The CBO has released its budget and economic outlook update.

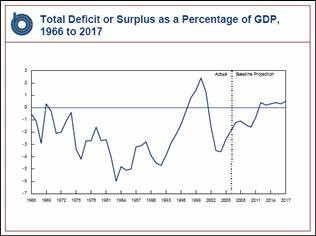

One graph from the slides seems to indicate all is well, with the budget balance under current law going to surplus by FY2012.

Source: CBO Budget and Economic Outlook Update slides (Aug. 23, 2007).

What is important to remember is that — as the document itself stresses — the projections are under current law. One important aspect of this caveat is that this means the provisions of EGTRRA and JGTRRA are allowed to expire in tracing out this scenario, a path that President Bush has opted against. A second point is that the curent budget deficit is one being run at full employment (see the discussion in this post). If the economy were to go into a marked slowdown, or even maintained growth where the distribution of income were to skew towards lower income deciles (think about the Wall Street bonuses disappearing), or the economy were to descend into recession, then one would obviously expect the deficit to balloon.

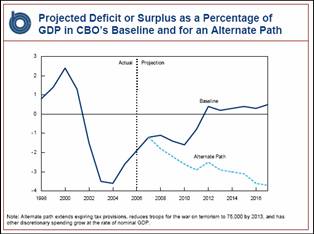

To highlight what is more likely as — if not more — plausible, even if the economy maintains relatively healthy growth over the next few years, assume (1) the tax cuts are made permanent, (2) troop levels in Iraq, Afghanistan and other GWOT activities are reduced to 75,000 by 2013, and (3) discretionary spending rises with the growth rate of nominal GDP. This yields the following graph.

Source: CBO Budget and Economic Outlook Update slides (Aug. 23, 2007).

Of the FY2017 gap between projected and alternate, $316 billion is accounted for by the extended tax cuts, $265 by faster (and given history, more realistic) growth in discretionary spending, and -$120 billion by the reduction in troop levels.

Technorati Tags: tax cuts, budget deficits

fiscal policy, and

full employment budget surplus

Menzie Chinn…

The elephant in the room is, of course, what happens to expenditures should we elect to introduce a force of conquest and occupation into Iran, something that is close to inevitable if the set of “surgical” strikes engenders a regional conflagration.

Now we all know that Jack Straw has labeled any attack on Iran as “nuts” and our new theater commander (go NAVY!!) has said “not on my watch” but George only listens to his “higher” father and the Lord only knows who Dick listens to (if anyone).

I would love to see a thorough discussion regarding the effect on expenditures for various scenarios of conquest and occupation of Iran.

Perhaps somewhat beyond the scope of what you prefer to do in a “thread” here.

Anyway, keep up the info flow … you and JH have lots of “aficionados!”

esb: Thanks for the compliment. I have some budgetary cost estimates for a limited strike, discussed here. In that post, I conclude: “In sum, the expected value of the costs associated with military action in Iran would likely dwarf the direct fiscal and nonpecuniary costs that we have already incurred in Iraq.”

I understand that tax revenue is becoming harder to forecast due to the increasing variability of capital gains taxes and corporate profits.

The forecasting of capital gains tax revenues is obviously a political minefield – and presumably an economic minefield as well, given that three analysts are creditted with working on the projections – but are there any useful rules of thumb relating capital gains taxes, capital gains and capital markets?

I see that the equilibrium level of capital gains realizations is estimated as 3.4% of GDP (page 31). Ten Year Treasuries are projected to yield 5.2% (page 39). Add an equity risk premium of 5% and project stocks to yield 10% p.a. after rounding. That would suggest to me that the equilibrium market-cap-to-GDP ratio is projected to be 34%, which seems very low.

Can you shed any light on these relationships?

And – I can’t help asking – if we can assume infinite liquidity for a moment – could the Treasury hedge its exposure to the stock market by shorting S&P500 futures?

Chalk up another one for divided government.

