I was struck at how Federal government interest payments to the rest of the world have risen even as interest rates have fallen.

Figure 1: Federal interest payments (red, right scale) and Federal interest payments to Rest-of-World (green, right scale), and three month Treasury yields in percentage points (blue, left scale). Source: BEA, NIPA release of 27 March 2008, Table 3.2, and St. Louis Fed FREDII.

Note that we’re not talking big figures: $294 billion (SAAR) in 2007Q4 for total payments, and $161.4 billion for payments to the rest-of-the-world. But what’s of interest is that, rather than being an intra-country transfer, interest payments to the rest-of-the-world represent resources not made available to US residents. Of course, we benefitted from the borrowed resources which enabled US residents to consume and invest at higher levels than otherwise would be possible.

One interesting question is what will happen to this figure when interest rates rise. That is, in 2008Q4, with 3 month Treasury bill rates at 3.39%, and the ten year constant maturity rate at 4.26%, Federal interest payments expressed as a share of GDP were just over 1.1%. With most foreign holdings of Treasuries at the shorter end of the maturity spectrum, over time we should expect Federal interest payments to rise.

Just some facts to remember as various individuals [1] propose even more tax cuts.

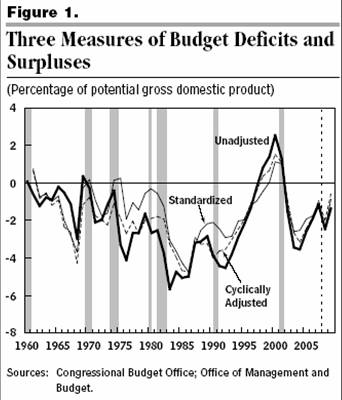

And there is no end in sight. The CBO has just released its estimates of the full-employment and standardized budget balance. Despite the apparent bump up in FY2009, don’t be fooled. That results from the assumed end of the “fix” to the AMT, and the end to the effects of the stimulus package.

Figure 1 from CBO, The Cyclically Adjusted and

Standardized Budget Measures, April 2008. [pdf].

Since the graph depicts the full employment and standardized budget balances, if output turns out to be weaker than CBO projects in the next two years, then the budget deficits will tend to be bigger than depicted, and interest payments will tend to rise as debt accumulates faster.

Technorati Tags: href=”http://www.technorati.com/tags/interest+payments”>interest payments,

Treasurys,

Federal debt, deficit,

cyclically adjusted budget balance.

This is just one of the many unpleasant consequences that await us as a result of the insane decision of our “leaders” (both political and economic) to continue the flow of foreign consumer goods.

Our primary role in the world economy appears to be to consume in excess of what we produce,

and everyone fully understands this.

However, the Summer Games will come and go, and then this game may go away as well if the enabling lender takes the decision that the USA is just a little too “subprime.”

So, we’re giving a massive tax break to mortgage debtors which is translated into bigger payments to the Chinese. It ain’t right. Angry Renter.com

It isn’t just the government that is borrowing $ from rest-of-world (ROW) at amazingly low rates. Thank you, ROW. As long as they’re willing to loan $ there is little to worry about.

Those cheap consumer goods are a big part of our standard of living. We’d be crazy to cut off the supply.

Climatologists worry about breakdown of the North Atlantic circulation that powers the Gulf Stream, preventing Europe from having the climate of Canada (London is at least as far north as the southern end of Hudson’s Bay).

I worry about the breakdown of the circulation that brings the dollars paid to Asian exporters back to our shores, preventing the US from having the consumption patterns of other nations having similar inability to produce the things their citizens want to consume.

Menzie — i am not sure that most foreign government holdings are at the shorter-end of the maturity spectrum. When Elisa Parisi-Capone and i looked at this issue in the summer of 2006 (using the mid-2005 survey data) we found that central banks had a lower share of the bill market (compared to the stock outstanding) than either the 2-5 year maturity bucket or the 5-10 year maturity bucket. The fed holds mostly bills, but my sense is that the big foreign central banks like coupon-paying notes. in the short-run, the average rate on us debt held abroad should come down, which will help. but with the stock held abroad rising rapidly (look at FRBNY’s custodial holdings), over time net payments should trend up strongly.

Larry: Yes, it works well, until the interest rate on the credit card goes up (or, the teaser rate resets on the mortgage).

brad setser: I will defer to you on best-guess of the Treasury holdings of the rest-of-world. Taking your presumption, interest payments should not decline substantially as short interest rates decline.

So, once again the comments seem to confirm a truth: China owns America (in every respect), and it will soon decide to cut America off, which will destroy the United States and, of course, have no appreciable impact on China. They will find someone else to buy several hundred billion in goods annually without missing a beat, and unlike US dollars held by Americans, those held by the Chinese have their value protected by ancient magicks.

mm:

Those who have the factories and the manufacturing labor possess the option of distributing the output among those who produce it.

