The dollar falls and oil prices go up. So the two must be related, right?

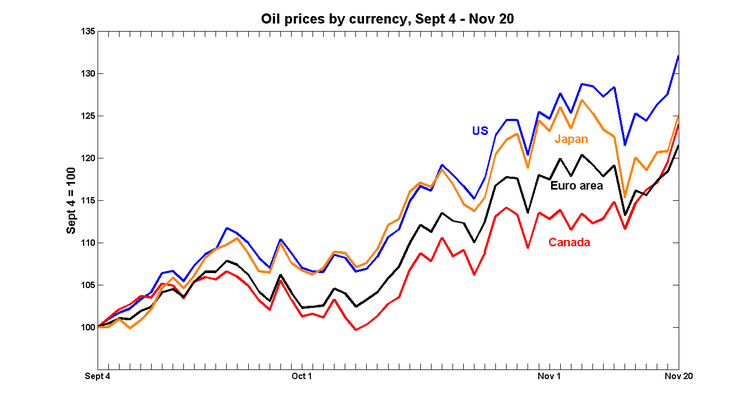

Stephen Gordon has updated his graph of the price of oil measured in four separate currencies, noting that the price for oil-exporting Canada has gone up even more this month than for the oil-importing United States. Blaming the rising price of oil on the falling value of the dollar requires quite a leap of imagination.

|

Not that the facts should get in the way of more blustering from Iranian President Mahmoud Ahmadinejad:

They get our oil and give us a worthless piece of paper….Oil is priced in US dollars on the world market, and the currency’s depreciation has concerned oil producers because it has contributed to rising crude prices and has eroded the value of their dollar reserves.

And Bloomberg quotes Ahmadinejad as asserting:

The dollar has no economic value.

The depreciation of the dollar has certainly been the focus of much discussion by reasonable people recently. And if reasonable people are talking about it, then unreasonable people will also be talking about it. But if you believe that the falling dollar is the explanation for why oil prices are going up, then maybe you also think that Osama Bin Laden’s real mission is to reverse global warming.

Venezuelan President Hugo Chavez also offered his thoughts on the value of the dollar:

The empire of the dollar is crashing…. we had a chance to talk about it in Tehran [on Nov. 19], creating together a sort of currency, a basket of currencies. So instead of carrying out transactions only in dollars, including in that basket the euro, the yen, the yuan and why not the (Venezuelan) bolivar?

I can’t improve on Mish’s analysis:

Before continuing, it is clear that this basket of currencies deserves a name. I propose we call it the WHISIT. This stands for “What the Hell Is It?” But the name does not really matter. If you have a better one, please send it my way.

Regardless of what the basket is called, politics is ruling over sanity.

No one ever buys anything in a basket of currencies. For example, go to the store and try and buy a loaf of bread in WHISITs. It can’t be done. Nor can one buy gas in WHISITs, or for that matter anything else. The same holds true in Europe. I defy anyone to buy anything anywhere in a basket of currencies regardless of what that basket is called. The only way it can be done is by exchanging everything in the basket to the local (favored) currency. What a headache for those walking around with Swiss Francs in their pocket trying to buy a loaf of bread in the US.

The currency in which oil exporters hold their assets matters a great deal. The currency in which the price of oil is quoted matters substantially less. And the latest economic insights offered to the world press by Ahmadinejad and Chavez are to me worth substantially less than those much-maligned pieces of green paper with George Washington’s picture on them.

Technorati Tags: macroeconomics,

inflation,

commodities,

oil,

oil prices,

exchange rates,

dollar

I get your point that the value of the dollar is not the dominant effect in rising oil prices, but certainly it cannot be true that it has no effect. In a world in which the value of a barrel of oil is constant and the value of the dollar goes down, surely the number of dollars per barrel of oil must increase because as an oil producer your fist full of dollars will buy you less stuff. And of course in the real world, the value of a barrel of oil is not constant and seems to be increasing because of scarcity so again the number of dollars per barrel must increase. But how do you separate out the two effects and what are the proportions?

JDH writes, “… the price for oil-exporting Canada has gone up even more this month than for the oil-importing United States.”

Sorry Jim, but this example actually supports the argument that you are attempting to disprove, because the Canadian dollar fell hard against the US dollar this month.

Perhaps you will put up a chart of FXC in an update so that all can see.

Hugo, as always, is right on the point. The dollar is un trozo de papel and oil should be paid in hard currencies like the Venezuelan bolivar, the Angolan kwanza, the Nigerian naira, the Azeri manat and the Irani rial. Cowrie shells should also be in the basket.