Stephen Sliviniski, economist, author of Buck Wild, Director of Budget Analysis for the Cato Institute, and DWSUWF favorite, comments on recently released CBO budget estimates in “Finally, Some Not-So-Bad News on the Budget” posted at Cato@Liberty:

One thing I cannot understand is: with the budget on track to be in surplus in 2008 or 2009, under current tax structures, why do we need to increase taxes?

Given CBO and OMB’s recent track record of overestimating deficits since the 2003 tax cuts went into effect, I don’t believe them.

Relative to my previous post, from a Fox News story early in 2006:

Budget Deficit Estimated to Reach $337B This Year

Friday, February 03, 2006

* E-MAIL STORY

* PRINTER FRIENDLY VERSION

WASHINGTON The federal budget deficit will reach at least $337 billion for the current year, the Congressional Budget Office estimates, and the deficit is likely to go higher because of tax cuts and new additional spending for hurricane relief and the war in Iraq.

The deficit estimated by the nonpartisan CBO was lower than predicted by the White House budget office, which two weeks ago said the 2006 deficit would top $400 billion because of emergency aid for victims of hurricanes Katrina and Rita.

CBO’s estimate was to be officially released at 10 a.m. But the overall figures were provided to The Associated Press by a congressional aide, who acted on condition of anonymity because the numbers had not been officially released by the budget office.

Deficits for 2006-10 will total $1.3 trillion, CBO predicts, but such “baseline” figures may prove inaccurate because of the rules the scorekeeping agency has to follow when producing its estimates. For instance, the agency does not account for upcoming Bush administration requests for the war in Iraq or additional hurricane relief, which promise to add tens of billions to the 2006 deficit.

————–

The actual for the FY – $248BN, with this year’s predicted to come in around $160BN.

Rich Berger: There was consistent underprediction of surpluses in the years before the 2001 tax cuts. For a formal statistical analysis, I suggest you take a look at CBO’s assessment, which will provide details of the relative accuracy of the forecasts. My one observation on this issue is that CBO makes projections under current law (as is its mandate). Other agencies and private forecasters are not under such a restriction.

What are the prospects for extending the tax cuts now that the Democrats control Congress?

Neither of the two scenarios described here sound very realistic to me. I’d like to see what the deficit looks like under a “best guess” set of assumptions rather than these which sound like “best case” and “worst case”.

CBO makes projections under current law (as is its mandate).

This makes CBO estimates meaningless. There is no allowance for changes in behavior due to the tax cuts expiring or any other potential change. The CBO is mandated by congress to prepare an inaccurate projection. The White House budget office has a little more leeway but not much. Most government projections are wrong from their inception. The only reason they are taken seriously is because the government actually uses them to make policy decisions.

It is my understanding that these budget deficit numbers do not include the emergency funding e.g. Iraq and natural disasters, that politicians love to use to hide spending. Well north of $100 billiion. Nor does it include the social security money that is simply being spent and replaced with the oh so valuable bonds – something in the $150 billion area? I also note that the Treasury is making noise about raising the debt ceiling again after being raised less than two years ago. Something doth stink in the budget deficit calculation dept, me thinketh.

I heard a segment on NPR that due to the challenges in meeting military recruitment goals, we are now providing $20,000 signing bonuses. I could be wrong, but I suspect this wasn’t projected in previous budgets. Probably we didn’t have a bridge-to-nowhere budget either. I am so tired of hearing that X is only a tiny amount when compared to our GDP. Earmarks may be a sign of an effective politician in bringing home the bacon, but the costs far outweigh the benefits in 90% of the cases. I will continue to have absolutely zero trust in our government and their spending until we have full and accurate accounting that are separate from policy recommendations and must include multiple projections with the likelihood for each measured frequently based on new data. If we had this, we would all be looking more carefully at the downside projection based on the possibility of a recession. And, policy makers would have more pressure to cut spending and determine what actions need to be taken to support our people through the difficult times and get us back on the right path.

