Macroeconomic Advisers says the probability of recession is less than 50%.

“While it suggests the probability of a recession has gone up in the last month it is still well below 50 percent,” Prakken told Reuters. “It’s a slightly higher higher risk than it was a month ago but it’s still not a dominant risk.”

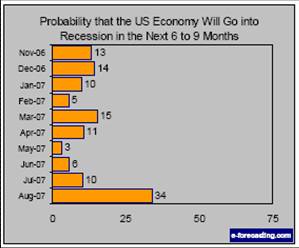

Based on August data, e-forecasting cites in their newsletter (no link) a 34% probability based on their leading economic indicator index, a composite of seven variables, with weights inversely related to the component variability (documentation here).

The figure below shows how the probability of recession has risen according to the e-LEI.

Figure from e-LEI September newsletter.

In contrast, coming from a non-scientific direction, WSJ is doing an online poll of recession predictions. When I checked (8pm Eastern on Thursday), 48% said the economy in the next six months will — or has already gone — into recession; 52% said no recession.

Finally, something from the prediction markets. MidasOracle has some interesting graphs showing the evolution of the intrade’s views on recession probabilities in 2007 and 2008. It looks like the bettors are guessing over 45% probability in 2008 (although on low volume), as shown in the figure below.

Figure from MidasOracle.

Technorati Tags: href=”http://www.technorati.com/tags/recession”>recession,

leading economic indicators,

prediction markets.

Well, all those economists that were predicting 110,000 new jobs in August didn’t do so well. And as Dean Baker points out “In the fall of 2000, just six months before the last recession, the “Blue Chip” 50 forecasters were unanimous in projecting strong growth for 2001.”

If the forecasters are 50-50 now, it must be time to head for the bomb shelter.

Joseph,

I agree that most economists focusing on the data have been bullish and wrong. But those bears who kept warning for a long time about asset bubbles and potential recession–Stephen Roach, Dean Baker, Nouriel Ruubini, Gary Schilling, Paul Krugman, Robert Shiller, among others, were too early in making that call–so much so, that as the years went by, many ignored them.

It is impossible to make accurate predictions about the decisions and behaviors of millions/billions of people. The capitalist system is founded on certain fundamental deceptions–the assumption that people can somehow divine such behaviors correctly, the witholding of information about true costs, etc. But in the absence of alternative systems that provide the same level of individual freedoms, people quietly go along with such deception–just say ‘caveat emptor.’ It helps to keep this in mind always.

Baker, Shiller, etc were right about the bubbles, both tech and housing, but as you point out, you can’t time the market because no one knows how long the bubble will last — one year, five years or ten years — nor how fast it will deflate.

That’s why I like JDH’s recession probability index. As Yogi Berra pointed out, predictions are tough, especially about the future. Instead, JDH’s index attempts to predict the past but just tries to do it a little earlier than the NBER.

It is impossible to make accurate predictions about the decisions and behaviors of millions/billions of people.

Or even the Fed.

The data that many people make a definite statement is always out of date, by days, months or years (you can ‘probably’ see where I’m going at this point).

That so many more people are talking about the possibility of a recession does bear (no pun intended) thinking about. That the US hasn’t been in a recession for years will weigh on peoples’ minds, and forecasting isn’t only a science, but also an art. That so many more are forecasting a recession leads me to believe we are either in one now, or soon will be.

Armaggedon, on the other hand, is pure fiction and was once the preserve of the lunatics in their country shacks, complete with tins of food, guns and water purifying tablets. The thing that has surprised me is (normally) rational people actually debating when or if this could happen. Then again, I believed that planes could fall out of the sky when the 3rd millenium started.

While it may be impossible to forecast a recession with absolute 100% certainty, we went on record in April with a forecast of a twenty + month recession starting this year. We now think a two year recession, or at least a major slowdown in the economy, is most likely. You can see details of our research at Van Schaik’s Economic Outlook – http://jpetervanschaik.googlepages.com