The U.S. economy appears to be slowing. Predictions of continued growth probably rely on assumptions the rest of the world continues to grow. How reasonable is this view?

This article from Bloomberg provides a skeptical view:

Global Growth Threatened as U.S. Contagion Spreads (Update1)

By Rich Miller

Sept. 10 (Bloomberg) — This time, when the U.S. sneezes, the rest of the world may well catch a cold.

Global economic growth looks likely to slow markedly in the months ahead as further weakness in the U.S. infects Asia and Europe. That would represent a shift from the last 18 months, when the world economy proved immune to a U.S. slowdown and grew at an annual clip of more than 5 percent.

What’s different now is the U.S. slump is starting to spread from the domestic housing market to consumers who buy imports from companies such as Toyota Motor Corp. And the sudden increase in borrowing costs that followed the collapse of the subprime-mortgage market is now showing up overseas, raising the price tag on credit worldwide.

“It will be a much bigger deal this time,” says Raghuram Rajan, a former chief economist for the International Monetary Fund who’s now a professor at the University of Chicago. “I don’t see growth falling off a cliff, but it will slow.”

If growth in the U.S. slips below 2 percent from an average of 2.3 percent in the first half, the global economy may suffer a modest slowdown to about 4.75 percent, say forecasters at Morgan Stanley & Co., Global Insight and the Economist Intelligence Unit. The contagion from a U.S. recession would hurt more, cutting global growth to 3.5 percent or less.

‘Major Problem’

“If we have a major problem in the U.S., the rest of the world will feel an impact,” says Otmar Issing, former chief economist of the European Central Bank.

Faced with an unsettled global outlook, central bankers in England, Europe, Canada, Australia and South Korea held back on raising interest rates last week. In the U.S., futures-market traders are betting that Federal Reserve Chairman Ben S. Bernanke and his colleagues will cut rates when they meet on Sept. 18.

The world economy is most at risk when a shock — like the steep oil-price increases of the 1970s — hits the U.S. and other nations simultaneously, according to an April IMF study. That’s what seems to be happening now, as global investors and lenders turn more cautious in response to rising delinquencies on loans to borrowers with patchy credit.

To be sure, the world economy is stronger than it was when turmoil last struck credit markets a decade ago, driving much of Asia into recession.

Slower Growth

Still, there’s agreement that global growth will suffer — even among some prominent Wall Street proponents of the theory that the rest of the world can “decouple” from the U.S., including Jim O’Neill, chief economist at Goldman Sachs Group Inc., and Stephen Jen, head of foreign-exchange research for Morgan Stanley, both in London.

While Luxembourg Prime Minister and Finance Minister Jean-Claude Juncker doesn’t see a “major” hit in 2007 for the 13 nations that use the euro, “there could be a stronger impact” next year, he told reporters Sept. 5. Juncker is the chairman of a panel of euro-zone finance ministers.

Even before the latest rise in borrowing costs, some of Europe’s strongest housing markets were showing signs of weakness. Spanish home starts plunged 21 percent in May, virtually wiping out growth for the year, while Irish house prices suffered their first annual decline in at least a decade in July.

Qualceram Shires Plc, an Irish maker of ceramic bathroom sinks and toilets, said on Sept. 4 that its first-half profits fell 7.4 percent as cooling property markets in Ireland and the U.K. reduced sales.

Trouble Ahead

There could be further trouble ahead. U.K. lenders, including Merrill Lynch & Co.’s Mortgages Plc unit and Deutsche Bank AG, are tightening terms on home loans, raising the cost for borrowers with less-than-perfect credit ratings.

“The same person trying to get a mortgage will find the situation more difficult now than three months ago,” says Fionnuala Earley, chief economist at Nationwide Building Society, the U.K.’s fifth-biggest home lender.

European companies also face higher costs as the region’s banks become stingier with their money, says Adam Posen, a former Fed official who is now at the Peterson Institute for International Economics in Washington.

German business confidence fell to a 10-month low in August after a rise in the cost of credit, according to the Munich- based Ifo Institute for Economic Research.

Tighter Credit

While tighter credit will take a toll on Asia, the region’s economies are even more vulnerable to a slowdown in U.S. demand for their products. Consumer spending, which accounts for about 70 percent of the U.S. economy, rose at an annual rate of 1.4 percent in the second quarter, its slowest pace in a year.