I don’t think the CBO estimates are useless, as DickF says. Instead, basing them on current law helps make the forecasting assumptions clear. What is useful in the CBO estimates is some baseline forecast that takes account of the relevant information in an explicit fashion. From there, we can move into alternate forecasts with the policy prediction of the forecaster’s choice.

seth, do you not feel that politicians design their policies around the baseline forecast in ways that they can be excluded / hidden from view. We already have hundreds of alternative forecasts, but the problem is that they are unofficial and tend to be focused on policy recommendations so that they are ignored/attacked by the other side of the aisle. We need multiple projections from an official source with the factors for each explicitly given, IMH(and fairly ignorant)O

Footwedge it does include the Social Security Surplus. That makes up most of the figure labeld ‘Off budget’ in Summary Table 1 and Table 1-1.

__________________

Menzie you kind of lost me here.

“(2) troop levels in Iraq, Afghanistan and other GWOT activities are reduced to 75,000 by 2013”

On my reading I see CBO projecting spending on Iraq, Afghanistan and GWOT as $203 billion in 2017, with a reduction of that figure by $125 billion if we get troops to 70,000 by 2013, or by $158 billion if we get troops to 30,000 by 2010 (with additional savings on debt service)

The discussion is on p.18 and the data in Table 1-8. That is it looks to me like you get the sign wrong on troop levels, your scenario would add to the surplus and not the deficit. What am I missing here?

.

Dr. Chinn-

I printed out the CBO assessment to read on my commute home this evening. Thank you.

I am skeptical in general of long-range projections because there are too many variables to get right. What is more interesting is the effects of changes in assumptions – gives you a feel for variability.

I don’t know whether Bruce Webb is right, but his post illustrates the need to read the fine print and the assumptions used in any complex projection.

Bruce Webb: It’s kind of hard to see in the post, but there’s a negative sign before the $120 billion.

The budget excludes so many provisions for future liabilities that it is in effect a useless document. It’s analogous to only reporting personal deficits based on tapped into lines of credit and ignoring outstanding credit card debts….that is until you pay them,..by drawing upon your line of credit. In this case clearly assessing ones debt by only looking at the line of credit balance is foolish.

The US fiscal position is similar to having a $9.9 Trillion dollar line of credit incurring interest and a pending VISA bill of $65 Trillion coming due by installments in a matter of months. Fiscal budget deficit figures from the CBO…..right, give me a royal break.

I think it is all too easy to dismiss projections just because they do not incorporate all the factors one thinks are important. I believe this is “throwing out the baby with the bathwater”. What one needs to do is to take the information contained in these projections in context, with an understanding of how the projections are made. It is useful to know what revenues and expenditures are likely to do under a variety of assumptions. Different people with different views regarding the probability distributions can then develop their own trajectories.

Stuart: I agree with your point that there are many liabilities off-budget. But that means one should take the information in the budget report here in conjunction with other estimates. CBO has conducted a “balance-sheet”-like analysis in Comparing Budget and Accounting Measures of the Federal Government’s

Fiscal Condition, December 2006.

By the way, I have posted several times about the fiscal exposure of the Nation (with special reference to the President’s gift to the Nation, Medicare Part D).

There is no reason for the US government to feel compelled to run a balanced budget. People make the mistake of comparing the government budget to our personal budget, but the two aren’t the same. The US government is a permanent entity that is supported by a growing economy, so the best way to analyze the situation is by looking at debt to GDP, in which the US has one of the lowest ratios of the major industrialized economies. The US also has faster population and productivity growth than its primary rivals, which would allow it to support a higher level of indebtedness. Not only that, no future generation ever really gets “stuck with the bill” as long as the economy continues to grow. As long as the government doesn’t choke off productivity or population growth with bad policies, the debt can be rolled over ad infinitum.

