The Fed will probably vote for another 50-basis-point cut in the fed funds rate this week, bringing its target down to 1%. Here’s why I think that would be a good idea.

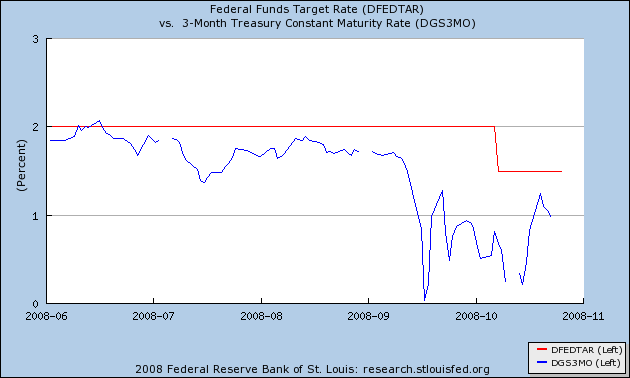

First, the current fed funds target of 1.5% remains 50 basis points above the 3-month T-bill rate. That gap is the one factor contributing to the worrisome TED spread that the Fed clearly has the power the change.

|

Second, I have a hard time seeing a resurgence of inflation in the current troubling economic environment, in which plunging demand has brought oil back below $70 a barrel, and the big concern is that we’re about to see a surge in the unemployment rate.

Third, the primary worry that would prevent the Fed from cutting rates at the moment is the prospect of triggering a flight from the dollar. But the problems have clearly gone global now, with other central banks likely to cut as much or more as we do. I’ve been a little surprised at the flight back into dollars that those global developments seem to have instigated.

Would another 50 basis points really help? Maybe not much. But I expect we’re about to find out.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

interest rates

A FED rate cut is meaningless.

First, FFR have very little real impact of the economy because any affect is sterilized.

Second, our economy does not have a liquidity problem but a credit problem and that is a trust problem. Government intervention has made the problem worse rather than better because it injects the uncertainty of arbitrary rule changes into the market. No one will transact if there is a possibility that tomorrow everything will be different. What if you had bought AIG the day before the government bailout?

Normally a rate cut has a psychological effect but at this point conditions are so bad that another cut would signal worry on the part of the FED. But this psychological effect would be next to zero.

But what would be a disaster would be a rate increase, a tax increase, or another bailout. All would signal a reduction of productive capital being redistributed to the inefficient segments of the economy.

At this point the FED is basically irrelevant.

DickF,

I don’t think the term “sterilized” means what you think it means. “Sterilization” in a central banking sense means preventing central bank activities that might drive the funds rate way from target from doing so. If the central bank intervenes in the FX market by selling its own currency to buy a foreign currency, there will be too much of its own currency in circulation, so it sells bills to sop up currency. “Sterilizing” the effect of a fed funds cut is kind of an oxymorom.

James H.

Are you suggesting that the TED spread is a causal factor, and not a symptom? I’m all for treating causes, but I think we stray from the efficient use of policy tools when we start aiming them at symptoms.

Several people I respect, including JDH, keep saying that US policy is not inflationary.

Taken in isolation, the bailout might be non-inflationary, since by taking equity stakes, the US can mop up any excess liquidity by selling those stakes.

But the US is also running a massive structural deficit and a CA deficit, and there’s not a mop large enough for those.

Furthermore, I take the point that US labor costs are suppressed. But the labor content of what the US consumes is increasing from abroad. And those labor costs are not necessarily suppressed. Indeed, labor throughout the world is getting restive. The Democratic tide this year is just one indication that working people here are tired of working harder for less.

Taken in full context, could someone please explain to me how this is not going to end in a mushroom cloud of inflation? I think I can plot a non-inflationary escape path, but it’s not a path I expect either party to adopt.

Not to mention the fact that the ACTUAL fedfunds rate (as opposed to the target) has been under 1% for 2 weeks now. The Fed has given up on managing to the target, so a cut in the target to 1% will actually do absolutely nothing.

The dollar surge reflects strong deflationary forces.

The Fed needs to cut for that reason alone.

50 bp is the right number.

Like kharris I don’t get what the importance of the 3 mo Tbill rate is right now. The supply of Tbills has increased so much in the past month or so that it’s not clear to me that this rate reflects anything but government policy. In particular when it rises, it’s not at all clear that the flight to quality is receding — it may just reflect supply increases.

On Sept. 10, 2008, required reserves for U.S. banks stood at $41.9 billion. Banks held reserves of $44.2 billion, leaving excess reserves of $2.3 billion.

On Oct. 22, 2008, required reserves for U.S. banks stood at $45.9 billion. Banks held reserves of $327.6 billion, leaving excess reserves of $281.7 billion.

The Fed can certainly change the published target, but what policy tool do they have to change the actual rate?