You missed this one. The condition of oil and the dollar may not be as Chavez proclaims, but they are related.

The falling dollar (and collapse of some financial markets) has created the next bubble in commodities, where dollars have flown to hide from currency chaos.

Your chart shows only that oil is going up rapidly in every currency “this month.” It still shows significant disparity between currencies over two and a half months, still hardly the long term.

Why only show the last few months? Why not show the change in oil prices since 2001 or the introduction of the Euro so we can get some historical context? A few months of evidence is better than nothing, but certainly not a definitive answer.

Why only show the past few months? Because it’s only in the last few months that we’ve seen a sharp drop in the USD accompanied with a sharp rise in oil prices.

The data are publicly available; knock yourself out.

I believe Professor Hamilton’s message is something along the lines of people not seeing the forest while looking for a particular tree to blame it on. Singling out one, particular, variable as the cause doesn’t explain the overall trend.

Oil and its byproducts are, perhaps, the most convenient sources of energy to package, transport, and use. While it takes more of today’s USDs to equal that of a year ago, drawing a straight line between depreciation and price doesn’t take into account supply and demand and they’re both more relevant, to my mind. If demand was stable, the oil producers would just have to decide whether to increase price and lower demand or take the cut in profit should they actually sell the dollars for non-US goods.

I blame the whole situation on developing nations for not being as far behind in development anymore and would ask they cut back on industry and consumerism. As a US citizen, I demand the right to the lowest cost of food, housing, and transportation so I have more surplus currency to spend on the most prestigious of those very same items, as well as frivolous iCrap.

I guess the dollar has dropped about 10% on international markets. To say that you have to pay 10% more for all foreign goods except oil just doesn’t make any sense. I think that this is propaganda related to politicians saying that the domestic economy is insensitive to the international depreciation of the dollar. The FED champions this view.

I was watching (on internet video) Congressman Ron Paul questioning the FED’s Ben Bernanke on the inflationary effect of the falling dollar and its perjorative effect on people with fixed incomes. Bernanke stated:

“If somebody has their wealth in dollars and they’re going to buy consumer goods in dollars (the typical American), then the only effect that the decline of the dollar has on their buying power is that it makes inported goods more expensive”

I don’t know about this man’s brains, but he sure has a lot of balls! Here is the head FED implying that that a major international devaluation of the dollar is of minor importance, and saying that it will have little effect on the US domestic economy. In fact, this will cause many severe problems for the domestic economy; the most obvious and immediate problems having to do with the dollar-inflation powered, sky-rocketing cost of petroleum. Petroleum is important both as a fuel and and as a raw material. The “typical American” needs fuel to run his car and to heat and cool his house, etc. But say he wants to buy a cake. How will the increased cost of petroleum raise the price of your store-bought cake? Take one by one each ingredient in the cake, starting with wheat flour. The wheat farmer needs fuel and oil for his tractor (plowing, applying fertilizer, harvesting, etc.). Typically, the production of insecticides and fertilizers use (directly or indirectly) petro fuels for processing, and the marketable products include as ingrediants petrolium and/or its derivitives. And all this growing and processing takes place at different locations, so much petroleum based transportation is also involved. So for every cake ingredient and every process in the production hierarchy, an additional cost will be incurred (sort of like a value-added tax on steroids). Maybe you won’t want or be able to afford to buy the cake, and you will have to settle for a cookie!

I guess it really doesn’t matter why oil prices are sky-rocketing–they certainly are doing so, and this is surely going to raise hell with the US economy (especially considering all the other problems of the current US economy).

You’re forgetting the fact that the currency of exchange for oil *is* the dollar (at least for the moment). So, when the dollar devalues, all currency markets experience oil cost increases.

The only other factor of significant importance is supply chain disruption risk. The fact of the matter is that the world’s oil supply runs on very thin production and distribution margins. Future disruption risk to production and distribution are reflected in the current market price for oil.

If Iran were imminent, I would at least expect to see oil in the $150 to $180 per barrel (if not higher) and OPEC to be making strong efforts to move towards a basket of currencies.

So… while OPEC stays on the US dollar, devaluation in the US dollar impacts everyone who buys oil. If anything what you’re seeing is a lag between the devaluation of the US dollar and the exchange rate at which other currencies trade against it (oil went above $100 a week or so ago… the dollar is just now taking a hit in the currency trading markets). Prices at the pump are beating the currency markets… remarkable!

As you requested, I have created the figure showing data since January, 2003. The figure is available at http://www.screenshots.cc/view_image/f9d7d925/oil_prices_2.png

Please feel free to repost as you wish.

