From a timely BIS working paper by Lucy Ellis released on Thursday:

Mortgage lending standards eased in many countries in recent years, but the limited available cross-country evidence does suggest that the process went further in the United States. Standards are difficult to measure because different aspects need not all move together (Gorton 2008), but the observed increase in early payment defaults in the United States (but not elsewhere) provides direct evidence that it occurred (Kiff and Mills 2007); Gerardi, Lehnert, Sherlund and Willen (2008) provide additional detail on the easing in lending standards.

Two developments seem to have spurred the easing in US standards. First, a range of legislative and policy changes had been made to encourage the development of a non-conforming (Alt-A and subprime) lending sector, lying outside the model defined by the government-sponsored enterprises (GSEs, Fannie Mae and Freddie Mac). Part of the motivation for this was a desire to ensure that home ownership was accessible to households who had historically been underserved by mortgage lenders (Gramlich 2007). In addition, the administration had wanted to reduce the GSEs’ domination of the mortgage market. Following problems with accounting and governance at both institutions, the GSEs’ capacity to expand lending was capped by new regulatory limits on their activities (Kiff and Mills 2007, Blundell-Wignall and Atkinson 2008). [emphasis added — mdc]

Second, origination volumes had fallen following the end of the the refinancing wave of 2003. Lenders therefore faced a substantial reduction in fee income, with implications for the size of the entire industry. The low rates on long-term fixed-rate mortgages available in 2003 had allowed borrowers to cut their interest rate significantly, by one-fifth on average for loans refinanced with Freddie Mac, for example. Total originations peaked at around $4 trillion, with mortgage backed securities (MBS) issuance not much less than that (Figure 3, left-hand panel). As a

result, around half the outstanding mortgage stock turned over through moving or refinancing in that year. According to the Federal Reserve’s 2004 Survey of Consumer Finances, 45% of households with a first mortgage had refinanced within the previous three years (Bucks,

Kennickell and Moore 2006).

Lenders seem to have responded to these developments by easing underwriting standards across several dimensions. The first of these was that non-conforming mortgages did indeed gain market share. Subprime loan origination grew particularly strongly, but the Alt-A category did as well (Figure 3). Although some full-service lenders branched into these market segments, much of the expansion occurred in lending originated by specialist lenders. This shift included entry into the market by major investment banks via newly acquired mortgage lending subsidiaries. Even if lenders within each category had not eased standards, the result would have been that more of the US mortgage book contained features that raised arrears and

default rates. As documented by Quercia, Stegman and Davis (2007), even in the late 1990s, loans originated by designated subprime lenders were much more likely than prime lending to include features that boost default rates, such as prepayment penalties and balloon payments.

The easing in US mortgage lending standards went beyond a shift amongst lenders with different business models. An array of statistical evidence and legal findings shows that underwriting

standards of individual lenders eased as well. First, and perhaps most importantly, requirements for documentation of income and assets became progressively laxer. Instead of assessing

borrowers’ abilities to service their loans, lenders ended up focusing on collateral values, in effect betting on rising housing prices (Gorton (2008) makes a similar point).

The analysis also indicates that it wasn’t just subprime that exhibited deterioration, although it was by far the one hit hardest. Rather the key distrinction was…

The real distinction is between loans that were in the FHA pool or the conforming market — those insurable by the GSEs — and those that were not in either of those groups. Although there was

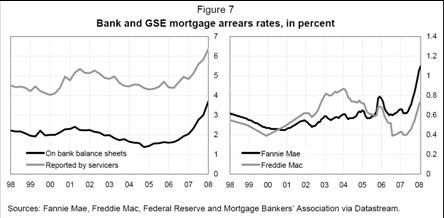

some easing of standards in the conforming market, especially in the GSE’s extended programs and the FHA seller-financed downpayment program, it was minor compared with the one that occurred in the rest of the market. Arrears rates on the GSEs’ single-family home portfolio have risen a great deal recently, but this only started in the second half of 2007 (Figure 7, right-hand panel). Likewise, the increase in arrears rates on FHA mortgages has been fairly mild.