Those who earn their livings by printing partially-valueless pieces of paper of various types are in a whole different circumstance entirely.

Since this is April 20, I assume that the contents of this post are not an April Fool’s joke.

Did the federal fiscal year suddenly change? 2008 Q4 hasn’t yet arrived: it is July, August, and September. The article acts like we’ve already experienced 2008 Q4.

I also note the bizarre caption under the first figure: “Source: BEA, NIPA release of 27 March 2009, Table 3.2, and St. Louis Fed FREDII.”

I don’t know how Econbrowser got financial information from the future. Could you ask them to send us the stock prices from March 2009?

Dr. T: Sorry. All fixed now.

mm,

You’ve fallen for the “Blazing Saddles” gambit — the one where the character played by Cleavlon Little holds his gun to his head and says, “Hold it! Next man makes a move, the [Sheriff] gets it!”, just like the townspeople in the movie.

It certainly needn’t take any longer for the US to reconstitute its manufacturing capability than it did for the Chinese to build their’s from scratch.

The US would be starting from a level far above where China started.

For most of the last several hyndred years, China’s been a basket case in chaos, and it’s all too likely to return to that state — especially if and when it can no longer sustain the vendor financing fraud the Communist Party leadership has been perpetrating by lending the people’s money to the US at bargain rates, and paying out 7+ yuan for every US$ its exporters can snag.

mm,

Sorry for misjudging you — I read your comment in excessive haste and skipped over the last line, in which all the snark was concentrated. Looks like in fact we share similar opinions. But there certainly seem to be a lot of people in the blogosphere who can be taken in by the Blazing Saddles gambit.

Why does the ROW want to get up and go to work to produce something in exchange for a dollar? I guess for the same reason we Americans do. Just because they live overseas does not matter. I don’t care that the Chinese are getting financially wealthy any more than I care how much money Bill Gates has.

The question I have is why do so many people think govt debt (and the interest payment that goes with it) is a bad thing. From the end of WWII through 1965 the public debt to gdp ratio was over 40% and the DJIA went up 10X (from 100 to 1000). From 1965 to 1982 the debt to gdp ratio was under 40% and the DJIA stayed flat. From 1982 – 1999 the ratio was back above 40% and the DJIA went up another 10X (from 1000 – >10000). Since 1999 the ratio has been below 40% and the DOW has again been flat. History tell us the stock market (and the economy) does better when the debt ratio is higher. Why is that?

@Menzie: Interest rates on foreign borrowings may well climb. They haven’t (substantially) yet. Even now, within inflation growing, and the Fed refusing to fight it, the world still is happy to put money into our economy. Critically, they aren’t forcing us to take the currency risk.

@mm: Yes, ROW is loaning $, not euros or yen. Amazing.

@esb: China relies on every part of world markets to prosper. To quote another cliche, loan me $1, and you own me. Loan me $1Trillion, and I own you.

Another great graph, Menzie.

There seems to be a few year lag from recession to peak in the graph of payments to ROW. Maybe I’m reading too much into it.

I think that we shouldn’t be too quick to ignore “secord order effects”. One reason that the US savings rate is so low is that interest rates are so low, and the alternative (consumption) is so cheap. A reversal of the situation (higher interest rates, higher inflation making goods more expensive) very well may be the cure to the disease.

Remember that the US savings rate peaked in 1980 or so. Interest rates were incredibly high.

Menzie — the average int. rate will fall, just at a slower rate than the 3m bill. I suspect that over a two to three period you would get most of the stock effect. the average rate tho on the new 5 to ten years the us is selling matters too.

however, if you throw in a much bigger deficit this year and much bigger official treasury purchases, i would guess that absolute payments won’t fall. just a guess tho.

jm. good comments. mm had me going at first also. I like your blazing saddles metaphor. Great movie.

Why do so many think the world is going to end because a bunch of us want to buy stuff made in China. They accept my money. I want the product. What’s the problem? It seems esb would rather force me to buy american and force some other american to produce it because that is somehow a better thing.

Perhaps he likes Moet a whole bunch and I could cry that California wine growers are being put out of work and the entire wine producing industry in america is threatened by this clearly higher quality product. Let’s ban them. Che would support it.

No offense, Menzie but my first impression when reading the post was, so what? I don’t see the importance of either measure really.

As you stated, those interest payments represent payments on money we borrowed. Does where we borrow from really matter? Wouldn’t we naturally seek the lowest cost lender?

What is potential gross domestic product in the subtitle of the second graph. Perhaps I should do some research into CBO forecasting methodology. It has never made much of an impression on me in the past. Since I am not an academic, I have not kept up with it. Most tax revenue forecasting seems to use a simple static model, a balance sheet model, whose assumptions are highly suspect.