Looking at the data over a longer time frame does indeed show substantial separation in the oil priced in various currencies since mid-2005. Exchange rates were taken from oanda.com. Light crude oil prices were taken from http://www.eia.doe.gov/emeu/international/oilprice.html

Let me know if I erred in any of my calculations. I’m interested to know why it appears that as much as half of the increase in US oil prices since 2003 appears to be a result of currency depreciation.

The point is that it doesn’t matter which currency you use, oil prices have been going up. If it really were the case that the increase in oil prices was due to a depreciating USD, oil prices in other currencies would be stable (or even decreasing).

But that’s not the case. The rise in oil prices is not just the obverse side of a depreciating USD; oil prices are rising in all currencies.

Prof Hamilton…and Prof Chinn,

What do you think about portfolio balance effects here? the more commodities priced in dollars, the greater the likely stock of dollars the world is willing to hold for the network externality benefits. Reduce the number of commodities priced in dollars (really, total value of these)and the benefit of holding dollars for transaction purposes declines. Oil is a major commodity so end the pricing of this in dollars and move to say Euros and yen and you potentially generate portfolio effects that shift demand curves for dollars. Possible?

The above is a question about FX valuation, not the international value of oil itself.

JDH wrote: “But if you believe that the falling dollar is the explanation for why oil prices are going up, then maybe you also think that Osama Bin Laden’s real mission is to reverse global warming.”

Bin Laden is green? Fantastic. Does he have a health plan as well?

I think you are wrong with respect to basket currencies

When the Ecu existed you could buy debt in it and i wouldn’t be surprised if organizations like esa had contracts etc. in Ecu.

You could certainly negotiate contracts in Ecu’s.

There is also the question if there were paper currencies that were backed by part gold, part silver as that would be also an example of a currency basket.

Perhaps I’m just stating the obvious, but it seems to me that the increasing spread between the price in dollars and other currencies over time as shown in JDH’s chart represents the decrease in value of the dollar, while the overall upward slope represents the market increase in the value of oil. So while the U.S. price of oil has gone up about 32% during that period, about a quarter of it can be attributed to devaluation of the dollar — not the major cause but not insignificant either.

cowrie shells might fit quite well in any currency basket, at least until some junior banker came up with idea of selling collateralised cowrie dust as a security against which to launch leveraged loans to put on the horses at some racetrack . . . or whatever else it is they do.

if cowrie shells start to appreciate, sell the swiss franc – the swiss have no beaches.

if this sounds ridiculous, that’s as it should be. a global reserve consisting of a privately controlled fiat currency is by its very nature ridiculous. either the dollar will crack up, or more likely unilateralism (with or without limited nuclear war) will crack up.

Joseph: You have it right. The USD depreciation is an aggravating factor for the USD price of oil, but it is far from being anywhere close to being an explanation for the rise in USD-denominated oil prices. Oil is at an all-time high in all of the four currencies I used in that graph.

Note this from the Financial Times:

“[Federal Reserve] Policymakers believe that a 1 per cent decline in the dollar increases the price of oil by at least 1 per cent. Rate cuts reduce the value of the dollar and boost the price of oil in other ways, too, by reducing the risk of a global recession and encouraging the buying of oil by speculators who have lost faith in the dollar as a store of value.”

Here’s the link to the FT article:

http://www.ft.com/cms/s/0/50dbf2a2-9b9c-11dc-8aad-0000779fd2ac.html

Stephen, it is clear that oil prices are going up in all currencies. It is also obvious that it has gone up about twice as much in US dollars compared to the Loonie or the Euro since 2003. The implication is that as much as half of the increase in oil prices in US dollars might be attributable to USD depreciation. Maybe I’m parsing your language, but I feel that you are downplaying the USD depreciation as an explanation. If oil priced in Loonies has gone up 90%, in Euros has gone up 118%, and in USD has gone up 208% since January 2003, then I’m not sure that you can downplay depreciation as a meaningful explanation. Since the numbers look even worse if we choose an earlier start date, I’m not sure that your figure really presents a meaningful historical context.

Isn’t it true that the dollar is the dominate currency in which oil is traded? It would seem, this being the case, that a depreciating dollar would result in the rise in oil prices. Seeing the relationship between a weaker dollar and rising oil prices isn’t to say that there aren’t other factors that contribute to higher oil prices. Nor can one draw a single causal link between higher oil prices and a weaker dollar. It is all much more complex with a multitude of casual factors going both ways.