The report identifies several factor for the fact that the US housing market deteriorated even before the macro economy deteriorated — unlike in Canada and UK.

Figure 7 from Luci Ellis, “The housing meltdown: Why did it happen in the United States?” BIS Working Paper No. 259 (September 2008).

(I think if one observes closely the the fact that the scale of the vertical axes are very different, one may very well have an altered perspective on the role of the GSE’s in the mortgage crisis.)

- Supply of new housing is relatively flexible

- Tax system encourages higher leverage and flipping

- Legal system is swift but generous to defaulters

- Lenders could rely on external credit scores

- Cash-out refinancing is inexpensive in the United States

- Structured finance enabled subprime and other non-conforming lending

- Financial regulation did not prevent riskier lending

I excerpt the section on this last point below:

…

The US mortgage market is subject to an array of laws and different regulators. The regulated GSEs enforced quality control in the conforming market, but the rest of the mortgage market was more lightly regulated. Mortgage lenders that were not also depositories were the lightest regulated of all. As one example of the relatively light regulation of many mortgage lenders, consider the new regulations announced by the Federal Reserve in December 2007 and approved in July 2008, as part of its role of enforcer of the Home Ownership and Equity Protection Act. Among the practices newly banned by these regulations were “coercing a real estate appraiser to misstate a home’s value” and “making a loan without regard to borrowers’ ability to repay the loan from income and assets other than the home’s value” (Federal Reserve

Board 2008). The implication is that these practices were permitted in the absence of the new regulation, and were common enough to merit an explicit ban. Had all US mortgage originators been bound by a requirement to consider the affordability of the repayment explicitly — as is the case under Australia’s Uniform Consumer Credit Code or the requirements of UK legislation, for example — it seems unlikely that no-documentation (stated-income) mortgages or “exploding ARMs” would have become so prevalent.

In addition, following intervention in 2004 by the Office of the Comptroller of the Currency (OCC), federally regulated lenders were exempted from state legislation which was in many cases stricter than that at the federal level. Some of the practices banned under some states’ law included the prepayment penalties and balloon payments that have been shown to raise default rates, independent of the borrower’s credit score (Quercia, Stegman and Davis 2007).…

A paper well worth reading, for those who want numbers and analytics.

Technorati Tags: GSEs, subprime,

Fannie Mae, Freddie Mac,

and

deregulation, Office of Comptroller of the Currency, and mortgage markets.

Just prior to the bolded portion, Ellis mentions “a range of legislative and policy changes.” I’ve read comments by Janet Yellen (SF Fed) seemingly arguing that subprime loans were mostly made by non-CRA firms handling non-conforming loans, and thus policy wasn’t responsible.

So while this further confirms Yellen’s point that most subprime stuff isn’t GSE-generated, it disputes the “this was just the market on its own” claim, right?

You are quite correct Mr. Steele but the article, like many regarding the mortgage meltdown, fails to ‘connect the dots’.

Behind the ‘if you have a pulse, you get the loan was not, as this piece claims, due to a sudden shift in focusing on ‘the value of the collateral’.

It was principally driven by the ‘elimination of risk’ created by ‘originate and sell’ model rather than the tried and true ‘originate and hold’..policy.

But this is only the ‘tip’ of the iceberg. Where did all of this money (to buy mortgage securities) come from?

Globalization has, um, ‘enhanced’ the fortunes of people in goods producing nations and these people were saving their money.

You have a few hundred million people saving their new-found wealth and it starts adding up to some ‘real’ money, all of it looking for ‘returns’.

Now we need to consider how, after promising that ‘globalization’ would improve the lives of all parties (when in reality, it was turning the US into an economic desert.) Our ‘financial sector’ was charged with the task of ‘pumping up’ the GDP.

