Well, that’s the IMF Survey title, describing the IMF’s World Economic Outlook.

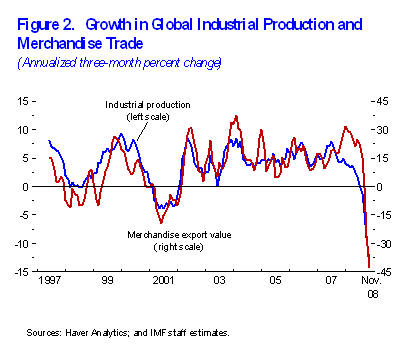

I’ll just reproduce Figure 2, which pretty much sums up the situation.

Figure 2: from IMF WEO update.

Table 1.1 in the Update is also instructive, mostly because it shows how rapidly growth prospects have collapsed since the November (not October) WEO forecasts (e.g., World Output projected growth for 2009 has slid 1.9 percentage points since November’s forecast).

Thanks for the links. The IMF website has their estimate of global GDP growth back to 1980. If they are correct and 2009 global GDP growth is 0.5%, that would be the lowest number in their series. The fact that GDP was above trend of 3% from 2003 through 2008 goes a long way toward explaining why oil prices got so high and why they have now colapsed.

Am I reading their graph correctly? They are projecting a growth recovery in 2009?

DickF: No, according to Figure 1, it’s a growth recovery for advanced countries in 2010. See also Table 1.1.

Sitting snuggly in my warm home on a cold and snowy day, I am pleased to see that economic growth can cease – for a while. Those whose jobs are destroyed are not so comfortable. The hard reality is that we all like more wealth, more goods and service produced by the national economy. HOWEVER – We all know that some such loss is the only way the average citizen will listen to talk to change the relationship between those who are clever enough to gather the fruits of national labor unto themselves.

Obama is going to sweat. He is wrong to accept the current view that

WE MUST PREVENT FURTHER DECLINE IN THE ECONOMY. The economy is not going to respond to stimulus applied today. All we can do today is to try to mitigate the suffering. After the biggest banks have been allowed to fail and the fall out from that has further eroded the level of wealth in the country, we will then be able to return to creating goods and services we all need.

Taxes will be the battle ground. Obama doesn’t seem to recognize that. The Republican leadership has already staked out their position on this issue.

When Obama gets his feet on the ground, and when enough people get out of work, I hope to see a really good redistribution law passed for national income tax.

My preference is special treatment from all income from all sources (including capital gains, dividends and tax-exempt municipal bonds) that exceeds $250,000 per year. The first $250,000 will get all the current deductions. Any amount over $250,000 will pay a flat tax of 35% on that money.

The beauty of this proposal is that it keeps all the deductions people love for the first $250,000 of earned income. It also eliminates all loopholes for that income over $250,000.

I believe this proposal will generate enough revenu to allow the Alernative Minimium Tax to be repealed.

The IMF forecast assumes that developing economies continue to grwoth this year. Indeed they assume China grows 6.7% in 2009. Given China grew 0 in the last quater that seems extremely unlikely and this makes their forecast for otehr developing economies also look optomistic. The only way China will grow 6.7 % this year is if they rig the figures.

I’ve looked at comparisons between the current US recesion and other post war recessions and it does indeed look like the worst since WWII. Any comparisions to the Great Depression are simply speculation that fuel fear and that probably isn’t a healthy thing in this environment. More detail at http://reflexivityfinance.blogspot.com/

Cheers

Steve

Ho-hum. So the good news is :

1) They are saying the bottom is in 2009. 2010 turns mildly positive.

2) Every datapoint is always ‘the worst since 1982/1974/1945’. I see good news there. For those who can survive 2009, something this bad won’t happen again for another 30 years or more.

Tough it out. This why you are supposed to have ‘life savings’.

Thanks Menzie.

So much for decoupling, huh? How’s that BRIC driven growth working for ya?