been expecting.

This was another week when we seemed to get highly contradictory signals on the housing market, with the latest data showing existing home sales down 2.6% but new home sales up a staggering 16.2%. As I’ve been emphasizing, however, it’s not really a contradiction, since the new home sales numbers reported on Thursday represent contracts that were signed in April, whereas the existing home sales reported on Friday refer to houses that went into escrow in April, which contracts were likely signed in February or March. And according to the most recently revised new home sales data, new home contracts signed in February had been 3.8% lower than January, while those signed in March were 1.4% below those of February. Thus the latest data for new and existing home sales seem to jibe pretty well.

But what about that huge jump in new home contracts signed in April? I share the skepticism about this datum expressed by Felix Salmon,

Barry Ritholtz, and

Calculated Risk. The principle of Bayesian shrinkage says that when you’re given noisy new data, the best inference comes from weighting the data back in the direction that you were rationally anticipating before getting the data. A reasonable person would guess that the actual situation is unlikely to be as good as the preliminary April new home sales numbers seem to suggest. On the other hand, I see no way of reading this month’s housing numbers as bad news.

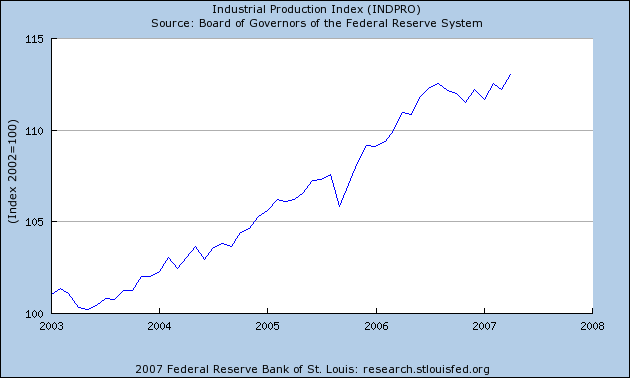

The incoming data also continue to allay some of the concerns I had about the earlier sluggishness seen in industrial production:

|

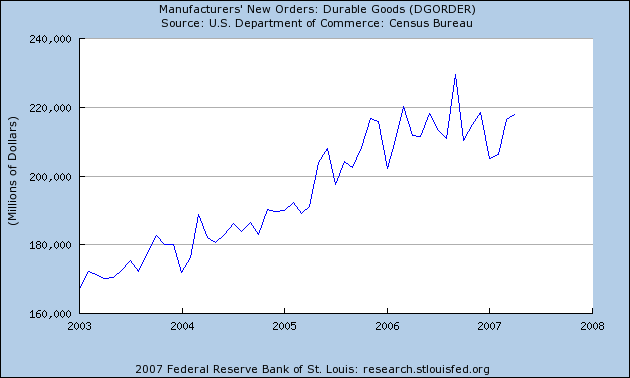

We’ve also clearly broken out of the very scary trends that had appeared earlier in new orders of durable goods

|

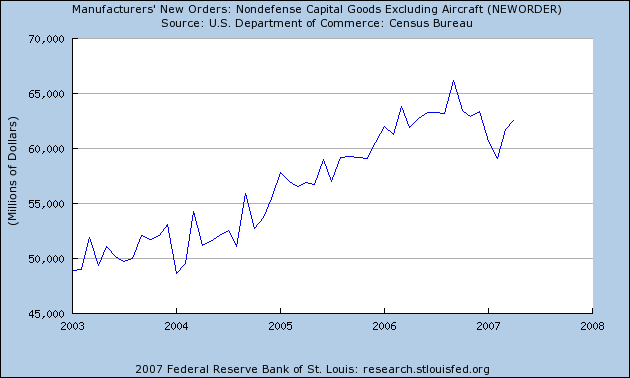

and nondefense capital goods (excluding aircraft):

|

Notwithstanding, I’m still calling for very slow real GDP growth for 2007:Q2. Even if the new home sales data are for real, we still have a long way to go and there are a lot of unsold homes. I viewed last month’s job reports as very weak, and there’s reason to expect these to worsen. April auto sales were also quite weak, and rising gasoline prices give us solid grounds for anticipating those will worsen also. And I still worry plenty about systemic financial problems.

All of which leaves me very much still feeling like this:

Technorati Tags: macroeconomics,

housing

If you’re not 🙁 then everything is cool.

Even us supply siders are surprised how significant even small supply side tax cuts have been to sustaining the economy, but at least we do understand why.

