Is there (an “equlibrium” exchange rate) model for all seasons?

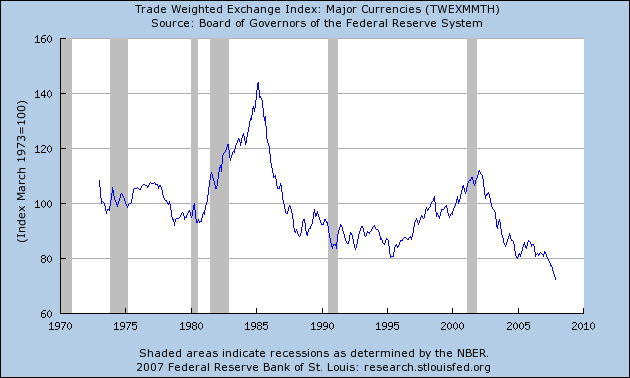

Figure 1: Nominal trade weighted dollar against other major currencies. Source: Federal Reserve via St. Louis Fed FREDII.

Setting the stage: from Bloomberg:

Dollar May Extend Two-Year Decline Versus Euro on Slower Growth

By Bo Nielsen

Jan. 1 (Bloomberg) — The dollar may extend a two-year decline against the euro on speculation a slowing economy will make U.S. assets less attractive to investors.

The U.S. currency fell versus 14 of the 16 most-actively traded currencies in 2007 as the Federal Reserve reduced borrowing costs three times to temper the worst housing slump since 1991. The unemployment rate probably increased last month to the highest since July 2006, according to the median forecast in a Bloomberg News survey before the government reports the data on Jan. 4.

“The U.S. economy will be pushed close to the recession level,” said Greg Salvaggio, vice president of capital markets in Washington at currency-trading company Tempus Consulting. “There will be further dollar weakness in early 2008.”

The dollar lost 9.5 percent against the euro in 2007, dropping to $1.4588, following a 10.2 percent drop in 2006. It increased 0.9 percent yesterday after a report from the National Association of Realtors showed purchases of existing homes unexpectedly rose in November.

The difference in the number of wagers by hedge funds and other large speculators on a decline in the dollar versus the euro, compared with those on a gain — so-called net shorts — fell to 30,641 in the week to Dec. 25, from 31,149 the previous week and a record of 120,000 in May, figures from the Washington-based Commodity Futures Trading Commission show.

“One of the larger positions in the market” in 2007 was bets the euro would rise versus the dollar, “and that’s being reduced,” said Robert Fullem, manager of corporate foreign exchange sales in New York at Bank of Tokyo-Mitsubishi UFJ Ltd.

…

Implied Volatility

Implied volatility on the three-month dollar-yen option, a gauge of the risk associated with currency bets, reached 10.58 percent yesterday, the highest since Dec. 5.

Japan’s benchmark interest rate of 0.5 percent, the lowest in the industrialized world, compares with 11.25 percent in Brazil, 8.25 percent in New Zealand and 4 percent in the 13 nations sharing the euro.

The dollar fell 17 percent versus the Brazil real in 2007 on speculation that growth in U.S. gross domestic product will slow.

The economy will increase at a 1 percent annualized rate in the fourth quarter, down from 4.9 percent in the third quarter, according to the median forecast of 63 economists surveyed by Bloomberg News from Dec. 3 to Dec. 10.

The Fed cut its benchmark lending rate by a total of 1 percentage point to 4.25 percent in three steps in 2007 beginning in September. The European Central Bank increased its rate two times last year to 4 percent.

The chance the Fed will cut the target rate for overnight lending between banks a quarter-percentage point at its Jan. 30 meeting has risen to 92 percent from 76 percent a week ago, according to futures on the Chicago Board of Trade.

The U.S. currency will trade at $1.45 against the euro and 110 against the yen by the end of March, according to the median forecasts of 42 analysts and brokerages surveyed by Bloomberg.