“Third, the primary worry that would prevent the Fed from cutting rates at the moment is the prospect of triggering a flight from the dollar. But the problems have clearly gone global now, with other central banks likely to cut as much or more as we do. I’ve been a little surprised at the flight back into dollars that those global developments seem to have instigated.”

In essence, interest rates are lower here, but people are still moving money here. Is that correct? Is it because they feel we’re a less risky investment, or is it seen as a way to shore us up?

If my question doen’t compute, leave it.

Won’t a cut to 1% just cause the same problem all over again?

Won’t that put us dangerously close the a Japanese-style 20-year stagnation? Japan had 0% interest for a long time.

I think one thing we can all agree on is that major inflation (a CPI rise greater than 5% a year for 2 or more consecutive years) is not going to happen again in the forseeable future.

It would take a rapid rise in Oil prices to $200/barrel for that to happen, which is improbable in the medium term.

The markets and consensus have been notoriously wrong about predicting everything – that is the only sure thing.

We’ve been jumping from crisis to crisis this year. Subprime/foreclosures, then the worthless dollar, then $147 oil crashing the global economy, then all the global equity markets and currencies crashing, then too strong a dollar killing our exports, etc. etc. etc…

One thing is for sure: I never envisioned so many trillions of dollars being printed across the world so unabashed in such a short time. With deflation unsustainable for the US due to a need to collect tax revenues and service a rising debt load, in addition to the fact that aggregrate supply falls deleteriously in deflationary environments, I suggest in the not too far future we will think $147 crude is cheap. Maybe this next time along, the wage environment will be a little richer (hopefully) to match.

Interesting article on Vox:

http://www.voxeu.org/index.php?q=node/2488

John N Muellbauer

27 October 2008

Print Email

Comment Republish

The current financial crisis will probably lead to a deep recession. This column suggests that European central banks, misguided by outdated econometric models, should have cut rates faster and deeper in a coordinated fashion. They should now scrap these models and agree on a large, coordinated cut of 2 percentage points.

When future economic historians look back to trace the triggers for the October 2008 financial panic and the unnecessarily severe recession of 2009, they will likely put their fingers on two.

* The failure to keep Lehman Bros functioning as a going concern.

* The failure of the ECB and the Bank of England to use their interest rate setting firepower to organise a substantial globally co-ordinated interest rate cut (the 8 October 2008 cut was too timid).

JDH,

It would be helpful if you could clarify your stance on Fed policy.

If a 50bp cut is both not inflationary AND not effective, as you imply, then why not advise them to do more? What about abandoning the Fed Funds target in favor of a of an inflation target (say, 3%) and/or a quantity target (say, a $1tr unsterilized injection in one quarter)? Either of these would be in keeping with deflation-fighting policy prescriptions raised by the Fed Chairman in past speeches.

Secondly, you argued in your previous post that the spike in the monetary base concerned you. Given that you don’t think it has inflationary consequences, the source of that concern is unclear. Further, if the existing spike has no inflationary consequences, then why not advise them to do more?

JDH wrote:

Bernanke’s first approach to this challenge was to “sterilize” the new loans from the Fed, basically selling off the Fed’s Treasury holdings at the same time that it extended the new loans.

kharris,

Your definition is too narrow. Note the quote above from the Professor’s cost just previous to this one. Sterilization when it applies to monetary policy is essentially taking a monetary action that offsets a previous monetary action. Ben Bernanke has taken sterilization to a new level.

The fed is dealing with two term structures due to the role of the dollar as reserve currency.

The global, trade weighted term structure will be the nearest, non-inverted approximation to the trading agents, say by nation by direct sum. That term structure is proxied by the inter bank rate, the US treasury is the domestic USA term structures, and the two are identifiably different in structure, the global having “law of large number” smoothest to it.

The global imbalance is demanding a global term structure for optimum bond reserves. The more we try and make the reserve currency bend to the domestic term structure, the more volatile asset values become.

The fed needs to be buying IMF bonds, and turning IMF management into a profit center. Then the fed has a chance of turning the IMF into the reserve monetary standard for a period of time. Get nations off of the dollar and onto something global and trade weighted.

JDH,

Could I ask a question?

I saw a recent blog that suggested that overall government and private debt has gone to an unprecedented level (even higher than in the 30’s), and that this necessarily means massive defaults or depression to fix.

Does this make sense?

I think that the Fed is mindful that their very low target for the funds rate during 2002-3003 may have stoked the housing bubble.

That is one reason they have not pushed their current target for the funds rate any lower.

If they do use this lever more forcefully, it will be very grudgingly.

Ah, for the good old days back when commodity prices were soaring, oil was $140+ and rising, inflation was at a long-term high, and the big policy question was whether the Fed had pushed rates too low.

You remember, four months ago.

The only thing that is good now is that nearly everyone seem convinced that the Fed should bring down the rates. Maybe this time it will work because there is much more consensus sorrounding the Fed decision. And private economists are not yet blaming the Fed behavior. At least for now.