At the current level of deficit (1.5% of GDP), the US is actually DE-levering. Why? Well, if nominal GDP growth is 4-5% this year and we only add 1.5% of GDP in new debt, debt to GDP would shrink by 1.5-2.5% of GDP. The US actually has scope to run higher deficits, supporting faster growth while paying for entitlements without meaningfully affecting the country’s creditworthiness. The economy and the population’s retirement benefits do not need to be unduly sacrificed based purely on a puritan aversion to borrowing money, particularly when it never really needs to be paid back.

One of my concerns (and not a small one) is that I have absolutely no idea whatsoever regarding the extent to which the corrupting influence of the “Bushies” has spread throughout the bureaucracy.

To what extent can the official data series be trusted? We simply do not know.

No less a figure than the Attorney General of the United States of America has been forced out of office. The Department of Justice is in chaos.

Does anyone really believe that the BLS and other data producers are isolated from this rot.

Does anyone really believe that the BLS and other data producers are isolated from this rot.

To the extent that they’re produced by career bureacrats, they are isolated from “the rot”.

Career bureacrats are Democrats, not Republicans.

Okay, I see it know, in my browser it falls on a totally different line.

Table 1-8 sets out funding for Iraq etc under the baseline at $203 billion in 2017 and then sets out two alternatives, one that costs $121 plus $32 billion in debt service less than the baseline, and one that projects $158 billion plus $55 billion in debt service less than the baseline. And even the latter assumes 30,000 remaining troops. If we assume that all troops were out by 2013, then the savings in 2017 would be $203 billion plus some $46 billion in debt service, which is more than half the projected deficit, nor do I see a reason why all the tax cuts should expect to be extended.

(Though of course it would be thoroughly dishonest to brag about a budget surplus that relied on a policy outcome you have openly opposed. I don’t expect this to deter the Bushies)

But given that I support withdrawing the troops and restoring some progressivity to the tax code, and moreover believe the CBO estimate for Social Security, while more positive than the Trustees, still is a likely underestimate then I see a better possible outcome than most.

Bruce Webb: The tax code is actually more progressive now (in terms of the percent of revenues that come from the top earners vs. the lower earners) than it was under Clinton. The difference is that the government’s total take is lower and the top earners’ percent of total income is higher. More progressivity can be had by policies that specifically benefit the middle class, rather than by simply punishing the top earners with higher rates.

Let me translate Tyler’s words for you.

There’s no problem in increased debt, we’ll just grow so much that we’ll always be good for the money.

It’s just like the subprime borrowers counting on their real estate holdings and income to grow, so everyone ends up with a win-win in the end. And that is what’s happened with those mortgages, isn’t it? Those musical chairs never stop. Right?….

And that’s not even counting the national security problems of having another country holding a trillion dollars of your debt over your head. Or the fact that a country that relies on consumption for 70% of its economy has been relying on policies that give away the bulk of tax benefits to rich people who are much less likely to consume their extra holdings than lower and middle-class individuals.

Jake Miller: It’s not like that at all. The US economy WILL grow long term. Then you turn around and argue against policies that would encourage savings/investment in favor of consumption.

If we had a free market we would not need these projections. The reason it is vital to have accurate projections is because politicians make policy based on these horrible projections, they run our lives based on bad numbers. I repeat with different words if the US did not have a command economy then the bad projections would not be a problem.

Interventionist policy is bad enough but when you throw in bad numbers that are forced to be bad by legislation or regulation then we are in a heap of trouble.

Tyler: If the CBO baseline (current law) proves right, then indeed, the debt/GDP ratio declines. But that result is quite sensitive to the assumptions. Last year, I showed what happens under a reasonable alternative. Debt/GDP then continues its climb (see here).