(It should be lost on no one that our GDP dropped like a stone once the market for MBS and CDO’s dried up.)

While ‘exports’ have been touted as a ‘bright spot’ in the US economy, manufacturing has been bleeding jobs for the past 18 months.

So our media tends to ‘gloss over’ the fact that the bulk of our ‘exports’ are in fact foodstuffs and raw materials…just like a ‘third world’ economy.

Our ‘service economy’ has a much lower ‘payscale’ than our former manufacturing based economy so, um, excessive executive compensation provides a smokescreen for our actual shrinking payrolls.

Just as the sale of ‘financial instruments’ had become the ‘engine’ of our economy, masking the fact that we ‘produce’ little for ourselves.

Now we’re ‘paying the price’ for having an ‘imported’ economy (that is also severely unbalanced.)

Since we are in fact broke, one can only wonder how the Fed and the Treasury are going to ‘collateralize’ the huge amount of debt they are proposing to save the financial system from collapse.

Will these fools sell the nation out from under us? (As Thomas Jefferson warned.)

Be afraid, be very afraid.

A simple question: Does the current crisis indicate that the group of “households who had historically been underserved by mortgage lenders” were not underserved at all, but rather had been able to obtain all of the mortgages which they could reasonably be expected to repay at appropriately risk-adjusted interest rates?

Michael Cain, why would these be mutually exclusive states? If one could measure the amount of unextended lending by which a population were underserved “historically,” i.e. in a recent period before the changes in practice, could this not be a positive number, indicating that indeed there were such a population, yet still be smaller than the lending of the early 00s, indicating that there nevertheless was too much lending under the new regime?

Menzie, thank you for bringing attention to this study.

Interesting paper – I think I’ll pull this out anytime I hear someone say that the whole issue was caused by fair lending standards.

I’ll admit that this is good analysis. Is that all we have to offer the public at this time? Here is a letter to the editor that will be ignored by my local newspaper. Can I get a reaction to a proposal for action?

Paulson says the financial markets will collapse unless the proposed bailout is approved promptly.

Paulson has made some predictions in the past that turned out not to be true. Yes, those predictions were optimistic rather than pessimistic. He has sought to play down the severity of the problem again and again.

I would like to know exactly when this collapse is scheduled to take place. Can we wait until the end of the week to pass the legislation? Or will the collapse happen before then? If the world can wait one week, why cannot it wait 2 weeks?

ONE WEEK IS NOT LONG ENOUGH TO CONSIDER SO IMPORTANT A DECISION. THE FIRST DECISION THAT SHOULD BE MADE BY THE CONGRESS IS TO PROMISE THE PUBLIC THAT NO DECISION WILL BE MADE IN ONE WEEK.

Fear is the wrong emotion at this time. Sober reflection is required. If the U.S. adds $700 billion to its debts, this might just be the action which finally destroys the value of the U.S. dollar.

Spending $700 billion is not the only solution available. The problem is largely an accounting issue. Firms are forced to write down their losses as though they were selling their securities today. That is stupid. No one is selling these securities. Why not recognize and exploit that fact?

The U.S. should establish a way for firms to place the toxic contracts in quarantine until the contagion passes. The Congress should set up a new federal agency with a budget of 1 billion dollars per year rather than authorize spending $700 billion. This new agency will receive temporary ownership of all the toxic contracts that any firm or individual anywhere in the world wants to unload. By law, the value of these contracts will remain fixed as long as they are in the possession of this agency. While in the possession of this agency, none of these contracts can be bought or sold. This agency should be given the power to manage these contracts for the benefit of the original owners. The power transferred must include the ability to adjust mortgage payments to that level which will return the most dollars to the owner, as compared with default. Owners will have the right to reclaim their assets any time they wish, at which time their value will be estimated by the federal agency and the owner will have to take the contracts back and show them on their books at the new, realistic price.