Interest rate cuts at this point do more harm than good. The last thing we need is to crush the remnants of the money market industry, and funds will suffer further outflows and literally become unprofitable if this policy is enacted.

Also, it’s way too late for monetary policy to have any effect at all. Real 5 year interest rates measured by TIPS spreads tonight are at 3.74%, 115 bps above nominal.

http://www.ustreas.gov/offices/domestic-finance/debt-management/interest-rate/real_yield.shtml

However, back during the peak of the commodity bubble, 5 year real rates touched 0.01% (Mar. 10). They routinely sat in the 1% range during the housing bubble.

I had a discussion with Menzie earlier this year (https://econbrowser.com/archives/2008/02/expenditure_swi_1.html) where I feared the cessation of petrodollar and Asian vendor financing recycling flows would create a vicious feedback loop. He thought the effects of these flows were minimal, depressing yields at most 1%. I hope he was right and something else — reparable — is responsible for this uptick, because otherwise real rates at this level are going to kill off a ton of economic activity.

David Pearson: my primary concerns about the deliberate explosion of excess reserves are (1) the greater exposure to Fed balance sheet risk and (2) I think this may prove to be an unwieldy means to achieve goal (1) in terms of being difficult to undo. My primary concern about bringing the target to 0.75 would not be inflation, but the currency crisis risk that I mention above.

Nick G:The argument that debt in and of itself will cause a depression is not one that I would make. I would certainly agree, however, that the combination of private debt plus falling real estate prices is one of the core economic problems today. I also am concerned that the government debt could yet prove to be a huge problem, but I do not see the evidence that it has done so yet.

The long-term trend of the exchange value of the dollar is dependant on our trade balance. It is only dependant upon interest-rate differentials in the short-run. So the trend won’t be stopped regardless.

The FFR is 1.5% & (1.5% – .35 basis points = 1.15% or the interest rate payment on excess reserves). This compares to .96% for 3 month T-Bills on 10/23/08. Thus, it is more profitable to hold balances at the Reserve banks, than buy creditorship obligations.

The required interest rate payment is 1.4%. This is of course more restrictive and is a disincentive to loan or invest. I.e., the FED is “pushing on a string”.

MattYoung – Thank you for your comment regarding term structure variation between domestic and Eurodollars… I do agree that FED support of IMF bonds would sooth international interbank lending and go a long way to avoiding a repeat of emerging market sovereign debt default… Such a policy would not be palatable in Washington right now, and will require the new administration and congress’ assent. I doubt that you’ll see action to prop up the IMF for at least three months.

I believe that we will be in a shadow-land for quite some time relative to foreign exchange, international bonds, and international banking…The BIS and the entire international banking structure needs additional reform and retrenchment (derivatives and reserve quality)… The international monetary system requires systematic restructuring, since the US economy has proved to be too inflationary and weak to provide stability as the default international reserve currency.

JDH,

FWIW, one could place concerns over a potential “flight from the dollar” in the same bucket as the 1930’s Fed’s concerns over “a run on gold”.

In other words, the Fed Chairman spent years telling people that the 1930’s Fed made an egregious policy mistake in giving a stable currency priority over fighting deflation. And now, it appears, you advise them to make such a priority?

You might answer that this situation is different because the U.S. is not in deflation — the monetary base is actually growing. Perhaps. But I would argue the monetary base is poor indicator of monetary conditions as the velocity of new reserve deposits is effectively zero.

In his “Essays on the GD”, Bernanke cites Eichengreen and Sachs on the beneficial aspects of currency depreciation (p.78):

“(they) argued that depreciation, in this context, should not be thought of as a “beggar thy neighbor” policy; because depreciations reduced constraints on the growth of money supplies, they may have conferred benefits abroad as well as at home…”

Again, presumably you are near the point of disagreement with Bernanke on the issue of currency depreciation. It would be very interesting to know why this context is different than the one faced by the 1930’s policy makers.

One interesting point raised by BCA in arguing for a rate cut is that it would further steepen the yield curve which is critical for banks to shore up their balance sheets.

Their research points to needing at least a 300 bp spread between the Fed Funds Rate and the 10 Year Treasury Yield, which would imply needing a current Fed Funds Rate of about 0.89% based on the current 10 Year Treasury Yield of 3.89%.

Not an economist but was wondering if anyone had some perspective on this line of reasoning.

I believe that reducting in Velocity will counteract the increase in money supply caused from rate reduction. Also, the increase in money supply will be tempered by a possible currency drain (if more people start distrusting the bank and keep cash under their mattress) and an increase in cash reserves (caused not from Fed policy but due to the a natural risk aversion from banks).

http://econjournal.com/2008/10/20/the-effects-of-current-lower-interest-rates-on-inflation/