Although the recent fuss around the dollar-oil causal link is clearly overblown, dollar exchange rate changes may still have an effect on oil demand and consequently prices: see Krichene’s IMF WP: http://www.imf.org/external/pubs/ft/wp/2007/wp07135.pdf

I reproduce below a related assessment of the current oil situation and prospects for 2008 I posted at http://peaktimeviews.blogspot.com/2007/11/assessing-impact-of-current-oil.html

Let’s consider the following points:

Re the USD (part 1):

1. The fall in the dollar’s value since August 2007 has taken place against a backdrop of a slightly improving US trade deficit.

2. From point 1., it is just logical to infer that, if the US trade deficit had instead worsened during that period, the dollar would have fallen further.

Re crude oil prices and supply/demand balance:

3.

On Nov 20, 2006 WTI = $59 and EUR = $1.28, so WTI = EUR 46.

On Nov 20, 2007 WTI = $98 and EUR = $1.48, so WTI = EUR 66.

That’s for a WTI price rise of 66% in dollars and 44% in euros in a year.

4. This yearly WTI price rise cannot be explained by Iran-related geopolitical tensions, which were actually higher a year ago. It cannot be explained by speculative pressure either, since NYMEX net positions a year ago and now are fairly similar. Therefore the price rise can only be explained by a deterioration in physical supply and demand balance.

5. To support the inference in point 4., it’s worth noting that,

on Nov 21, 2005 WTI = $58 and EUR = $1.18, so WTI = EUR 49.

However, on Nov 2005 speculative positions at NYMEX were net short at historic record levels, so a year later we had both increased speculative pressure and increased geopolitical tensions, yet the oil price was roughly the same. Therefore, reasoning like in point 4., we deduce that supply and demand balance should have improved during 2006. And indeed, as we see in the IEA Oil Market Report (OMR) at http://omrpublic.iea.org/, total OECD closing stocks were:

for 4Q2005, 4083 mb amounting to 81 days of forward demand

for 4Q2006, 4180 mb amounting to 84 days of forward demand

6. In contrast, and adding support to point 4., OECD closing stocks for 2Q2007 were the same as for 2Q2006 (in mb and days). But more importantly, OECD stocks experienced a net *draw* of 380 kb/d during 3Q2007, contrasting with a 1160 kb/d net *build* in 3Q2006, and an average 280 kb/d 3Q net *build* over the past five years (and anecdotically, with Japanese crude stocks falling to their lowest level in at least 20 years.) Which clearly shows the worsening in supply/demand balance over 2007.

Re oil production:

7. According to the EIA, world oil production peaked on a monthly basis on May 2005 for (Crude Oil + lease condensate = CO) as well as for (Crude Oil + lease condensate + Natural Gas Plant Liquids = CO + NGL). If we consider All Liquids (which includes biofuels) then the peak month was July 2006.

8. Also from the EIA, for all 3 categories (CO, CO +NGL and All Liquids), production for the first half of 2007 has been the same as (actually slightly lower than) that for the first half of 2006 (73.23 vs 73.48, 81.20 vs 81.26, and 84.28 vs 84.35 mb/d respectively).

9. There are strong reasons that expect that 2008 world oil production will not be higher than in 2007, as shown by Stuart Staniford at

http://www.theoildrum.com/node/3236

Re oil demand and price projection:

10. According to the latest (Nov 13) IEA OMR, average global oil demand was/is expected to be:

for 2006: 84.7 mb/d

for 2007: 85.7 mb/d (+1.2%)

for 2008: 87.7 mb/d (+2.3%)

11. Therefore, with constant production over the 3 years, if a 1.2% increase in demand caused in 44% increase in price in euros, a 2.3% increase in demand can be expected to cause a 44 x 2.3/1.2 = 84% price increase in euros, to a price in Nov 2008 of EUR 121. Assuming EURUSD stays at 1.48, that’s $180. (Realistically, it is very unlikely that stocks experience such big drawdowns during 2008 as to meet all of the projected demand. Rather, the estimated price can be reasonably thought of as that needed for causing the amount of demand destruction that will allow stocks to remain at acceptable levels.)

Re the USD (part 2) and the US economy.

12. However, the EURUSD = 1.48 (and consequent WTI = $180) assumption in point 11. may not be realistic for the following reasons:

a. If US oil and petroleum products imports remain constant, an 84% increase in the oil price can be expected to cause the US trade deficit to worsen, which in turn can be expected to cause a further fall in the dollar (as per points 1. and 2.).

b. An 84% oil price rise will greatly increase the current account surplus of oil exporters and as a result their foreign exchange reserves, very likely to the point of compelling them to at last unpeg their currencies from the dollar and further diversify their foreign exchange reserves from it.

c. Moreover, the $200+ oil price expected to result from factors a. and b. can in turn be expected to increase the pressure for oil exporters to start pricing and trading their resource in other currency/ies, thus adding further downward pressure to the dollar and conceivably taking it to its “Wily E. Coyote moment”.

