2007 ended like it began, only worse.

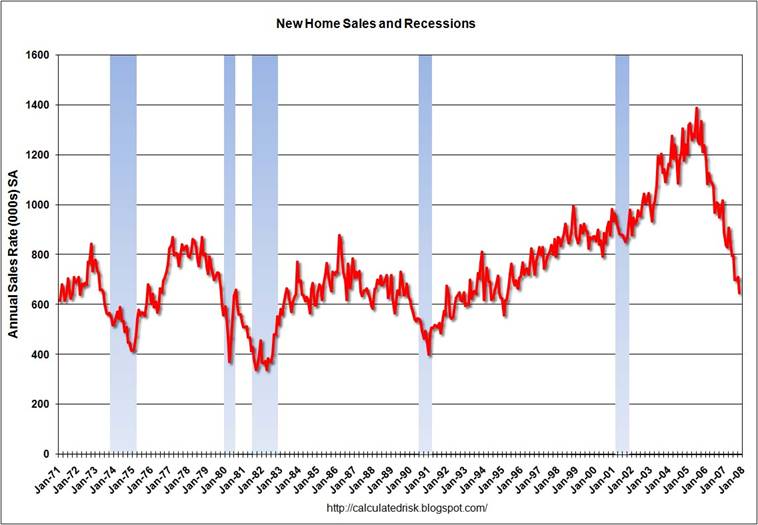

The Census Bureau reported on Friday that seasonally adjusted sales of new single-family homes fell 9% between October and November. And I don’t need to remind you that October was very, very bad.

The first five years of the millennium began with a remarkable housing boom, in which the number of new homes sold grew at a compound annual rate of 8.6% per year, almost four times as fast as real GDP. But that’s all over now, with Friday’s numbers effectively wiping out a full decade’s worth of growth. Almost like the housing boom was all just a dream.

|

Which makes you wonder– how much of the doubling in San Diego real estate prices over the last five years is also going to be undone? The answer so far, according to the S&P/Case-Shiller home price indexes released on Wednesday, is 13%.

|

Technorati Tags: macroeconomics,

housing,

bubble,

economics

Professor, a lot of that San Diego home price run-up will be undone, I think.

For substantial periods of time (’88-’00) in recent history, San Diego’s home price-to-annualized rent ratio has been reasonable (10-12). However, during the bubble, it reached an unreasonable level of 20.

I assume that we will revert to the normal home price-to-rent ratio.

Unfortunately, rents will be going down (due to falling incomes, rising home/condo vacancies, continued outflux of native born Americans, i.e., folks with means) during the upcoming deep recession.

http://piggington.com/has_price_to_annualized_rent_ever_been_normal_in_san_diego

Why the slightly gloomy tone? As a result of the great housing boom of the 2000s, there are now a whole lot of lovely new houses around for people to live in, which did not exist before. True, some of the existing owners will get foreclosed on, and so the ownership of this new stock of housing will get shuffled around. But society as a whole is still sitting pretty. The flow of new housing has slowed, sure, but that is inevitable after such an enormous boom as we have had. Note also (from the first chart) that the current flow rate of a little over 600000 units looks to be around the average of the last few decades (although, no doubt, it will be somewhat below the average on a per-capita basis). I say we take the Panglossian long run view that things are probably turning out as well as they might in the (broadly) best of all possible worlds.

Well, professor, you’ve come a long way in your view on housing since you used to dismiss bubble talk as ‘babble. link.

Glad to see you’ve joined us in the bubblesphere!

I’ll pick Jan 2003 as a reasonable price. So we’re looking at a total drop of about 38%.

Look at the 9-years it took to recover from the 1989 peak. And even then, if wages were rising 5% a year, 9 years of flatness equates to a 50% correction in wage-adjusted price.

The same can easily happen again. 9 years to get to the same nominal $525K price = 50% correction in real wage-adjusted price, if wages rise 5% year.

From the Detroit Free Press:

All 20 major metro areas were in decline in September compared with September 2006. Detroit’s drop tied with San Diego for third place among the major U.S. metro areas. Tampa had the largest decline in home prices with an 11.1% fall, and Miami had a 10% decline over the past 12 months.

David Blitzer, managing director of Standard & Poor’s, noted that no city in the top 20 is at its peak price any longer. There also seems to be no correlation between how high the peak was and how deep the decline.

“Detroit had a modest peak and had one of the biggest declines of any,” Blitzer said.

http://www.freep.com/apps/pbcs.dll/article?AID=/20071128/BUSINESS04/711280363

So, was it a “bubble” or is the price decline symptomatic of larger issues?

So, was it a “bubble” or is the price decline symptomatic of larger issues?

I agree with that. Big declines in Ohio, Michigan, and Indiana can’t be explained by the bubble meme.

In the county in Indiana that I live in, prices declined 10% from last year. 10%! That’s a whole lot. But this is in a county that essentially has had no home inflation whatsoever in decades. Median home prices are well in line with median incomes (

I was amused last month to read that someone had named a law (I forget the name) for “if something can’t go on forever, it will stop.”

I think it was the accumulation of American debt, especially consumer debt, that could not go on forever.

So has it stopped (yet?) The talking heads on financial TV say that nothing can stop the American consumer … but at some point, what are they going to spend?

I sure wish home prices in my neighborhood would drop!

I’ve had to wait to buy a home in San Jose over the last 9 years due to my job situation. Now that I’m ready to buy, prices are still going up. Homes are on the market only a few days before getting offers higher than asking prices. Granted, it is not as crazy as it had been but so far, little signs of a price collapse in my neck of Silicon Valley.