W. Raymond Mills

1006 Oberlin Dr.

Columbus, OH 43221

Ph. 614-451-4075

wrmills@wideopenwest.com

Sept. 21, 2008

A modest proposal:

1) Treasury gets extremely dilutive warrants from any bank that touches this facility. This is what happened at AIG: the taxpayers may lose a lot of money, but at least Wall Street’s profit from the scheme is minimized and the taxpayers get something back in a best-case scenario.

2) Executive compensation is capped at any bank that touches this facility. Nobody makes more than 10x or 20x the median employee, and no more stock options. Maybe even a clawback for ill-gotten gains during the bubble. Executives don’t go along? Push them out.

3) Substantial new funding for the Justice Department to prosecute mortgage fraud and securities fraud for everyone that caused this problem, from Angelo Mozilo and investment bankers all the way down to speculators who committed fraud on their loan applications. We saw “perp walks” for Enron and WorldCom. Why have we still seen none for this much larger fraud?

I like Barney Franks idea that regulatory reform must be passed by Congress and agreed to by the Administration before the bailout.

I like mr. Varones suggestions.

I do not like Mrs. Pelosi’s proposal to provide money to homowners. Can’t afford more expenditures. In fact, can’t afford the bailout.

Can anyone comment on the valuation of the assets to be purchased by the government? Seems to me that if the assets are purchased at a discount, it will remove them from the balance sheets but will also require further mark downs by the companies. Alternatively, if the government pays higher prices, then the assets will almost certainly require a writedown by the government and that would fall on the taxpayers.

Anybody have a grip on this?

inthewoods-

You are exactly right. That is the paradox. Either this plan rips off the taxpayers, or it doesn’t help the banks. Krugman is all over this point.

Paulson isn’t saying how he would price the assets, but the obvious implication is that the only way he can help the banks is to screw the taxpayers.

Barney Frank, head of the House of Representative Financial Service Committe, is talking intelligently on TV this morning about the urgent need to reform the regulatory system to prevent a re-occurance of this problem. However, he apparently is not willing to hold up the grant of funds until after the reform takes place. That shows his priorities. He is cowed by Paulson and fear. If he had any guts and could respond responsibility to the demands of his position, he would insist upon reform before funds.

Mrs. Pelosi wants to increase the total outlays to take care of ordinary citizens. Prevention of collapse of the financial system is the best way to take care of ordinary citizens.

But we need some people in the Congress who will put on the brakes, refuse to be stampeeded and take at least 2 weeks to consider this question. (all those members who think their need to campaign is more important than staying in Washington can go home and leave the decision to responsible people).

As you can see, I am almost frantic with fear that fear will overcome good sense, not only in the Administration, but in the Congress and in the general public. The only thing we have to fear is fear itself. Where is our Roosevelt?

W.C. – thanks for clearing that up – clearly they haven’t defined it.

The other question I have is what happens to CDSs vs. CDO/CMOs – buying the CDO/CMOs seems to make sense to me (as far as the whole plan makes sense), but I don’t see how the government could possibly buy up the Credit Default Swaps – the transactions are so complex and intertwined.

I’m really curious what happens with market this week following all this action. Strikes me that the dollar is once again toast, inflation will go up, and equities may rally further. Comments welcome.

Any $700 billion rescue plan administered by a man whose career was spent as a trader will see that the financial system will be rescued by this bailout.

What about the rest of the economy? Everybody says we have at least one more year of mortgages going sour. I prefer to keep the $700 billion for the real crisis, when the U.S. economy will need a jump-start. One year from now,if this bailout passes, we will be in a REAL crisis. And the real fear that U.S. government credit will be non-existent.

Ok – so are we going to require that the banks:

– Get rid of their dividend?

– Get warrants on the stock price so that there is an opportunity to benefit from the stock rising?

– Allow any bank that doesn’t agree to the above to be wiped out?