Another contributor could be the FED targets. Bernanke has stated that he believes in inflation targeting and Art Laffer has stated a number of times that the FED is now targeting the monetary base rather than the FFR (how he knows this I do not know). The dollar has been relatively stable (low inflation/deflation) for a number of quarters so businesses have been able to plan better rather than hedge against monetary swings. Of course the dollar has continued to weaken against other currencies so it appear it is still seeking equilibrium internationally.

Concerning housing especially construction labor, a strong economy will absorb the construction unemployment. From the overall unemployment numbers this seems to be a rational conjecture. And if this is the case it is reasonable to see why the slowdown in housing is having such a small impact on the economy. The negative effect of a housing decline is more an unemployment problem than a builder profitability problem so, if the economy is dealing with that, we seem to be right on track.

Housing declines are also normally from a normative housing market signaling lower demand due to unemployment. This decline appears not to be a demand decline but the result of an over supply. So the signal from housing could be different than in another economy.

Here in the Washington DC there are a number of new construction condo projects still going forward despite the current Washington area oversupply (a project in motion continues in motion and is eventually converted to rental and or exerts downward pressure on existing condos). A large number of construction workers in this area and in some other areas of the country are immigrant workers documented and not. When construction demand finally slows many of the these workers will have difficulty finding alternative jobs but may not show up in the unemployment statistics either. Another thing to consider is the extent to which decling or even flattening housing prices will induce additional savings as homes are at least for a time not a source of increased wealth.

DickF, actually the U.S. dollar is at a 6 week high versus the euro and a 3 month high versus the yen. I think the U.S. economy is starting to strengthen this quarter into a higher growth phase, and that the biggest risk going forwards would be if a major hurricane hits the Gulf Coast.

Why do supply side tax cuts work? Do you mean the paper by Romer and Romer which JDH talked about earlier?

I’m sorry, but I need to dispel the idea that new home sales data was anything but negative, even if not revised down (but they will be).

Please do me a favor, make a simple exercise – multiply new home sales by average price, do it for April and March – and compare.

You will be surprised how bad things are. If you don’t want to spend time you can check my blog for answer.

The end is here, and this week’s release of April personal consumption expenditures will prove it.

Existing home sales dropping March to April, when they should be increasing, seasonally; home prices dropping month to month and year over year; new home prices dropping 11% in one month; resale home inventory now at 8.2 months. C’mon, the April numbers were a disaster.

Professor, are you the beneficiary of one of these outrageous sweetheart home loans:

http://www.signonsandiego.com/news/education/20070526-9999-1n26mortgage.html

Why in the world would the Chandlers require a follow-on $500K loan when they cleared $1.35MM on their first home-bought-with-UC-money?

With silliness such as putting love partners on the payroll (UC Santa Cruz), to ridiculous severance packages to offended minority faculty (at a CSU school), to home loans that are prohibited in the private sector since Sarb-Ox, the university sector needs to clean up its act.

JDH,

The NHS data is consistent with the thesis that builders will cut price to gain share from existing homes. As such, it is negative for adherents of the “sticky house price” hypothesis.

I suggest the following thought experiment: imagine a 25% nominal price drop, now go back to find the sequence of events that led to it. Something must have broken the traditional reticence of homeowners to discount their prices. What was it? Clearly, the favored culprits are 1) competition from builders needing to monetize sunk-cost land holdings; and 2) competition from REO’s. Further, you could posit that there is a non-linear relationship between the percentage of inventory that is REO/new homes and HPA. It works like this:

-assume that new home and REO owners comprise 20% of the market; that they need to have a probability of 50% that their home sells within eight months; and that price is the only factor UNDER THEIR CONTROL affecting probability.

-assume that each month is an “independent event”; that is, the probability of selling does not improve with time (more buyers seeing the home offsets the home becoming “stale”).

-given an 8-month supply of homes, there is a one-in-eight chance a home will sell in any given month.

-assume the existing home sales will discount once their expected probability of selling falls below one in eight.

-if 50% of the 20% of REO/new homes sell, this takes out 80% of the buyers in the eight month period, leaving a one-in-forty chance of the undiscounted homes selling.

-existing home owners will discount such that their probability of selling returns to one-in-eight.

It is difficult if not impossible to test this hypothesis. However, “absence of evidence” in cycles for which we have data (the past thirty years) is not “evidence of absence”. It may just be that the historical experience has not encompassed this “critical mass” of REO/new homes that drives down expected probabilities to such low levels.

JDH,

The above is of course a simplified game with expected payoffs and probabilities. The outcome is driven by the wide difference in expected pay-offs/costs between the two groups, creating an incentive to discount and steal share.