Asia is “still heavily dependent on exports,” Stephen Roach, chairman of Morgan Stanley in Asia, said in an interview on Sept. 6. “And the largest market for most Asian economies remains the overly extended American consumer, who I think is the next shoe to drop in the subprime shake-out scenario.”

Some Asian countries are already feeling the impact. The growth of Thailand’s exports slowed to an annual rate of about 6 percent in July and August from 18.1 percent in June. Malaysia’s exports declined for a second straight month in July as waning U.S. demand reduced shipments of electrical and electronic goods.

Even China’s booming economy is susceptible to a consumer-led slowdown. The U.S. is China’s biggest single-nation trading partner, accounting for nearly one-fifth of its record $107.7 billion exports in July.

‘Serious Risk’

“The rising probability of a U.S. recession and growing trade protectionism means China’s export growth is at serious risk,” Huang Yiping, chief Asia economist at Citigroup Inc. in Hong Kong, said in an Aug. 30 report to clients.

Faced with inflation at a 10-year high, China has raised interest rates and acted to curb bank lending to cool its overheated economy. Sun Mingchun, an economist for Lehman Brothers Holdings in Hong Kong, said in an Aug. 31 note that those concerns “could be turned on their head if the global economy turns down sharply.”

Japan, Asia’s biggest economy, is already showing signs of faltering. Gross domestic product contracted at a 1.2 percent annual pace in the second quarter, almost twice the rate forecast by economists, as companies pared spending and net exports failed to contribute to growth, a report today showed.

Toyota, Japan’s largest automaker, saw its U.S. sales drop for the second straight month in August, the first back-to-back decline in 4 1/2 years. Weaker demand in California, Toyota’s biggest U.S. market and one of the states where housing is slumping, was partially to blame.

“There is a lack of confidence over where the economy is heading,” Bob Carter, head of U.S. sales for the Toyota brand, said on Sept. 5. The Toyota City, Japan-based company “would welcome” a Fed interest-rate cut, he added.

So, as I noted before, even if the dollar depreciates further as a consequence of loosening monetary policy, this might not be sufficient to offset other contractionary forces. This makes the impact of monetary policy more “conditional” on what’s going on in the rest of the world, than when business fixed investment and housing were spurred in the late 1990’s and in the early 2000’s, respsectively.

I think decoupling was mostly (although not completely) thought of in terms of trade flows. Here we see that the effects seem to be working primarily through interlinked financial markets. Given the relative novelty of CDO’s in an environment of uncertainty, we have limited guidance from previous episodes financial turmoil, in terms of guaging the impact on the real side of the economy.

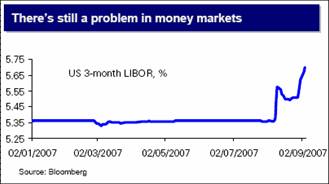

The fact that markets are still in turmoil can be illustrated by looking at the LIBOR rate (courtesy of Gertjan Vlieghe, Economic Update, Deutsche Bank, 7 September).

Source: Gertjan Vlieghe, Economic Update, Deutsche Bank, 7 September.

Deutsche Bank in its latest Global Economic Perspectives (September 10) takes a stab at calculating the effect on world growth of the credit crunch:

“…Our main scenario is that the

immediate crisis is successfully resolved and we reach

the adjustment phase. The simulations above suggest that

tighter credit conditions could shave about 0.3pp off

world growth. Moreover, some additional losses are likely

to occur through credit rationing – we would put them

very tentatively and conservatively at about 0.2pp. Hence,

our baseline scenario suggests a loss of growth of about

½% from earlier expected rates. We need to caution,

however, that our assessment of the effects of credit rationing

is highly tentative. If rationing were more severe, a

credit crunch and recession could still emerge.”

Note that this is the optimistic scenario.

Technorati Tags: decoupling scenario,

recession,

credit crunch.

Monetary policy can destroy an economy but it only helps an economy when the monetary authority corrects its prior mistakes. What this means is that debasement of the dollar will not in any way create more business. We need a stable dollar and that is what the FED is not giving us.

What has been happening is that the FED has used its interest rate methodology to damage the economy in an attempt to control a nonexistent inflation.

It will take time to work through the mistakes of the FED concerning interest rates but this will only begin if they lower interest rates to non-contractionary level.

