Could well be, and yes you should.

There is no question that we’ve been experiencing an episode of economic stagnation in which key indicators of output and employment are not growing at their usual historical rates. Some analysts take the position that this is all that really matters, and whether it meets the formal definition of a “recession” is a pointless question of semantics. In support of such a position, there are a number of economic models quite popular among academics today that would warrant just such a perspective, in that they presuppose linear dynamic systems in which a “recession” is indeed just an arbitrary definition you would make up to characterize a string of bad luck.

I espoused the opposing view in a recent academic paper. I argued that recessions represent distinct and objectively identifiable episodes in which the usual dynamic factors that drive economic growth– technological progress, population growth, and capital accumulation– are replaced by a distinctly different dynamic in which lost income in some sectors feeds back into declines in output for others. One of the defining characteristics of this phenomenon is the rapid rise in the unemployment rate that we’ve seen in every historical recession. It’s very difficult to generate that kind of pattern from a system governed solely by linear dynamics, or interpret it from a perspective in which there’s nothing special going on during a true economic recession.

|

I was therefore quite alarmed by the 5.5% unemployment rate reported yesterday by BLS. Although the rate itself remains moderate by historical standards, the increase last month is the biggest monthly change that we’ve observed in over 20 years. King Banian, Paul Krugman,

and Howard Gold argue the numbers aren’t that bad, reflecting a surge in young job seekers rather than a big decline in employment per se.

I personally share the more pessimistic interpretations of Jared Bernstein, Calculated Risk, Michael Mandel,

and Mark Thoma; (you can find other interesting discussion from Phil Izzo, Barry Ritholtz, Andrew Samwick, and Angry Bear). It is true that the estimated May employment decline from the BLS payroll series was only 49,000, more moderate than the 285,000 drop implied by the household survey (from which the 5.5% unemployment rate is derived). But we’ve now seen 5 consecutive months in declining nonfarm employment as estimated from the BLS establishment survey, putting the overall level essentially back to where it was a year ago. Year-on-year employment stagnation is another thing we just don’t see outside of an economic recession.

|

And while I’m collecting graphs that make me feel bearish, I can’t resist updating this one, despite Menzie’s cautions against reading too much into consumer sentiment numbers.

|

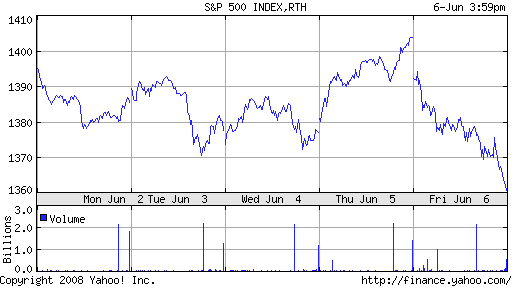

And how would one reconcile this view that the economy may already be in a recession with the very strong gains in the stock market on Thursday? Oops… never mind.

|

Technorati Tags: macroeconomics,

employment,

economics,

unemployment,

recession

Is it possible to forecast the Fed’s interest rate decision based on unemployement numbers and perhaps consumer sentiment readings?

Also, when do you plan to publish the next update of your recession probability index? I can’t wait.

Yes, you are right. We reach a point in time when the next bit of efficiency in the current production model yields returns less than the reorganization of the production function.

The economy tends to pile up on reorganization at the same time. The reason for this is that a reorganization is most efficient when many production functions do so at the same time, we get economies of scale in restructuring.

As time passes, more an more organizations needs restructuring, and they delay until a quorum is established.. This delay is equivalent to letting a bubble float around and waiting for the bubble to grow big enough that it has energy necessary to break some organizations and get the ball rolling.

Tom, one common prediction of Fed policy is based on GDP and inflation, though there are versions that use the unemployment rate.

Next update of the index will have to wait for GDP 2008:Q2 numbers on July 31.

JHD, thanks for the references. I hadn’t realized that Taylor Rule equations were having so much empirical success.

If I may muse out loud, I suppose one could use a Taylor Rule framework for formally testing if central banks have fully adopted price stability/inflation targeting as the dominant policy objective. This is something US policymakers may wish to know before formally adopting a priority 1% to 2% inflation target.

im not schooled in economics but i do read a lot of history.i see a lot of things that happened in the 20’s that we seem to be repeating today which is drivin by greed and de-regulation.as a conusmer based economy the population needs to have spendable cash.we dont. and all of the bad financial policies of the last 8 years are a direct cause.nobody is talking depression yet but we should be considering it.then who is responscible?

I must say, the rationalization put forth by many that the 1/2 percent rise in the unemployment rate could be explained by students entering the labor force was so weak (as if students haven’t entered the labor force every June for the last 20 years too) as to genuinely frighten me that some serious people aren’t taking these rather clear economic signals seriously enough.

Krugman, whom I respect and admire tremendously, is dangerously off the mark when it comes to inflation too. His “the wage-price spiral isn’t apparent” is an astonishingly narrow-minded way to look at it in a world of global labor arbitrage and diminished power to labor, particularly for arguably one of the best trade economists going.