A key simplifying assumption(s) is short term price in-elasticity of buyers and stability of months-of-inventory at eight.

Of course in real life the game is much messier, but the payoff differences should still dominate the other factors at significant levels of REO/New homes. In a multiple round game, the price eventually declines to the point that rental yields are at peak levels, and the inventory clears with the entry of new price-elastic buyers.

I don’t think it’s appropriate to multiply seasonally adjusted numbers in this way, oxylandr. What I would do is take the seasonally unadjusted number of units sold during the month of March (81,000 units, found on the second sheet of the Census spreadsheet) times the average (not the median) price per March unit ($324,700) to calculate the total nominal spending on new homes in March ($26.3 million) . Do the same for April and you come up with $27.5 million, a 4.6% increase in spending on new homes.

I also don’t agree with you that this is a poor March-to-April change. Although I have not gone back to calculate the historical average March-to-April change in total nominal spending on new homes, I have calculated the average March-to-April change in number of units sold, and it is actually negative– March in a typical year is actually the peak sales month.

By comparison, the nominal increase in spending on new homes this year between February and March was up 18.2%.

So, I do not think things are quite as grim as you are making them out to be.

jg, my focus here was on number of units sold rather than the house price because that it what will matter for GDP. I guess I should always repeat that that is my focus, since from the perspective of a homeowner the interest tends to be more in the price rather than the number of units sold.

It is possible that the price declines will precipitate the financial problems I was referring to, and perhaps this is your concern.

On the UCSD mortgages, no, I do not have one, though I think you are blowing this way out of proportion. The rates and terms on these mortgages are barely, if at all, more attractive than those that can be obtained without going through the university. Quoting from the San Diego Union Tribune article to which I presume you’re referring, “UC officials say the housing program does not cost the university money. Mortgages are funded through a short-term investment pool that includes tuition dollars and state funding. As mortgages are repaid or sold to secondary lenders, that money is returned to the pool and provides opportunities for other home buyers. UC is virtually guaranteed payment because the mortgages are deducted from paychecks.”

I am a non-economist who has been driven to study the dismal science by the best of reasons: fear. I only started to pay attention to economic trends and data a few years ago which turned out to be an unfortunate event. I was actually driven to find a real economist that I could talk to regarding my fears; Voila! Here I am at this very erudite website.

Forgive me but a little context is necessary in order to properly frame my concern here.

I am a retired AF officer who is now a Six Sigma project manager. I really like data. I really dislike improper metrics. When I began to think about the economic data that I was trying to understand it soon became clear to me that either the data is so horribly mis-measured or is fundamentally immeasurable (both probably true) that it was easy to see why almost any economic forecast could be made from the same data set while being in total opposition to each other. I believe this symptom of bad data may explain some of the comments in this particular string regarding the strength of the economy.

Nonetheless, it is, as our former SecDef said, what it is.

Finally to my point, fear. Having to draw a conclusion from the data available (most notably current account flows, import/export and monetary and government employment data) I am trying to understand how anyone can NOT conclude that we have a dysfunctional economic system in America. Specifically, how can the famed service economy, which is made up to a great extent of non-exportable products such as home building, health care (my particular job area), retail and many other non-productive (globally speaking) services notably including all levels of government, possibly flourish in a global economy? Logical answer: it cant. The data cries out this conclusion, from jobs exported (job unbundling indeed!) to % of products imported Vs exported, personal savings rate and dollar devaluation. My friends, we have an economy that looks an awful lot like a company that is all HR and no actual product.

Yet there are countless theories of why our economy is actually strong, almost all of the this time its different variety. My fear is that, like the theory of evolution, the basic of economics havent changed and we are all ignoring that at our peril. It could be simple chauvinism whatever the US does is always been right or it could be incompetence of our economic leaders. Maybe its just laziness and arrogance Id much rather be an service worker than a production worker. Or maybe Im completely goofed up. Im willing to accept that if someone can just show me the light.

Regardless of any feedback here, I greatly enjoy the give and take.

Do the same for April and you come up with $27.5 million, a 4.6% increase in spending on new homes.

No, that is not correct. Especially when you revise it out, it is a loss of money. Complete misread.

So spell out your point for me, dryfly. I calculate 92,000 new homes sold in April times $299,100 per home equals $27.5 million, 4.6% more than in March.

Footwedge, the economy has been weak but it may be strengthening because the stock market, the US dollar and ten year yields have each been trending higher for weeks. If the economy were weakening then these markets should be heading lower. However, don’t be surprised if there is a minor correction in the stock market along the way.