Larry, it looks like the Japanese have had their fill of our t-paper, and are net sellers, now, since June.

http://www.treas.gov/tic/mfh.txt

My guess is that the sheikhs (Britain and oil exporters) and Chinese get fed up soon with the inflation in their countries and principal losses on their ‘investments’ in our t-paper.

It is going to be a ‘fun’ summer/fall.

I’m with jm; we’ll see how well China and its society holds up when demand for its products dries up in the U.S. and Europe.

markg, I agree with you, the scary number is not government debt to GDP. The much scarier number is household and corporate debt to GDP. Those levels today are 2X what they were in ’29, and we know what happened thereafter.

@Hitchhiker: Somebody’s definitely net selling. That’s why the dollar’s falling. If there’s a $ panic “out there”, we’re the ones who benefit, because the value of our debts in other currencies would correspondingly collapse.

Yes, we’d see a burst of inflation, and that would be bad, but a period of relative benefit for workers and exporters over consumers and importers would not be before time.

@jg: I think the more important number is net worth, and that’s not doing that badly, although I’d be happier if the debt to cash flow (GDP) ratio was better.

What is more amazing is that the investment income part of the current account has somehow managed to avoid going clearly into deficit so far, at least the last time I saw the number, despite the continually mounting US net foreign indebtedness, with the payments on the US national debt just a part of this broader picture.

I would imagine that this would provide “evidence” for that crowd who was going on and on about “dark matter” a couple of years ago, but mercifully they seem to have disappeared from the public discourse more recently.

Larry, today, the financial obligations ratio for homeowners is 31% higher than it was in 1980 (earliest data available):

http://www.federalreserve.gov/releases/housedebt/default.htm

And, the inflation premium and risk premium are returning, now.

Asset prices are going to get crushed by skyrocketing interest rates, and net worth will plummet.

Today’s home and stock prices are a fiction in light of falling wherewithal to buy (for homes) and consume (for stocks).

While the numbers may appear large and the trends concerning, I would like to see more context before claiming the sky is falling. How much interest does the US obtain from other countries? I assume the rest-of-the-world is more than just China as some have implied, but also include other foreign governments as well as foreign pension plans. I would be more interested in the net difference between what our government pays out versus how much we receive.

@jg – Real property prices are certainly falling now, but other assets are not. And haven’t we had an asset price bubble over the last years. A correction is required.

The last time interest rates went sky-high, asset prices didn’t crash…

esb:

“However, the Summer Games will come and go, and then this game may go away as well if the enabling lender takes the decision that the USA is just a little too ‘subprime.'”

My guess – for what it’s worth – is that the ‘enabling lender’ will not lose taste for U.S. dollar currency intervention on fears of debt repudiation. Instead, I think it more likely that the practice will be curtailed as a result of U.S. workers putting up a fuss because U.S. aggregate demand has fallen short of what is needed to keep U.S. unemployment low while simultaneously supporting a massive trade deficit.

But we’ll see. Helicopter Ben may postpone this result. What then? Will debt repudiation become the dominant concern (a situation that couldn’t be postponed by further monetary easing)? The U.S. might be rich from food exports before then.

don:

China is a civilization with eight thousand years of recorded history. Planning and policy decisions tend to have an entirely different time horizon than in the Anglo Saxon societies (esp. the USA) where “right now” is all that matters. Sacrifice for an ultimate higher geostrategic goal is entirely possible in Chinese political planning.

Today, one of the highest geostrategic goals being discussed in China is the quickest and least painful way to diminish or remove the influence of the United States Pacific Fleet in the Southern Western Pacific.

Since the USA has maneuvered itself into a precarious financial and greatly overextended military position it would not surprise me to see a Chinese knockout punch thrown with the full understanding that the economic pain will be felt by all. Imagine the fallout from a single press release stating, “it is no longer in the interest of the Peoples Republic of China to purchase United States sovereign debt” or “over the past eight weeks the Peoples Republic of China has divested itself of its holdings of all dollar denominated debt instruments.”

Stratfor has done some work on this general subject but it is not for free public dissemination.

esb, you are dreaming. China can as much issue that press release as we can. THEY are the ones dependent on buying our debt. If they can’t recycle their trade dollars, they can’t maintain their peg. And if they can’t maintain their peg, they can’t run their mercantalist economic policy.

Seriously, I wonder if the Bush Administration would WANT the Chinese to issue that press release. Talk about a weak dollar!

esb, Iraq has ten thousand years of civilization. Big deal.

The Chinese government will have its hands full with its population no matter which path it chooses, continuing to ‘ice’ its dollar reserves or not.

Yeah, you’re right: selling $500-600 billion in U.S. Treasuries in the course of two months will be unnoticeable. LOL.