My worry here is that we’ll be like Japan by not allowing these horrible institutions to fail.

Paulson and Bush have said that putting out fires on a daily basis did not work, we have to look ahead and fix the financial system.

Their looking ahead consists of about 3 maybe 4 weeks. It does not include looking beyond the financial system and it does not include looking beyond their time in office.

Agreed, the financial contagion must be stopped. But what then? Will the economy then be in a postion to return to growth?

Someone other than this administration must look beyond Jan. 1, 2009 and beyond the financial system. We cannot depend upon this administration to propose a rescue plan that is protective of the U.S. in the years ahead.

Menzie,

This constitutes excellent evidence of points you have been making abut regulation & GSEs. But I would submit that the lax regulation (some of it flowing from anti-redlining gov’t regulation) primarily affected the distribution of the misallocation of resources into housing vs. other parts of the economy.

The misallocation was caused by our Fed & the other central banks of the world creating too much money & credit. Furthermore, the most recent egregious episode under Greenspan was kind of the icing on the cake as debt/GDP (now well over 300%) has been expanding, particularly in the US, for a couple of decades.

Other signs of this include ballooning the percentage of US GDP that was finance-derived over this period…and the expansion of the square feet of retail per person in the US over this period.

The chicken aren’t now coming home to roost primarily because mother gov’t didn’t tell lenders to use their brains. Tho’ I’ll grant you present a good case that it would be better if they had.

The comments of intewoods and W.C. Varone are very clear and very persuasive. Please re-read them.

The one solid agreement of almost every thinking person that something has to be done to stabilize the financial system. Do not lose sight of that concensus.

Any plan beats no plan, under those conditions.

The Paulson plan will pass unless a better plan is developed and entered into the discussion.

W. Raymond Mills said:

Spending $700 billion is not the only solution available. The problem is largely an accounting issue. Firms are forced to write down their losses as though they were selling their securities today. That is stupid. No one is selling these securities. Why not recognize and exploit that fact?

I thought that the banks were doing exactly that for the most part. Moving the toxic assets to ‘level 3’ and pretending they don’t exist.

Simply disgusting:

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4795072.ece?token=null&offset=0&page=1

inthewoods says: “I’m really curious what happens with market this week following all this action. Strikes me that the dollar is once again toast, inflation will go up, and equities may rally further. Comments welcome”

Why not play a bit? I believe fear will continue to control behavior. None of those predicted outcomes will happen. I look for paralysis and little change as everyone waits to see what the Congress will do. Note: I do not back my predictions with money.

Anonymous: Whatever banks and other instiutions are doing, the fact that they periodically write-down their assets by billions and billions is the problem.

I am the most active participant on this blog right now, which is unfortunate because I am not the most highly qualified to speak. I am, apparently, the person most disturbed by the Palson initiative and lack of opposition to it.

I agree that something has to be done, and damn quick. But I refuse to leave it up to officials of the Bush administration to figure out the best course of action.

Unless someone comes up with a better plan, the Palson plan will win by default. Am I the only one willing to say “Here is a beter plan?” Am I the only one who thinks he can made a difference?

“Someone other than this administration must look beyond Jan. 1, 2009 and beyond the financial system. We cannot depend upon this administration to propose a rescue plan that is protective of the U.S. in the years ahead.”

Just whom that might be? The Democrats control congress and I certainly haven’t seen any signs that they are interested in stepping up to the plate. In fact it looks like they are more interested in getting out of the ballpark. Other than hot air the presidential candidates can do nothing. It would appear that everybody is rather content to let the present administration do as it pleases. Do you believe Charlie Rangel has the financial wherewithal to lead us into regulatory Nirvana?

I think the leadership should come from people with Ph.D.’s in economics or sociology (mine is in sociology).

