…or putting some bounds on the magnitudes of effects.

knzn at Economics and… had an interesting post the other day on “The Indirect Effects of Export Demand”, which seems particularly germane to the current situation. After all, net export demand is one of the few bright spots in the US economy.

In knzn’s post, he notes:

Today let us be thankful for multiplier and accelerator effects. And in any case let us at least be aware of multiplier and accelerator effects. In particular, if you want to talk about the potential role of export demand in preventing a US recession, the story you tell should mostly be about multiplier and accelerator effects rather than direct effects. If you tell the story without mentioning multiplier and accelerator effects, the prospect looks pretty dismal…

He continues with a nice discussion of the basics of the Keynesian multiplier in an economy without taxes (approximately) and without a financial sector (or one at least with a flat LM curve).

A little quick Keynesian arithmetic should make the point. Let’s suppose that the marginal propensity to consume is 0.7. That is, for every dollar in new income that households receive, they increase their consumption by 70 cents. (There may be other things happening simultaneously that reduce their consumption, so I don’t necessarily expect consumption to grow at 0.7 of the growth rate of income, but 0.7 seems plausible to me as an estimate of the direct effect of income. It’s certainly a lot more conservative than what we would get from the rule of thumb that takes the average propensity to consume as an estimate of the marginal propensity.) Then, as the familiar story goes, people in the export industry will spend 70% of their new income; then the people from whom they buy will spend 70% of their new income; and the people from whom those people buy will spend 70% of their new income; and so on. The sum of that infinite series is 1/(1-0.7) or 3.3. The total effect of that hypothesized 1 percentage point contribution from export growth becomes 3.3 percentage points. Suddenly I’m glad the actual export contribution is unlikely to be that high: I wouldn’t want the Fed to have to raise interest rates dramatically to prevent overheating.

I think it’s very useful to have these rules-of-thumb handy to cross-check the many assertions that fly around. At the same time, one often wishes for rules-of-thumb that control for other effects. For instance, in the standard IS-LM model [pdf] I work out in intermediate macro courses, one incorporates the effect of transactions based crowding out; this tends to reduce the Keynesian multiplier. One also wants to account for leakage [pdf] due to the fact that the marginal propensity to import is probably around 0.10. On the other hand, we know there are repercussion effects [pdf] in an open economy. When our GDP rises, that induces more imports — but those imports are the rest-of-the-world’s exports, so GDP abroad rises partly as a consequence of our export surge (at least the exogenous component). And there is, as knzn points out, the accelerator effect which links investment to changes in GDP. A lot of stuff to keep in mind, even for back of the envelope calculations.

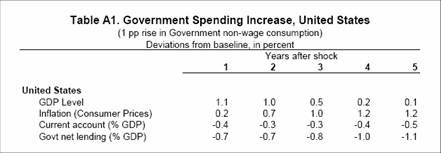

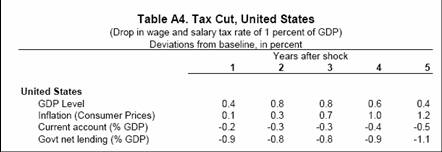

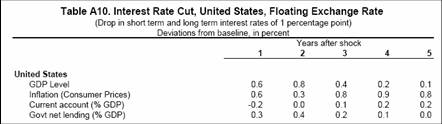

So in the spirit of better informing our debates on what is likely to happen, I invite people to contribute their estimates of multipliers (or where they’ve found listings of multiplers). I’ll start off the process with the ones I’ve found useful: from the OECD’s Interlink model (documented in this working paper by Dalsgaard, Andre and Richardson (2001)).

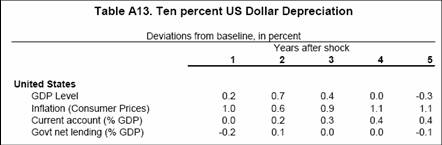

Note: The dollar depreciation has to be interpreted as an exogenously induced drop in the exchange rate associated with a risk premium change.

