The OECD has just released What is the economic outlook for OECD countries? An interim assessment (5th September 2007), which reduces US 2007 y/y growth by 0.2 percentage points relative to what was forecasted five months ago. Yet, in a testament to how fast-moving the situation is, that reduction in growth estimates might have been too conservative (consider today’s pending house sales numbers).

The report states:

1. The turnaround in the US housing market and the woes in its sub-prime mortgage segment were highlighted as a pivotal element of the global business cycle in the May 2007 OECD Economic Outlook, and have since triggered a more general reassessment of risks. To date, swift and forceful central bank action has helped contain the ensuing financial market turbulence. While it is too early to gauge to what extent the repricing observed so far – and possible further financial adjustments – will affect prospects for activity, it has happened at a point in time when world economic momentum was still strong. Hence, the May 2007 OECD growth projections for the year as a whole are not revised that much. However, year averages mainly reflect past developments and prospects going forward are now clearly less buoyant and more uncertain. Downside risks have become more ominous, in a context where overall financial market conditions are likely to remain durably tighter.

2. In the United States, durable goods orders and household spending were up going into the third quarter, and profit margins are ample, albeit declining. However, the housing sector is set to exert a longer and more potent than expected drag, and confidence has weakened. As a result, GDP growth is projected to fall distinctly below potential during the second half of this year, following the strong rebound in the second quarter. All in all, our growth estimates may err on the upside, since it has not yet been possible to fully evaluate the negative impact of credit market turbulences on economic activity. In any event, consumer resilience will be tested by mortgage rate resets, tighter credit standards, weaker collaterals and slower job creation.

3. Contrasting with developments across the Atlantic, activity decelerated in the second quarter in the euro area at large and in most of its economies. While consumer confidence is fairly elevated, consistent with receding unemployment, retail sales have remained subdued. Business sentiment has been dented by the financial turmoil, but expectations are still fairly upbeat. Accordingly, growth should pick up to around potential in the euro area, including the three larger economies, in the second half of the year. Nevertheless, the peak of the euro area growth upswing now seems to lie behind.

…5. The major central banks generally face an economic outlook characterised by scant spare capacity and unemployment rates close to or below their structural levels, as well as high energy prices and rapidly rising food prices. Outside Japan, inflation rates – despite recent easing in some cases – are still at the high end of what is consistent with price stability. At the same time, they are confronting risks to financial stability, which have prompted them to step in with large but temporary injections of liquidity. An important requirement in this respect is to avoid a situation where excess risk taking would be bailed out. Hence, besides short-run liquidity management, monetary policy and interest rate setting should continue to focus on prospects for inflation and economic activity. In that light, there may be a case for some easing in the US federal funds target rate, following the August cut in the discount rate. In the euro area, rising underlying inflation pressures, partly related to the evaporation of labour market slack, would seem to warrant some further tightening once financial market conditions have steadied and the recovery develops as expected. In Japan, it is advisable to wait for market volatility to quiet down and for a durable end to deflation before hiking the policy rate further.

6. Recent developments have revealed serious imperfections in the functioning of US housing markets and, more broadly, in credit markets worldwide. Markets will learn from recent mistakes through the usual “learning-by-doing” process. Such progress may nonetheless be enhanced by improved regulation. There may be a need, for instance, for more encompassing supervision of US sub-prime mortgage markets, with greater attention to non-bank originators which have often evaded effective scrutiny. As well, there may be a case for a more active fight against predatory lending, including through better disclosure and education. More transparency also seems to be called for in credit markets, where securitisation has made risk assessment increasingly difficult for many investors, leading to widespread loss of confidence. Given the swathe of re-ratings in recent months, more pugnacious and inquisitive rating agencies could help bring this about.…

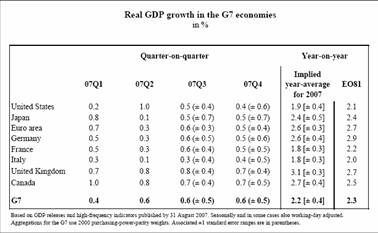

Here’s the relevant table.

Source: OECD, “What is the economic outlook for OECD countries? An interim assessment” (5th September 2007)

While 0.2 ppts doesn’t sound like much, a revision concentrated in a couple quarter’s worth of growth (and taking into account the upside surprise in Q2 growth) is actually somewhat more consequential than it sounds like originally. And this is a conservative downward revision…

The other notable downward revision is in the core euro area countries of Germany (0.3 ppts), France and Italy (0.2 ppts).

Does OECD, or anyone else, keep track of the accuracy of the GDP forecasts made by the OECD? In other words, is this downward revision likely to happen – based on past performance of the forecasters?

Mike Laird: Here are some studies of the OECD forecasts: Lenain at OECD, and Batchelor (2000).

Thanks, Menzie