Also, as measured by real GDP, manufacture of goods is about 34% of the economy (whereas services is about 55% and construction is about 8%). So it is not true that we don’t produce any goods. Furthermore, 80% of the quarterly ups and downs in overall GDP growth come from quarterly changes in real GDP for goods.

US manufacturing is still the best in the world, and capital investment growth typically lags industrial slowdowns. Now that industrial activity has been improving we might expect an improvement in capital investment growth.

Remember the important thing is that the Boston Red Sox are now the best team in baseball.

Footwedge, your comment raises all kinds of issues so I’m not sure where to start. Let me just begin by noting that the question I was addressing in this particular post is focused exclusively on what the next few months will look like, whereas I think that the issues you are raising have more to do with what the next ten years will look like.

In terms of the longer run issues, we share some of your concerns, and have discussed some of the issues, for example, in Does manufacturing matter?. One of the key variables in my mind is one you don’t mention– changes in the exchange rate can alter all of the magnitudes you refer to. One important concern I have is whether those exchange rate adjustments would occur gradually enough not to cause significant disruptions in their own right and yet still be powerful enough to have an impact on these magnitudes.

Menzie (the author of both those posts) is more of an authority on these questions than I.

One view that Menzie and I share is that government budget deficits are at least part of the imbalances to which you refer and for which I think there is no good economic rationale. So from a policy point of view, that seems to me to be the logical place to begin to try to address these problems.

Footwedge: Services are about 29% of total US exports, so just because the overall economy is now more oriented toward services does not mean we can’t export. See this post for a graph of some estimates of the tradable share of US GDP. Note that I report nominal shares because it is not appropriate to divide chain-weighted real values by chain-weighted real indices.

What I also point out in that post — and is echoed in your comment — is that the trade deficit expressed as a proportion of the tradable component portion of US output is clearly rising. That means if we are forced to adjust, the adjustment will take place on a relatively small amount of output.

In the Union-Buffoon article, an analyst stated that the ‘offending professors’ received a mortgage rate 1.5-2% better than us taxpayers could.

Revenue neutral? C’mon, Professor: what’s the opportunity cost of lending money out at rates as low as 3%?

No wonder universities keep raising tuition higher than the rate of inflation; someone has got to keep those folks in their Rancho Sante Fe digs.

Oh, sorry jg, I didn’t read to the end of the article. The standard faculty loan, which I was offered, was the one I was talking about and I promise you, the terms I was offered were no great deal. We ended up turning it down, because it had to be used within a certain interval of coming to San Diego (I don’t remember what that limit was), and we decided it was really better for us to rent for a number of years before trying to buy a home. Actually, that decision turned out very well for us, in terms of both personal finances and market timing. I don’t have any inside information about the administrator deals the article discusses, but such inside information as I have about loans to faculty suggest there’s really no big deal there.

My take on the new home sales increase and existing home sales decrease in April is this –

Existing home sales came in at 5.99 mil instead of the expected 6.11 mil annualised. That is (6.11 mil – 5.99 mil)/ 12 = 10,000 less sales than expected in April.

New Home sales were 981,000 instead of the expected 865,000, annualized. That is (981000 – 865000)/12 = 9,666 more sales than expected in the same month.

That is nearly a wash of about 10,000 sales going into new homes instead of existing homes, as expected. That is most probably because the discounts/promotions being offered by the home builders. With all the incentives, buying a new home is probably a better value than buying an existing home.

In my opinion, there is no news here, in spite of the eye-popping (16%) surge in the new home sales.

Overall housing market stayed just as expected in April. No reason to change any ones outlook on the housing market as a result of these numbers.

Charlie Stromeyer wrote:

DickF, actually the U.S. dollar is at a 6 week high versus the euro and a 3 month high versus the yen.

Charlie,

Sorry it took me so long to get back with you.

If you look at the major currencies, with the exception of the yen, you will see that the dollar is declining in value. Look at a longer trend on the euro.

I think the U.S. economy is starting to strengthen this quarter into a higher growth phase, and that the biggest risk going forwards would be if a major hurricane hits the Gulf Coast.

While a stronger economy could sop up some of the excess currency the dollar has already declined against other currencies. I hope you are right about the economy strengthening. It is still moving forward but at a slower pace due to government regulation (SarbOx, FED arbitrary interest rates). A major hurricane would be a bad thing but a strong economy can and always has healed such disasters. Florida and Mississippi worked through their hurricanes and have recovered. It was only the incompetence of the local authorities in NO that created that disaster. Off shore rigs have been designed to withstand most storms so this is not a very serious problem.