I really don’t understand the lack of response to the audacious claim, made in this thread at 6:27 this morning, that this tremendous problem, that is threatening to destroy the U.S. financial system and with it the U.S. economy, is primarily an accounting problem and that it can be solved by taking the most toxic contracts off the books and storing them temporarily in a new governmental agency, set up to receive and maintain these contract.

If that is not an audacious claim, I would like to know what is.

Yet, not a single comment, good or bad about that claim. It has been over 6 hours. Is everybody asleep or what?

This claim is not political, it is technical, in the sense that it proposes a cause and effect relationships that economists are qualified to judge.

Is it a breach of good taste to presuppose that educated people should actually try to intervene in the real world? I realize that politicians have a long history of ignoring academics. But in this case, the Congress badly needs some help and there is some possibility that help might be appreciated.

Would anyone like more details? If so, contact me at wrmills@wideopenwest.com. I will send you a 3rd draft of a document titled “The Contract Repricing Corporation”.

People with Ph.D.’s in economics or sociology do not have leadership ability.

Our political leaders should be consulting the Ph.D.’s and taking knowledge from their profession seriously.

Unfortunately, that requires leadership, and our political leaders also do not have leadership ability (anymore). They have become followers. Who do they follow? Ignorant, anti-intellectual, irrational, screaming masses (many of whom may not even bother to vote).

I am an 82 year old man, not some young hot-shot. I have said enough and should keep quiet – unless asked to speak.

Wendy –

At the moment the Ph.D.’s reading this blog have nothing to offer the political system. Only one proposal has been offered and it has not been critiqued or evaluated. One person means nothing. If many qualified people agree, that would be meaningful.

Mr. Mills: Your plan seems more like a gimmick than a real plan. If so called “toxic assets” are taken off the balance sheets of banks and other financial institutions how does that help them? The only outcome will be to further reduce the asset side of their balance sheets. A much more simple proposal would be to simply eliminate mark to market accounting.

Further, you’re assuming that financial institutions aren’t already working out loans on their own. That is happening every day, in various forms, but it’s a slow process. I don’t see how creating a single government agency with a $1B budget to act as the mortgage workout czar will speed up this process.

Is anybody else concerned that the legislation in its present form gives the treasury secretary absolute authority, with no review? Just because Henry Paulsen is a very bright and respected man does not make him infallible, and we need some people in place who can challenge his thinking, and if enough of them question a particular action, they should be able to veto or delay that particular action pending further study.

Steve Perlestein said this morning that we should not criminalize this, that the CEO’s who got us in this mess did not deliberately deceive the American people, that they deceived thenselves. Based on their compensation packages these guys are supposed to be the best and the brightest, but I knew a lot of people with high school educations making less than 30K who said that liar’s loans with no down payment were not good loans. If these guys believed their own spin, it is because spreading that nonsense was going to be profitable for them. Let’s see, I think deceiving other people for your own profit is….fraud?

Remember, corporations and banks are not greedy. Some PEOPLE running some corporations were greedy, just like the guys at Enron, and there has to be consequence for that deception and greed. You cannot punish Lehman as an entity, or AIG, but you can certainly punish the people who put them in that position.

And the guys at Merrill Lynch who are going to make a fortune for one year’s work or less… the Bank of American board has to look at that compensation.

Steve B – You are my man. I am so happy to have some reaction.

The proposal is to stabilize the value of these assets while they are in the possession of the federal agency, by the law that creates the agency. Thus these “quarantined” assets cannot reduce the balance sheet of the owners.

Mark-to-market accounting is widely used, and apparently has advantages over any other system, normally. My proposal involves only a segment of the economy and for a short period of time. Changing the rules for this sub-set of the whole system is better than quarreling with a bunch of accountants.

A part of my proposal, which you have not yet seen, requires the owners of the toxic asset to surrender to this agency the power to reduce the terms of the loan to households, if, in the judgment of the federal employees hired to do this work, the total returns to the owner will be better than a default. Safeguards, other than the approval of the owner, can be built in to check the reasonableness of this modification. The assumption is that people devoting full time to managing these loans will have a more objective picture of the options than the original owner. In any case, building in a way of reducing the loan payments is an essential part of the proposal.