In the excerpt from Table A1, the responses can be read as the change in GDP relative to baseline, for a one percentage point change in government consumption spending, expressed as a share of GDP. If you work out the units in which this is measured in, it’s sort of analogous to the simple real dollar for real dollar change multipliers we teach in class {specifically, instead of dY/dG, we have (dY/Ybl)/(dGbl/Ybl) ]. The succeeding excerpts are for tax cuts, interest rate cuts, and (exogenous) exchange rate depreciations.

In these excerpts, I’ve omitted the spillover effects on other economies. The interested reader can refer to the working paper for details.

One point that the reader will note is that there is no multiplier for “autonomous net exports”, which is the closest to the boost in net exports people have been discussing (kind of — it depends how much you attribute to the dollar depreciation). But if one takes the government spending multiplier as being similar to multipliers for other types of autonomous spending, then one could use the government spending multiplier as the lower bound (here, I’m assuming there is some portfolio crowding out that occurs with deficit financed government spending).

Personally, I think a better way of getting at this issue is to consider how much of the drop in the dollar has been due to monetary policy, and how much is due to an exogenous decline in the demand for dollar assets. A tough question, but I think one can probably think of the portion that’s taken place since asset backed securities markets blew up (around 5% on the broad Fed index since mid-’07) as kind of an exogenous increase in the risk premium associated with dollar assets.

A couple of caveats. As PGL pointed out in a previous post on multipliers, the Interlink model has a few odd assumptions built in (or at least built into the simulations used to generate the implied multipliers). So the implied multipliers from Macroeconomic Advisers, and the other econometric models, would be welcome. (And if anybody’s got a credit crunch multiplier, well that would be very interesting…

Disclaimer: I know that for anybody who’s received an economics PhD in the past 20 years, this post is hopelessly old-fashioned. But, even those who learned the econometric policy evaluation critique (a.k.a., “the Lucas critique”) in their first year of studies remember that if the policy changes are not drastic, then the multipliers (convolutions of the correlations) will still be informative. For those schooled in the last ten years, they are even more likely to dismiss the entire discussion. But to the extent the DSGEs in use now are calibrated to mimic the dynamics of these macroeconometric models, well, think of these multipliers as super-ad hoc approximations. In any case, a nuanced view of the usefulness of models like that of Macroeconomic Advisers’ is provided by Mankiw [pdf].

Technorati Tags: budget deficit,

fiscal policy, monetary policy,

crowding out, exports,

exchange rate.

Hmmm, so pgl says it is about 2.5, assuming nothing funny with monetary policy or exchange rates. I shall go for more like 2.0, which is the “back of the envelope” number used by a lot of regional planners and modelers. Where does that come from? Oh, rough approximation from a standard consumption multiplier formula with the numbers to the nearest single digit, mpc=.9, t=.3, mpm=.1. Without any fancy crowding out and all that, those will give about 2 as the answer.

BTW, I do find it a bit amusing how all these DSGE models and their kin pretty much deny multiplier effects. However, you will never find members of chambers of commerce denying multipliers. If a large local employer closes due to import competition, you do not see them cheering gratefully because of the reduced pressure on wages they will be feeling from their workers. Rather, they will be concerned about the decline in sales they will experience, and they will petition their representative and senators to “do something” about that import competition, gosh darn it.

The bottom line is that the first round multiplier effect of any autonomous spending change is usually largely experienced in the local economy where it occurs, then spilling out more broadly in the later rounds. Of course, it is the view implicitly of the DSGE and other recent macro models that those apparent effects will get offset by one or another mechanism in those later rounds in the rest of the economy.

Menzie wrote:

After all, net export demand is one of the few bright spots in the US economy.

Actually, net export demand is an indicator of a weak economy. Countries with net exports are usually commodity and raw material economies sending real goods and assets to other countries for their little pieces of paper or cloth. The fact that export demand has increased tells us that the world would rather give us our little pieces of cloth called dollars back to us and take our hard assets.

The assumption that increased exports is a net gain is myopic. The reasons are dollar inflation eating away at dollars held by the citizens and the losses of exporters with a negative multiplier.

Because the US economy is a mature economy it imports raw materials and sells most of the products to domestic consumers then exports the surplus. If exports are in demand then it means that domestic consumers are subsidizing foreign countries. Discussions of multipliers are always amusing because they almost always only consider one side of the equation.

