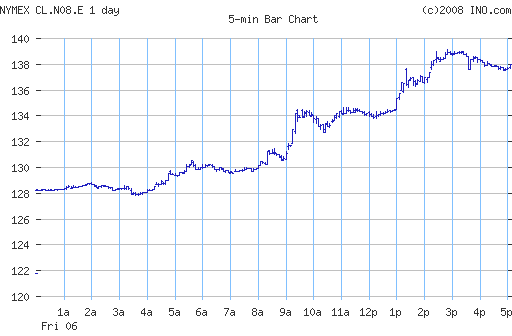

Why did oil breach $138?

|

One key impetus certainly came from news about U.S. interest rates and the dollar. European Central Bank President Jean-Claude Trichet Thursday cautioned that the ECB may raise interest rates next month in order to contain inflation, while Friday’s U.S. unemployment numbers may have put further U.S. rate cuts back on the table. The twin developments sent the dollar plunging 1.1% against the euro and the dollar price of many commodities soaring. Gold was up 2.6% and the Commodity Research Bureau Index up 3.5% (numbers from ino.com). Still, oil’s 7.5% rise was clearly the Homecoming Queen.

In terms of news specific to the oil market, this story out of Saudi Arabia could be significant:

Saudi Arabia’s Shura council (parliament) will hold a series of meetings over the next two weeks to discuss a controversial proposal by a key member to curb oil production to save reserves for better prices.

Also noteworthy is an increasing likelihood of military conflict involving Iran:

An Israeli deputy prime minister on Friday warned that Iran would face attack if it pursues what he said was its nuclear weapons programme.

“If Iran continues its nuclear weapons programme, we will attack it,” said Shaul Mofaz, who is also transportation minister.

“Other options are disappearing. The sanctions are not effective. There will be no alternative but to attack Iran in order to stop the Iranian nuclear programme,” Mofaz told the Yediot Aharonot daily.

If Saudi production has indeed peaked, or if military conflict involving Iran is indeed imminent, that would unquestionably be the kind of news that should send the price of oil soaring. But this much of a move on just the whiff of a rumor?

It seems likely that the fundamentals above warranted a big move in the price of oil, but the momentum then caught some traders short who had to scramble to buy oil to cover their positions. But who? Via Brad Setser, the Financial Times reports:

Traders who had bet on falling oil prices through short sales– in which they sell the commodity in hopes of buying it back later at a lower level– were forced to cover their positions, sending oil prices skyrocketing.

Wall Street banks contributed to the rally as they bought crude oil futures to cover their obligations under agreements that compensate investors and companies such as airlines if crude rises above $140 a barrel.

Hmmm…. you mean some of the big guys have been quietly raking in cash by selling far out-of-the-money options? Now where have I heard that strategy before?

I remember– it was Capital Decimation Partners.

Technorati Tags: oil,

oil prices,

Iran

Saudi Arabia,

oil bubble,

oil price bubble,

oil+speculation,

oil+supplies,

oil+demand

Of course, a hedge fund that accepts higher risk for higher returns has to deal with global monopolies that can create the high risk result and deliberately wipe you out.

The Saudis, for example decide that oil in the ground is more valuable than greenbacks in the mattress.

but the momentum then caught some traders short who had to scramble to buy oil to cover their positions. … Hmmm…. you mean some of the big guys have been quietly raking in cash by selling far out-of-the-money options? Now where have I heard that strategy before?

I will certainly agree that some investors are better than some other investors, but I think this is a little unfair.

You have previously noted the effects on prices due to speculative buying. In a world where production is constrained, this speculative buying cannot be met by hedger selling … it must be met with a short position of equal size by speculator. I will suggest that there are two supply/demand curves that are operative (linked, ultimately, by the law of one price) the hedger/hedger curve and the speculator/speculator curve.

You can’t just say, post hoc, that the fact that this particular speculation has worked against the shorts (and we don’t know for sure that it actually has worked against the shorts; that depends on the option premium and strike) that this proves that the shorts were stupid ex ante. That’s probably a formal logical fallacy of some kind, but I will admit to not knowing its name.

One other factor putting upward pressure on speculative markets was the comment by a Morgan Stanley analyst that oil could hit $150 per barrel. In other commdodities, Corn is pushing $7 per bushel. Corn prices are not impacted very much by the comments of some Israeli politician, or some group in the Saudi government. I have faith that in the long run, over the next year or so that prices will return to fundamentals of genuine supply and demand. But in the mean time, how much damage will be done by hedge fund speculators? In the corn market, if the price of corn does not come down soon, you will start to see a massive slaughter of stock cow herds. IF that happens, it will take quite a few years to rebuild those herds. Speculative bubbles have long term consequences. I would think we would have learned from the low margin requirements on stocks in the twenties. There has been some discussion on this website to raise the margin requirement on commodities. That change alone would take some of the air out of this bubble.