Indeed, how can he expect a wage price spiral when he himself has been (rightly) fretting for years about the declining power of labor over capital?

Strange days, these.

My opinion has been consistent and straightforward.

It IS a recession (that began in December), and it is almost over, probably by July. 7 months total.

The only thing that could extend it further is oil shooting above $150 and staying there. If oil is below $120 by July, the recession is over.

RN: I have to agree with Krugman on that point. I do not observe a wage-price spiral. I do not observe any indication of a disasterous increase in inflationary expectations…. yet.

Between the “hire and fire” nature of the US labour market and the increasing integration of US economy into the global economy, plus the fact that the Bernanke fed seems determined to not budge the monetary base suggests that 70s style inflationary spirals may not happen.

I’ll have more on this later this week, but the stock market decline on Friday doesn’t appear to be all that out of line with the state of order that appears to be emerging in the market following the disruptive event that occurred in January.

If corporate dividends actually begin to be cut further than already announced for the S&P, look for something more serious to develop in the stock market. Otherwise, the market would seem to be mainly reacting to the price of oil and the index will continue to track along a range of normal volatility.

I.e., price spirals which include labor. As far as I can seem to tell, we’re in a commodity-based price spiral. We’ve seen costs in some sectors increase, due to oil costs, even in a business slump (e.g., air fares, Dow chemical, trucking).

Bernanke fed seems determined to not budge the monetary base suggests that 70s style inflationary spirals may not happen.

There are three things that have me worried about inflation. First, what happens when the Fed runs out of treasuries to exchange for the Banks SIVs and other structured real estate, car, credit card and student debt? I fear the fed may start printing to buy this debt. Second, what happens when the federal governments deficit explodes from a simultaneous increase in expenses and decrease in revenue? Where will the government get the money to fund this increased deficit if the Fed doesnt buy treasuries? Can we rely on foreign government forever? If the fed doesnt buy it, I fear interest rates will rise which will put the economy under even greater pressure. A weaker economy will cause the dollar to fall which will cause more inflation. If the fed does buy the bonds, then the money supply will increase and there will be more inflation. Third, foreign governments in Japan, China, and Saudi Arabia hold vast quantities of American treasuries. If they decide to use their dollars to buy commodities and assets rather than more treasures, then we will have a flood of these dollars returning to America which will cause a great deal of inflation.

E. Poole –

Yes, I agree with him too, there is no domestic wage/price spiral going on. At least in the US.

But you (and he) miss the point. That almost certainly couldn’t get traction in today’s global labor arbitrage world. So it’s either irrelevant or at best only marginally relevant to the current inflation discussion.

E Poole,

There is some evidence that a varient of the Taylor Rule, the inertial Taylor Rule, does both a better job of tracking actual central bank policy and a better job of moderating price and output swings. In essense, the varient argues that central banks shouldn’t be in a hurry to reach interest rate targets dictated by the basic rule.

CIBC has been publishing some interesting work on the impact of oil prices on trade. One implication is that there may be less downward pressure on US wages due to trade with Asia at current oil prices. This view is contrary to claims that Asian trade has not put downward pressure on US wages. We may see this disagreement worked out in developments over the next few quarters, if oil prices remain high.

Are there any teachers out there ready to grade Bernanke’s work? Didn’t the FED lower interest rates to keep us out of a recession?

Now that Bernanke has said no more interest rate cuts he is being praised for his brilliant move, saving us from ourselves, yet we have more signs and are nearer to recession than when he started. And it seems that we are headed toward another bout of Jimmy Carter economics where we have increasing recession, rising unemployment, chronic inflation, and rising interest rates all pouring together. Will anyone connect the dots and notice that all these dots are emanating from the FED and congress?

Sure we’re in a recession and, if you have investments or a marginal job, you should care. The stock market still has a long way to fall – down to S&P 800 or so, and tens of thousands of jobs will still disappear before the excesses are driven out of the system. I continue to believe the recession started last fall and will last about two years. More details and past forecasts can be found on my website: http://jpetervanschaik.googlepages.com

The primary cause of the divergence between the establishment (-49k jobs) and household survey (-285k) seems to come from the BLS’s birth/death model, which attempts to correct for the under-reporting of business start-ups in official data. This model added 217k jobs in May and has added 383k YTD. The problem is, the model is not calibrated to the business cycle, so it continues to add reported jobs as if we are in trend-growth mode rather than mid-slowdown/recession.

JDH, I’m really pleased to see your serious pursuit of non-linear feedback in macroeconomics. Your notion of some feedback loops dominating in growth phases and other feedback loops dominating in stagnation or recession is spot on. There is far too little of this thinking in economics, and I hope you are successful in bringing it forward into the mainstream. The idea that important economic systems are linear is bankrupt and contrary to observed facts that any systems engineer can see. As a former engineer and businessman, I have used these powerful modeling concepts to achieve significant results. I wish you the same luck with modeling US macroeconomics.