Here’s my two cents on the latest two trillion.

Treasury Secretary Timothy Geithner began his remarks to the Senate Banking Committee this morning as follows:

To get credit flowing again, to restore confidence in our markets, and restore the faith of the American people, we have proposed a fundamental reshaping of the government’s program to repair the financial system.

It all begins with transparency. We propose to establish a new framework of oversight and governance of all aspects of our Financial Stability Plan. The American people will be able to see where their tax dollars are going and the return on their government’s investment. They will be able to see whether the conditions placed on banks and institutions are being met and enforced. They will be able to see whether boards of directors are being responsible with taxpayer dollars and how they’re compensating their executives. And they will be able to see how these actions are impacting the overall flow of lending and the cost of borrowing.

To which I responded, Amen! And Amen! And I continued reading:

These new requirements, which will be available on a new website FinancialStability.gov, will give the American people the transparency they deserve.

So I surfed to that site, where I read:

This site is coming soon.

Hmmm. Going back to Geithner’s statement:

Second, we are going to bring together the government agencies with authority over our nation’s major banks and initiate a more consistent, realistic, and forward looking assessment about the risk on balance sheets. We’re calling it a financial “stress test.” We want banks’ balance sheets cleaner, and stronger. And we are going to help this process by providing a new program of capital support for those institutions that need it.

OK, so what do we do if we discover that an institution’s balance sheet is, like, stressed?

Institutions that need additional capital will be able to access a new funding mechanism that uses money from the Treasury as a bridge to private capital. The capital will come with conditions to help ensure that every dollar of assistance is used to generate a level of lending greater than what would have been possible in the absence of government support.

Oh, dear. We obviously don’t have clear details of the plan, only the concept, but it sounds to me like the wrong concept. As I’ve argued before, there basically are five parties who might be asked to absorb the losses on existing assets, namely, stockholders, creditors, managers, employees, and the taxpayers. My favored concept is, we use player 5 to get as much leverage as possible out of the first 4. It appears that the Treasury’s concept is instead a continuation of Plan A, namely, hope that if we hold on tight and keep the ship from sinking long enough, everything will turn out OK.

And maybe it will. But if I were in Geithner’s position, what I would be asking for immediately is legislative authority, where needed, to crack heads and make the tough decisions necessary to turn the financial system over to good banks rather than the walking dead.

But let’s hand the microphone back to the Treasury Secretary:

Third, together with the Fed, the FDIC, and the private sector, we propose the establishment of a Public-Private Investment Fund. This program will provide government capital and government financing to help leverage private capital and get private markets working again. This fund will be targeted to the legacy loans and assets that are now burdening many financial institutions.

I’m even less clear as to exactly how that’s going to work. Perhaps the statement released separately by the Federal Reserve fills in some details:

The Federal Reserve Board on Tuesday announced that it is prepared to undertake a substantial expansion of the Term Asset-Backed Securities Loan Facility (TALF). The expansion could increase the size of the TALF to as much as $1 trillion and could broaden the eligible collateral to encompass other types of newly issued AAA-rated asset-backed securities, such as commercial mortgage-backed securities, private-label residential mortgage-backed securities, and other asset-backed securities. An expansion of the TALF would be supported by the provision by the Treasury of additional funds from the Troubled Asset Relief Program.

Here’s what I don’t like about this. The Treasury is acting as though there’s a sixth party who can step into the funding gap here in the form of the Federal Reserve. Once again, that will be OK if Plan A works out, that is, if things go well enough that the Fed’s losses on any assets acquired and loans extended are limited to the TARP funds already authorized. But if not, we’re back to the same calculation– the Treasury must borrow (if foreigners remain willing) and taxpayers must ultimately pay the bill. Either that, or the Fed just covers the bill by printing money for the whole thing.

There’s a very real danger in going as far down the road of Fed-Treasury cooperation as we already have. The Administration starts to think of the Federal Reserve as another cookie jar it can draw on to cover all these pesky bills which, if Plan A fails, we’ll find are impossible to pay by any means other than monetization and a huge inflation.