As is proven by the current credit mess by the time the FED sees a problem it is has already become a crisis.

But the greatest danger to world prosperity is fiscal. Currently we are seeing such things as the AMT and state and local taxes eating away the gains from the Bush tax cuts. Taxes are increasing every year without the Democrats doing anything. If this continues the economy will get worse and worse and a decline in the US will effect the whole world.

Concerning Europe and Asia, most countries will follow the US into recession, but China actually has the best chance of decoupling. Robert Mundell has been encouraging the Chinese to invigorate their domestic economy. A decline in the US might just force China to do just that. If they maintain a stable currency with low domestic taxes they would come out of a US led recession stronger than they went in and they could be a formidable economic force.

Taxes are increasing every year without the Democrats doing anything.

Prosperity produces automatic tax increases as people are pushed into higher tax brackets via income growth. It’s an ironclad law. It should be named after somebody. “Buzzcut’s Law”.

Menzie, your analysis seems reasonable. My only quibble is that one of your memes is that the voracious and overextended appetite of the American consumer is responsible for the trade deficit.

But this analysis shows that the American consumer is the consumer of not only last resort, but also first resort. What is really needed is for other countries to become less mercantalistic, less export oriented, and more domestic consumer oriented.

China will not decouple. They have geared their production to export to foreign consumers whose demand is unsustainable. They will discover that they have misallocated more resources than anyone.

Americans love to consume, We buy “Stuff We don’t need, with money We don’t have from People We do not know”. With Our Home Equity long gone,energy costs up due to the cooling, and heating of our Mcmansions, driving our gas guzzling SUV’s, higher insurance costs, from health care to homeowners, higher tuition costs for our kids, higher food costs due to corn being diverted to ethanol, ROW eating burgers and fries, and a big wage tax increase looming for Bush’s spending spree, the American consumer will have to cut back, and the exporting nations will feel this drop, and their GDP’s will decline accordingly.

The big unknown for the economy will come in October and November, when the holiday shopping season begins, I predict a 7% decline over last years, but the big test will come in Q1 of 2007, what stimuli will drive growth after the holiday season is over?

Thanks for that international perspective Menzie. The LIBOR is important because a significant portion of the ARMs that are resetting in the next few quarters are tied to that rate and not the Fed rate, no?

James writes We buy “Stuff We don’t need, with money We don’t have from People We do not know”. and the last part needs some modification to illustrate that there is a difference now when you buy a foreign made item from someone you don’t than buying a domestic item from someone you usually don’t know either. The purchase confirms/reinforces the practice of off-shoring, increases the likelihood that more domestic jobs will lost and strengthens transnational co-ventures at the expense of local entrepreneurs and local workers.

Yes, calmo When I said, “People You don’t know”, I meant non US sources. If we go into recession or not, I think everyone believes in a slower groeth scenario, and to “preserve profits” offshoring of labor will increase to offset lower revenues, so You are right that a slowdown/recession will further the quest for cheaper “commodities” aka the American worker.

Buzzcut wrote:

Prosperity produces automatic tax increases as people are pushed into higher tax brackets via income growth. It’s an ironclad law.

Buzzcut,

Take a look at Japan during the 1950s and 60s. This was perhaps the most proserous period in Japanese history. Every year during this period the Japanese cut taxes so the tax burden was constantly dropping on the people. But what you will also find is that total tax revenue received by the government continued to climb during this period. It was classic Supply Side.

My point is that automatic tax increases only come from progressive tax systems. A combination of progressive taxes (income tax brackets, AMT) and inflation is devastating to an economy. The Democrats have found that this is the best system for them to use to raise taxes because the tax increases come from them doing nothing so they do not have to answer to the voters concerning voting for tax increases. The Stupid Party (Republicans) play right into their hands by adding sunset provisions to tax cuts. It is the same thing.

algernon wrote:

China will not decouple. They have geared their production to export to foreign consumers whose demand is unsustainable.

True – unless economic conditions force them to take different path. This is my point. They may be forced to develop their domestic markets by a worldwide recession.

Dick F

Recession will force them to correct mistakes, as usual–unless the Central Bank tries to short-ciruit them as ours did in ’02-’03, but the misallocation has already occurred & will inflict a cost. Perhaps their massive saving rate will assuage their downturn.