Joseph: This chart seems to show that declines have set in, even in San Jose.

And

this chart (click on San Jose) seems to show that–with the three month averaging–prices have held up fairly well in San Jose but are finally on their way down.

But you’ve got a few years before I’d feel safe buying real estate in an expensive market like San Jose.

“As a result of the great housing boom of the 2000s, there are now a whole lot of lovely new houses around for people to live in, which did not exist before.”

I’m with you, mb. We do live in the best of all possible worlds.

Some might decry the housing boom as a huge expenditure on non-productive assets. But look at the GREAT architecture that has been created. Generations to come will marvel at the unprecedented advances made in red tile roofs. And the gated community guard shack! My Lord! A gift to humanity.

Here’s a bit of slightly good news for a change:

http://www.bizjournals.com/birmingham/stories/2007/12/31/daily3.html

“Pre-owned home sales up 0.4%”

“Existing-home sales rose slightly in November, a hopeful sign of stabilization in the wake of mortgage disruptions earlier this year, according to the National Association of Realtors, which performed the study.

“Across the nation, pre-owned home sales rose 0.4 percent to a seasonally adjusted annual rate of about 5 million units, up a bit from the 4.98 million units sold in October 2007.

“Still, the sales figures pale in comparison to the 6.25 million-unit level recorded in November 2006 – representing a 20 percent drop.”

Chipboard walls may crumble, but granite counter tops and barbecue islands will stand in testament …

Mock if you must, but here in Chicago, the housing boom has involved knocking down crappy little ranches in inner ring suburbs and replacing them with McMansions.

That’s a net benefit to society in my book. Those ranches were cheap, crappy housing and a blight on their community when they were slapped together 50+ years ago.

It is amazing to see how far residential housing has come in the last 10 years. Houses built 15 years ago are unreconizable compared to today’s.

And, yes, the granite countertops and stainless steel appliances are part of that change for the better.

Yeah, those McMansions are top-flight quality — perfect fit for McPeople everywhere returning from shopping at the faux Town Square, complete with fake bell tower and false windows.

I’m tryin to see it mb’s way: lookit all that New Improved Bigger and Better Housing..just sitting and waiting for occupants…requiring annual maintenance and municipal taxes…surely there are some buyers somewhere?

So open up the borders…we’ll even take Iraqis, yes?

Temptation to talk about the optimal allocation of resources not apparently happening with the Free Market System, narrowly avoided.

Kudos to JDH, mountaineer and possibly poet with that phrase “come undone” which I recognize but cannot place (The Doors?).

It’ll come undone to the extent that the labor force (RE agents and that wad of technical skills) can transition to another sector that can compete in the world’s market place.

So quite an unraveling I make it, you?

“She’s Come Undone” by the Guess Who

She’s come undone

She didn’t know what she was headed for

And when I found what she was headed for

It was too late

She’s come undone

She found a mountain that was far too high

And when she found out she couldn’t fly

It was too late

Real estate investors? Option ARM bag holders? CDO investors?

Buzz, I’ve seen neighborhoods improved as well. The thing is, they still remain to be paid for. This was not just an asset bubble, this was a leveraged asset bubble.

Let’s say we accept the idea that bubbles are good in general and in the long term for the wealth they create.

That does not mean that there are no specific current-generation bag holders.

And current generation harm may yet spread …

“Here’s a bit of slightly good news for a change:

… according to the National Association of Realtors …”

Good news on housing from the National Association of Realtors. Good news on the economy from Ben Bernanke. Good news on the Iraq war from George W. Bush.

According to a study conducted by the National Association of Wolves and Mangy Predators, the best grasslands for sheep to enjoy pleasant and nutritious grazing are those surrounded by thickets and groves of dense trees. The same study also finds that nighttime grazing is best because the moon brings out the flavor of chlorophyl. Good news for sheep.

“if something can’t go on forever, it will stop.”

From Herbert Stein.

Herbert Stein memorial link since it looks like anchor tags are not supported.

http://www.nabe.com/am2000/grnspnvid.htm

Damn. More flight to quality today. 10 year is well under 4% once again.

It’s a good thing the San Diego city employees’ pension fund didn’t invest in a local real estate portfolio, or it would be even more screwed now.

Wait … it didn’t, did it? :-/

An interesting thing is happening here in Silicon Valley – Expensive houses are selling better than cheap houses. This has the paradoxical result that the median house prece is increasing, while the volume of sales is drastically decreasing.

Specifically: the closer to Google’s headquarters the more likly you are to get a good price.

On the other hand, cheap houses, the kind that would have been sold to sub-prime customers, is virtually impossible to sell.

This brings up the general observation that it’s not supply and demand but rather peoples ability (and willingness) to pay that determines house prices.

What that means is, any area where there are an increase in high paying jobs (or a steady job supply of increasingly higher paid jobs) there will be an increase of house prices.

The real estate bubbly is proof of this, because peoples ability to pay, increased when intrest rates decreased.

Using that logic, you should expect to see some areas start to recover, if mortgages declines. It appears that this decline may be starting.

Housing in areas where it’s merely cheap to build but with no increase in well paid jobs, will not recover as easily.

B

Happy New Year guys!

considering that ATM that house was for the average Joe is gone, all that’s left is his income.

And I can tell you that income is going nowhere (certainly not up).

Homes will either wait for higher wages or drop precipitously.

42 years old. No debt. No kids/wife. Safe job but not crazy about it. 120K/year in Richmond, VA. Thinking about buying a townhouse in the city (can’t buy the fanciest, but could find something decent in yuppy area). Should I do it? If not, how long to wait?