And fear of that, if it catches fire, would be a far more destabilizing event than a controlled receivership for a few more big financial institutions.

|

Technorati Tags: macroeconomics,

economics,

bailouts,

Treasury Financial Stability Plan,

credit crunch

It’s been years since I’ve played Monopoly. And, not being an economist, I’ve little knowledge of the macro/micro things that drive the system. Like Monopoly though, there’s only one winner. And, at the point in the game just prior to being declared the winner, the player with the biggest pile has all of the control.

Who has the pile now? Is it a country? A corporation? An individual?

It’s seems that no one on the North American continent has the pile nor can they influence the pile-holder to restart the game so we and other countries can continue to play.

It seems as though we’ve tried the war thing (….without fully mobilizing) and the results have not “trickled” down. Resorting to leveraging to pick up the slack has had disastrous consequences. Why would the pile-holder want to stay in a game like this?

I don’t know, at the moment, full nationalization of the worst banks gets a higher and higher probability from me. I have the feeling Geithner is counting on markets to lift valuations ahead of economic recovery, as usual, playing for time, like you say, but underweights the possibility that there is selling pressure unconnected to fundamentals and forced from deleveraging. The scary thing is, every insider who has had a look at the inside dope looks scared, truly scared.

Also, what was this thing in the NYT today, what with “it was Geithner’s plan, he prevailed over other advisors”… makes it look like people are already priming the scapegoat.

You missed one of the parties who could be asked to absorb losses:

Counterparties.

Also, the TALF expansion is separate from the public-private investment fund (“P-PIF”). The former is pretty well-defined. The latter is still in “make it up as you go along” mode, and will likely involve a convoluted scheme to hand taxpayer dollars to private equity firms and banks in some ratio. Non-recourse high-leverage loans to buy “troubled assets”, for instance.

@Nemo: That would be fair, but I was of the opinion that counterparty risk is exactly what froze the banking system after Lehman’s fall and the whole egg dance (is that even an expression in English?) is to prevent a repeat of that.

By “you”, I meant Prof. Hamilton. 🙂

And I am not necessarily saying counterparties should take a hit. Only that it is an option in theory. (Also note that the trouble surrounding Lehman’s debt was a big part of the problem. Lehman was counterparty to relatively few derivatives compared to, say, Bear Stearns…)

I know. I was just commenting on your comment, a meta-comment, if you will 😉

One thing is for sure. These must be some of the most interesting times for everyone interested in economic/financial systems ever.

If the banking system is insolvent, then the taxpayer is already on the line for this, right? And monetizing it would not necessarily lead to inflation since any collapse would be deflationary? Taming the beast may be difficult, but I am skeptical of alternatives. Nationalization of some may just lead to more fear even sound institutions will be next. Nor do I consider these large institutions independent entities, but as rather close subagents of the treasury for whom liquidation would only make its work more difficult. I expect capital dilution, perhaps with some reorganization, is the most we will see for them.

Nemo: I was lumping counterparties in with creditors, but thanks for emphasizing the possibility.

Are you saying that today’s announcement by the Treasury that the Fed and Treasury will cooperate with a PPIF is unrelated to today’s announcement by the Fed that the Treasury and the Fed with cooperate with an expansion of TALF?

Say, for the sake of argument, we have to monetize the debt. (I’m biting my tongue.)

This would not be the first time. From around the time of the new Deal until 1951 the Fed was committed to peg the price of Treasuries. As I understand it, a huge inflation did not ensue afterwards. Yes there were spikes in the rate of inflation during the late 40s. But that, if I understand correctly, had to do with bottlenecks associated with the pent-up demand for consumer goods.

My question is why, this time, a huge inflation would prevail if it did not occur the last time? By how much more do you expect the debt to GDP ratio to rise by if the Treasury continues with Plan A and Plan A fails?

smg: The Treasury Accord is quite different from monetization. Between 1947 and 1951, currency held by the public did not change. Monetization in the present context would refer to, say, a $1 trillion increase in currency held by the public.

Good job on NPR this afternoon, Professor.

Good to hear your skeptical note on these Treasury machinations.

The correct answer will be ‘Debt Jubilee.’

And, the question will be — in eighteen months or so — ‘Now that everything we have tried has failed miserably; now that tax receipts are fractions of past values; and now that we have massive social unrest on our hands; what do we do?’

Thanks, jg. Here’s a link to the broadcast.