I guess my viewpoint is, unless you include all the expenses in the budget that you’re liable to pay, what’s the point completing a budget. I wouldn’t do a household budget leaving out groceries, dental costs, gas and mortgage payments and then calculate what my cashflow and debt to cashflow ratios amongst still other ratios. They’d be utterly useless since they wouldn’t mean anything. Those other expense items I left off don’t disappear. They are real costs and I am going to have to pay for them. All the liabilities not included are not going away. That is the most salient point. The expenses excluded from the Federal budget prepared by the CBO are NOT going away. Excluding them is what got is in this mess as it creates a false sense of financial security. I read that other piece you reference and it is enlightening. If the state governments need to account for future liabilities, so to should the Federal Government. I know one of the main arguments against inclusion of unfunded liabilities is there is no legal guarantee to make payment for OAS and medicare. Ya, right. Go ahead Mr. Politician. Let me watch you try and tell tens of millions of Americans that, hey you know all those FICA remittances you were making…well we spent them all and now you’re not entitled to receive anything. Sorrry about that. Please, go ahead, make my day. Lets see how far that get you Mr. Politician. There would be riots in the street. The bottom line is any analysis that incomplete in accounting for all the variables leads to false conclusions. I think that is something David Walker was trying to get across to everyone. I guess he has no idea what he is talking about. These papers prepared by the CBO are much more a political document than they are economic.

Dr. Chinn-

I read CBO’s assessment of their performance in forecasting and their conclusion, if I may summarize, was that they are no better or worse than private economists. In addition, they noted that all forecasters have difficulty at turning points in the economy.

The CBO report commented that the sample of forecasts (I believe it was 29) was too small to draw firm conclusions about the accuracy of forecasts in general. That led me to consider the business of comparing recoveries from recession, as you often do, usually to prove that the current recovery has not been robust, at least as compared to that from the last recession that ended in 1991. The sample of recession/recoveries is even smaller and drawing conclusions even less credible. Each recession and recovery period is unique and not really comparable.

Despite the claims of David Walker, the Concord Coalition and others, the US debt is not going to doom us. On the other hand, thanks to the gifts from FDR (Social Security) and LBJ (Medicare), actions will have to be taken to rein in benefits in order to avoid onerous increases in taxes on my children.

Rich, your children and grandchildren might be sorry if those benefits are not available, god forbid they be disabled. If those who think like you are successful in cutting these benefits take a look into the future and think about the impact to our economy when a larger percentage of our populace can no longer spend money on basic necessities. I’d rather we reigned in corporate welfare, unnecessary wars, and ridiculous earmarks.

Bill,

Let’s just look at one thing, healthcare.

Imagine a total government system where the govenment pays the doctor and you can go anytime you want. How long do you believe the waiting line would be? With the government setting prices (that is the only way since there would be no market prices) how comfortable do you believe doctors would be? Also since the doctor is paid by the government how attentive would he be to your problem, especially since he would probably be paid by the number of patients he saw.

Now consider a health care system where you have a Health Savings Account. You can deposit into the HSA and while you are young and healthy build a reserve account. If you change jobs your health care account is still yours. When you go to the doctor you pay the doctor and so he knows that he must please you not some bureaucrat. Now consider that you have a catastrophic illness. If you were smart you would have used your HSA to purchase a catastrophic health policy.

So which do you prefer paying for your own care or allowing some bureaucrat to determine you care?

Would Rich’s children be better off with a Soviet style government system or an HSA passed down from parent to child continuing from generation to generation?

DickF, HSAs are not the solution. I did a little searching and found a paragraph that summarizes my view nicely:

Incentives for Health Savings Accounts remove those funds from the income tax system and increase the deficit. HSAs are most likely to be employed, as discussed in other postings, by those who are healthiest and wealthiest. HSAs will not be adequate to deal with the real cause of rising health care–those who have serious illnesses that require expensive diagnostic testing, hospital stays, and modern drug and surgical treatment. Health Savings Accounts mainly provide a tax-free route of saving for wealthier individuals who would save anyway.”

We can fight for more price transparency without HSAs. And, we should as a civilized society help disabled children who were not fortunate enough to have parents with an HSA that can provide all that they need.