Keynes flipped economists on their heads and they have had trouble getting right-side-up ever since.

I meant “the losses of importers with a negative multiplier.”

Anonymous,

Another rather primitive but still useful economic notion is that of self-correcting mechanisms. Your description is of trade as a symptom of economic activity. knzn and Menzie are, if I understand properly, looking at the effects of trade. To claim that they are myopic because they have chosen to look at trade from some other perspective than yours may be a bit, well, myopic.

Exports represent demand for US goods. Domestic consumption represents demand for US goods. They are in that sense equivalent. Seen from the perfectly legitimate perspective employed by knzn and our host, if you appreciate the growth implications of domestic demand, you ought to be willing to acknowledge the growth implications of export demand.

I was specifically interested in “the potential role of export demand in preventing a US recession.” In that context, I think one has to assume that the Fed will be reasonably cooperative, since the Fed probably doesn’t want a recession either. So the crowding-out effect that exists in most models isn’t really relevant.

Realistic models for the general case would even include a Fed reaction function, which is like hyper-crowding-out. (In the extreme case, if you assume the Fed fully anticipates the exogenous stimulus and targets output at potential, there would be 100% crowding out.) But this is a special case where I want to hold monetary policy (in the form of an interest rate) constant. To the extent that estimates come from more general models, they may not be relevant to the question I’m considering.

Also, for this question, I don’t think it matters if the export growth is the result of Fed policy or not. The Fed presumably wants to avoid a recession; it can use exports as an indirect instrument to achieve this goal; it can also welcome any help it gets from exogenous export growth. But my question is just whether export growth, whatever the source, can do the trick.

The feedback to Fed policy becomes interesting more from the point of view of judging current Fed policy. Is the Fed being too tight in the face of factors tending to weaken domestic demand? Or is the Fed taking into account likely indirect effects of export growth that others may be missing?

I should also note that realistic, general models will contain price adjustment effects, with the Phillips curve becoming progressively steeper as the horizon increases. At a sufficiently long horizon, the effective multiplier will be near zero, because output always returns to potential. I don’t think these effects are relevant to my question either, but the issue can get quite complicated, as it may depend on things like the shape of the Phillips curve, exogenous inflation influences, the process of forming inflation expectations, and where we are relative to the “target” inflation rate. I would like to assume (as Keynes would, I think) that recessions happen on a nearly flat part of the Phillips curve, but that assumption will obviously be controversial.

knzn: I think you make an excellent observation — that the multiplier depends upon the reaction function of the Federal Reserve, and this may in fact depend upon the state of the economy (although most estimated reaction functions do not incorporate the nonlinearity you hypothesize). The Interlink fiscal multiplier, which does not incorporate the reaction function, then should accord with the scenario you lay out (I think a stronger critique might be on whether a short run MPC of 0.3 makes sense).

A general obseration: I don’t want to be put in the position of defending the Interlink multipliers — I was trying to get people to contribute their estimates of the multipliers. So if you have the relevant documents, send ’em on in. I’ll share the results.

“Disclaimer: I know that for anybody who’s received an economics PhD in the past 20 years, this post is hopelessly old-fashioned. But, even those who learned the econometric policy evaluation critique (a.k.a., “the Lucas critique”) in their first year of studies remember that if the policy changes are not drastic, then the multipliers (convolutions of the correlations) will still be informative.”

Sadly, I have only MBA level training, and the Lucas critique was only mentioned in passing. Would you be able to recommend some reading on these newer, more general, realistic models (as knzn calls them)

To Robert Bell:

An accessible Masters level treatment of some of the newer macroeconomics models is William

Scarth’s Advanced Macro textbook.

Also, Roger Farmer at UCLA is working on a text that re-works some of old Keynesian ideas

Robert Bell: Here’s a quick discussion of the Lucas critique. Expectations consistent macroeconometric models were developed during the late 1980’s and 1990’s in response. The IMF’s Multimod is one example of such a model.

A primer on DSGE’s at the Fund is here.

Thank you very much!

I will check it out.