Not a good start to the week week for those holding on to hopes that the U.S. will avoid a recession.

Start with autos. Every sales category was down– imports or domestic, cars or light trucks– relative to February 2007. But the sharpest drops were seen by domestic light trucks, a category that includes the SUVs and still accounts for more than half the number of light vehicles sold. Domestic light truck sales last month were down 12.4% compared with February 2007. The graph below records the sales for each month over the last 5 years so that you can simultaneously see both the seasonals and trends. To make year-over-year comparisons, look across the adjacent columns for any given month. The most recent drop looks like a significant deterioration.

|

Perhaps Detroit’s woes are related, and perhaps not, to an apparent recent break in the behavior of U.S. gasoline demand commented on by the Wall Street Journal on Monday. Apart from the effects of the 2005 hurricanes, U.S. gasoline consumption has remained remarkably resilient to the steady increase in price over the last several years. Although there is a lot of noise in the weekly series, the most recent four-week average is running 1.1% below that for the same period last year.

|

Taken together, the auto and gasoline data may signal that American consumers are finally starting to adapt their behavior to record crude oil prices. If so, given historical patterns, it’s likely also showing up in cutbacks in a number of other categories as well. Or perhaps it’s not the price of gasoline so much as loss of income and worries about the economy that are bringing both car sales and gasoline purchases down. In either case, it does not bode at all well for an economy that is struggling to avoid a recession.

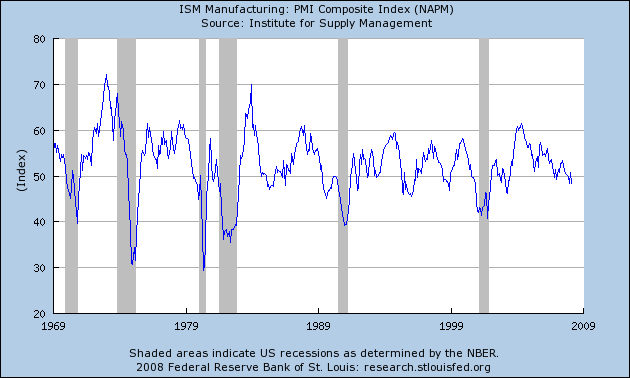

Also on Monday we learned that the Institute for Supply Management’s PMI index fell from 50.7 in January (indicating that manufacturing was still expanding at that time) to 48.3 (meaning that more plant managers are reporting decreases than are reporting increases in key categories). Slipping below 50 is a pretty good indicator that manufacturing is at least experiencing a slowdown.

|

And if that’s not enough good cheer for you in one day’s news, growth in nonresidential construction, which had previously remained positive even as residential housing was battered so badly, slipped into the red in January. Here’s what Calculated Risk thinks of that development:

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. This is additional evidence– along with the Fed’s Loan Officer Survey and other data— that suggests the slowdown in nonresidential spending is here.

We’ll be watching the BLS employment numbers on Friday to see if the bears can make a clean sweep for the week.

Technorati Tags: macroeconomics,

autos,

auto+sales,

economics,

recession,

oil prices,

oil,

oil shocks,

This hardly comes as a surprise. All the warning signs have been in place for at least months; some have been flashing for two and a half years. You just have to know where and how to look.

Nice first graph, Professor. Yep, that is quite the drop in February.

Tomorrow’s release on ISM Services should be interesting; we’ll see if January’s precipitous drop was an outlier, or not. Thursday’s initial unemployment claims should be enlightening, too.

Me, I vote for a clean sweep for the bears. We have lots and lots of messes to clean up; we might as well get started, now. There is nothing like a steady drip of bad economic data and a stock market correction to get folks’ attention.

As the first commenter said, this is hardly surprising news. The credit crunch has been developing inexorably for the last year at least, and has recently picked up momentum considerably. With huge inventories building up, housing has nowhere to go but down for a long time, with inevitable knock-on effect on commercial real estate and the default rate of the loans that supported it.

The Fed is pushing on a string, pay option ARMs will have far more impact than subprime, the ratings agencies reputations are in tatters, Fannie and Freddie are being loaded up with dodgy debt, the monoline bond insurers are flatlining, the auction rate securities market has dried up, the restructuring of Canadian ABCP is dead in the water, the ABX indicies are telling a frightening story, problems appear to be looming in the $45 trillion credit default swap market, and with non-borrowed reserves gone the US banking system is essentially insolvent. A large scale mark-to-market event, instead of mark-to-make-believe, is approaching – a firesale of assets in other words. It’s difficult to see how this could avoid pitching the global economy into a second Great Depression.

Ilargi and I, who used to do the financial round-ups at TOD:Canada, are now offering daily coverage of financial developments at The Automatic Earth (http://theautomaticearth.blogspot.com).

In re the PMI chart: looks to me like we’ll need PMI to touch 40 to signal recession.

Services still in decline. Sad when that’s considered a positive because the contraction’s not as bad as anticipated.

http://biz.yahoo.com/ap/080305/economy_service_sector.html

It may not officially be recession, but it sure feels like it. Especially when $4 gas drives up the deflators.

Son’t cry over spilt milk. A recession began in December.

If anything, the drop was so sharp, that recovery will be equally sharp, and we might be in full recovery as soon as August/Sept.

The PMI doesn’t need to touch 40 right away. Both the 90 and 01 recessions started with the PMI not touching 40, matter a fact, the PMI rose as well for a few months.

Typically, the PMI will touch 40 near the end of a recession.

Somebody mentioned the $45 trillion dollar credit default swap market. When I first heard that number I thought it was a mistake. Googling around I found estimates in the $300 trillion range. Why so large differences in these estimates? And how could what seems to be a bond insurance market exceed the total value of all bonds and mortgages?

syvanen:

This is what happens when a pack of con men (and women) take control of the investment banking business and are enabled and even empowered by a “maestro” who abdicates his regulatory responsibilities and runs an experiment that can best be described as an attempt to see just how much debt it takes to destroy the orderly functioning of a financial system.

I do believe that Greenspan indeed found the necessary level.

What did the wicked witch say? Oh, yeah…”I’m melting. I’m melting”

Hee hee!

I have now gone into negative sympathy mode for anyone who loses a house, loses money in stocks, or in a hedge fund. If you showed me an orphan with cancer who lost his home because he took out HELOCS to pay for chemo, I would be hard pressed to care.

The light truck sales figures are not good examples. We have moved into a new era of very high oil prices while at the same time facing regulatory changes in light truck mileage regulation… in this environment the light truck market has to be crashing and its only in small part due to the economy. Light truck sales benefited from an artificial “subsidy” with CAFE mileage requirement for SUVs to be treated as small farm trucks. This also caused the Big Three to quit innovating — just as they did not innovate in the 60s and 70s. Total number of passenger cars and light truck sales has not grown much in past years around – 15-16 million passenger car and light truck meanwhile the share of light truck and SUV out of total passenger car and light truck grew from aroun 15% to 60%. Thank our politicians, political system and automotive lobbyists. Would you be buying a light truck in this environment… I just bought a hybrid.