13. In assessing the impact of a doubling of the oil price on the US economy, (neo)classical economic analysis can be expected to point out that the share of energy in US GDP is still low. Recent oil price action, however, shows how easy it is for the oil price to double, and a doubling here, a doubling there, and pretty soon you’re talking about real share. Therefore a $200+ oil price (which BTW assumes peace and love between the US and Iran) can be reasonably expected to add significant inflationary pressures in the US. If, however, the US Federal Reserve adjusts its monetary policy REACTING to those inflationary pressures once they are manifest, it is very likely that by then the dollar will have already lost a substantial part of its international trade and reserve currency status.

Conclusion:

The currently expected oil supply and demand situation for 2008 portends at least a doubling in the dollar oil price and poses a significant risk of triggering the much-feared collapse in the dollar value. The only alternative is a significant “endogenous” (i.e. not due to higher oil prices) reduction in oil consumption in the main consumers (US, Europe and China, in that order). Which in turn can be reasonably expected to occur only as a result of a US-led OECD recession (causing a Chinese deceleration of economic growth). A new Fed monetary policy focused on the preservation of the dollar value for international transactions through checking its global supply growth can do the trick.

If the ECB does not have the nerve to follow a similar path, and issues whatever amounts of euros are needed e.g. to prevent any recession to happen or any bank from falling, that will lay to rest the expectations of the euro challenging the dollar status as the main international trade and reserve currency.

for what it is worth, I increasingly think there is an “oil/ dollar connection” on the asset side. Right now i get the sense that the oil exporters are more actively diversifying their portfolio (by changing what they buy at the margin) than Asia (and china in particular). Higher oil prices = more funds for the petro-states central banks and oil funds and several now have a targeted dollar share of under 50%, ergo large flows … and an additional source of dollar weakness.

at some point, the dollar will fall enough to make dollar assets attractive to everyone — european private investors as well the oil funds. but we don’t seem there quite yet.

I don’t think anyone believes that there is no connection between oil prices and USD depreciation, but it goes in the way you describe. Which is exactly the opposite of the argument that Ahmadinejad and Chavez are making.

Brad Setser wrote:

at some point, the dollar will fall enough to make dollar assets attractive to everyone — european private investors as well the oil funds. but we don’t seem there quite yet.

This is amazing ignorance for an economist so well respected. An unstable currency is one of the worst wedges in any economy. No one knows what the actual price of products are because the currency is swinging prices around artificially. Businesses cannot plan because they have no idea what things actually cost.

To welcome a falling dollar is most cruel to those in our economy who do not have enough to hold hard assets and deal primarily in dollars. In other words such a welcome of a weak dollar directly attacks the poorest, those in our society who can lease afford the loss of purchasing power.

Professor,

This may be one of your worst postings. To single out Canada’s oil prices for a period of a few days and comparing it to the US price of oil. Then drawing such a strange conclusion that the rest of the chart totally refutes is certainly amazing. The falling dollar is very much contributing to the rise in oil prices as it has since Nixon floated the dollar. Oil was like any other commodity until the dollar was floated, then after the float oil went crazy. It may be the most sensitive commodity to both monetary and fiscal changes. All one has to do is look at a graph of oil prices before and after the dollar float.

“The dollar falls and oil prices go up.”

The dollar falls against what? Perhaps it’s better to say that that the dollar falls against *everything* which is what happens when more and more dollars are created. Hence, “the dollar falls and oil prices go up” is true by definition.

The fact that oil prices also went up in other currencies only proves that there are more units of those currencies as well.

Question: suppose there were only 100 dollars in existence in the entire world. What would be the oil price – as measured in dollars – then? Does the relative exchange rate to the euro,yen etc change the answer?

An article, “Jobs Report Sends Oil Futures Lower”, in the NY Times said the following, “Oil futures offer a hedge against a weak dollar, and oil futures bought and sold in dollars are more attractive to foreign investors when the greenback is falling.” Is this true?

scb, the dollar price of oil is a combined reflection of the real price of oil and the value of a dollar relative to other currencies. The primary point I’m making here is that the former is much more volatile than the latter. If you expect the dollar to fall against the euro, then you’d want to buy euro futures rather than oil futures, which would give you a pure dollar play rather than a relative-oil-price play.