Why do supply side tax cuts work?

This is pretty simple actually. What would happen in your life if your personal tax bill declined? You might have been considering opening a business but your cash flow was just not quite enough. Assume the tax cut would give you just the little extra that you needed. Now in economic terms your business purchase would be a one-time event but for you and for the economy your business would be an on going concern adding wealth to the economy well beyond the initial tax reduction. And with a successful business your business tax payments would actually increase as your income and well-being increased. Supply side cuts are a win-win.

Do you mean the paper by Romer and Romer which JDH talked about earlier?

No, Romer and Romer take a short-term view of tax cuts. Their data is correct in the savings that they show, but they do not build in the continued savings from tax cuts or the increased long-term production the tax cuts allow. They see tax cuts more as a point-in-time event rather than a long-term investment.

This is actually related to the Broken Window Falacy in economics. Economics cannot measure the absence of productive capacity that never materializes because of restrictive taxes, but the compounding effect of tax cuts can be seen in the improvement in the overall economy and the increased the supply of goods and services. This is what supply siders see that others miss.

JDH – thanks for the nudge to the other link – Exactly what I was looking for. I’m REALLY happy that there are other people who are at least considering this issue (I call the Seinfeld Economy syndrome.)

Sorry to have try to usurp this string but will look forward to the many other posts going forward. FW

DickF, to be fair to you I should admit that I think the yen is undervalued and that it will rally. I don’t mind if the US dollar has a gradual decline which benefits our exporters but I’m hoping that it doesn’t tank.

I remember the Laffer curve from my econ textbook but I had never seen a rigorous study about the benefits of supply side economics. However, last year KPMG International did a study of 86 countries and found that corporate tax cuts attract and retain business investment with little loss of revenue:

http://www.bloomberg.com/apps/news?pid=20601109&sid=aev_LMGsw3aw&refer=home

This article also says that the link between corporate tax cuts and growth may be debatable, but that an OECD study on this topic is expected to be completed by March.

I wonder whether paying attention to the new home price measure makes any sense unless one also notes the massive rise in homes sold in the South. Prices in the South are lower than for comparable homes elsewhere, all else equal. The rise in homes sold in the South probably accounts for much of the drop in median price. Doing nationwide comparisons of the amount spent on new homes between March and April seems awfully misleading if one ignores the skew in prices due to the big surge in the South.

That Southern surge, by the way, makes the sales total all the more suspicious. When is the last time sales anywhere rose that much, after all the revisions are in? Anybody know of a special factor in April that makes that Southern jump more credible? I don’t.

Charlie Stromeyer wrote:

DickF, to be fair to you…

Thanks Charlie. I really do appreciate that.

I sometimes write a little stronger than I should because supply side does take a lot of abuse (Voodoo Economics) and usually I find that those who argue the points have no idea what supply side economics is all about.

The Laffer Curve is a small portion of supply side economics but has taken on a primary role because taxes are generally out of control and everyone wants something magic. Supply side is not magic. It is the classical economics that was all but forgotten in the 1960s and 70s with disastrous results I must add. Had it not been reintroduced by the Reagan Administration in the 1980s our economy would probably have crashed under the geometrically increasing weight of progressive income taxes and inflation.

I only present supply side issues because they are a minority in economic academic circles and I hope that it will make some reconsider their economic dogma.

Thanks again for your consideration.

DickF, if I remember correctly, didn’t you say earlier that peak oil in America wasn’t real? Today, I got home from work and turned on Bloomberg TV and there is a story which vindicates you. This story totally blew my mind because I had no idea whatsoever that there is as much oil in Colorado and Utah as all of OPEC combined:

http://www.bloomberg.com/apps/news?pid=20601109&sid=aoZ7q9LhDrVs&refer=home

You must read this story, however, note that final approval for full-scale projects won’t be made until after 2010. What does supply side economics say about excessive government regulations and also about the energy industry? (Disclosure: I have been long shares of almost every energy company since February 2003).

(Returning to an earlier blog post topic, some idiot(s) put up stickers in my hometown -Concord, MA- saying that the war on terror is a myth and that 9/11 was an inside job, but the stickers are on highway signs so I can’t reach them to pull them off.)

Charlie, I offered some thoughts about oil shale here.

Thanks for the link, JDH. Since I am not an energy expert I looked up “oil shale” in Wikipedia and their entry is quite informative (but the Bloomberg article has more up-to-date info on the different technological processes that are now being developed):

http://en.wikipedia.org/wiki/Oil_shale