To contact the reporter on this story: Bo Nielsen in New YorkLast Updated: December 31, 2007 16:53 EST

Can we get a better feeling for what forces are pushing the dollar in any particular direction? I return now to the point I’ve made on a number of occasions — that there are a series of models that pertain to various horizons, and apply with greater relevence to differing countries (see [1], [2]). In this regard, I found an excellent survey by the IMF’s Peter Isard, entitled “Equilibrium Exchange Rates: Assessment Methodologies” [pdf]. From the introduction:

Assessing the equilibrium levels of exchange rates is an important responsibility of macroeconomic policymakers. Exchange rates have a major influence on the prices faced by consumers and producers throughout the world, and the consequences of substantial misalignments can be extremely costly. The currency crises experienced by a number of emerging-market economies over the past decade testify to the large output contractions and extensive economic hardship that can be suffered when exchange rates become badly misaligned and subsequently change abruptly. Moreover, there is reasonably strong evidence that the alignment of exchange rates has a critical influence on the rate of growth of per capita output in low income countries.

Economists have developed a number methodologies for assessing equilibrium exchange rates. Each methodology involves conceptual simplifications and/or imprecise estimates of key parameters; and different methodologies sometimes generate markedly different quantitative estimates of equilibrium exchange rates. This makes it difficult to place much confidence in estimates derived from any single methodology on its own. By the same token, it suggests that, ideally, policymakers should inform their judgments through the application of several different methodologies.

This paper describes six different approaches that economists have used to estimate equilibrium exchange rates in recent years and discusses their pros and cons. The taxonomy of approaches distinguishes between purchasing power parity (addressed in Section II), purchasing power parity adjusted for Balassa-Samuelson and Penn effects (Section III), two variants of the macroeconomic balance framework (Section IV), assessments of the competitiveness of the tradable goods sector (Section V), assessments based on estimated exchange rate equations (Section VI), and assessments based on general equilibrium models (Section VII).3 Four of the methodologies are illustrated using 2006 data for the United States (Section VIII), which is a particularly interesting case because of the dollar’s importance and because the different methodologies generate a wide dispersion of assessments for the U.S. currency.

Which of the many approaches should be emphasized when assessing whether exchange rates are badly misaligned (Section IX)? The answer depends on the purpose of the assessment exercise and the resources available. ….

…how should national policymakers choose among approaches if they are primarily interested in assessing their own exchange rates and have limited resources to devote to assessment exercises? One way to narrow the field is to consider the approaches that seem most relevant for predicting when exchange rates have become unsustainable. Turning the question in that manner, and looking to the currency crisis literature for guidance, suggests that two of the approaches — the external sustainability variant of the macroeconomic balance framework, and assessments of the competitiveness of the tradable goods sector — warrant particular attention. …

One version of the macroeconomic balance approach is described here, as well as in the paper itself. Basically, at the risk of over-simplification, one variant focuses whether the current account is greater than that suggested by saving and investment fundamentals (see Chinn and Prasad [pdf] for some discussion). The other variant centers on the net investment income flows necessary to stabilize the net foreign liabilities position (about 21% right now for the US).

Isard walks through the application of these various approaches, and notes how several of them imply rough equilibrium for the U.S. dollar in 2006, while both versions of the macroeconomic balance approach suggest substantial overvaluation.

What is particularly useful about this survey is that it reminds us that there is a great degree of uncertainty surrounding not only the parameters of interest, but even the models that might be most useful in discerning the future path of the dollar.

That being said, this is not an exhaustive survey. Excluded are difficult-to-estimate models that rely upon forex reserve holdings, as well as other portfolio balance models.

I would finally add that the approaches enumerated in Isard’s survey are related — but are logically distinct — from models that seek to explain exchange rate behavior (see this post). The survey covers essentially normative statements about what “should” be the level of the exchange rate, while latter concerns positive statements about what actually moves exchange rates. The distinction is not a hard-edged one, but useful nonetheless for thinking about the two types of literatures.