“Are you saying that today’s announcement by the Treasury that the Fed and Treasury will cooperate with a PPIF is unrelated to today’s announcement by the Fed that the Treasury and the Fed with cooperate with an expansion of TALF?”

I am saying they are independent initiatives with independent price tags. According to the fact sheet, the PPIF will be “$500 billion – $1 trillion”, while the TALF will be “up to $1 trillion”. So $1.5 trillion to $2 trillion total. (Not counting the other parts of the Plan.)

As much as I like the song and dance about the P-PIF, I am less concerned about existing bad assets and more worried about new bad assets as a result of the string of bankruptcies we are about to experience (SiriusXm is reported to be ready to file Chapter 11.) The banks are at the moment solvent, but bank capital is thin before we are reaching the part of the business cycle that would normally stress it the most.

I hate Paulson’s idea of giving money to banks that don’t need it just to prove how stupid the Federal government can be. If I could believe that the stress test being promised would really reveal which banks need more capital and which could survive without government help, then I would feel that Geithner has made some progress in the short time that he has been Treasury Secretary.

Oh, please. Help me believe!

For the first time, I am truly astounded by the stupidity of the ruling class and half of the US population. Sure, I have always found them stupid, but now I am flabbergasted.

The bubble was caused by forcing banks to lend mortgages to people who could not pay them back. When previously a bank would decline a loan request from someone with a low credit score, now, groups like ACORN shake down the banks with threats of racism for not lending to black people (never mind that the black person’s credit score is under 500).

So we had this bubble. Now, they want to force banks to lend some more. It is not that the banks don’t have money, it is that they DON’T WANT TO LEND TO UNSUITABLE CUSTOMERS.

Hey, if white leftists want to destroy their own wealth in a mad craze to try and make black people prosperous beyond their own earning capacity in a free market, and white people with common sense can’t/won’t stop them, then America will get what it deserves. And I’ll be moving to Asia.

smg: The Treasury Accord is quite different from monetization. Between 1947 and 1951, currency held by the public did not change. Monetization in the present context would refer to, say, a $1 trillion increase in currency held by the public.

JDH, thanks for your quick reply.

I take it it is assumed the public spends this $1 trillion. Suppose there was no stimulus package like the one being negotiated on by the House and the Senate. But plan A fails and the Fed monetizes. Would the likelihood of a huge inflation be reduced?

“… and taxpayers must ultimately pay the bill”.

Congratulations, Professor, you have got it.

As the first 700b taxpayer-rob under Bush went extremely successful, let us go now for 1000b.

Geithner is a member of the GS money club-thats the most important whats happening around here.

JDH wrote:

“…we’re back to the same calculation– the Treasury must borrow (if foreigners remain willing) and taxpayers must ultimately pay the bill. Either that, or the Fed just covers the bill by printing money for the whole thing.”

Professor,

Thank you. One of your better posts.I especially thank you for the caveat above.

This morning all of the talking heads I heard comment on Geithner’s remarks said the markets went down almost 400 pts because he was not specific enought. You actually analyzed what he said and demonstrate that what spooked the markets were the concepts that he discussed. Specifics on these concepts would have spooked the markets even more.

Geithner said, “Trust me” to the IRS. Now he is saying, “Trust me” to the American people. I’m not so sure his track record gives me a warm fuzzy.

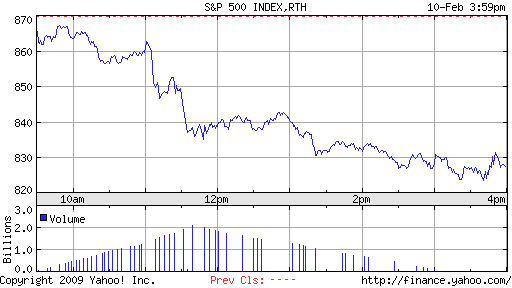

Just to clarify, both the beginning of the Geithner speech and the official posting time on the Fed website concerning the expanded TALF were at 11:00am, when the market began to decline.