Bill-

Your unstated assumption is that my children will not be able to take care of themselves. If I were alive, and one of them became disabled, I certainly would help. Alternatively, they could purchase disability insurance.

Where do you think the government gets the money to provide “free” healthcare or disability coverage?

Rich asked, “Where do you think the government gets the money to provide “free” healthcare or disability coverage?”

Not from you alone my friend. That is the idea of insurance, we collectively pay for the costs of many. I always felt this was one of the ideals that made our country great. We can continue to improve the system so that it is not abused. But, abandoning the lower income class through privatization will in the end hurt not only them but our country as a whole. Think beyond yourself and it will benefit you.

Well, Bill, the country got along without Social Security for approximately 160 years and without Medicare for approximately 190 years, so the idea that government “insurance” made the country great is without merit. It certainly has made the country indebted, I will grant you.

Actually, insurance is the voluntary pooling of risk by the insured.

Freedom is what has made the country great, not government programs.

“Past performance is no guarantee for future results.” I think that if ever there was an apt statement for our times it is this one. I happen to believe that the West in general, but more egregiously the U.S. in particular, have undertaken changes to their economies that make comparisons to past experience dubious at best and worthless at worst for predicting the future. The laws of trade have not changed in several thousand years; you need to exchange products – service or otherwise – in order to survive. We have been pursuing monetary and fiscal policies that ensure that we have a “Seinfeld economy” (about nothing). This, in turn, breaks the historical link with past experience in forecasting the future. Yet we have acted as if those laws have been suspended and thus we “can” run budget, trade and current account deficits in perpetuity. No country in history has been able to and neither can we. Think about what effect a severe recession in the next 5 years would due to the debt:GDP ratio. It’s not only scary, it’s likely. I doubt raising taxes for all the things everyone in the country wants (and I do mean all of us) will be possible. In fact, we’ll probably have to get use to living with a lot less at least for a while.

On positive side, if there is a country that will be able to take our licks and struggle back it is the US. (We just might have to ask our parents about how to handle a little adversity.)

I agree Footwedge. For me this is also another argument against privatization. It would be great if we had a guarantee that our investments would always go up or at least time retirement / disability for the peaks. If this isn’t enough to convince someone, than let them explain how we handle the transition costs without raising taxes.

The coming recession, hopefully not a depression, is an opportunity for us to once again reevaluate what is important to us.

Bill,

I haven’t heard your arguments since the Soviet Union crashed. Do you like such large capital projects as electric utilities, auto manufacturing, and on and on? Your call for redistribution would hinder capital expenditures and return us to a subsistence living.

I know your intention is not to take your redistributionist ideas that far but with health care consuming 16-17% of national output you are suggesting a massive redistribution of wealth and a great hinderance to capital accumulation to improve economic output.

If you know anything about 401Ks you can see the power of HSAs. 401Ks are creating millionaires as would HSAs.

Finally, on a moral basis, what gives you the right to force Rich and his daughters to fund your health care?

DickF says: Imagine a total government system where the govenment pays the doctor and you can go anytime you want. How long do you believe the waiting line would be?

Yes, because if there’s two things Americans enjoy doing in their spare time it’s 1) standing in lines and 2) going to the doctor.

Bill-

I think you missed my point on where the government gets the money. All money must be extracted from the citizens, either through taxes or inflation. We get “free” healthcare, but we lose our ability to purchase things to the tune of the taxes we pay. I would rather the government not force me to purchase healthcare and let me keep the money. If there remains a need to help those who cannot afford healthcare – surely a minority of the population – that’s a separate matter.

Rich,

Under our current system those who do not have health insurance or medicare/medicade still receive treatment. Just because they do not have insurance does not mean they do not receive care. Most, I would assume you and I, have no problem with taking care of such people. Where we have a concern is with the health care of middle class and upper class America.

The Democrats are currently attempting to pull all children into the government system no matter what the income of their family. It is pretty clear that this is just more incremental implementation of a socialized system and has nothing to do with actual care.