One other factor on the comments of the Israeli transportation minister, is that supposedly US military planners had approved of the Israeli plans. Is the US government willing to risk the closing of the straits of Hormuz just so the Israelis can launch another unprovoked preemptive strike?

James Hymas, that’s a valid point. We won’t know until the dust has settled whether the option sellers were doing so with leveraged capital or were taking a diversified risk they could afford.

In the mean time, though, here’s my complaint. Do you know, on the basis of currently publicly available information, who these players are and the size of their exposure? My ongoing concern is, in the absence of transparency in these derivative positions, I don’t see how the market can efficiently allocate capital. My worry is that some insitutions are assuming an unmonitored risk, the outcome of which could end up hurting the rest of us.

People are selling far out of money options on oil futures? Calls and not puts? Upside? Are you kidding?

My eight-month-old niece is a better trader than that.

Hmmm.

The way I read your FT quote, it sounds as though once again financial insurance policies are having a destabilizing effect on markets (c.f. 1987).

The convention in the journalistic world is to hang each days market movement on some little (or perhaps great) event or quotation. Sometimes they are right, but most often they are either wrong or irrelevant.

Some days results are just random, and need no further explanation. Some days are non random because the markets have new information, but it is most likely that the new information and its import will be unclear for a while.

The quoted remarks above, don’t strike me as the kind of information that should move the market.

Various people inside and outside the Israeli and American Governments have speculated about the need to blow Iran’s nuclear program up before they test a bomb by lobing it at Tel Aviv. It is not new.

The Saudi government, which is more like the mafia than like a real constitutional government, is a different matter. Surely there are those who counsel them to leave the oil in the ground, but the monarchy is in a delicate position. It needs vast resources to pay-off its potential rivals, including the thousands of princes, thousands of clerics, and the huddled masses who have no rights. The real questions* cannot be answered by outsiders, but insiders are market players also and the market is fully informed in the premises.

*The real questions are things like, what is the real state of their reserves, how long does Abdullah have to live, what will happen when ibn’Saud’s last son dies, can Saudi-Arabia turn into a real country before it turns into a bloodbath.

We await further enlightenment. In the meantime, make sure your tires are properly inflated.

Here’s one way to put it: the price of oil doubled since the credit crunch began in August 2007. That is the thing that needs explaining.

A claim that oil is much more abundant than the oil companies let on is here.

Thank you, Fat Man, for making a point that isn’t made often enough. There is a financial-journalistic cookie-cutter that requires tying price movements to headline events. In many cases, the result is pure balderdash.

Having said that, I will now risk some balderdash of my own. It may well be that shorts were forced to cover as oil began heading higher. Certainly, that was a massive move, and covering of leveraged short positions was almost certainly an element. I wonder if there wasn’t another element to the trade – just a refinement of what we already know. Non-dollar based accounts that liked oil faced the prospect of losses in domestic terms if the dollar moved up faster than oil moved up in own-currency terms. Bernanke’s June 3 speech was taken by some to suggest the Fed might begin to support the dollar. Those accounts needed to reduce exposure to oil, or hedge against dollar gains. They probably did a bit of both. Then, Trichet comes along and says essentially “don’t worry about fx losses on your long-oil positions” so the accounts in question could go back to doing what they wanted to do.

This spike is just a sign of things to come. While I doubt that it will rise that fast again, I am predicting a gradual rise in price for as long as we use oil. This article I was reading called $225 Per Barrel – The New Gov’t Standard for Oil talks about how the Government is preparing itself. They are even using the figure $225 to base its estimate off of. And to me if its good enough for the government and the Navy, its good enough for me. So I’m keeping this in mind as I watch the gas prices rise and I hope this article I posted, along with this one above we read, helps people to plan so they don’t get blind sided. Thanks Ya’ll

Charles, your link conflates the amount of oil left in the ground with the amount that can be produced each year. Peak Oil says very little about the first but a lot about the second. (Much of the oil “left in the ground” is uneconomical to retrieve at virtually any price – such as the marginal garbage that requires huge inputs of water and natural gas – or the high-sulfur stuff the Saudis keep trying to convince people to buy).