Rather than attribute the market fall to an implied removal of Fed independence (which sounds like a reach), I have to agree with the conventional wisdom that the administration’s inability to decide on a path forward (indicating that there are no good solutions) is what led to the market decline. Also note that Treasury yields declined pretty sharply at the same time (the on-the-run 2-yr note went 10bps lower within a few minutes of the speech).

jult52

In defense of market expectations and other issues, can I note that the stock market rallied smartly last week in anticipation of both the stimulus package being passed and the Geithner/Treasury plan being announced on Monday/Tuesday. I personally thought it was nuts that the market would rally in the hopes of the government producing a wonderful plan(s), but that is what happened – optimism is a hardy shrub, I supppose. Then yesterday no question but that reality intruded on the dreams, though many would argue simply that what we’ve seen up to this point was no more than traditional “buy the rumor, sell the fact” investor behavior.

That said, I’m not defending Geithner nor the Fed. And as DickF and maybe others have noted, the fact that Mr. Geithner is a tax scofflaw detracts enormously from the goodwill that a more fastidious taxpaying Treasury Secretary might obtain (I would vote for Paul Volcker, though I realize that at 81 years young he might not want the job or be healthy enough to handle the time demands).

Given that the sixth party option is, in effect, the default option in the absence or making tough decisions, it seems the most likely outcome to me.

Anarchus wrote:

Changes in the growth rate of stock prices are primarily driven by how investors expect the growth rate of their underlying dividends per share will change. The unveiling of the Obama administrations incoherent plan to deal with distressed financial institutions forced investors to sharply mark down stock prices, particularly for financial stocks, to match the new expectation that these companies will not be able to sustain the lowered level of dividends they’re paying today, nor will they be likely to increase them in the near-to-long term future.

If Geithner or Obama are serious about repairing the financial health of these institutions and gaining public support for their programs, they need to demonstrate how the new plan they now need to come up with will work to fix these companies’ balance sheets, how it will absorb the failure of those institutions too far gone to be fixed, and how the standards they use to decide which is which will be fairly, consistently and transparently applied.

Or their replacements will. Along with cleaning up the mess they’re now responsible for creating.

“They will be able to see whether boards of directors are being responsible with taxpayer dollars and how they’re compensating their executives.”

We can already see those things and it does NOT inspire confidence – it tells us there is looting and plundering and that we have no control over it. We really do not need these banks to be saved or fixed; we need them to be changed. Without that there will be no confidence.

Most economist agree that the government actions during the 1930s did more harm than good.

Currently, our government thinks the best approach is to do the same thing but more of it.

Everytime someone gets stimulated, someone else gets the shaft.

Let’s see:

(a) Compensation for bank management is being dictated by the government;

(b) Nationalization awaits banks who inch too close to failure;

(c) Relatively successful banks will face pressure to purchase toxic assets in “partnership” with government;

(d) Government investment in banks perverts and destabilizes their capital structures;

(e) Nationalized banks will likely select management from the labor pool of experienced bankers, who will be compensated at levels dictated by the government.

What incentives, precisely, will bankers possess with respect to the success or failure of the institutions they serve?

I continue to be amused by the fact that so many pundits continue to ignore the reality that the US is already overleveraged in excess of 350% of GDP. The banking crisis has occurred because there is no longer enough positive cash flow to service the debt level that has been accumulated. It is inevitable that the real estate market will probably decline another 20% from its high, as Alt-A and adjustable rate mortgages reset, and prime mortgages erode with the recession. The $10 trillion in losses have to be written off. I would anticipate that at the end of the day, 50% will fall to the private banking industry, 30% will be absorbed by households, and 20% will be absorbed by government.

Personally, I have a great deal of sympathy for Geithner. I believe that he knows that the credit default and interest rate derivative markets will implode from counter-party failure if large insolvent banking institutions are forced into bankruptcy, leading inevitably to more credit constipation. This constipation will result in business failures by over-leveraged commercial clients. I would suggest that the current jaw-boning about the TALF and PPIF are only delaying tactics to allow the Obama administration enough time to study and formulate a plan forward. I anticipate that the government will set up regulation and clearing for the derivative market, and force all OTC contracts to be registered. Then, after the information has been digested, a concrete plan for nationalization/bankruptcy of the banking industry can proceed. The barnyard will squeal, but the herd has to be culled.

Thanks IronMan for succinctly stating that:

“…they need to demonstrate how the new plan …will work to fix these companies’ balance sheets, how it will absorb the failure of those institutions too far gone to be fixed, and how the standards they use to decide which is which will be fairly, consistently and transparently applied.”