Returning to the title of this post — whence whither the dollar? While several observers point to a bottoming out of the dollar in 2008, for either cyclical or monetary policy-based reasons, I think we need to take our cue from the current account balance (and income components thereof). For me, that seems to signal continued decline.

Technorati Tags: dollar,

exchange rate,

purchasing power parity,

depreciation,

macroeconomic balance,

net foreign liabilities,

competitiveness,

general euilibrium.

Great post.

However, re: “whence the dollar?” Perhaps you meant “whither the dollar?”

Bloomberg’s doom-and-gloom tone toward anything American lately has me trusting them less and less. (Their article on the “gain in the euro against the dollar” in currency reserves was an interesting example of that.)

The dollar hasn’t declined enough against the currencies against which it needs to decline, and it’s declined far too much against others like the euro. I’m not sure at this point there _is_ a logical model out there for determining where it’s going to go in 2008 in terms of exchange rate, as there seems to be a snowballing of emotion against the dollar.

(Speaking of the reserves article in Bloomberg, when do we get the latest count for dollars and euros in circulation? Wasn’t it about this time last year that the euro reportedly overtook the dollar in circulation?)

I’m with Michael. If the current account deficit had anything to do with the dollar’s value, the yen would be at 80 to the dollar, where it should be.

Menzie,

So, just to rewrite your summary slightly differently, the macro balance models, in which the current account figures heavily, have the dollar overvalued (although maybe not necessarily against the euro specifically), while some of the others, notably PPP, have the dollar undervalued, or maybe not too far from equilibrium?

I have not dug through the associated papers, but it is my memory from at least one earlier post by you that there are competing CGE/DSGE models of forex rates that come out with some very conflicting results, at least regarding relations between budget balances and exchange rates, and I also note that some of the theoretical models suggest multiple equilibria for forex rates. Any comment on these matters?

“According to the median forecasts of 42 analysts and brokerages surveyed by Bloomberg, the U.S. currency will trade at 110 against the yen by the end of March.”

Or, by today. Great job guys.

Travis Pantin: Good point, fixed now. Thanks.

Buzzcut: Not certain what you mean. The macroeconomic balance approach does not indicate that the equilibrium exchange rate is that which balances the CA at zero; rather, it is that which sets the CA at norms established for countries of those particular demographic, fiscal, and structural characteristics (see the Chinn and Prasad reference in the post for concrete examples).

Barkley Rosser: I think your rewrite is appropriate, insofar as it pertains to the case of the United States.

It is true that DSGEs can come up with many different conclusions regarding the impact of fiscal policy and exchange rates, even in the long run. The big difference depends on how investors allocate their assets in proportion to government debt. As a consequence, the “steady state” real exchange rates will differ between models, even for the same configuration of government spending, taxes, and monetary reaction function. To my knowledge, these “steady state” exchange rates have not been used to assess currency misalignment, partly because the models say a lot about deviations from baseline, and little about the levels of the variables at baseline. (At least, that’s my non-expert interpretation.)

The macroeconomic balance approach does not indicate that the equilibrium exchange rate is that which balances the CA at zero; rather, it is that which sets the CA at norms established for countries of those particular demographic, fiscal, and structural characteristics

Fine. Then riddle me this: why has the Euro gone stratospherically higher since, say, 2003, and the yen is essentially flat. Are European “demographic, fiscal, and structural characteristics” very different than the Japanese ones?

I’d say that they are very, very similar. Not different enough to cause the disparity.

Buzzcut: I don’t have the Europe-wide statistics handy, but in this paper [pdf] (Figure 4), we don’t find Japanese current account behavior anomalous, by the standard statistical criterion.

Menzie, an interesting point that does not seem to have hit the wider press. Kuroda of the ADB stated, according to NNI that there is some kind of agreement that the yen will not become a reserve currency. This news has been lost on the markets, which sent the yen to 109.5.

Nice paper, Menzie. Very readable.

The difficulty I’m having is that it doesn’t make sense.

If fiscal policy is driving the current account deficit and the dollar/ Euro exchange rate, why has the change in that rate come at a time of a falling deficit?