Glad I wasn’t trying to provide a play-by-play explanation of fed funds futures last week. But whatever was going on, we seemed to end up with the same conclusion with which the week began.

A week ago I offered my (invaluable yet nonetheless free) opinions as to what was driving fed funds futures. At that time I opined that the market shared my pessimistic interpretation of the most recent economic data, and that a fed funds rate cut by the October 30/31 meeting now seemed fairly likely. Monday seemed to tell the same story, but on Tuesday and Wednesday, the fed funds futures retracted, with the November contract falling back down to a price of 94.875 (corresponding to an expected November fed funds rate of 5.125%, which would be consistent with a 50% or greater chance of no cut at all from the current 5.25% target), only to surge back up again on Thursday and Friday to 95.095, consistent with an expected November interest rate below 5%. If I had offered a play-by-play, I suppose I would have described this as a surge in optimism midweek that was beaten down and then some by week’s end.

|

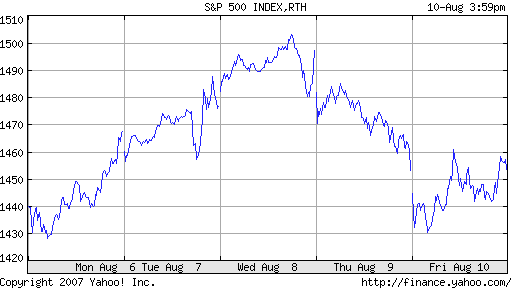

One sees a similar pattern in stock prices, though these ended the week slightly positive,

|

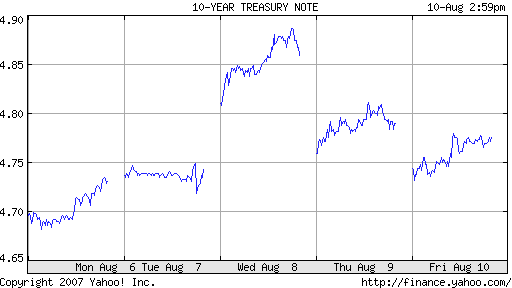

and long-term bond yields, presuming you buy my thesis that in the current environment, rising yields tend to signal expectations of improving real economic activity.

|

The end-of-week pessimism is perhaps easily attributed to the latest liquidity events. But what was the favorable, if ephemeral, news on Tuesday and Wednesday? If I knew the answer to that, perhaps my invaluable advice would be less free.

But a week later, I’m still worried, and it looks like I have plenty of company.

Technorati Tags: macroeconomics,

Federal Reserve,

interest rates,

yield curve,

fed funds,

fed funds futures,

economics

I read a plausible idea on another blog …the Fed on Tuesday basically said inflation was still the main worry and they didn’t expect any other significant problems. The market read this as good news (i.e. If the Fed thinks the economy is still good who are we to argue??). So the market drifted higher until the melt down started in Europe Friday morning.

I’m rather annoyed actually …if the Fed hadn’t stepped in to defend the 5.25% rate I might have gotten my 10%+ drop finally. I’m short everything at the moment except BRK and some commodities…

Maybe my limited knowledge of eonomcis makes me ignorant. but how does the Fed printing billions in currency lead to lower inflation?

The huge tick up on money supply will push rates much higher in the medium term, especially if the people on the street start to lose confidence in the fiat money.

I’m inclined to agree with NoFate. However, the IKB, MacQuarie, Sowood and BNP meltdowns are testing Bernanke’s credibility re so-called subprime “containment.”

Mr. Market is more aware than he was a week ago, but still doesn’t get it: there’s hundreds of billions of dollars in questionable paper out there. No one knows who’s holding, or what it’s worth. In my view, the fed and other central banks will be engaged in massive repos for months-every time a bank or hedge fund blows up and Mr. Market gets angst-until it’s sorted out. Meanwhile, we have a weakening economy. Real confidence-building stuff.

I expect another brutal day tomorrow if retail and inventory numbers come in even slightly bearish.

Cityunslicker, as long as these are held as desired excess reserves, there will be zero increase in the money supply. If these are not desired as excess reserves, the Fed will need to drain reserves next week in following the same program of achieving the target 5.25% fed funds rate.

Note again that the rp means these reserves will disappear on Monday. If that isn’t enough, we will see open market sales next week.

Current month CBOT Fed Funds Futures are now at 94.96, implying a current month average of 5.04%.

I’ve seen speculation that the target rate will be cut imminently. I’ve also seen official data indicating that Fed Funds are trading well below target.

Can someone explain how the yen rising significantly in the last week (now around 114 from 123) relates to this? The carry-trade’s been talked about before, but how does the exchange of dollars for yen (which I suppose would be the reason for this steep rise) relate to liquidity problems?