My ongoing concern is, in the absence of transparency in these derivative positions, I don’t see how the market can efficiently allocate capital. My worry is that some insitutions are assuming an unmonitored risk, the outcome of which could end up hurting the rest of us.

May I presume that you are in Willem Buiter’s camp? any large leveraged financial institution, commercial bank, investment bank, hedge fund, private equity fund, SIV, Conduit or whatever it calls itself, whatever it does and whatever its legal form, will have to be regulated according to the same principles.

I take the view that such regulation would stifle innovation at the very least; and lead to financial central planning at worst. I prefer a layered approach, with highly regulated banks, moderately regulated brokerages and lightly (or un-!) regulated shadow banks.

James Hymas, the regulatory changes I favor are (1) greater transparency in accounting, (2) capital requirements for any institution too big to fail, and (3) a system that replicates margin requirements for OTC derivatives trading.

JDH, and those margin requirements on OTC derivatives are….

(2) capital requirements for any institution too big to fail,

Who would make up the list of institutions too big to fail? Would the Fed be prohibited from lending, directly or indirectly, to institutions not on the list? Would the list be restricted to financial institutions?

(3) a system that replicates margin requirements for OTC derivatives trading.

It is my understanding that, when unrealized profit is booked on a derivatives position by a US regulated institution, it is accounted for as a loan by that institution to the extent that it is not collateralized. See, for example, this Fed rule. Is this not acceptable?

Today’s speech by Geithner of FRBNY announced a clearing-house for CDS. Is this acceptable?

rdm and James Hymas, these are excellent questions, which I hope to address in a subsequent post.

Super, thank you! I realize the questions strayed a little from the post’s topic.

I hope I did not sound too belligerent; please accept my apologies if I did.

James Hymas, I always value hearing your thoughts.

Oil is just another bubble waiting to burst, much like housing and tech stocks before it. Hysterical price moves, non-stop chatters in the media are all signs of a bubble.

M1EK says, “Charles, your link conflates the amount of oil left in the ground with the amount that can be produced each year.”

So do the people who claim that drilling offshore and in ANWR will be our salvation. But costs of development very often are overstated, because technological developments change the cost structure of a project. The oil companies don’t want to pay the costs of preventing the despoliation of Florida’s beaches, for example. I don’t have any doubt that, at some price, environmentally-responsible offshore drilling is possible nor that if the oil companies wanted to, they could substantially lower those costs by research. Similarly, twenty years ago, no one would have dreamed of drilling for Brazil’s offshore oil. But technology has made it feasible.

The point is that the oil is there. We just can’t agree on how or whether to develop it.

I can recount a number of spill incidents connected to tankers but I am having a difficult time remembering one incident where an offshore oil drilling rig had any kind of serious spill. Could someone help me?

Charles, the issue of “how or whether to develop it” as applied to “how quickly and at what cost” is the fundamental principle of Peak Oil – NOT that there’s not a lot of oil left; but rather that the oil that remains is hard enough to pump compared to the easy stuff we pumped before that it will be nigh-impossible to increase annual production from the peak on out.

DickF, Santa Barbra Channel back in 1969. A few million gallons of crude leaked onto the beaches.

(gallons not barrels)

Oil should be below $100bbl by the fall.

China is subsidizing oil, at prices from over two years ago. Imagine if the U.S. govt were subsidizing oil from the mid-$60 range; oil would be well over $150 with all the excess consumption.

Malaysia, Indonesia, India, among others, also subsidize oil prices. Some of those countries have been trying to ease off, allowing gas prices to rise for consumers, to howls of protest.

This subsidy is probably the #1 contributor to the continued rise in oil. BTW, those countries already have an inflation problem, so look for Son of ’97 Asia Crisis in the Fall.

After that, the shorts from the $70-dollar range, who have been forced to cover, have driven the price lately. Commodity hedge funds have grown over the last few years, but have held steady positions since the $70 mark. It is the speculators who have been driving the price upwards, but it is the capitulation of the shorts, not the longs, who have sent WTIC parabolic.

Morgan Stanley. Goldman Sachs ex-CEO/Chairman now United States Department Secretary of the Treasury. Oil hedge funds are secretive and not too many people know too much about them. Mr. Paulson knows a lot about oil hedge funds – as Secretry of State of the U.S. is it reasonable that he work with the U.S. government to find solutions to this “oil bubble” situation? I beg journalists more informed & more intelligent than myself to address this question on the front pages of newspapers and in the editorial pages. Please help avert an ever growing fiasco. A tremendous number of U.S. citizens do not understand oil hedge funds and their “black box” reputation for secrecy. Please, please help educate Americans.