“Well, Bill, the country got along without Social Security for approximately 160 years and without Medicare for approximately 190 years, so the idea that government “insurance” made the country great is without merit. It certainly has made the country indebted, I will grant you.”

Yes, and in those great low-spending times of yore, senior poverty was exponentially higher than today, overall poverty ran in the low 20-percent range even in times of prosperity, and people’s life expectancies were signifcantly less. I think we’re better off today with these “burdensome programs.”

And yes, government health care might mean long lines and rationed types of care with money taken out of your paycheck to help pay for the program. And this is different from long lines, rationed types of care and money taken out of your paycheck today because….

Oh wait, I got it. In a government or non-profit system, the money doesn’t go to a for-profit corporation that can pay its officers millions while raising premiums and cut care however it wants without taxpayer oversight, which drives up costs for businesses to insure their employees, making U.S. businesses less competitive. Ah, THERE’S the difference you’ve all been looking for.

Rich / DickF: I suggest you read the NY Times article, “Whats the One Thing Big Business and the Left Have in Common?”, if you want to debate health care and it’s impact on corporate America.

As far as moral rights, I thought it was called a Democracy. At least that’s what I tell myself when I see all our tax dollars going into Iraq and corporate welfare.

The attacks on SCHIP are beyond ridiculous. Do some fact checking!

How many more generations before we start talking about the debt and not just the defecit?

Anon,

Corporate America loves government funded health care because it takes the burden off of them. They jumped into the health care business because of government action allowing them to deduct the expense, or cover employees tax exempt. Now they are suffering the consequences of government targeted-subsidy price inflation of health care.

No, we are not a democracy. We are a republic. I won’t go into the details of why. We do not have a RIGHT to vote to take someones property and give it to another even if the government think it is okay. Our nation was founded and became great because of property rights.

The [SCHIP] bill would massively expand government health coverage to include 90% of children who are currently already privately insured. 71% of the children in the U.S. would be eligible for taxpayer subsidized medical care, including those in the country illegally. Families of four making up to $83,000 would receive government healthcare coverage practically free. It is a sneaky step towards nationalized healthcare….

The House voted on August 1st to increase funding for SCHIP by $50 billion. The Senate version… would increase funding by $35 billion. Bush is proposing an increase of $5 billion instead.

The Congressional Budget Office estimated that the House version would create a $72.9 billion deficit over the next 10 years. The House version would limit the program to those living at 200% of the poverty level, although for some that would increase to 250%…. The expansion raises the age eligibility to 24.

According to the nonpartisan Congressional Budget Office: 4.3 million of the 4.9 million otherwise-uninsured children who would gain coverage under the bill the House Energy and Commerce Committee is expected to approve in the next few days have incomes below states current eligibility limits; and 3.5 million of the 4 million otherwise-uninsured children who would gain coverage under the bill the Senate Finance Committee approved last week have incomes below states current eligibility limits.

and more…

Most SCHIP (and Medicaid) beneficiaries receive coverage through private managed care plans that contract with their states, not through government doctors. The American Medical Association and the trade associations for the private insurance companies and the drug companies hardly supporters of government run health care, a single-payer system, or socialized medicine support the efforts in Congress to use SCHIP to cover substantially more uninsured low-income children.

Bill,

I didn’t know there were any government doctors. Do you mean military doctors?

How much good does it take to wipe out a bad decision? How many low income children must be supported to justify supporting a high income child? How much health insurance does it take to give health care to a society with no doctors or nothing but incompetent doctors?

(I’m a different Bill btw)

I’m assuming by government doctors, Bill means doctors employed by the government. As there are thousands of in the UK, France and Germany for example.

With free health care at the point of need, both rich and poor children can recieve the health care they need. As in the UK, France and Germany for example.

As far as I’m aware in all the countries, the cost of health care as a % of GDP is far lower than in the US.