A paper that says the US is the only country experiencing a real estate correction may need to go back to the drawing board. For the BIS to publish such a paper suggests the need for a quiet withdraal from the world scene.

The root causes of this credit implosion go back a long way, but can be summarised as “easy money” policies of government. Whenever cyclical economic pullbacks loomed, governments have responded by droppng interest rates and pumping liquidity into the banking system. Lending institutions, having access to cheap money (often at interest rates below the rate of inflation) lended it out, as that is their business. The need for new investments overrode common sense and soon lending standards were dropped, real estate markets were inflated and levered buyouts proliferated. None of these activities were productive investments, no new wealth was created, but more money was put in circulation and more debt incurred.

Republicans , who as recently as 1996 campaigned to pass a constitution amendment to balance federal budgets, completely reversed course and when elected proceeded to run spiraling deficits through a policy of borrow and spend and tax cuts. A lot of the new spending was sent overseas and blown up in wars.

The current crisis will be managed by the simple expedient of nationalizing private losses, though leaving any real returns to the private sector. This however does not undo all the bad investments, or reduce the supply of money or its velocity.

Public and personal savings are now exhausted and the only way out it seems it to print more money and pump it into the system in order to stimulate investment, the same “solution” which is the root of the problem. The result will be inflation, devaluation of the greenback, and if the investments are not made profitably, a protracted recession.

The point is that the resolution of the current financial crises, is only a step on the road back to solvency… the causes have not been reversed.

stewart: The paper does not say the US is the only country undergoing a real estate correction. If you got that impression from my description, then that is my mistake. Rather, the paper highlights the fact that the US entered into mortgage problems at a pace more rapid than experienced elsewhere, based upon macroeconomic conditions.

Either this plan rips off the taxpayers, or it doesn’t help the banks. Krugman is all over this point.

I like Krugman’s general points about the Paulson plan, but not this one.

This isn’t necessarily a zero-sum game between the banks and the taxpayers. The banks could have a valuable but illiquid asset which they give to the Treasury in exchange for cash. The banks gain liquidity, and in a few years the Treasury sells them off for more than they paid for them, now that everyone isn’t panicking.

Of course, you can well point out that we have no assurances of that happening, and that we have a major market for lemons in which the sellers know which of their assets are worse than others and sell those to government, and the total lack of oversight on the Treasury’s part. Those are all very valid criticisms.

But it’s not impossible for both the banks and the Treasury to benefit from a deal they make.

Opening Bell: 9.22.08

Democrats Set Bailout Conditions as Treasury Chief Rallies Support (NYT) There’s like $1.5 trillion on

On September 11, 2003, the New York Times published this report on the proposed reform of Fannie and Freddie.

Read this, and answer the questions: who proposed the reform of Fannie and Freddie? Who opposed them? Who stated specifically that these institutions had no problem?

http://query.nytimes.com/gst/fullpage.html?res=9E06E3D6123BF932A2575AC0A9659C8B63&sec=&spon=&pagewanted=print

Copy and paste into your address bar if this does not appear as a hot link

I think if one observes closely the the fact that the scale of the vertical axes are very different, one may very well have an altered perspective on the role of the GSE’s in the mortgage crisis.

First, bad English. Second, Fannie and Freddie had “reached more than 80% of market share” this year.

.01 x .80 = .008

.05 x .20 = .010

So: the Government Sponsored Enterprises broke 0.8% of the market, while private enterprise broke 1%. Clearly, a marvelous Victory for Socialism!

So, I take it the U.S. government will simply repudiate the debts of Fannie and Freddie without the embarrassment reserved to the peons in the private sector? And without the threat, needless to say, of jail time for those whose malfeasance crossed the line to outright fraud?

Yippee.