Holy cow, I’ve been reading you for years but I didn’t even recognize your name when I listened to Marketplace last night. Good show.

Geithner’s proposal for the PPIF shows he is playing one step at a time chess, and has little concept of action-reaction in the financial system. Presume he gets entreprenuers to bid on banks’ toxic assets. The prices will be so low, it will create a riot in board rooms. Multiple banks will then have a market price on similar assets and have to recognize huge write offs. Word of the emerging price deal circulating on Wall Street will force Geithner to back off.

Geithner has a couple weeks to quietly find support for nationalizing 4 to 8 major insolvent banks. If he wastes his time, events will overtake him within a few weeks. He will become a “discredited duck” fighting huge crises in catch up mode. Its not a pretty picture, but its where we are.

Check out Simon Johnson’s slant on the Obama administration’s tactics with the banks. It hints at where the financial policy will be going after triage (the Stress Test) has been completed. Link to Baseline Scenario

Geithner is an ideologue. So have private parties buy troubled assets and have fed guarantees the losses on these purchases. This will somehow get the private lending market moving, all it needs is some inertia. This perspective only makes sense if you view this crisis as a function of short term liquidity. As opposed to the reality that these debt instruments contain substantial losses in varying stages of realization. The only question is who will realize these losses, the parties who received a premium to assume the risk or the public, who had no choice and actually pay the income streams underlying these debt instruments. The only way to have the needed financial regulation is for the holders of these notes to take the loss and feel the pain. Only a groundswell of political discontent from the upper middle and upper classes steered into this crap by the financial industry can hope to overwhelm the political influence of wall street and rationally regulate these markets. Capitalism is great but the excesses of the profit mechanism must be reigned in by laws or the whole system is endangered. This is a lesson that must be painfully learned by the risk takers and the retail market. To ensure economic recovery the fed gov can lend directly to businesses and force modifications and refi’s for mortgage holders who have the ability to pay a fixed rate mortgage on their property. If your going to reliquify the market and save the economy one must start from the bottom and allow credit to trickle up. Geithner/Obama plan is a creature of wall streets political influence and does not reflect any credible economic theory.

Im too late to add anything to the discussion. I do want to express my admiration for the insightful discussion of Professor Hamilton.

Whose ox will be gored is the question that remains first in my mind. I see no way out other than many debts not being paid. Geittner should pose his problem in that fashion – What is the best way to not pay debts and get them to disappear?

Geithner’s swarm of accountants smells a lot like what Sweden did before taking the two big banks over.

I’m very skeptical that there is an alternative to nationalization/bankruptcy. The identified bad assets will be taken out of town until the baby is born. Nobody, including the taxpayer, can afford to buy these assets.

And commercial property is about to take a large hit, as well.

Simple fact. Trading illiquid securities in this deflationary recession is literally impossible. The chances of getting Congress to put taxpayers further out on the hook relative to bank balance sheets is slim and none. And slim’s left the building.

At some point Obama is going to look around him and realize some of the people he’s hired are in la la land. Way too close to the banks, and way to distant from the taxpayer. Not Obama’s cup of tea, I’d imagine.

Also, we have 2 solid years of unsold home inventories. Does anyone have even a clue to what that means?

This is already a catastrophe. Underwater homeowners need to mail in the keys. These banks are going down and there is absolutely nothing that can save them. And politically, throwing more money into them is cyanide.

For every 7 people underwater, there’s 93 who aren’t. As a pol, I wouldn’t like that percentage at all. What do you say when they ask for a lower % rate, or principal reduction? Wouldn’t want to be taking that call.

“a new funding mechanism that uses money from the Treasury as a bridge to private capital.”

“money from the Treasury as a bridge to private capital.”

“a bridge to private capital.”

“a bridge to …”

Whose private capital?

The five largest US banks could be bought and owned at present market cap with the TARP money.

Citibank = 20 Billion

Bank of America = 40 Billion

JP Morgan Chase = 100 Billion

Morgan Stanley = 25 Billion

Wells Fargo = 70 Billion

Buy out all 5 of those and use the change to buy out GM, Ford, Chrysler, Fannie and Freddie.

Only Goldman Sachs is big enough to cause a burp, and I think we know why that is.

“a bridge to ” nowhere.

Thank you for elucidating some difficult financial concepts. I enjoyed reading your article.